The digital euro is coming — and Europe should be afraid of what comes with it

Lionel Eddy

- Published

- Opinion & Analysis

The European Central Bank wants a digital euro by 2029, promising convenience, privacy and continuity with cash. Yet beneath the assurances lies a far more troubling reality: a central bank digital currency that risks weakening privacy, distorting banking, and handing future governments an unprecedented lever over everyday economic life, writes Lionel Eddy

A joint article titled A digital euro for the digital age written by ECB Executive Board member Piero Cipollone and European Commission Executive Vice President Valdis Dombrovskis indicates that initial preparatory steps, which include pilot exercises and test transactions, could commence by 2027. The European Commission has introduced the Single Currency Package, which comprises two draft laws. The first law ensures that citizens and businesses throughout the euro area will maintain access to cash euros and be able to use it without restrictions. “The ECB plans to prepare for the potential issuance of the digital euro by 2029, assuming the European co-legislators adopt the necessary regulation by 2026. Preparatory steps, including pilot exercises and initial transactions, could begin as early as mid-2027,” Dombrovskis said in his ECB blog.

The second law outlines the regulatory framework for the digital euro. This digital currency is anticipated to be free, user-friendly, widely accessible, and to provide a high level of privacy protection that closely resembles the confidentiality of cash transactions. Additionally, the digital euro is designed to operate both online and offline, facilitating transactions even in the absence of an internet connection.

Currently, central bank money is accessible to the public only in the form of banknotes and coins, since a digital version of public money has not yet been established. Cipollone and Dombrovskis have also made it clear that the digital euro will not replace physical cash and instead complement it: “For now, euro cash exists only in physical form, the banknotes and coins we hold in our wallets. As the most tangible expression of our single currency, cash brings us together. We know we can rely on cash. It is accepted throughout the euro area. It is easy to use and inclusive. It protects privacy. And it is our money, issued by a public institution, the European Central Bank.”

“However, more and more Europeans are choosing to pay digitally in shops or buy products online. We therefore need a digital form of cash to complement the banknotes and coins we are familiar with. The digital euro is designed to respond to the opportunities and challenges presented by this transition”, they wrote in an op-ed.

In an Executive Summary titled Preparation phase of a digital euro, the Eurosystem is working on a digital euro project designed to modernise central bank money for the digital era, tackling the existing issues within the European payment system.

In a blog titled Why Europe needs a digital euro, Dombrovskis and Member of the Executive Board Fabio Panetta have argued why the European Central Bank should launch a CBDC for the Eurozone while also understanding the importance of cash. “Central banks around the world are now working on complementing the public money they currently make available cash with a digital version of it, a central bank digital currency. In the euro area, the digital euro would offer a digital payment solution that is available to everyone, everywhere, for free. Cash remains important; it is still the preferred means of making small in-store payments and person-to-person transactions. Most people in the euro area want to keep the option to pay with banknotes and coins. This is why the European Commission and the European Central Bank are fully committed to making sure that cash remains fully accepted and available across all 20 countries in the euro area.”

On 30 October, the European Central Bank published The Digital Euro Scheme Rulebook, a scheme conducted in coordination with the Rulebook Development Group of the digital euro initiative. This group includes senior representatives from associations that represent both the supply and demand sectors of the European retail payments market, as well as the European Central Bank and observers from national central banks within the euro area and EU institutions. “The digital euro scheme rulebook will serve as a single set of rules, standards and procedures aimed at standardizing digital euro payments across the euro area. This standardization will ensure that the experience of users of the digital euro will be the same across euro area countries, irrespective of the payment service provider involved just as is the case for euro cash today,” said the Executive Summary.

However, the European Association of Co-operative Banks, European Banking Federation and the European Savings and Retail Banking Group published a study titled Digital euro cost study, highlighting concerns about the financial and operational viability of the digital euro for retail banks. Based on the Digital Euro Scheme Rulebook, the study estimates that the minimum exchange costs for introduction of the digital euro would cost each bank an average of €110 million and concludes that the total cost would be €18 billion for the entire euro area.

The European Central Bank and their digital euro scheme is also facing opposition from Members of European Parliament. Parliamentary apprehensions regarding potential disruptions in the banking sector, the safeguarding of privacy, and the risk of stifling innovation underscore a wider European skepticism towards central bank digital currencies. Fernando Navarrete Rojas, a Spanish MEP tasked with producing the digital euro report, has expressed continued skepticism regarding the initiative despite efforts by the European Central Bank to engage with him. In the paper titled Do we really need the digital euro: A solution to what problem exactly?, Rajas questions the claimed advantages of the Digital Euro, raising concerns related to financial stability and privacy. He acknowledges the necessity for Europeans to continue using foreign payment systems but advocates for the European Union to prioritize the development of private European solutions instead of introducing an instrument like the digital euro into the market.

The Spanish MEP’s scepticism towards a CBDC for the eurozone is well founded. Around the world, governments routinely offer assurances and propose regulatory safeguards intended to prevent abuse. Yet, the reality is stark: almost every country that adopts a central bank digital currency will likely experience a gradual erosion of personal liberties. The allure to exploit this tool is simply too powerful, as history has repeatedly demonstrated the pitfalls of monetary manipulation.

CBDCs have the potential to wreak havoc on businesses, and it is essential to acknowledge this reality. These digital currencies could become tools in political conflicts, stifling transaction flows between nations and jeopardizing international trade. On a domestic front, a CBDC might pressure companies into mandatory compliance with specific regulations. For those in management, the environment could become increasingly stifling, limiting the ability to express personal beliefs in public without fear of repercussions that could adversely affect the company and its employees.

Lionel Eddy is a journalist specialising in digital identity, biometrics and state surveillance, and the author of The Digital Agenda.

READ MORE: ‘The US Supreme Court just ripped up the Fourteenth Amendment. Britain should be paying close attention‘. The U.S. Supreme Court has just gutted one of the most fundamental constitutional protections in American law: the right to citizenship and equal protection under the Fourteenth Amendment. In doing so, it handed the president unprecedented power to act without effective judicial oversight. Britain, and every democracy that values the rule of law, should be paying very close attention, warns barrister and civil rights campaigner, Raj Joshi.

Do you have news to share or expertise to contribute? The European welcomes insights from business leaders and sector specialists. Get in touch with our editorial team to find out more.

Main image: Masood Aslami/Pexels

RECENT ARTICLES

-

Facial recognition is leaving the US border — and we should be concerned

Facial recognition is leaving the US border — and we should be concerned -

Wheelchair design is stuck in the past — and disabled people are paying the price

Wheelchair design is stuck in the past — and disabled people are paying the price -

Why Europe still needs America

Why Europe still needs America -

Why Europe’s finance apps must start borrowing from each other’s playbooks

Why Europe’s finance apps must start borrowing from each other’s playbooks -

Why universities must set clear rules for AI use before trust in academia erodes

Why universities must set clear rules for AI use before trust in academia erodes -

The lucky leader: six lessons on why fortune favours some and fails others

The lucky leader: six lessons on why fortune favours some and fails others -

Reckon AI has cracked thinking? Think again

Reckon AI has cracked thinking? Think again -

The new 10 year National Cancer Plan: fewer measures, more heart?

The new 10 year National Cancer Plan: fewer measures, more heart? -

The Reese Witherspoon effect: how celebrity book clubs are rewriting the rules of publishing

The Reese Witherspoon effect: how celebrity book clubs are rewriting the rules of publishing -

The legality of tax planning in an age of moral outrage

The legality of tax planning in an age of moral outrage -

The limits of good intentions in public policy

The limits of good intentions in public policy -

Are favouritism and fear holding back Germany’s rearmament?

Are favouritism and fear holding back Germany’s rearmament? -

What bestseller lists really tell us — and why they shouldn’t be the only measure of a book’s worth

What bestseller lists really tell us — and why they shouldn’t be the only measure of a book’s worth -

Why mere survival is no longer enough for children with brain tumours

Why mere survival is no longer enough for children with brain tumours -

What Germany’s Energiewende teaches Europe about power, risk and reality

What Germany’s Energiewende teaches Europe about power, risk and reality -

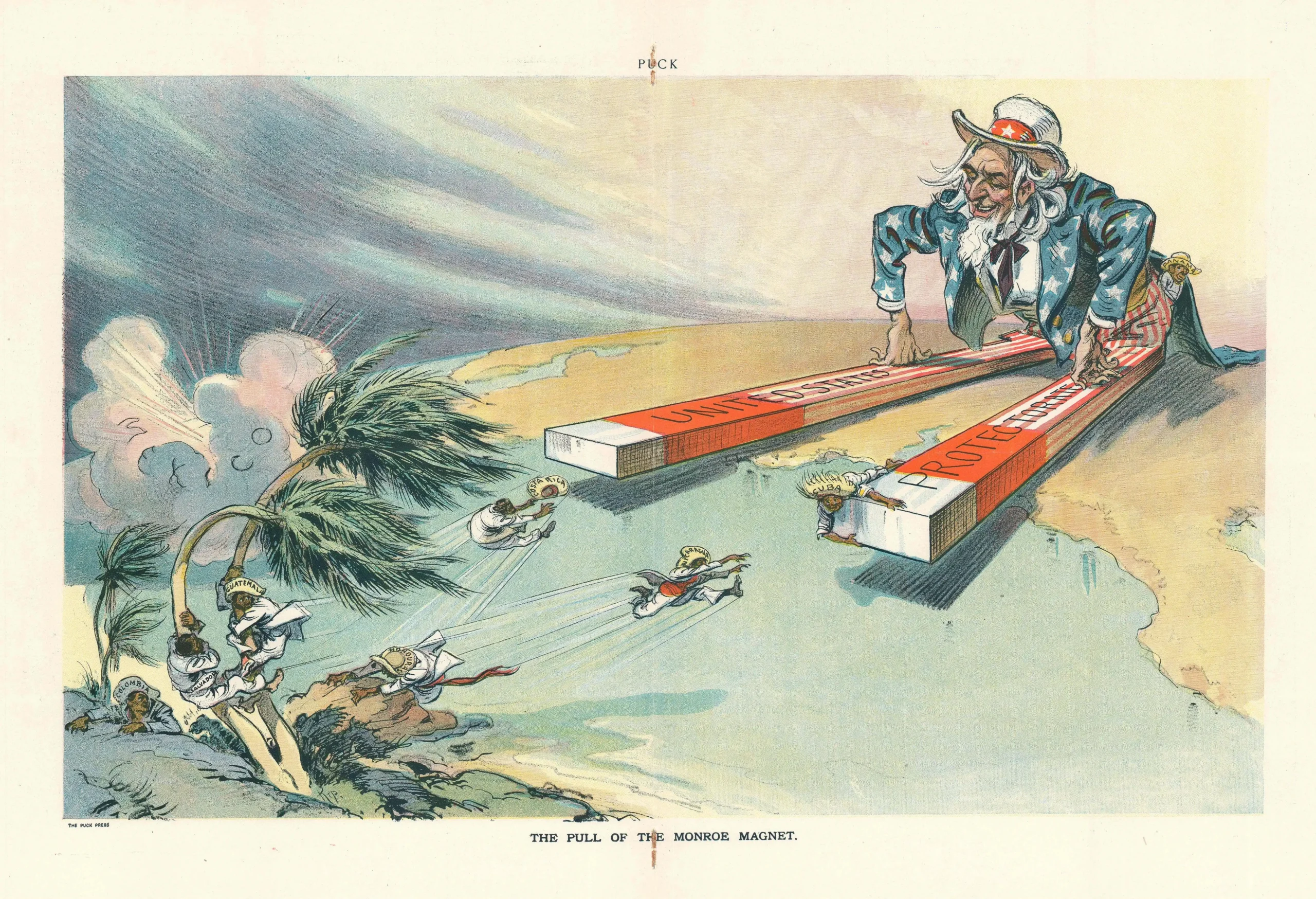

What the Monroe Doctrine actually said — and why Trump is invoking it now

What the Monroe Doctrine actually said — and why Trump is invoking it now -

Love with responsibility: rethinking supply chains this Valentine’s Day

Love with responsibility: rethinking supply chains this Valentine’s Day -

Why the India–EU trade deal matters far beyond diplomacy

Why the India–EU trade deal matters far beyond diplomacy -

Why the countryside is far safer than we think - and why apex predators belong in it

Why the countryside is far safer than we think - and why apex predators belong in it -

What if he falls?

What if he falls? -

Trump reminds Davos that talk still runs the world

Trump reminds Davos that talk still runs the world -

Will Trump’s Davos speech still destroy NATO?

Will Trump’s Davos speech still destroy NATO? -

Philosophers cautioned against formalising human intuition. AI is trying to do exactly that

Philosophers cautioned against formalising human intuition. AI is trying to do exactly that -

Life’s lottery and the economics of poverty

Life’s lottery and the economics of poverty -

On a wing and a prayer: the reality of medical repatriation

On a wing and a prayer: the reality of medical repatriation