Is Europe’s transition to electric vehicles losing power?

Mark G. Whitchurch

- Published

- Motoring, Opinion & Analysis

Falling sales, economic struggles and policy changes mean some of Europe’s largest car manufacturers are unlikely to meet the 2035 EV deadline, warns our motoring editor, Mark Whitchurch

The future looks bright – but is it really electric? For years, policymakers, automakers, and drivers have been pushing towards a world powered by EVs. But as we progress through 2025, that vision is looking increasingly uncertain. With major European manufacturers rolling back plans for full electrification by 2035, governments reconsidering legislation, and second-hand electric vehicle (EV) values plummeting, industry experts warn that we are entering one of the most unpredictable periods in motoring history.

This uncertainty is particularly evident in the premium segment, where sales of pure electric vehicles have fallen sharply in 2024, missing manufacturer forecasts by a wide margin. Despite billions invested in EV technology to compete with Tesla and the growing dominance of Chinese brands, consumer uptake has stalled. Many early adopters, lured in by tax incentives and company car schemes, now feel short-changed as their vehicles’ residual values have collapsed.

And the financial impact has been severe. European car manufacturers have seen profits tumble, with share values following suit. Germany, entering its second consecutive year of recession, is home to some of the hardest-hit brands. Volkswagen Group, Mercedes-Benz, and BMW have all responded by reviving combustion engine research and development, slowing their push towards full electrification as a means of stabilising their balance sheets.

This shift represents a stark reversal from the industry’s trajectory over the past decade. The turning point came in 2015 with the Volkswagen “Dieselgate” scandal, which exposed the company’s manipulation of emissions data. The fallout led to tougher emissions standards under Euro 7 regulations, which many manufacturers saw as impossible to meet without heavy investment in internal combustion engine (ICE) technology. Meanwhile, Tesla was revolutionising the market, and politicians were eager to embrace an all-electric future.

In 2020, then-Prime Minister Boris Johnson announced that all new cars sold in the UK from 2030 onwards would be electric. For a time, it seemed the industry, government, and consumers were all singing from the same electric hymn sheet. However, the COVID-19 pandemic reshaped the global economy, leaving both consumers and carmakers facing financial strain.

As supply chain issues mounted, the first wave of electric car buyers – many using company car schemes – began to see their vehicles depreciate far more than expected. The Porsche Taycan, for example, lost up to 60% of its value within three years, exposing a harsh reality: in the premium segment, EVs were not holding their value.

At the same time, charging infrastructure across Europe has struggled to keep pace with demand, and economic uncertainty has further dampened enthusiasm for electric-only motoring. Vehicle sales fell by 13.9% in 2024, adding to the pressure on manufacturers. In response, carmakers have begun to backtrack on their EV commitments:

- Volvo and Lotus, despite having Chinese parent companies, announced in late 2024 that they would continue producing traditional combustion engines well into the 2030s.

- BMW confirmed plans to maintain V8 petrol engine production for US and Middle Eastern markets indefinitely.

- Bentley postponed its all-electric transition to 2035.

- Audi is shutting down a factory in Belgium and cancelling the Q8 e-tron, citing a steep drop in demand for large premium EVs.

- Porsche, one of the earliest brands to go all-in on electric, has seen a 40% drop in sales in 2024, with vehicle margins shrinking from over 20% to just 10%.

Despite these setbacks, the EV revolution isn’t over. Instead, manufacturers are increasingly turning to hybrids as a compromise. The upcoming BMW M5 exemplifies this shift, using an electric motor to enhance performance rather than replace combustion entirely. While the added weight of batteries remains a challenge, hybrid technology allows manufacturers to navigate legislative requirements while still delivering the driving experience customers expect.

In the smaller A- and B-segment markets, electric models continue to gain traction. The Renault 5, a retro-styled EV with a 252-mile range and a starting price of £26,995, has been hailed as the “new spark” of 2025. Similarly, revised versions of the BMW MINI and Fiat Panda are injecting nostalgia into the electric market, helping to maintain interest in EVs where they make the most sense.

Without further legislative adjustments, carmakers are being pushed into a corner. The UK government has already extended Johnson’s original 2030 deadline to 2035, aligning with European counterparts, but further consultations are needed to assess the economic impact of forcing a rapid shift to zero emissions.

Globally, many nations have not committed to going fully electric, and experts suggest that a true worldwide transition is unlikely before 2050. Meanwhile, the real winners in the current situation appear to be China and Tesla. European manufacturers are now buying carbon credits – worth up to £5,000 per vehicle – to comply with Brussels’ 2025 emissions targets, effectively handing financial gains to their biggest competitors. In 2023 alone, Elon Musk pocketed an estimated $1.79 billion from this system.

The need to tackle climate change is undeniable, but the transition to electric must be sustainable – not just environmentally, but economically, too. If Europe continues on its current path, it risks handing long-term market dominance to China and Tesla while damaging its own industrial base. Consumers, manufacturers, and legislators must find a balanced approach that supports both sustainability and economic stability.

The road ahead for EVs is still open, but for now at least, it’s no longer a one-way street.

Mark G. Whitchurch is a seasoned motoring journalist whose work—covering road tests, launch reports, scenic drives, major races, and event reviews—has appeared in The Observer, Daily Telegraph, Bristol Evening Post, Classic & Sports Car Magazine, Mini Magazine, Classic Car Weekly, AutoCar Magazine, and the Western Daily Press, among others. He won the Tourism Malaysia Regional Travel Writer of the Year in 2003 and is a member The Guild of Motoring Writers.

Main image: Courtesy Kindel Media/Pexels

RECENT ARTICLES

-

Can we regulate reality? AI, sovereignty and the battle over what counts as real

Can we regulate reality? AI, sovereignty and the battle over what counts as real -

NATO gears up for conflict as transatlantic strains grow

NATO gears up for conflict as transatlantic strains grow -

Facial recognition is leaving the US border — and we should be concerned

Facial recognition is leaving the US border — and we should be concerned -

Wheelchair design is stuck in the past — and disabled people are paying the price

Wheelchair design is stuck in the past — and disabled people are paying the price -

Why Europe still needs America

Why Europe still needs America -

Why Europe’s finance apps must start borrowing from each other’s playbooks

Why Europe’s finance apps must start borrowing from each other’s playbooks -

Why universities must set clear rules for AI use before trust in academia erodes

Why universities must set clear rules for AI use before trust in academia erodes -

The lucky leader: six lessons on why fortune favours some and fails others

The lucky leader: six lessons on why fortune favours some and fails others -

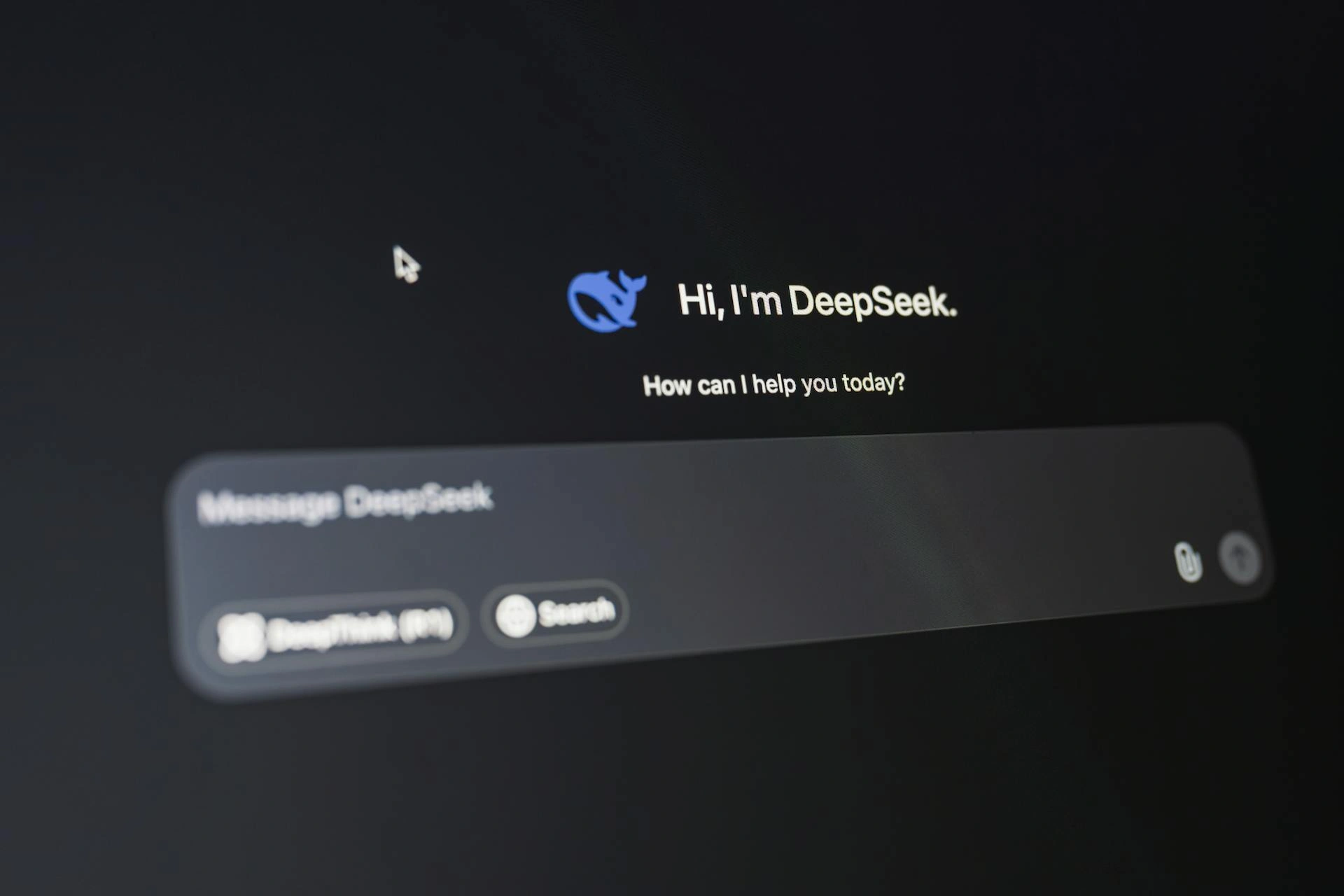

Reckon AI has cracked thinking? Think again

Reckon AI has cracked thinking? Think again -

The new 10 year National Cancer Plan: fewer measures, more heart?

The new 10 year National Cancer Plan: fewer measures, more heart? -

The Reese Witherspoon effect: how celebrity book clubs are rewriting the rules of publishing

The Reese Witherspoon effect: how celebrity book clubs are rewriting the rules of publishing -

The legality of tax planning in an age of moral outrage

The legality of tax planning in an age of moral outrage -

The limits of good intentions in public policy

The limits of good intentions in public policy -

Are favouritism and fear holding back Germany’s rearmament?

Are favouritism and fear holding back Germany’s rearmament? -

What bestseller lists really tell us — and why they shouldn’t be the only measure of a book’s worth

What bestseller lists really tell us — and why they shouldn’t be the only measure of a book’s worth -

Why mere survival is no longer enough for children with brain tumours

Why mere survival is no longer enough for children with brain tumours -

What Germany’s Energiewende teaches Europe about power, risk and reality

What Germany’s Energiewende teaches Europe about power, risk and reality -

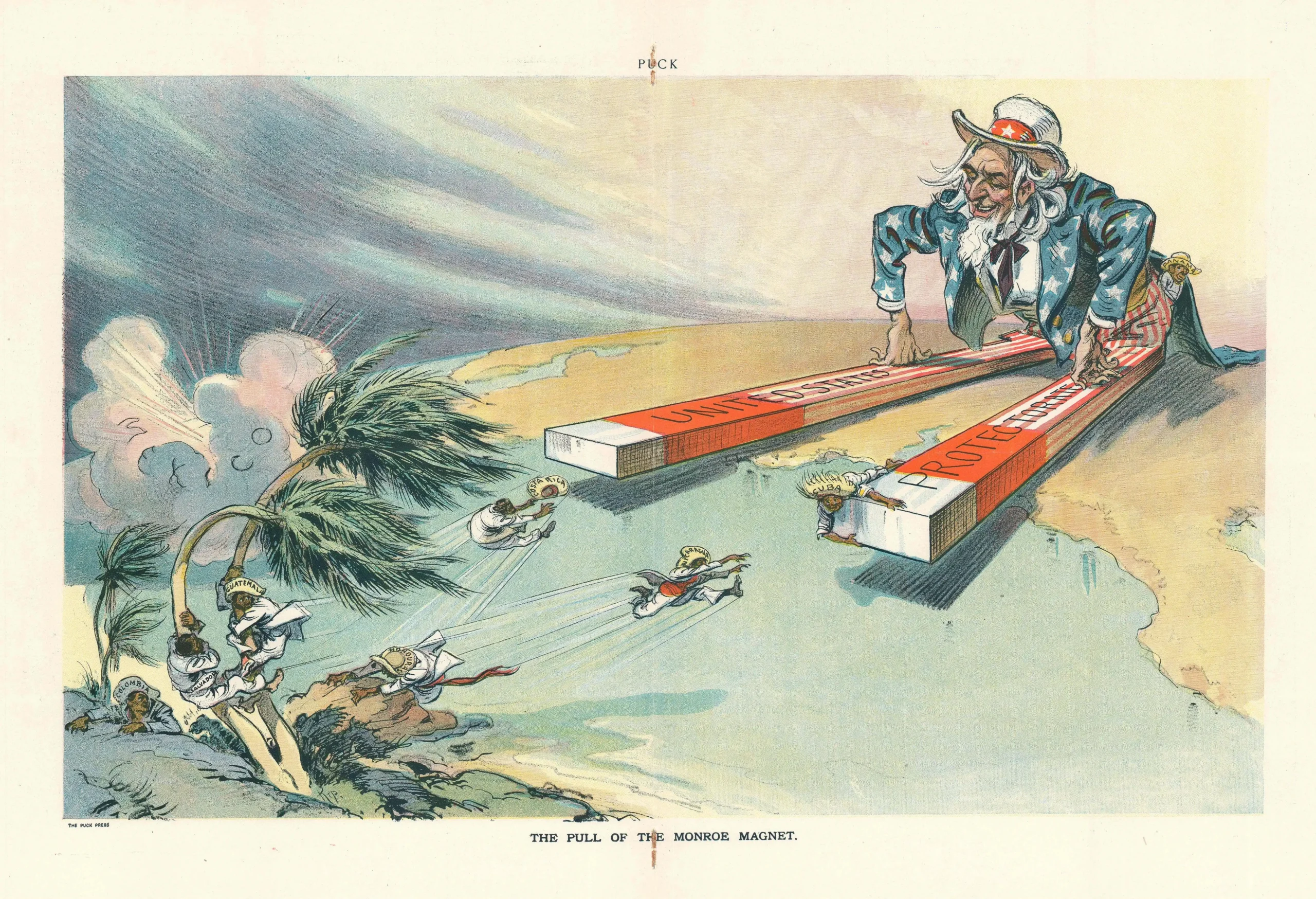

What the Monroe Doctrine actually said — and why Trump is invoking it now

What the Monroe Doctrine actually said — and why Trump is invoking it now -

Love with responsibility: rethinking supply chains this Valentine’s Day

Love with responsibility: rethinking supply chains this Valentine’s Day -

Why the India–EU trade deal matters far beyond diplomacy

Why the India–EU trade deal matters far beyond diplomacy -

Why the countryside is far safer than we think - and why apex predators belong in it

Why the countryside is far safer than we think - and why apex predators belong in it -

What if he falls?

What if he falls? -

Trump reminds Davos that talk still runs the world

Trump reminds Davos that talk still runs the world -

Will Trump’s Davos speech still destroy NATO?

Will Trump’s Davos speech still destroy NATO? -

Philosophers cautioned against formalising human intuition. AI is trying to do exactly that

Philosophers cautioned against formalising human intuition. AI is trying to do exactly that