Will the EU’s new policy slow down the flow of cheap Chinese parcels?

Dr Dafne Grigoriadi

- Published

- Opinion & Analysis

As the EU prepares to introduce a €2 levy on low-value parcels from abroad, Dr Dafne Grigoriadi examines whether the measure will meaningfully curb the flood of ultra-cheap shipments from China — or simply reshape consumer habits and accelerate the localisation strategies of platforms such as Shein and Temu

The European Union has approved a new €2 levy on low-value parcels—those under €150—shipped from non-EU countries. The intention is clear: reduce the competitive edge enjoyed by ultra-low-cost platforms like Shein and Temu. Yet many wonder whether such a small fee can meaningfully change market dynamics.

In the months leading up to the tax taking effect in early 2026, consumer behaviour will likely move in the opposite direction. Because people instinctively try to avoid losses, shoppers may rush to place orders ahead of time.

Meanwhile, Chinese platforms operating European warehouses—Shein’s facility in Poland being a prime example—are expected to stockpile as much inventory as possible. As a result, the real effect of the measure will be delayed and will only become noticeable after several months.

Rather than discouraging demand, the tax will probably eat into the platforms’ margins. A €2 surcharge is too small to force major pricing shifts or to significantly deter buyers. What may change, however, is the frequency of purchases: instead of making small monthly orders, consumers might consolidate their shopping into larger quarterly shipments to avoid paying the tax repeatedly.

This regulatory change is also likely to accelerate a trend already underway: Chinese companies moving more stock into European warehouses. Bulk importation allows them to pay duties once, avoid the €2 parcel fee for customers, speed up delivery times, and streamline returns. The underlying business model remains D2C (direct-to-consumer), but the logistics network becomes more localised.

At the same time, some Chinese platforms are experimenting with offline expansion. Shein’s recent opening of its first physical store in Paris illustrates this shift. Despite reports that Shein’s French operations were temporarily suspended that same week, following a widely discussed dispute concerning the sale of adult products, the store attracted long queues.

This episode highlights two important insights. First, when faced with a choice between affordability and ethical concerns, many consumers prioritise price—especially in countries experiencing economic strain, such as France. Low prices, combined with loyalty incentives like discounts, vouchers and gamified shopping features, reinforce the idea of “smart shopping,” overshadowing ethical dilemmas.

Second, Shein’s steady popularity shows how resilient strong brands can be in the face of scandals. Past controversies — including widely reported allegations about labour conditions and concerns raised over certain products — have created headlines, but not significant drops in demand.

To understand this phenomenon, one must ask: what need are these products fulfilling?

For Generation Z, the future engine of retail, purchases are largely driven by emotional impulses and the desire to belong socially. Trends circulate rapidly on platforms like TikTok, and owning certain items provides a sense of inclusion. Even when inflation and lower disposable income limit spending power, the desire to participate socially doesn’t disappear. Instead, young consumers seek cheaper alternatives that allow them to stay connected to trends. Platforms that recognise these emotional drivers while offering very low prices maintain the loyalty of Gen Z shoppers.

Looking ahead, Europe faces major strategic decisions. Competing with China on cost and production speed is unrealistic. Instead, Europe’s strength must lie in areas where Chinese platforms have limitations: high-quality products, technological innovation, sustainability, and premium customer experience.

Supporting advanced manufacturing technologies, improving logistics infrastructure, offering incentives for sustainable production, and building strong European brands with compelling narratives are essential steps. By focusing on value, durability and innovation—rather than on a price war Europe cannot win—the continent can strengthen its industrial base and reconnect with consumers.

Dr Dafne Grigoriadi is an economic analyst and media contributor specialising in international economics. She serves as a co-Programme Leader and lecturer at the Business School of Aegean College in Greece and holds a PhD from the University of Piraeus. Her professional background includes work with the Export Credit Insurance Organisation of the Greek Ministry of Foreign Affairs. She is also the founder of the SMEs Diplomacy Greece initiative, which promotes economic diplomacy and supports the global engagement of small and medium-sized enterprises.

READ MORE: ‘Inside MINISO’s new giant Amsterdam store aimed at Europe’s Gen Z shoppers‘. Chinese lifestyle retailer MINISO has opened its first European flagship in Amsterdam, part of a global expansion strategy that has already seen more than 7,000 stores launched in over 100 countries. The three-storey, 1,000 sq m site underscores the brand’s push to capture Europe’s Gen Z and young adult markets through immersive retail concepts and trending product lines.

Do you have news to share or expertise to contribute? The European welcomes insights from business leaders and sector specialists. Get in touch with our editorial team to find out more.

Main image: A warehouse handling bulk imports for European distribution — a logistics model increasingly adopted by low-cost e-commerce platforms as new parcel levies come into force. Credit: Tiger Lily/Pexels

RECENT ARTICLES

-

The era of easy markets is ending — here are the risks investors can no longer ignore

The era of easy markets is ending — here are the risks investors can no longer ignore -

Is testosterone the new performance hack for executives?

Is testosterone the new performance hack for executives? -

Can we regulate reality? AI, sovereignty and the battle over what counts as real

Can we regulate reality? AI, sovereignty and the battle over what counts as real -

NATO gears up for conflict as transatlantic strains grow

NATO gears up for conflict as transatlantic strains grow -

Facial recognition is leaving the US border — and we should be concerned

Facial recognition is leaving the US border — and we should be concerned -

Wheelchair design is stuck in the past — and disabled people are paying the price

Wheelchair design is stuck in the past — and disabled people are paying the price -

Why Europe still needs America

Why Europe still needs America -

Why Europe’s finance apps must start borrowing from each other’s playbooks

Why Europe’s finance apps must start borrowing from each other’s playbooks -

Why universities must set clear rules for AI use before trust in academia erodes

Why universities must set clear rules for AI use before trust in academia erodes -

The lucky leader: six lessons on why fortune favours some and fails others

The lucky leader: six lessons on why fortune favours some and fails others -

Reckon AI has cracked thinking? Think again

Reckon AI has cracked thinking? Think again -

The new 10 year National Cancer Plan: fewer measures, more heart?

The new 10 year National Cancer Plan: fewer measures, more heart? -

The Reese Witherspoon effect: how celebrity book clubs are rewriting the rules of publishing

The Reese Witherspoon effect: how celebrity book clubs are rewriting the rules of publishing -

The legality of tax planning in an age of moral outrage

The legality of tax planning in an age of moral outrage -

The limits of good intentions in public policy

The limits of good intentions in public policy -

Are favouritism and fear holding back Germany’s rearmament?

Are favouritism and fear holding back Germany’s rearmament? -

What bestseller lists really tell us — and why they shouldn’t be the only measure of a book’s worth

What bestseller lists really tell us — and why they shouldn’t be the only measure of a book’s worth -

Why mere survival is no longer enough for children with brain tumours

Why mere survival is no longer enough for children with brain tumours -

What Germany’s Energiewende teaches Europe about power, risk and reality

What Germany’s Energiewende teaches Europe about power, risk and reality -

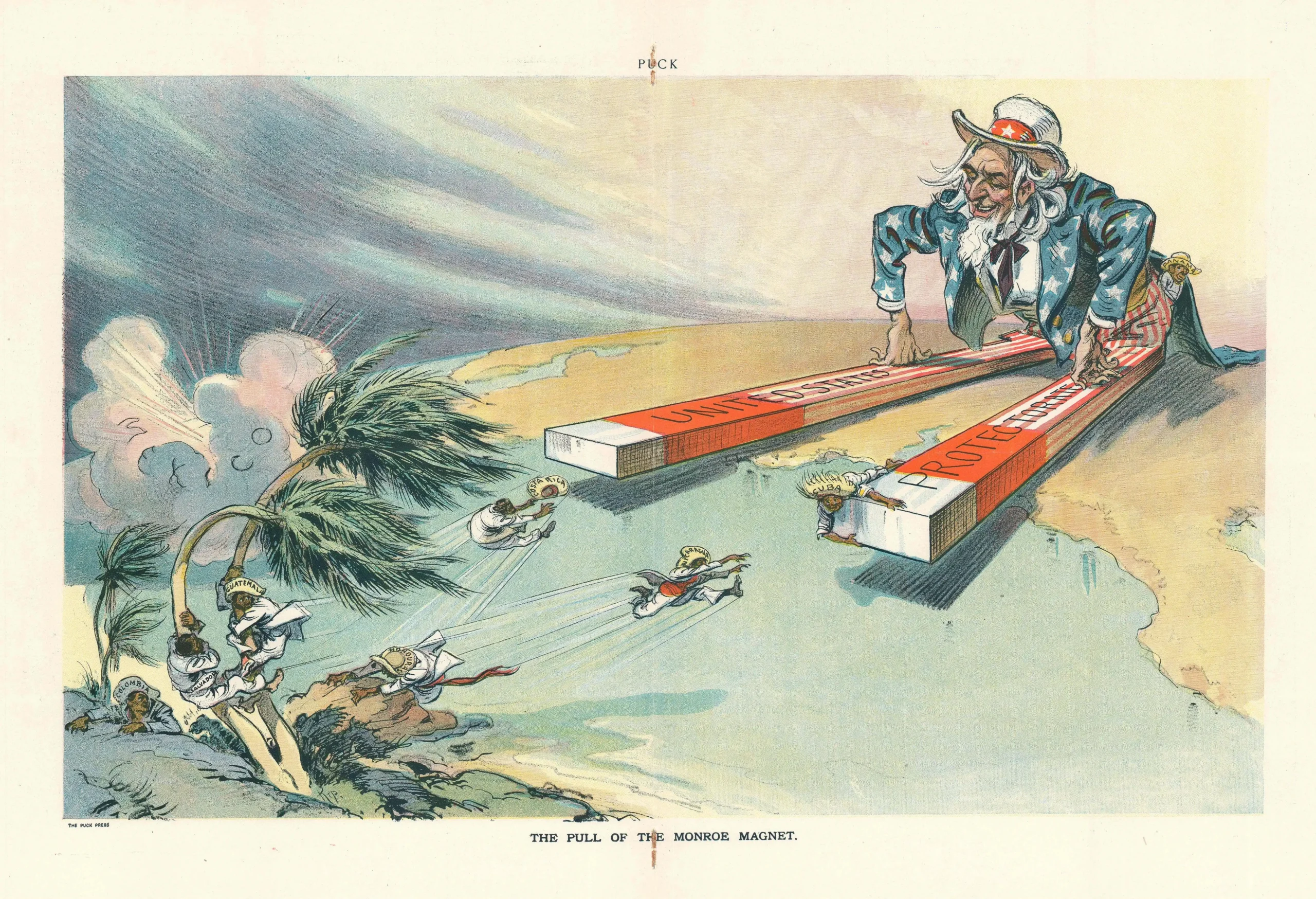

What the Monroe Doctrine actually said — and why Trump is invoking it now

What the Monroe Doctrine actually said — and why Trump is invoking it now -

Love with responsibility: rethinking supply chains this Valentine’s Day

Love with responsibility: rethinking supply chains this Valentine’s Day -

Why the India–EU trade deal matters far beyond diplomacy

Why the India–EU trade deal matters far beyond diplomacy -

Why the countryside is far safer than we think - and why apex predators belong in it

Why the countryside is far safer than we think - and why apex predators belong in it -

What if he falls?

What if he falls? -

Trump reminds Davos that talk still runs the world

Trump reminds Davos that talk still runs the world