Libyans deserve a secure future; changing the LIA’s asset freeze could be key in reaching it

John E. Kaye

- Published

- Home, Opinion & Analysis

Following the Libyan revolution in 2011, the United Nations has imposed a freeze on the assets of the Libyan Investment Authority (LIA) to protect these assets for the benefit of the Libyan people

As a result of this, Africa’s largest sovereign wealth fund, the LIA, saw its assets frozen globally. The LIA manages over $68 billion and has investments in hundreds of companies in Libya and around the world.

While this freeze was intended as a protective measure, to preserve the Libyan people’s wealth, it still harms these assets because the LIA has not been able, under the current regime, to manage and reinvest the frozen assets to preserve their value.

Earlier this year, the LIA’s chairman, Dr. Ali Mahmoud Hassan Mohamed, told Reuters that, following long discussions and cooperation with the UN’s Security Council’s Sanctions Committee (SC), he was hopeful for an amendment to the current freeze regime by the end of this year.

Dr Ali Mahmoud Hassan Mohamed comments: “The LIA has made clear to the SC and to the Panel of Experts that we are not asking for any of our assets to be unfrozen. What we are requesting is a landmark approval from the UN Security Council to be able to reinvest some of the frozen funds for the long-term benefit of the people of Libya.”

The fund was initially set up to reinvest the country’s oil and gas revenue, to ensure that the country’s natural resources continue to benefit future generations. Being independent from the Libyan government, its goal is to maximise the value of the Libyan people’s assets.

Since its establishment in 2006, the fund’s portfolio has grown significantly. Out of the $68 billion under its management, $29 billion comes from global real estate, deposits invested globally, and equities spread over more than 300 companies globally.

The LIA also holds matured bonds – these matured assets are most in need of reinvestment, hence the need to amend the protective freeze.

Many of the LIA’s assets – invested before 2011 – have matured and turned into cash deposits, with banks charging negative interest rates and high management fees on them. The LIA is therefore losing money. The LIA’s funds are held on behalf of the Libyan people, and it is their wealth which is diminishing under the existing freeze rules.

Since the appointment of a new chairman and CEO, Dr Ali Mahmoud Hassan Mohamed, the LIA has made significant progress in its governance procedures and third-party auditing. Over the last 4 years, the LIA has moved up 47 places in Global SWF’s ranking of sovereign wealth funds based on sustainability and governance – rising from 98th to 51st and following the Santiago Principles, which are the internationally approved standards to promote transparency, good governance, accountability and prudent investment practices by SWFs. Despite ongoing challenges in Libya, the LIA remains committed to ensuring its independence and following these Principles whilst encouraging a more open dialogue and deeper understanding of the fund’s activities.

As a pivotal step, the LIA has taken international legal measures to counter the measures taken by the Belgian authorities to seize its assets in Belgium and has resorted to international arbitration to compensate for the losses caused by illegal seizure of assets of the Libyan sovereign fund.

Additionally, the LIA has focused on financial disclosure and transparency, completing consolidated financial statements for 2020, and carrying out a large auditing exercise spanning multiple years and managed by EY and Deloitte, which continues to take place.

But despite its cooperation with the SC and better governance, the LIA’s activities remain limited due to the rigid provisions of the current freeze resolutions. It is currently seeking a change in the freeze regime, not to unfreeze any of its assets, but simply to allow the limited reinvestment of assets which have matured or are depreciating. This reinvestment would be in the same jurisdiction in which the funds are currently held, and in the same sectors.

As part of its efforts to amend the freeze regime, the LIA submitted a four-pillar investment plan to the UNSC in March this year, with a response expected by the end of the year. Its main goal is to grow the fund’s assets and protect their value for the long-term benefit of the Libyan people.

The Libyan Investment Authority has made significant progress in implementing its strategy, focusing on developing its business, sustaining its investments, and adopting best practices. In terms of investment development, the LIA has worked on setting a short-term and strategic investment plan, asset redistribution, and domestic investment to support local development.

The fund is also making efforts to enhance its competitive position through real estate development, investment in renewable energy, and environmental projects. In terms of asset protection, the Authority has strengthened preventive measures and taken international legal measures to safeguard its assets and investments.

In July this year, the LIA appointed Strategy & Co., the global strategy consulting arm of PwC, to help implement its investment strategy. The first pillar of the investment plan seeks approval to reinvest money that has built up during the freeze, such as payouts from bond holdings.

In due course, the LIA is also planning to request approval for two other investment plan pillars covering its share portfolio and its domestic investment plan respectively. The LIA aims to invest in solar power and in Libya’s oil exploration plan.

Approving the investment plan would provide Libyans with a new path towards a more secure future. To allow the LIA to reinvest some assets, the UNSC must pass a resolution, altering the existing freeze regime. In October last year, the UNSC acknowledged the need to consider changes to the asset freeze including allowing the LIA to reinvest frozen liquid assets for the purpose of preserving their value and benefiting the Libyan people at a later stage. If approved, the asset redistribution plan will be implemented and is expected to maximise the LIA’s financial assets.

14 years after imposing protective freeze, the UNSC must be prepared to make limited changes to allow this original mission to continue. The LIA has been collaboratively engaging with both the UN and the panel of experts which they have appointed, explaining the details of the investment plan, and promptly and fully responding to any requests.

Allowing the reinvestment of assets would send a strong signal to the Libyan people, that the UN and international community are prioritising the long-term welfare of the Libyan people.

RECENT ARTICLES

-

Europe cannot call itself ‘equal’ while disabled citizens are still fighting for access

Europe cannot call itself ‘equal’ while disabled citizens are still fighting for access -

Is Europe regulating the future or forgetting to build it? The hidden flaw in digital sovereignty

Is Europe regulating the future or forgetting to build it? The hidden flaw in digital sovereignty -

The era of easy markets is ending — here are the risks investors can no longer ignore

The era of easy markets is ending — here are the risks investors can no longer ignore -

Is testosterone the new performance hack for executives?

Is testosterone the new performance hack for executives? -

Can we regulate reality? AI, sovereignty and the battle over what counts as real

Can we regulate reality? AI, sovereignty and the battle over what counts as real -

NATO gears up for conflict as transatlantic strains grow

NATO gears up for conflict as transatlantic strains grow -

Facial recognition is leaving the US border — and we should be concerned

Facial recognition is leaving the US border — and we should be concerned -

Wheelchair design is stuck in the past — and disabled people are paying the price

Wheelchair design is stuck in the past — and disabled people are paying the price -

Why Europe still needs America

Why Europe still needs America -

Why Europe’s finance apps must start borrowing from each other’s playbooks

Why Europe’s finance apps must start borrowing from each other’s playbooks -

Why universities must set clear rules for AI use before trust in academia erodes

Why universities must set clear rules for AI use before trust in academia erodes -

The lucky leader: six lessons on why fortune favours some and fails others

The lucky leader: six lessons on why fortune favours some and fails others -

Reckon AI has cracked thinking? Think again

Reckon AI has cracked thinking? Think again -

The new 10 year National Cancer Plan: fewer measures, more heart?

The new 10 year National Cancer Plan: fewer measures, more heart? -

The Reese Witherspoon effect: how celebrity book clubs are rewriting the rules of publishing

The Reese Witherspoon effect: how celebrity book clubs are rewriting the rules of publishing -

The legality of tax planning in an age of moral outrage

The legality of tax planning in an age of moral outrage -

The limits of good intentions in public policy

The limits of good intentions in public policy -

Are favouritism and fear holding back Germany’s rearmament?

Are favouritism and fear holding back Germany’s rearmament? -

What bestseller lists really tell us — and why they shouldn’t be the only measure of a book’s worth

What bestseller lists really tell us — and why they shouldn’t be the only measure of a book’s worth -

Why mere survival is no longer enough for children with brain tumours

Why mere survival is no longer enough for children with brain tumours -

What Germany’s Energiewende teaches Europe about power, risk and reality

What Germany’s Energiewende teaches Europe about power, risk and reality -

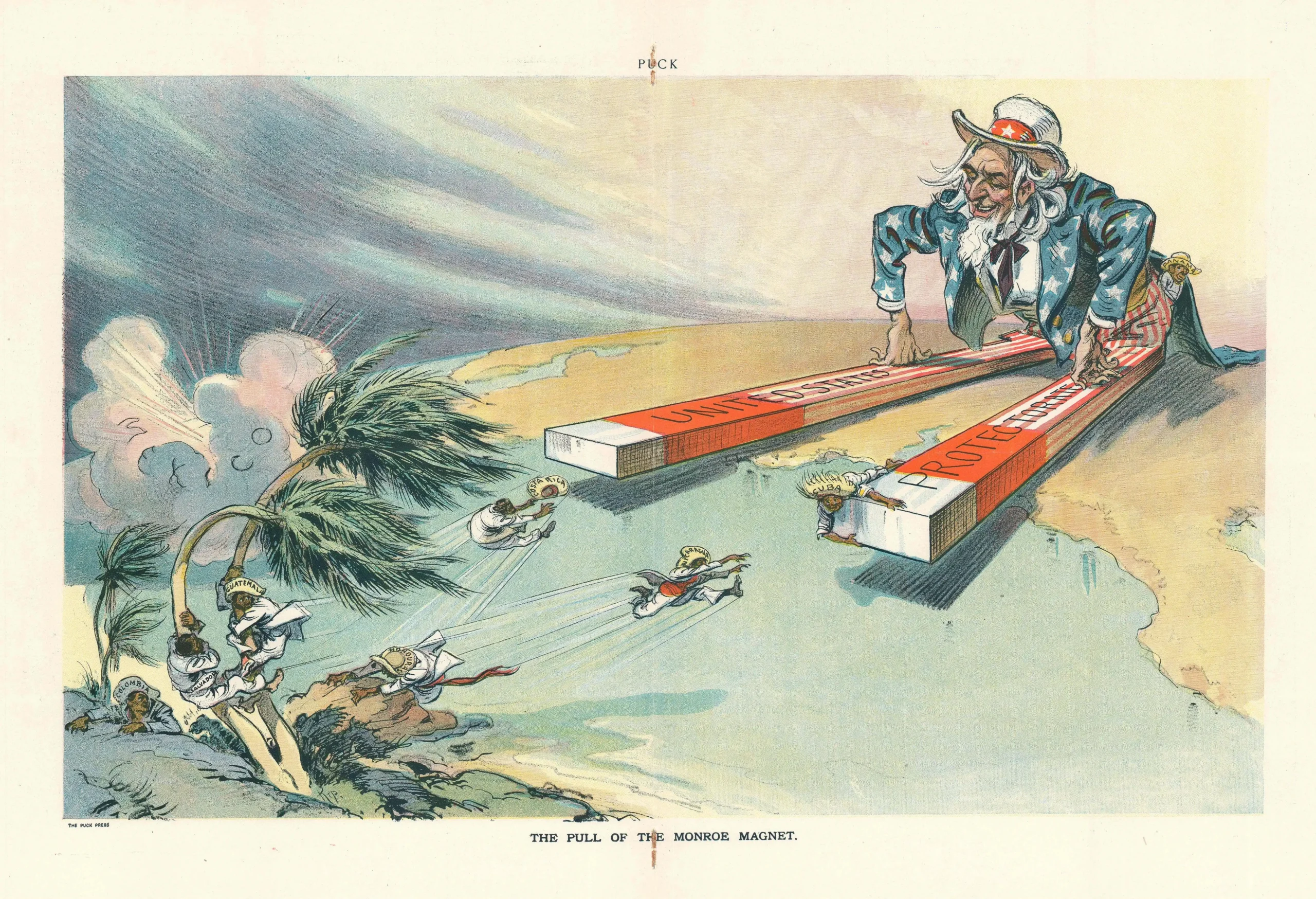

What the Monroe Doctrine actually said — and why Trump is invoking it now

What the Monroe Doctrine actually said — and why Trump is invoking it now -

Love with responsibility: rethinking supply chains this Valentine’s Day

Love with responsibility: rethinking supply chains this Valentine’s Day -

Why the India–EU trade deal matters far beyond diplomacy

Why the India–EU trade deal matters far beyond diplomacy -

Why the countryside is far safer than we think - and why apex predators belong in it

Why the countryside is far safer than we think - and why apex predators belong in it