Africa’s overlooked advantage — and the funding gap that’s holding it back

Alisa Sydow

- Published

- Opinion & Analysis

Africa leads the world in the share of women who start businesses, yet women-led ventures receive only a tiny slice of available capital. Drawing on new UN research, Alisa Sydow examines the financial, cultural and structural barriers that suppress growth — and sets out the practical steps investors and policymakers can take to unlock the continent’s strongest, yet most underfunded, entrepreneurial engine

Africa is often described as trailing the rest of the world. On one measure, it leads: the continent is home to the highest share of women founders globally — roughly 24% of women are founders. Yet celebration would be premature. Only a sliver of investment — about 2% — flows to women‑led ventures. The result is a paradox: a vibrant pipeline matched with parched capital.

So why does promise fail to translate into growth?

A recent UN publication, Breaking Down Barriers for Women Digital Entrepreneurs: Insights from Africa, points away from the usual myths. The problem is not a deficit of talent, ambition or venture creation among women. It is the web of financial, structural and cultural obstacles that quietly drags on their progress — the sort of friction that doesn’t make headlines but does shape outcomes.

Consider Ingrid Aringaniza, pictured, an entrepreneur from Uganda, building Rahami Agri Group, a Tanzania-based modular, community‑integrated cashew processing business. “The market is there”, she explains. Demand for processed cashews is strong and steady. The constraint is capacity. Processing equipment is capital-intensive; when large orders arrive, she must outsource steps in the value chain, pushing up unit costs and squeezing margins. Like many founders, she has launched different ventures over time and believes agribusiness is her “resting place” — a domain with daily demand and continental importance. What she needs is not applause. She needs financing that matches the realities of scaling production.

Her story mirrors three patterns we see across the continent.

1) Culture still acts as a gatekeeper.

Too many stories begin the same way. A woman arrives to lead a meeting and is asked to fetch the coffee. A negotiation stalls when a counterpart refuses to transact with “the woman on the team.” These slights are not just insulting; they’re economically costly. The problem intensifies in situations when female founders start asking for capital. Founders report questions no man would hear: “Is your husband comfortable with this?” “How will you run the company if you have children?” Laws may guarantee equal treatment, but norms in the room often decide who gets a term sheet. Equality on paper is not equality in practice.

2) Finance is designed for someone else.

Where women‑led businesses do secure capital, it often arrives later, in smaller tickets, with more strings attached. Banks ask for collateral that many founders don’t hold in their own names. Most of the time, banks would like to see some assets like real estate and/or land. However, usually those belong to the men in the families, not the women. Investors prize traction yet hesitate to fund the steps that make traction possible — equipment, working capital, and the first hires. The net effect is predictable: slower growth, higher costs per unit, and a persistent gap between potential and scale.

3) Time poverty is real — and it is gendered.

In many communities, women shoulder a disproportionate share of unpaid care: children, ageing parents, and extended family. Founders often describe it bluntly: “As a woman in Africa, you don’t fully own your time.” Time is the invisible currency of entrepreneurship. When it is fragmented, so are focus and networks — the two ingredients most correlated with early traction. Despite this, women entrepreneurs routinely demonstrate remarkable resilience: building customer bases between school runs, managing teams while caring for relatives, and keeping operations moving through sheer determination. Resilience, however, shouldn’t be the business model. And these extra duties are not rewarded by investors and banks. They are well aware of the situation and therefore they are even more critical when considering investing in the business of a female founder.

If we accept that the issue is structural, the response must be, too. Here are five moves that investors, banks and policymakers can make now — practical steps that convert a moral case into a commercial strategy.

Five moves to unlock Africa’s women founders

1. Redesign diligence to remove bias.

Replace informal biases with structured assessment: same scorecards, same questions, same thresholds for all founders. Require mixed‑gender investment committees. Record and review questions asked in pitch meetings; coach teams to focus on business fundamentals rather than family status. Bias thrives in ambiguity. Process is an antidote.

2. Finance the first scale, not just the first slide.

Women‑led ventures are too often told to “get more traction” — without the capital to achieve it. The financing sector needs to create instruments suited to early scale: revenue‑based finance, or purchase‑order financing. Consider milestone‑based tranches that release capital as production ramps. The goal is simple: fund the step from promise to production.

3. Underwrite time, not just tech.

If time poverty is a binding constraint, address it directly. Encourage portfolio companies to budget for childcare stipends or flexible scheduling during crunch periods. Public programmes can co‑finance community childcare near industrial parks and markets. These are not perks; they are productivity tools.

4. Build deal flow where women already are.

Don’t wait for founders to come to you. Partner with women’s business associations, university incubators, and sector‑specific hubs in agriculture, retail tech and health. Offer office hours, not just demo days. When the pipeline is wide and visible, capital has fewer excuses.

5. Reward impact that drives revenue.

Many women founders start companies to solve real problems — safer food supply chains, affordable health services, reliable logistics. Frame that social focus as a commercial edge, not a charitable add‑on. Tie incentives to measurable customer outcomes that also grow the business: repeat purchase rates, cost‑to‑serve, on‑time delivery. Impact and profit are not in tension when metrics link them.

The payoff for investors is clear. Backing women founders is not a concession. It is a way to access underserved markets, diversify portfolios and capture durable demand — the kind of demand that cashew processors feel when a retailer calls with the next order, or a clinic sees queues every morning, or a payments platform becomes the default in a market stall.

The payoff for policymakers is just as tangible. When finance reaches the people who are already building, jobs follow. Supply chains formalise. Tax bases expand. Communities see role models they recognise, not archetypes imported from elsewhere.

Africa does not lack entrepreneurs. It lacks a funding system calibrated to the realities of the women who are building some of its most resilient businesses. The data already tells the story: a high share of female founders, a tiny share of capital. The choice now is whether we keep treating this as a side issue — or as a straightforward business opportunity hiding in plain sight.

Invest in women not because it looks good, but because it works. They are innovators, leaders and changemakers — and, as Ingrid reminds us, they are feeding growing markets every day.

Alisa Sydow is an Associate Professor of Entrepreneurship and Innovation at ESCP Business School. Her research focuses on entrepreneurship in emerging markets—particularly technology and women’s entrepreneurship in Africa. She has published in leading journals such as Entrepreneurship Theory and Practice and Journal of Business Venturing. A 2025 Thinkers50 Radar honouree, Alisa also founded Nampelka, a start-up supporting African entrepreneurs. She holds a PhD in Management and Innovation from Università Cattolica del Sacro Cuore, Milan.

READ MORE: ‘Women turning to entrepreneurship to fight age bias at work, study shows‘. A new European study suggests older women are rewriting the rules of work — turning to entrepreneurship not out of necessity, but as a route to independence, confidence and control in a job market that often sidelines experience.

Do you have news to share or expertise to contribute? The European welcomes insights from business leaders and sector specialists. Get in touch with our editorial team to find out more.

Images: Supplied

RECENT ARTICLES

-

Why Europe still needs America

Why Europe still needs America -

Why Europe’s finance apps must start borrowing from each other’s playbooks

Why Europe’s finance apps must start borrowing from each other’s playbooks -

Why universities must set clear rules for AI use before trust in academia erodes

Why universities must set clear rules for AI use before trust in academia erodes -

The lucky leader: six lessons on why fortune favours some and fails others

The lucky leader: six lessons on why fortune favours some and fails others -

Reckon AI has cracked thinking? Think again

Reckon AI has cracked thinking? Think again -

The new 10 year National Cancer Plan: fewer measures, more heart?

The new 10 year National Cancer Plan: fewer measures, more heart? -

The Reese Witherspoon effect: how celebrity book clubs are rewriting the rules of publishing

The Reese Witherspoon effect: how celebrity book clubs are rewriting the rules of publishing -

The legality of tax planning in an age of moral outrage

The legality of tax planning in an age of moral outrage -

The limits of good intentions in public policy

The limits of good intentions in public policy -

Are favouritism and fear holding back Germany’s rearmament?

Are favouritism and fear holding back Germany’s rearmament? -

What bestseller lists really tell us — and why they shouldn’t be the only measure of a book’s worth

What bestseller lists really tell us — and why they shouldn’t be the only measure of a book’s worth -

Why mere survival is no longer enough for children with brain tumours

Why mere survival is no longer enough for children with brain tumours -

What Germany’s Energiewende teaches Europe about power, risk and reality

What Germany’s Energiewende teaches Europe about power, risk and reality -

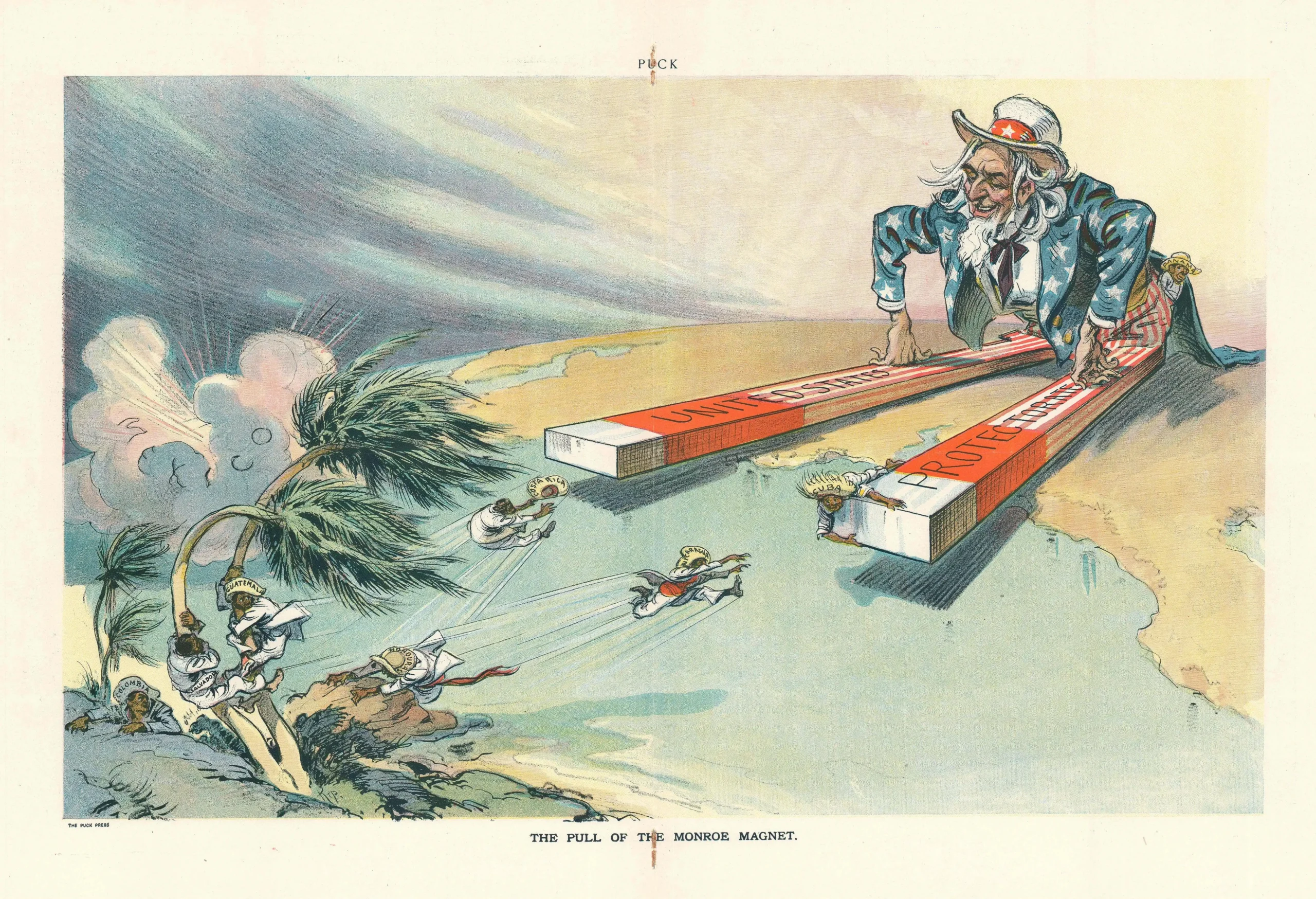

What the Monroe Doctrine actually said — and why Trump is invoking it now

What the Monroe Doctrine actually said — and why Trump is invoking it now -

Love with responsibility: rethinking supply chains this Valentine’s Day

Love with responsibility: rethinking supply chains this Valentine’s Day -

Why the India–EU trade deal matters far beyond diplomacy

Why the India–EU trade deal matters far beyond diplomacy -

Why the countryside is far safer than we think - and why apex predators belong in it

Why the countryside is far safer than we think - and why apex predators belong in it -

What if he falls?

What if he falls? -

Trump reminds Davos that talk still runs the world

Trump reminds Davos that talk still runs the world -

Will Trump’s Davos speech still destroy NATO?

Will Trump’s Davos speech still destroy NATO? -

Philosophers cautioned against formalising human intuition. AI is trying to do exactly that

Philosophers cautioned against formalising human intuition. AI is trying to do exactly that -

Life’s lottery and the economics of poverty

Life’s lottery and the economics of poverty -

On a wing and a prayer: the reality of medical repatriation

On a wing and a prayer: the reality of medical repatriation -

Ai&E: the chatbot ‘GP’ has arrived — and it operates outside the law

Ai&E: the chatbot ‘GP’ has arrived — and it operates outside the law -

Keir Starmer, Wes Streeting and the Government’s silence: disabled people are still waiting

Keir Starmer, Wes Streeting and the Government’s silence: disabled people are still waiting