Why Greece’s recovery depends on deeper EU economic integration

Christina Georgaki

- Published

- Opinion & Analysis

As Greece emerges from a decade of crisis, renewed debate over deeper EU economic integration has direct implications for investment, capital markets and financial resilience. Christina Georgaki, founder and managing partner of Georgaki and Partners Law Firm, assesses what closer alignment could mean for Greece and the wider bloc

The recent call by Greece’s finance minister, Kyriakos Pierrakakis, for the European Union to pursue deeper economic integration is not mere technocratic rhetoric. It is, in fact, a pragmatic solution for economic and social progress – for both Greece and the Continent more broadly.

As Greece’s national resurgence takes shape after years of crisis, we should not forget the role the EU played — or ignore the shared economic possibilities ahead. The EU provided us a lifeline when we were drowning in debt and remains the scaffold for our journey to resurgence. Simply put, without a stable and united Europe, the currency underpinning Greece’s economy, the markets sustaining its industries, the principles guiding its governance — and the bonds with its closest allies — could all be called into question.

It is naive to think that Greece would be better off alone. The disintegration of the EU would not merely be a geopolitical tragedy — it would be a direct threat to our hard fought and newly found stability and prosperity.

Not only will EU-enabled initiatives like Greece 2.0 play a vital role in the future modernisation of our economy, but at a broader level, our existing levels of interconnectedness with the Bloc cannot be ignored. Over 40,000 Greek higher education students are currently studying abroad, the highest number among all the EU nations in proportion to population. That means Greek culture, values and people are influencing neighbouring countries and, more importantly, that Greeks are returning to their homeland in greater numbers, having benefited from the flexibility of living abroad, as new data suggests.

The future economic possibilities of greater integration — as pointed out by Pierrakakis — are impossible to ignore. With greater alignment across the Bloc, investment can flow into Greece at continued high levels. As recent data from ELSTAT suggests, investment is driving the Greek economic renaissance, so this is vital.

Stability, standardisation, and regulatory compliance are three of the key things that investors tell me time and again they are looking for when deciding on where to invest. A closer economic union could make this process simpler while allowing capital markets to scale up across the Continent – rather than stagnate behind borders.

As pointed out by Pierrakakis — and as outlined in last year’s Draghi Report — a Capital Markets Union could also mitigate the effects of economic shocks, risks and external crises. With shared financial systems, unified capital markets and cross-border cooperation, the impact of shocks can be diluted. What Greece needs, what many of its peers now need, is the ability to plug into a truly united economic Bloc – one where capital, ideas, investment and talent move across borders with ease.

At a Continental level, it is more important than ever for the EU and its member countries to ally themselves with those other nations who share our common values of prosperity. In a time of Western fragmentation, European economic unity is more vital than ever. Strengthening our interconnectedness, safeguarding stability, and upholding moral leadership are imperative as we confront the challenges of an increasingly turbulent world and rising tariffs.

It is time to accept that our destinies are intertwined. The alternative — idling along as 27 half-functional economies pretending to compete — is a recipe for stagnation and wasted collective potential. By embracing deeper integration, we give Europe and Greece alike a fighting chance at a shared prosperity and a renewed sense of voice on a global stage.

Further Information

Produced with support from Christina Georgaki, founder and managing partner of Georgaki and Partners Law Firm, which specialises in international law, foreign direct investment and investment migration. She is completing a PhD in foreign direct investment at Warwick Business School and is a teaching fellow at Alba Graduate Business School – The American College of Greece. To find out more, visit www.georgakilawfirm.com

Main image: Deeper EU economic integration could strengthen investment flows, financial resilience and long-term growth across the bloc, including Greece. Credit: Supplied

RECENT ARTICLES

-

Why Europe still needs America

Why Europe still needs America -

Why Europe’s finance apps must start borrowing from each other’s playbooks

Why Europe’s finance apps must start borrowing from each other’s playbooks -

Why universities must set clear rules for AI use before trust in academia erodes

Why universities must set clear rules for AI use before trust in academia erodes -

The lucky leader: six lessons on why fortune favours some and fails others

The lucky leader: six lessons on why fortune favours some and fails others -

Reckon AI has cracked thinking? Think again

Reckon AI has cracked thinking? Think again -

The new 10 year National Cancer Plan: fewer measures, more heart?

The new 10 year National Cancer Plan: fewer measures, more heart? -

The Reese Witherspoon effect: how celebrity book clubs are rewriting the rules of publishing

The Reese Witherspoon effect: how celebrity book clubs are rewriting the rules of publishing -

The legality of tax planning in an age of moral outrage

The legality of tax planning in an age of moral outrage -

The limits of good intentions in public policy

The limits of good intentions in public policy -

Are favouritism and fear holding back Germany’s rearmament?

Are favouritism and fear holding back Germany’s rearmament? -

What bestseller lists really tell us — and why they shouldn’t be the only measure of a book’s worth

What bestseller lists really tell us — and why they shouldn’t be the only measure of a book’s worth -

Why mere survival is no longer enough for children with brain tumours

Why mere survival is no longer enough for children with brain tumours -

What Germany’s Energiewende teaches Europe about power, risk and reality

What Germany’s Energiewende teaches Europe about power, risk and reality -

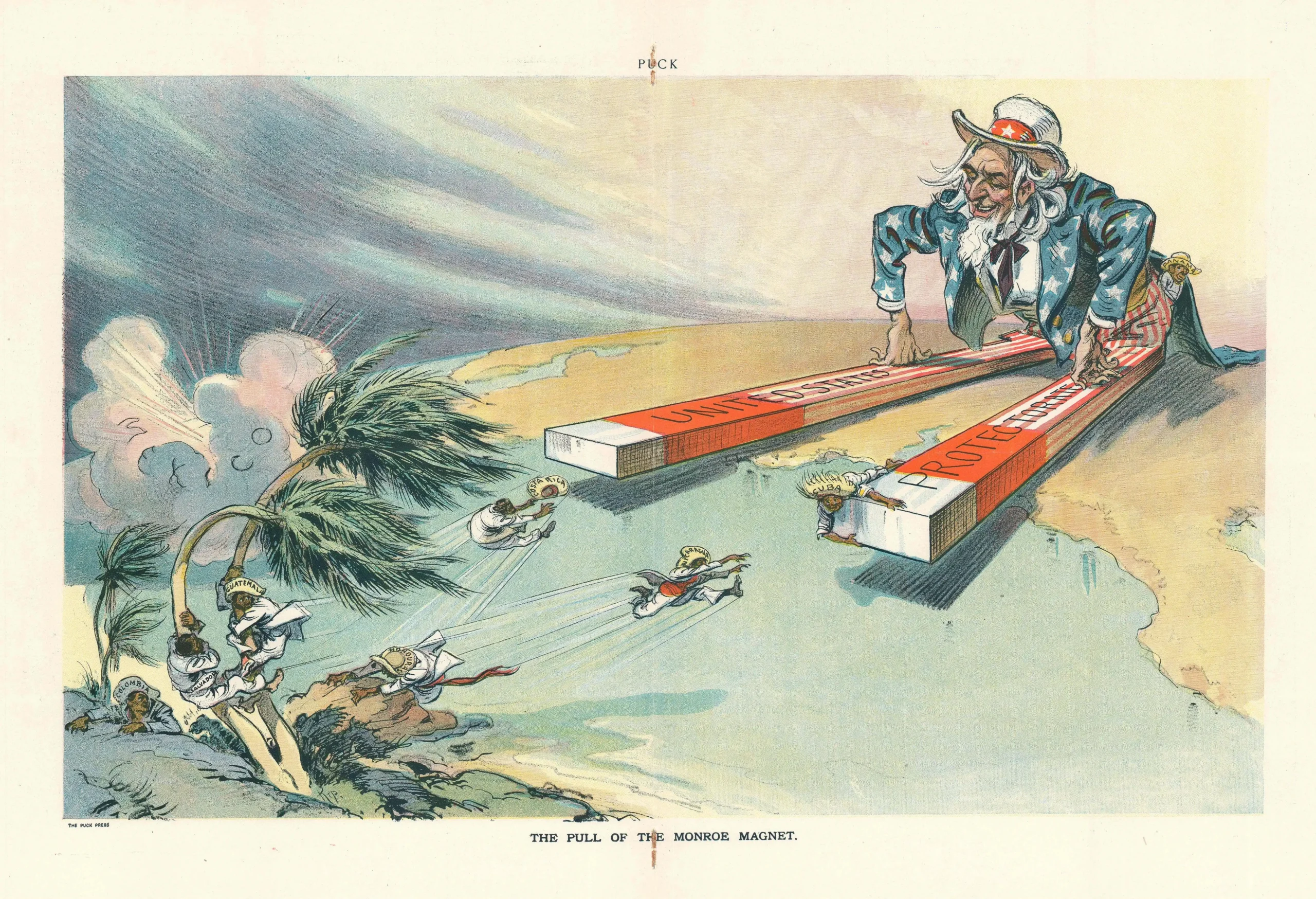

What the Monroe Doctrine actually said — and why Trump is invoking it now

What the Monroe Doctrine actually said — and why Trump is invoking it now -

Love with responsibility: rethinking supply chains this Valentine’s Day

Love with responsibility: rethinking supply chains this Valentine’s Day -

Why the India–EU trade deal matters far beyond diplomacy

Why the India–EU trade deal matters far beyond diplomacy -

Why the countryside is far safer than we think - and why apex predators belong in it

Why the countryside is far safer than we think - and why apex predators belong in it -

What if he falls?

What if he falls? -

Trump reminds Davos that talk still runs the world

Trump reminds Davos that talk still runs the world -

Will Trump’s Davos speech still destroy NATO?

Will Trump’s Davos speech still destroy NATO? -

Philosophers cautioned against formalising human intuition. AI is trying to do exactly that

Philosophers cautioned against formalising human intuition. AI is trying to do exactly that -

Life’s lottery and the economics of poverty

Life’s lottery and the economics of poverty -

On a wing and a prayer: the reality of medical repatriation

On a wing and a prayer: the reality of medical repatriation -

Ai&E: the chatbot ‘GP’ has arrived — and it operates outside the law

Ai&E: the chatbot ‘GP’ has arrived — and it operates outside the law -

Keir Starmer, Wes Streeting and the Government’s silence: disabled people are still waiting

Keir Starmer, Wes Streeting and the Government’s silence: disabled people are still waiting