The politics of taxation — and the price we’ll pay for it

Harry Margulies

- Published

- Opinion & Analysis

Governments promise fairness and balance through ever-higher taxes and redistribution. In practice, the results are stagnation, distortion and debt. Harry Margulies examines how moral ambition has turned modern tax systems against the very societies they are meant to sustain

The main purpose of a tax system is to fund public services. That includes healthcare, education, infrastructure, policing, firefighting and national defence. In a functioning democracy, people accept the need for taxes, but they also expect the system to be fair and productive.

Over time, tax systems have taken on additional responsibilities. They are expected not only to fund services, but to redistribute wealth, shape behaviour and stabilise economies. Some of these efforts make sense in theory. In practice, they are often self-defeating.

Governments impose sin taxes on tobacco and alcohol to discourage unhealthy habits. But they are also addicted to the revenue. Higher marginal tax rates aim to equalize income yet end up discouraging productivity. Wealth and inheritance taxes are intended to promote fairness but can end up producing broad economic damage.

Tax policy is increasingly guided by ideology and good intentions rather than basic economic logic. Too often, we ignore unintended consequences. The result is a system that redistributes in ways we did not anticipate.

Some redistributions are generational. We are living longer. Retirement ages have not moved up. Young people entering the workforce are expected to pay for pensions and medical care for retirees who may live for decades. That was not the original idea behind social insurance systems. But the political reality is clear. Retirees vote. Young people do not. So the imbalance continues.

Debt is another kind of redistribution. When governments run deficits year after year, they are not just borrowing. They are shifting the burden of calling in the tax to future politicians and to payment to future taxpayers. In effect, we are buying our own standard of living now and asking our children and grandchildren to foot the bill.

The promise is always the same. Growth will take care of it. But growth has been elusive. Productivity gains are slow. Demographics are unfavourable. Meanwhile, government debt levels in G7 countries are already high. Japan leads the pack with debt over 250 per cent of GDP. The US is around 125 per cent. Germany hovers near 70 per cent.

The interest payments alone are staggering. As debt grows, the cost of servicing it eats into budgets for everything else. If interest rates rise, which they will, there will be less money left for schools, hospitals and social programs.

That brings us to inflation. In theory, inflation makes it easier to pay off debt. It reduces the real value of what is owed. Governments may find this appealing. But inflation is a blunt tool. It hurts savers, squeezes the middle class and creates uncertainty.

People rush to spend before prices go up again. Renters suffer. Homeowners feel rich. Wage demands increase. Businesses raise prices to keep up. The cycle feeds on itself. Marcus Wallenberg, the Swedish industrialist, once described inflation as feeling like peeing in your pants.

At first it is warm and comfortable. Then it turns cold and sticky. He was right. Some argue we can tax our way out. Just raise taxes on the rich. Introduce wealth taxes. Raise inheritance taxes. But here, too, intentions crash into reality. Wealth taxes are easy to propose and difficult to enforce.

The truly wealthy do not sit on piles of cash. Their wealth is often tied up in assets. To tax it, governments would need to seize the assets with negative effects on value.

The French economist Thomas Piketty proposed taxing away 90 percent of wealth above two billion euros. It sounds righteous. But it means the government ends up owning private or public companies and likely crashing their share prices. France quietly abolished its wealth tax soon after Pikcetty’s proposal. When Sweden tried similar experiments, it led to bizarre outcomes.

In the 1980s, the top marginal tax rate was 87 percent. Once high-earning professionals hit the threshold, they stopped working. Golf replaced surgery. Productivity dropped. Astrid Lindgren, beloved author of Pippi Longstocking, made headlines when in her story about the witch Pomperipossa where she revealed she paid more than 100 per cent of her income in taxes. Imagine a social democratic finance minister providing tax planning advice. She didn’t want to plan, she just simply did not wish to pay more than her income in tax. Pomperipossa brought down the government.

In 1984, Sally Kistner, Sweden’s wealthiest woman, died. She held 300 million SEK in Astra shares. Her estate was hit with a punitive inheritance tax. In order to pay the tax, the estate had to sell shares and pay capital gains tax. The market expected a huge supply of Astra shares and the stock price plunged forcing the estate to go bankrupt. Let us call that the Kistner Effect.

Sweden, under social democratic governments, eventually scrapped both the wealth tax and the inheritance tax. Not because the rich protested. Because the taxes backfired.

Before you accept what your politicians are selling, ask what it will really cost. Not in slogans, but in consequences. Some redistributions may be warranted. It is reasonable that higher income earners pay higher marginal tax rate. They have better use for society’s protections.

It’s difficult to say when the limit is reached, but when it is, other redistributions simply make us poorer.

Harry Margulies is a journalist, author, commentator, and public intellectual whose work interrogates religion, politics, and morality with sharp wit and fearless clarity. A second-generation Holocaust survivor, he was born in Austria and spent time in an Austrian refugee camp before moving to Sweden. Educated by Orthodox rabbis throughout his childhood, he ultimately abandoned faith in his teens—a journey that has shaped his lifelong commitment to secularism, critical thinking, and freedom of expression. His latest book, Is God Real? Hell Knows, has been described by ABBA’s Björn Ulvaeus as “funny, sharp, and unafraid.”

READ MORE: ‘The Mamdani experiment: can socialism really work in New York?‘. With more than 123 million people displaced worldwide and traditional solutions faltering, the concept of ‘Free Global Cities’ could transform refugees from passive recipients of aid into active contributors to thriving, resilient communities, argues Dr. Christian H. Kaelin, Chairman at Henley & Partners.

Do you have news to share or expertise to contribute? The European welcomes insights from business leaders and sector specialists. Get in touch with our editorial team to find out more.

Main image: Nataliya Vaitkevich/Pexels

RECENT ARTICLES

-

Europe cannot call itself ‘equal’ while disabled citizens are still fighting for access

Europe cannot call itself ‘equal’ while disabled citizens are still fighting for access -

Is Europe regulating the future or forgetting to build it? The hidden flaw in digital sovereignty

Is Europe regulating the future or forgetting to build it? The hidden flaw in digital sovereignty -

The era of easy markets is ending — here are the risks investors can no longer ignore

The era of easy markets is ending — here are the risks investors can no longer ignore -

Is testosterone the new performance hack for executives?

Is testosterone the new performance hack for executives? -

Can we regulate reality? AI, sovereignty and the battle over what counts as real

Can we regulate reality? AI, sovereignty and the battle over what counts as real -

NATO gears up for conflict as transatlantic strains grow

NATO gears up for conflict as transatlantic strains grow -

Facial recognition is leaving the US border — and we should be concerned

Facial recognition is leaving the US border — and we should be concerned -

Wheelchair design is stuck in the past — and disabled people are paying the price

Wheelchair design is stuck in the past — and disabled people are paying the price -

Why Europe still needs America

Why Europe still needs America -

Why Europe’s finance apps must start borrowing from each other’s playbooks

Why Europe’s finance apps must start borrowing from each other’s playbooks -

Why universities must set clear rules for AI use before trust in academia erodes

Why universities must set clear rules for AI use before trust in academia erodes -

The lucky leader: six lessons on why fortune favours some and fails others

The lucky leader: six lessons on why fortune favours some and fails others -

Reckon AI has cracked thinking? Think again

Reckon AI has cracked thinking? Think again -

The new 10 year National Cancer Plan: fewer measures, more heart?

The new 10 year National Cancer Plan: fewer measures, more heart? -

The Reese Witherspoon effect: how celebrity book clubs are rewriting the rules of publishing

The Reese Witherspoon effect: how celebrity book clubs are rewriting the rules of publishing -

The legality of tax planning in an age of moral outrage

The legality of tax planning in an age of moral outrage -

The limits of good intentions in public policy

The limits of good intentions in public policy -

Are favouritism and fear holding back Germany’s rearmament?

Are favouritism and fear holding back Germany’s rearmament? -

What bestseller lists really tell us — and why they shouldn’t be the only measure of a book’s worth

What bestseller lists really tell us — and why they shouldn’t be the only measure of a book’s worth -

Why mere survival is no longer enough for children with brain tumours

Why mere survival is no longer enough for children with brain tumours -

What Germany’s Energiewende teaches Europe about power, risk and reality

What Germany’s Energiewende teaches Europe about power, risk and reality -

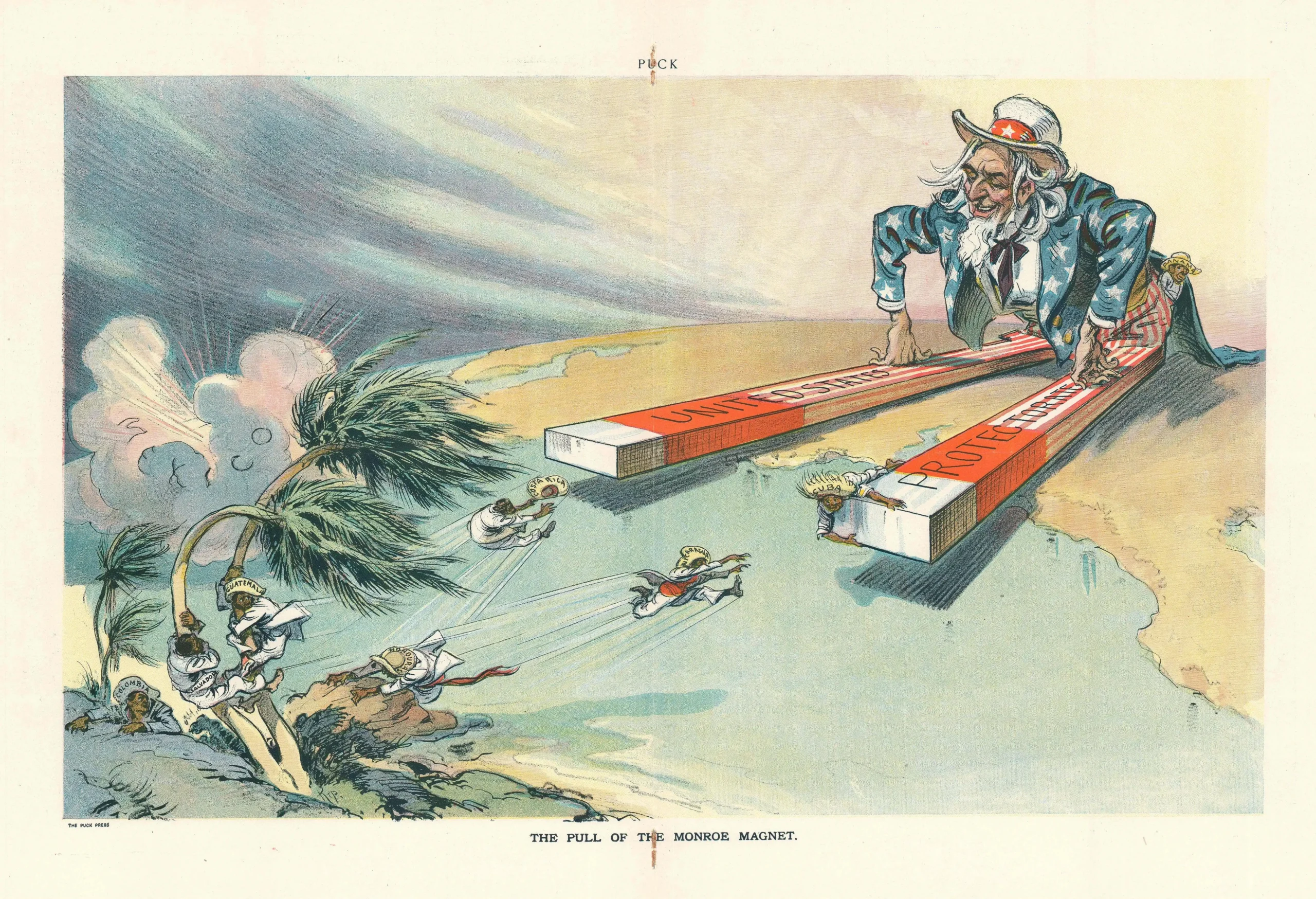

What the Monroe Doctrine actually said — and why Trump is invoking it now

What the Monroe Doctrine actually said — and why Trump is invoking it now -

Love with responsibility: rethinking supply chains this Valentine’s Day

Love with responsibility: rethinking supply chains this Valentine’s Day -

Why the India–EU trade deal matters far beyond diplomacy

Why the India–EU trade deal matters far beyond diplomacy -

Why the countryside is far safer than we think - and why apex predators belong in it

Why the countryside is far safer than we think - and why apex predators belong in it