WPSL Group unveils £1billion blueprint to build a global golf ‘super-group’

Feisal Nahaboo

- Published

- Opinion & Analysis

WPSL Group has outlined a plan to create a £1 billion global golf super-group by merging a wide range of golf businesses and running them through one structure. Here, it’s founder and CEO Feisal Nahaboo explains how the organisation intends to bring together golf tours, academies, indoor simulator centres, retail operations, manufacturers, tour operators, golf apps and influencer platforms and operate them under a single system with shared management, shared data and a centralised back office

WPSL Group has today set out a £1 billion blueprint built on two core pillars. The first is a business-side consolidation platform that merges compatible golf assets – including private golf tours, tour operators, academies, indoor centres, retail operations, golf apps, golf influencers and manufacturers – into a single, integrated super-group.

By aligning leadership teams, cross-fertilising databases for maximum commercial penetration and building one shared back office and operating system to run all merged entities, WPSL aims to generate significant financial, marketing and operational synergies before presenting the group to the City of London. The structure is explicitly designed to repeat what was achieved with the Xeinadin accountancy group, where an overnight multiple-merger model helped deliver record valuations running into hundreds of millions of pounds within just two to three years of inception.

The second pillar is a live global tour ecosystem that underpins and validates the commercial platform. At the heart of this sit Super League, the World Nations Cup Matchplay Players platform and the largest amateur tours in the UAE, all operating under the WPSL GROUP umbrella. This tour is played on bucket-list golf courses, features Ryder Cup players, European Tour winners and current DP World Tour talent, and is supported by a professional broadcast and presenting team – ensuring that behind the consolidation model there is a real golf product, with real players and real demand.

The golf industry is increasingly crowded: tours, leagues, academies, indoor simulators, retail brands and manufacturers all compete for the same players, sponsors and media space. WPSL GROUP’s £1 billion blueprint tackles this saturation by:

1. Merging and consolidating proven golf assets into a professionally run super-group.

2. Creating arbitrage value by acquiring individual businesses at sensible multiples and building a group that commands a materially higher multiple.

3. Driving organic growth through a powerful schedule, elite coaching, digital engagement and professional standards.

4. Using rising share value as acquisition currency, making deals more efficient for incoming partners and rewarding those who join early.

Over the last 24 months, WPSL Group has operated largely “underground”, building a pipeline of more than 20 golf-related businesses worldwide. Targets are selected not only for financial strength but also for leadership mindset, cultural fit and willingness to commit long term.

The £1 billion WPSL blueprint is directly inspired by, and structurally aligned to, the consolidation model I pioneered in professional services with the Xeinadin accountancy group. In that venture, more 122 independent firms were brought together under one umbrella through an identically structured overnight multiple-merger movement, creating group value of “hundreds of millions” literally overnight. That business grew from effectively zero to a valuation understood to be around £1 billion within seven years, which WPSL says provides the clearest precedent for the scale of its ambition in golf.

The WPSL model mirrors that proven approach in that it’s a way for owners to extract financial strength from what they’ve built, stay in the game for at least five years, and grow something much bigger together. We proved in professional services that the overnight multiple-merger model can create huge value at speed. I’m now applying that same blueprint to golf – but this time I’m working at the roots of the game, bringing great tours, academies, events and brands together under one house called WPSL Group.

The benefits are clear:

• Independent golf assets – golf tours, tour operators, academies, indoor facilities, private golf courses, retail and manufacturers – are invited to merge into a single, professionally governed group.

• Each joining asset contributes its own brand strength, database and cash flow, and in return participates in a larger, consolidated valuation driven by scale.

• Central functions, governance and commercial strategy are designed and executed in the same clinical manner that underpinned Xeinadin’s rapid rise.

The key difference is simply the sector: the emotional equity, fan base and lifestyle appeal of golf sit on top of an identical, disciplined financial engine.

The £1 billion blueprint is underpinned by a deliberate capital strategy. Despite already attracting interest from sovereign wealth funds in the Middle East and Far East, WPSL Group has so far chosen to turn that capital opportunity away while it continues to build intrinsic value in the tour and its underlying assets to make it more valuable for future sale.

The current plan is to present the group to the City of London – including leading private equity houses and institutional funds – in approximately 24 months’ time, once a stronger portfolio of merged assets and trading history is in place. The aim is to take a proven, Xeinadin-style consolidation story, now rooted in golf, to the institutional market at scale.

Golf doesn’t need another buy-and-flip story but a serious structure that protects what people have built locally and then gives them the muscle and reach of a global brand underpinned by a very strong back end operating office. That’s the job WPSL Group is here to do – clinically, professionally and at scale. When we go to the City, it will be with a properly built super-group, not a concept.

Strategic oversight comes from Ryder Cup Captain, 7 times Ryder Cup player and 18-time tour winner Mark James, who sits on WPSL GROUP’s strategic board.

“Across my career in golf, I’ve seen a lot of ideas come and go,” Mark said. “What WPSL GROUP is building has the potential to be one of the biggest movements I’ve seen in the game – particularly at amateur and aspirational level.

The combination of world-class venues, serious competition formats and a smart consolidation blueprint is unique. If we execute this correctly, WPSL could become one of the most influential forces in golf over the next decade.”

Supporting the blueprint is a star-studded playing and media stable that blends elite sport with mainstream appeal:

• Liverpool legends, including icons such as Robbie Fowler, Ronnie Whelan, Steve McMahon, Phil Babb, Steve Staunton, Bruce Grobbelaar and Jason McAteer, have all been involved within the WPSL environment, with some holding part-ownership positions alongside their playing contributions.

• Manchester United treble winners Andy Cole and Teddy Sheringham, key members of the historic 1999 side, have featured in the tour as has legends Lee Martin and Clayton Blackmore.

• Serial Premier League winners Lee Dixon and David Seaman of Arsenal have also taken part, adding further credibility from one of the most successful eras in English football.

• Global music is represented by Brian McFadden (formerly Westlife) and Keith Duffy (formerly Boyzone) – whose groups collectively sold around 80 million records worldwide – both of whom have played in Super League events and appearances, drawing wider audiences to the game.

In the media and broadcast sphere, WPSL Group benefits from a powerful line-up:

• Matt Le Tissier and Allan McInally, both former long-standing Sky Sports panellists, are part of the playing and punditry stable.

• Rishi Persad, who presents some of the world’s leading sports events including Royal Ascot, Wimbledon, snooker and the Olympics, is involved within the presenting roster.

• Top racing figures such as Richard Hughes, Mick Fitzgerald and John Francome have all played in Super League events, helping bridge golf with other major sporting audiences.

Alongside this, the tour continues to feature current DP World Tour player Brandon Robinson-Thompson, with a growing commentary and presenting team that includes DP World Tour presenter Robert Boxhall, ongoing negotiations with Amy Boulden, and further Sky Sports–linked talent.

Underpinning the corporate ambition is a live golf ecosystem:

• Bucket-list courses across the UK, Europe, the UAE and beyond.

• Pairs and team matchplay formats, including Ryder Cup–style events and World Nations Cup structures.

• A playing stable filled with major football legends, elite golfers and high-profile entertainers, giving amateurs the chance to compete in serious formats on world-class courses alongside household names.

This combination gives WPSL GROUP a unique platform: an authentic golf product with real emotional equity, sitting on top of a scalable consolidation model targeting £1 billion of group value over time.

Håkan Åkerlund, owner of the World Nations Cup Match Play Players (formerly World Amateur Matchplay) and head of WPSL’s global matchplay platform, brings a substantial international base and data engine into the group.

“We’ve spent years building our World Nations Cup matchplay concept and a database of tens of thousands of players from 34 countries,” Håkan said. “By integrating into WPSL GROUP, we can scale faster, improve player experience and give nations around the world a proper Ryder Cup–style amateur stage.

“The blueprint respects what each tour or brand has built locally, but connects them into a global system with better logistics, technology, media and commercial support.”

In the Middle East, Russell Yeomans leads WPSL’s expansion through his long-established platform, connecting golf with business and investment communities.

“In the UAE alone, we are already engaging around 2,000 resident golfers through our network, including more than 350 CEOs, high-net-worth and ultra-high-net-worth individuals to play in WPSL,” he added. “Bringing this into WPSL GROUP turns the UAE into a key pillar of the super-group – a place where major finals, premium hospitality and high-level networking can all come together.

“Investors want serious, scalable models with real participation. That’s exactly what we’re building here.”

Read More: ‘City and Gulf investors track golf’s newest global venture‘. The World Players Super League, headquartered in Dubai and backed by high-profile business leaders, is drawing interest from sovereign wealth funds and private equity as it expands rapidly from its European roots.

Do you have news to share or expertise to contribute? The European welcomes insights from business leaders and sector specialists. Get in touch with our editorial team to find out more.

Main Image: Feisal Nahaboo (centre front) with Mark James, right, and Westlife star Brian McFadden, left, and goalkeeper Bruce Grobbelaar, back.

RECENT ARTICLES

-

Facial recognition is leaving the US border — and we should be concerned

Facial recognition is leaving the US border — and we should be concerned -

Wheelchair design is stuck in the past — and disabled people are paying the price

Wheelchair design is stuck in the past — and disabled people are paying the price -

Why Europe still needs America

Why Europe still needs America -

Why Europe’s finance apps must start borrowing from each other’s playbooks

Why Europe’s finance apps must start borrowing from each other’s playbooks -

Why universities must set clear rules for AI use before trust in academia erodes

Why universities must set clear rules for AI use before trust in academia erodes -

The lucky leader: six lessons on why fortune favours some and fails others

The lucky leader: six lessons on why fortune favours some and fails others -

Reckon AI has cracked thinking? Think again

Reckon AI has cracked thinking? Think again -

The new 10 year National Cancer Plan: fewer measures, more heart?

The new 10 year National Cancer Plan: fewer measures, more heart? -

The Reese Witherspoon effect: how celebrity book clubs are rewriting the rules of publishing

The Reese Witherspoon effect: how celebrity book clubs are rewriting the rules of publishing -

The legality of tax planning in an age of moral outrage

The legality of tax planning in an age of moral outrage -

The limits of good intentions in public policy

The limits of good intentions in public policy -

Are favouritism and fear holding back Germany’s rearmament?

Are favouritism and fear holding back Germany’s rearmament? -

What bestseller lists really tell us — and why they shouldn’t be the only measure of a book’s worth

What bestseller lists really tell us — and why they shouldn’t be the only measure of a book’s worth -

Why mere survival is no longer enough for children with brain tumours

Why mere survival is no longer enough for children with brain tumours -

What Germany’s Energiewende teaches Europe about power, risk and reality

What Germany’s Energiewende teaches Europe about power, risk and reality -

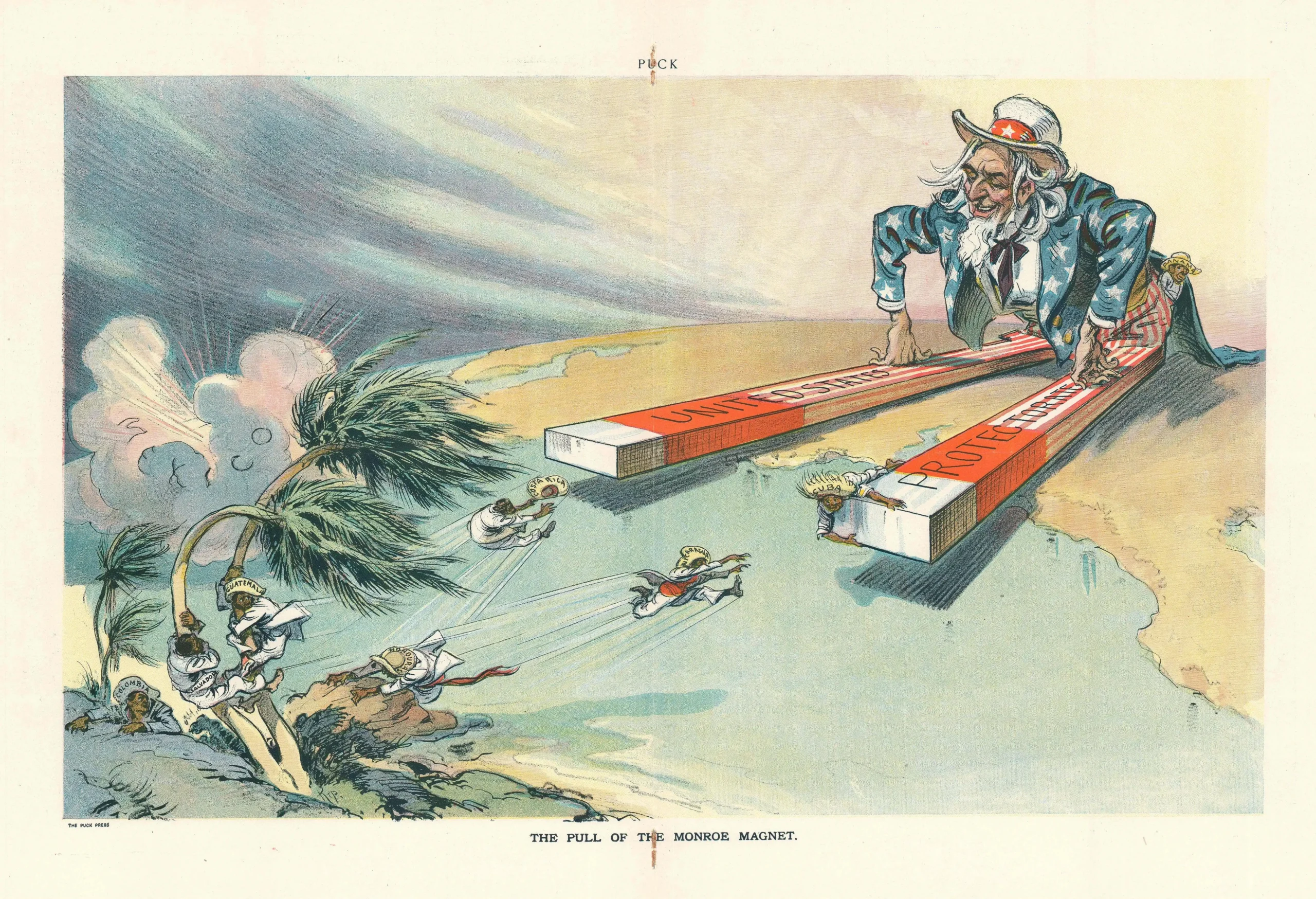

What the Monroe Doctrine actually said — and why Trump is invoking it now

What the Monroe Doctrine actually said — and why Trump is invoking it now -

Love with responsibility: rethinking supply chains this Valentine’s Day

Love with responsibility: rethinking supply chains this Valentine’s Day -

Why the India–EU trade deal matters far beyond diplomacy

Why the India–EU trade deal matters far beyond diplomacy -

Why the countryside is far safer than we think - and why apex predators belong in it

Why the countryside is far safer than we think - and why apex predators belong in it -

What if he falls?

What if he falls? -

Trump reminds Davos that talk still runs the world

Trump reminds Davos that talk still runs the world -

Will Trump’s Davos speech still destroy NATO?

Will Trump’s Davos speech still destroy NATO? -

Philosophers cautioned against formalising human intuition. AI is trying to do exactly that

Philosophers cautioned against formalising human intuition. AI is trying to do exactly that -

Life’s lottery and the economics of poverty

Life’s lottery and the economics of poverty -

On a wing and a prayer: the reality of medical repatriation

On a wing and a prayer: the reality of medical repatriation