How AI is revolutionising entrepreneurial finance

John E. Kaye

As artificial intelligence (AI) continues to reshape industries worldwide, its impact on entrepreneurial finance is particularly profound, levelling the playing field for business leaders who have capital ideas but not the capital, writes tech expert Mo Farmer

Where once spreadsheets, gut instinct and well-honed financial acumen defined the entrepreneur’s toolkit, now algorithms, machine-learning models, and predictive analytics have become indispensable. It’s not too bold a claim to say that we are standing at the cusp of a revolution—one where data, when wielded correctly, becomes as powerful as capital itself.

AI’s impact on entrepreneurial finance is substantial; it automates repetitive tasks, crunches numbers faster than a human ever could, and identifies new opportunities. But that’s not all. AI is also able to rethink how decisions are made and how risks are assessed, all at the touch of a button. The fundamental shift lies in the sheer scale of information AI can process and the actionable insights it generates, providing the clarity and precision that time-hungry entrepreneurs need to act decisively.

At the forefront of this technological renaissance are entrepreneurs like Elon Musk, whose ventures—be they in electric vehicles, space exploration, or neural interfaces—operate at the bleeding edge of innovation. Musk’s companies are prime examples of how AI has become intertwined with financial decision-making. Take Tesla: the US firm, recently valued at approximately $1.267trillion (£1.033trillion), relies on artificial intelligence for its autonomous driving technology, as can be found in the Model S, on sale in the US for around $75,000 (£61,000).

But Tesla’s operations and financial strategies are cemented in data-driven optimisation, too. The company doesn’t merely rely on AI for autonomous driving; its operations and financial strategies are cemented in data-driven optimisation. AI-powered simulations model everything from market demand to supply chain logistics, allowing the company to anticipate challenges and maximise efficiency in a way that would be impossible through traditional methods.

But it’s not just the entrepreneurial titans who are reaping the rewards. The rise of AI has empowered startups and smaller enterprises to compete on an unprecedented scale. Consider how AI-driven tools now allows entrepreneurs to access insights that were once the exclusive domain of well-funded corporates. From forecasting market trends to identifying investor preferences, AI is democratising access to information, levelling the playing field for those with a shortage of resources but a wealth of ambitious ideas.

Likewise, in the past securing seed funding—the life-blood of hungry startups—often hinged on who you knew or your ability to pitch convincingly. Today, an entrepreneur armed with compelling data generated by AI has a significantly stronger hand to play.

The predictive power of AI is also reshaping how investors approach their portfolios. Venture capital firms, private equity houses and even individual angel investors increasingly lean on AI models to inform their decisions. These tools examine the past performance of businesses seeking investment and use data patterns to estimate future growth, spotting trends that people might overlook. For example, an artificial intelligence system can analyse years of financial reports and market conditions to suggest whether a tech start-up is likely to expand or struggle.

This trend is especially evident in tech-heavy industries, where the speed of change demands more sophisticated decision-making frameworks. For an investor weighing whether to back a startup with an innovative but unproven concept, AI can provide a probabilistic roadmap of potential outcomes, mitigating risks while amplifying opportunities.

AI’s impact on the entrepreneurial landscape can be seen through the rise of capital-raising platforms such as Crowdcube and Seedrs, which have integrated AI into their operations to provide investors with tailored recommendations based on their preferences and financial goals. These services help connect investors with suitable projects while making fundraising quicker and more efficient. By analysing user behaviour, market trends and campaign performance in real time, AI is ensuring that capital is allocated more efficiently, benefiting both entrepreneurs and backers.

Then there’s the transformative potential of AI in financial management itself. Cash flow forecasting, one of the perennial headaches of running a business, is now being reimagined by artificial intelligence. By continuously monitoring revenue streams, expenses, and external factors such as market conditions or currency fluctuations, AI can provide entrepreneurs with dynamic, real-time updates on their financial health. This capability is particularly valuable for those navigating industries prone to volatility where even minor miscalculations can prove catastrophic. In the financial sector, for example, market fluctuations can lead to significant losses if not managed effectively.

Tech leaders like Sundar Pichai and Satya Nadella have spoken at length about the broader implications of AI, emphasising its role as an enabler rather than a threat. Their sentiments resonate particularly strongly in the context of entrepreneurial finance, where AI is motivating founders to think bigger, act smarter and scale faster. Microsoft’s AI-driven tools, for example, are designed to integrate seamlessly into business ecosystems, offering solutions that anticipate user needs and deliver insights in the moment. This type of proactive support is essential. Companies that rely on real-time data, such as stock traders or online retailers, need instant insights to stay ahead. A financial firm using automated risk assessment can react faster to market changes, giving it a powerful lead over rivals.

But while the potential of AI is staggering, its implementation is not without challenges. The sheer complexity of some AI systems can be daunting, particularly for entrepreneurs who lack a technical background. Ethical considerations, too, loom large. How transparent should AI-driven decisions be? How do we ensure that algorithms trained on historical data don’t perpetuate existing biases? These issues are real challenges that require careful management. Musk himself has raised red flags about the unchecked development of AI, warning that its misuse could have far-reaching consequences. Balancing optimism with caution is essential as we harness AI to reshape entrepreneurial finance.

Education and accessibility are critical components of this balancing act. For AI to deliver its full potential, entrepreneurs need to understand the capabilities and limitations of these tools. This requires a shift in mindset: viewing AI not as a mystical ‘black box’ but as a partner in problem-solving. Increasingly, platforms are addressing this need by offering user-friendly interfaces and customisable solutions that make advanced analytics accessible even to those with limited technical expertise. The goal is to ensure that AI becomes a force for empowerment rather than intimidation.

Looking to the future, the trajectory is clear: AI will only become even more integrated into every facet of entrepreneurial finance. Quantum computing, another area where Musk, Bill Gates et al. are investing heavily, promises to supercharge AI capabilities, enabling even more complex simulations and faster decision-making. Meanwhile, advancements in natural-language processing will likely see AI taking on advisory roles traditionally filled by human consultants. Imagine an AI system capable of negotiating deals, drafting contract or providing strategic counsel—all in real time and with unparalleled precision.

Of course, for all its promise, the human element remains irreplaceable. AI excels at pattern recognition and optimisation but it cannot replicate the vision, creativity and resilience that define successful entrepreneurs. The true power of AI lies in its ability to augment these uniquely human qualities, freeing business leaders to focus on what they do best: dreaming big, solving problems and driving change. In this sense, AI is not the protagonist of the story but a powerful supporting character.

The revolution in entrepreneurial finance is already well underway, and its being led by those willing to embrace change and adapt to new paradigms. Musk, Pichai, and Nadella may be leading the charge but the tools they are championing are available to all. Whether you’re launching a tech startup, running a family business, or venturing into uncharted territory, AI has the potential to transform your financial strategy and, by extension, your trajectory.

The question, then, is no longer whether AI will reshape entrepreneurial finance—it’s whether you are ready to harness its staggering potential.

Muhammad ‘Mo’ Farmer, CEO of Appbank (challenger bank), founder and president of the British Institute of Technology, England (BITE), is a global expert in technology, education, and cybersecurity. He has educated thousands of entrepreneurs, advised governments and corporations, and collaborated with tech pioneers including Sir Tim Berners-Lee, inventor of the World Wide Web. He also leads the Global Nuclear Skills Institute in partnership with National Nuclear Laboratory and his contributions to research and investment have driven more than £10billion into the British economy.

Main image: Courtesy tungnguyen0905/Pixabay

RECENT ARTICLES

-

The new gender divide is already reshaping Europe’s future leaders

The new gender divide is already reshaping Europe’s future leaders -

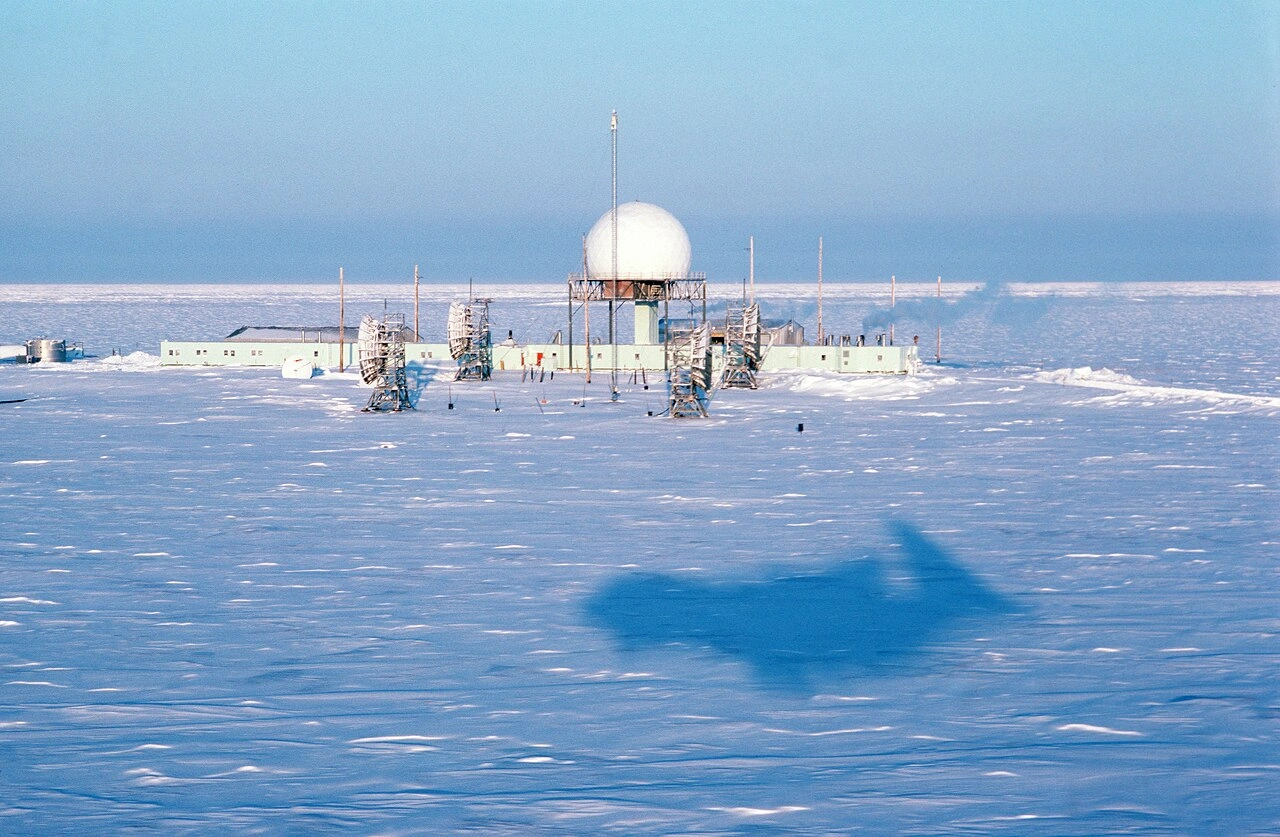

The Arctic’s unfinished cold war

The Arctic’s unfinished cold war -

Highway robbery: how the UK’s post-Brexit electric car policy blew a fuse

Highway robbery: how the UK’s post-Brexit electric car policy blew a fuse -

Nokia built the brains for the AI network revolution — so why is American capital leading the charge?

Nokia built the brains for the AI network revolution — so why is American capital leading the charge? -

What the UK SEND reform whitepaper means and what it might take to deliver it

What the UK SEND reform whitepaper means and what it might take to deliver it -

Europe cannot call itself ‘equal’ while disabled citizens are still fighting for access

Europe cannot call itself ‘equal’ while disabled citizens are still fighting for access -

Is Europe regulating the future or forgetting to build it? The hidden flaw in digital sovereignty

Is Europe regulating the future or forgetting to build it? The hidden flaw in digital sovereignty -

The era of easy markets is ending — here are the risks investors can no longer ignore

The era of easy markets is ending — here are the risks investors can no longer ignore -

Is testosterone the new performance hack for executives?

Is testosterone the new performance hack for executives? -

Can we regulate reality? AI, sovereignty and the battle over what counts as real

Can we regulate reality? AI, sovereignty and the battle over what counts as real -

NATO gears up for conflict as transatlantic strains grow

NATO gears up for conflict as transatlantic strains grow -

Facial recognition is leaving the US border — and we should be concerned

Facial recognition is leaving the US border — and we should be concerned -

Wheelchair design is stuck in the past — and disabled people are paying the price

Wheelchair design is stuck in the past — and disabled people are paying the price -

Why Europe still needs America

Why Europe still needs America -

Why Europe’s finance apps must start borrowing from each other’s playbooks

Why Europe’s finance apps must start borrowing from each other’s playbooks -

Why universities must set clear rules for AI use before trust in academia erodes

Why universities must set clear rules for AI use before trust in academia erodes -

The lucky leader: six lessons on why fortune favours some and fails others

The lucky leader: six lessons on why fortune favours some and fails others -

Reckon AI has cracked thinking? Think again

Reckon AI has cracked thinking? Think again -

The new 10 year National Cancer Plan: fewer measures, more heart?

The new 10 year National Cancer Plan: fewer measures, more heart? -

The Reese Witherspoon effect: how celebrity book clubs are rewriting the rules of publishing

The Reese Witherspoon effect: how celebrity book clubs are rewriting the rules of publishing -

The legality of tax planning in an age of moral outrage

The legality of tax planning in an age of moral outrage -

The limits of good intentions in public policy

The limits of good intentions in public policy -

Are favouritism and fear holding back Germany’s rearmament?

Are favouritism and fear holding back Germany’s rearmament? -

What bestseller lists really tell us — and why they shouldn’t be the only measure of a book’s worth

What bestseller lists really tell us — and why they shouldn’t be the only measure of a book’s worth -

Why mere survival is no longer enough for children with brain tumours

Why mere survival is no longer enough for children with brain tumours