Why Europe’s finance apps must start borrowing from each other’s playbooks

Aliaksei Ustauski

- Published

- Opinion & Analysis

As Europe’s banking, neobanking and investment apps pursue sharply differentiated growth models, new cross-market data from the UK, France and Germany shows that each segment has mastered one part of the performance equation while overlooking another, creating a clear opportunity for the continent’s finance platforms to strengthen acquisition, retention and long-term value by learning from one another’s playbooks, writes Aliaksei Ustauski

In 2025, the finance landscape in Europe has matured, and fragmented. While traditional banks, neobanks, and investment platforms each lead in their corners, they remain siloed in their strategies. Yet, each has cracked part of the growth equation. The biggest wins in the coming years will go to those who step outside their lanes and borrow from their neighbours.

New data from the UK, France, and Germany reveals three dominant user acquisition strategies, each tuned for different conditions. It also highlights a striking divide. Most financial sub-verticals are still led by local Western European companies, but investment and money transfer apps stand out as exceptions, increasingly dominated by international players. Across all categories, the data uncovers missed opportunities to boost retention, acquisition, and long-term value.

Traditional banks have perfected the art of customer retention, with 55 per cent to 85 per cent of their conversions coming from retargeting existing customers. Their primary strategy revolves around converting web and branch customers to mobile through deeplink-enabled customer journeys. A luxury afforded by their established customer bases across multiple channels.

This approach delivers impressive long-term results. Traditional bank apps achieve retention rates 1.5 to 2 times higher than neobanks at the 30-day mark, supported by sophisticated cross-selling and upselling through retargeting campaigns. With 45 per cent of their app installs coming from owned media, they have built sustainable acquisition models around their existing ecosystems.

However, this strength masks a critical weakness. Traditional banks show zero recorded growth in new user acquisition, whether organic or paid. This reflects both a gap in user acquisition capability and the reality that as more of their customer base has already migrated to app, the pool of first-time app users among existing customers is shrinking over time. The conversion pool from physical channels continues to shrink.

Neobanks have cracked the code on new user acquisition, surpassing traditional banks in both the UK and France (with France showing a dramatic 2-to-1 ratio of new users choosing neobanks and digital wallets over traditional banks in 2025). Germany, proving more conservative, is expected to follow within 18 months.

Their success stems from aggressive media mix experimentation. While traditional banks rely heavily on owned media (45 per cent of installs), neobanks spread their bets more widely with 35 per cent owned media and significant investment in ad networks, DSPs, and platforms like TikTok. This diversified approach allows them to capture younger demographics that traditional banks struggle to reach.

Yet neobanks harbour a surprising blind spot. Retargeting represents only three per cent to four per cent of their total conversions. Identical to investment apps and a fraction of what traditional banks achieve. This represents a missed opportunity to improve unit economics through better retention and cross-selling strategies.

Investment apps operate in an entirely different universe, with three-quarters or more of their installs coming from paid acquisition campaigns, and the remainder organic. Their performance correlates directly with market sentiment, particularly Bitcoin and cryptocurrency prices. Creating volatile but potentially massive scaling opportunities.

These apps have embraced a high-volume, low-retention model by necessity. Day-one retention averages just 19 per cent, dropping to eight per cent by day seven and a mere four per cent by day 30. Like neobanks, only three per cent to four per cent of their conversions come from retargeting, as their business models depend on constantly attracting fresh users.

Interestingly, 80 per cent or more of investment apps rely on agencies and lesser-known media sources for user acquisition, contrasting sharply with the owned media strategies of traditional banks and neobanks. This long-tail mix allows rapid scaling during bull markets, but it often brings lower traffic quality.

Most tellingly, this segment is dominated by international players. Over 85 per cent of non-organic installs in retail trading and investment apps across the UK, Germany, and France come from companies based in China, Australia, Israel, and Eastern Europe. This stands in sharp contrast to nearly every other finance sub-vertical, where local Western European companies still hold the upper hand. With money transfer and investment apps as the only exceptions.

Despite building substantial user bases through superior acquisition strategies, neobanks are essentially leaving money on the table. Their 3 per cent to 4 per cent retargeting rate suggests they’re treating customers as one-time acquisitions rather than relationships to develop over time. Traditional banks demonstrate that retargeting rates of 55 per cent to 85 per cent are achievable in financial services. Yet neobanks have not translated their acquisition sophistication into retention excellence. This represents a significant opportunity to improve customer lifetime value.

While neobanks prove that diversified media strategies work for attracting younger demographics, traditional banks remain locked into narrow acquisition channels. Their 45 per cent owned media dependence, while efficient for converting existing customers, limits their ability to expand beyond their current base.

The branch closure trend accelerates this challenge. As physical touchpoints disappear, traditional banks need new ways to attract first-time customers, but their media strategies haven’t evolved to capture users who discover financial services through digital-first journeys.

Investment apps’ acceptance of 4 per cent day-30 retention rates reflects an assumption that high churn is inevitable in volatile markets. However, other financial service segments achieve retention rates multiple times higher, suggesting room for improvement even in volatile conditions. During bear markets, when user acquisition becomes more expensive and market sentiment dampens organic interest, better retention strategies could mean the difference between surviving downturns and scaling back operations significantly.

The most actionable insights emerge when examining what each segment could adopt from others’ proven strategies.

Traditional banks could adopt media mix experimentation from neobanks in order to reach younger demographics while preserving their existing retention strengths. They could also draw on the market-responsive campaign scaling and operational agility demonstrated by investment apps, enabling them to capitalise more effectively on external events and shifting market conditions.

Neobanks, for their part, could learn from the advanced retargeting strategies long refined by traditional banks, increasing the share of retargeting within total conversions from the current 3–4 per cent into double digits. They could also incorporate the sophisticated retargeting best practices developed in ecommerce, a sector that remains considerably ahead of fintech in this discipline.

Investment apps could strengthen their resilience by adopting the retention and cross-selling frameworks used by traditional banks, with the aim of improving day-30 engagement rates. In addition, they could look to ecommerce for advanced retargeting approaches capable of re-engaging users during periods of market recovery.

Specialisation has worked, but the next generation of winners will be those who learn from adjacent strategies. Whether that means neobanks that already offer investment products putting more focus and campaigns behind them to compete with international platforms, or traditional banks scaling new user growth through diversified media, the opportunities exist.

The most successful apps of tomorrow will be ones that have both perfected their product offering and learned to adopt everything relevant not only from their own vertical in finance, but from ecommerce, subscription services, and games.

The most effective strategies aren’t always invented in-house. In today’s crowded market, they’re often adapted from others who’ve already figured out what works.

Aliaksei Ustauski is Sales Strategy Director for EMEA & LATAM at AppsFlyer, where he focuses on growth strategy and performance marketing across the financial services and app economy sectors.

READ MORE: ‘Neue Bank’s CEO on stability, discipline and long-term private banking‘. Neue Bank is refining a long-standing private-banking model that prioritises disciplined growth, transparent risk management and sustainability backed by data. CEO Roman Pfranger discusses the principles guiding the bank’s next phase in conversation with The European’s John E. Kaye.

Do you have news to share or expertise to contribute? The European welcomes insights from business leaders and sector specialists. Get in touch with our editorial team to find out more.

Main image: Wellington Silva/Pexels

RECENT ARTICLES

-

Why universities must set clear rules for AI use before trust in academia erodes

Why universities must set clear rules for AI use before trust in academia erodes -

The lucky leader: six lessons on why fortune favours some and fails others

The lucky leader: six lessons on why fortune favours some and fails others -

Reckon AI has cracked thinking? Think again

Reckon AI has cracked thinking? Think again -

The new 10 year National Cancer Plan: fewer measures, more heart?

The new 10 year National Cancer Plan: fewer measures, more heart? -

The Reese Witherspoon effect: how celebrity book clubs are rewriting the rules of publishing

The Reese Witherspoon effect: how celebrity book clubs are rewriting the rules of publishing -

The legality of tax planning in an age of moral outrage

The legality of tax planning in an age of moral outrage -

The limits of good intentions in public policy

The limits of good intentions in public policy -

Are favouritism and fear holding back Germany’s rearmament?

Are favouritism and fear holding back Germany’s rearmament? -

What bestseller lists really tell us — and why they shouldn’t be the only measure of a book’s worth

What bestseller lists really tell us — and why they shouldn’t be the only measure of a book’s worth -

Why mere survival is no longer enough for children with brain tumours

Why mere survival is no longer enough for children with brain tumours -

What Germany’s Energiewende teaches Europe about power, risk and reality

What Germany’s Energiewende teaches Europe about power, risk and reality -

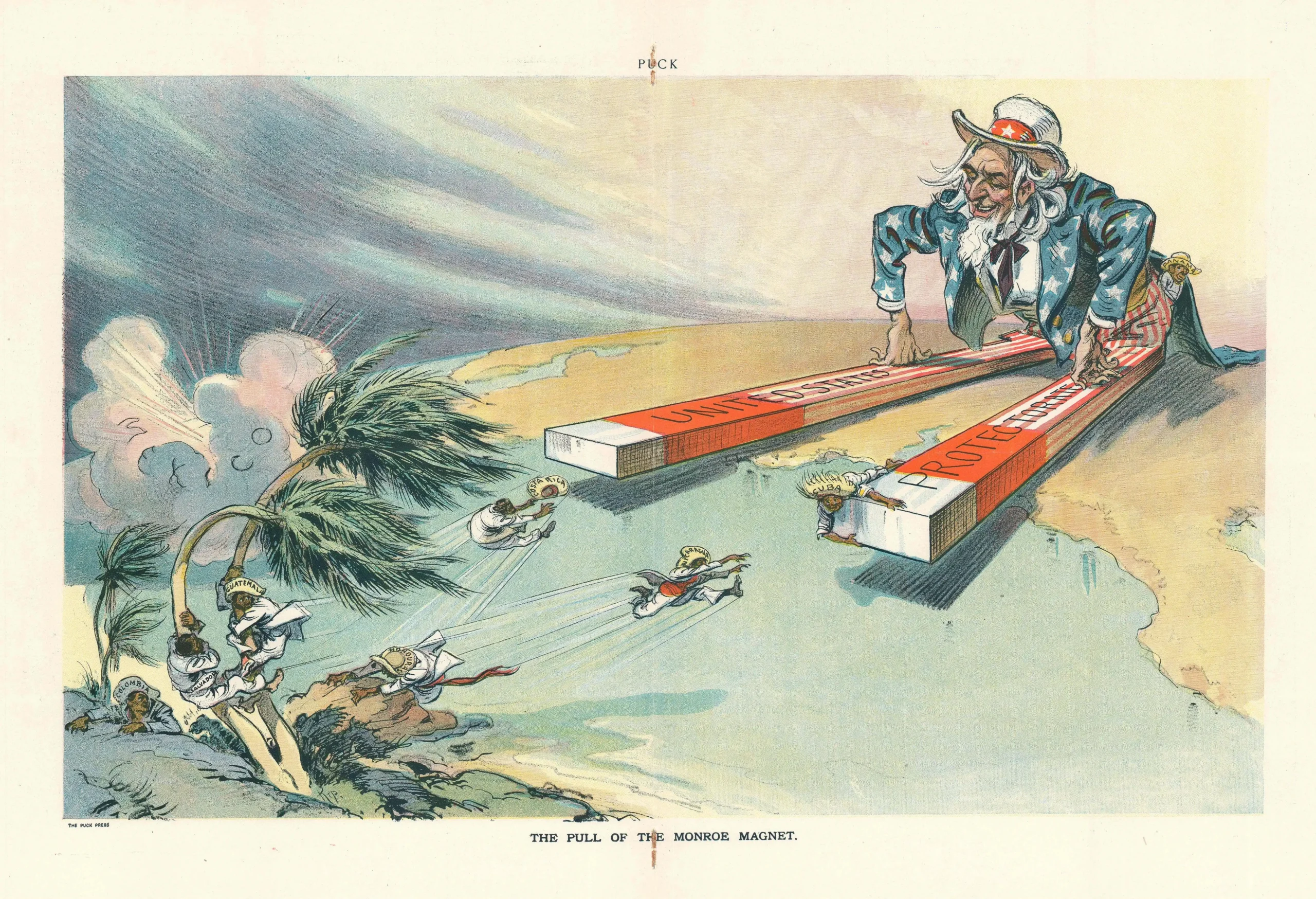

What the Monroe Doctrine actually said — and why Trump is invoking it now

What the Monroe Doctrine actually said — and why Trump is invoking it now -

Love with responsibility: rethinking supply chains this Valentine’s Day

Love with responsibility: rethinking supply chains this Valentine’s Day -

Why the India–EU trade deal matters far beyond diplomacy

Why the India–EU trade deal matters far beyond diplomacy -

Why the countryside is far safer than we think - and why apex predators belong in it

Why the countryside is far safer than we think - and why apex predators belong in it -

What if he falls?

What if he falls? -

Trump reminds Davos that talk still runs the world

Trump reminds Davos that talk still runs the world -

Will Trump’s Davos speech still destroy NATO?

Will Trump’s Davos speech still destroy NATO? -

Philosophers cautioned against formalising human intuition. AI is trying to do exactly that

Philosophers cautioned against formalising human intuition. AI is trying to do exactly that -

Life’s lottery and the economics of poverty

Life’s lottery and the economics of poverty -

On a wing and a prayer: the reality of medical repatriation

On a wing and a prayer: the reality of medical repatriation -

Ai&E: the chatbot ‘GP’ has arrived — and it operates outside the law

Ai&E: the chatbot ‘GP’ has arrived — and it operates outside the law -

Keir Starmer, Wes Streeting and the Government’s silence: disabled people are still waiting

Keir Starmer, Wes Streeting and the Government’s silence: disabled people are still waiting -

The fight for Greenland begins…again

The fight for Greenland begins…again -

Failure is how serious careers in 2026 will be shaped

Failure is how serious careers in 2026 will be shaped