European investors with $4tn AUM set their sights on disrupting America’s tech dominance

Daniel Beurthe

- Published

- Opinion & Analysis

Thousands descended on a fire-lit Helsinki for Slush, where investors controlling more than $4 trillion arrived with a pointed message: Europe’s tech ambitions are rising, and the long-assumed supremacy of Silicon Valley is no longer taken as a given

“Still doubting Europe? Go to Hel.”

The banner hung on posts fifteen feet high, in front of the entrance to the Helsinki Expo and Convention Centre. Behind it, two rows of pyrotechnics fired jets of flame into the sleety Scandinavian air.

It was through this archway that 16,000 attendees filed into this year’s installment of Slush: Europe’s biggest tech gathering, which last week drew entrepreneurs and investors managing more than $4 trillion between them.

Founded in 2008, the organisers had a clear message to convey at their largest event to date: Europe is open for business, and ready to challenge America’s tech dominance.

This bravado seeks to countervail a narrative of stagnation which has long plagued the continent. A state of affairs brought to the fore just over a year ago, when former European Central Bank President Mario Draghi published a now-notorious report on the EU’s competitiveness.

“A wide gap in GDP has opened up between the EU and the US,” Draghi wrote, noting the fact no EU company with a market capitalisation over €100 billion has been founded in the last fifty years, while all six U.S companies with a valuation above €1 trillion have been created in this period.

At Slush, the scale of this gap in the tech sector was treated as a given, but few if any of the attendees blamed a shortfall in talent or innovation.

“In terms of fintech, there’s definitely not an innovation gap,“ Johnnie Martin of Augmentum, Europe’s only publicly listed fintech-focused venture capital firm, told me.

“Europe actually outperforms in terms of the quality of company for weight of capital.” Martin pointed to Revolut, the neobanking giant which boasts over sixty five million customers in more than forty eight countries, as proof of Europe’s potential for innovation on a global scale.

The real problem, he said, is liquidity: “Europe has somewhat lagged the US in terms of capital availability, but this is changing as more institutions – especially in the UK – are opening their eyes to deploying into venture: rules are changing to allow pension funds to move money into more illiquid investments.

This liquidity lag is part of a broader trend of U.S economic outperformance since the Great Financial Crash. In 2008 the EU and U.S had broadly comparable economies, but by 2024 the latter’s nominal GDP ($29 trillion) was roughly 1.5 times that of the EU’s ($19.4 trillion).

Others at the conference were quick to highlight the need for development within Europe’s capital markets.

“There is a void of post-series B capital in Europe,” Santiago Muguruza, Global Head of BBVA Spark, a division of the Spanish multinational BBVA which provides financial and credit services to tech firms, explained.

He pointed optimistically to initiatives like the European Tech Champions programme, which channels late-stage growth capital to tech start-ups. But he conceded these are not a panacea for Europe’s woes.

“At the end of the day the reality is that companies exiting in the U.S tend to have bigger outcomes than in Europe.”

Muguruza also highlighted Europe’s cultural risk-aversion as a blocker to the continent’s tech development, with employees generating “equity goodwill” by staying on in their companies for many years. This prevents professionals joining promising startups.

The historic origins of these liquidity and risk tolerance gaps were explained to me by Dr. Teddy Amberg, Founding Partner of Swiss VC firm Spicehaus Partners AG: “The tech wave is inextricably tied to venture capital, which was already available in the US in the ‘90s when tech companies were being founded in garages. Meanwhile, we didn’t even know how to spell ‘venture capital.’”

Europe, he said, relied on “bank debt” which was only issued to traditional firms, predominantly in the industrial sector, which needed to put physical assets up as collateral for the loans.

“But now, a bank will not fund a start-up even in the industrial space. Regulation has changed, and VCs are stepping in to fill that gap. But still in Europe it’s not as advanced as the U.S yet, because it began ten or twenty years later.”

The continent’s fractured regulatory regime was also a big topic of discussion throughout the event.

“Fragmentation is a huge problem,” Steffen Ehrhardt, Investor Community VP at SICTIC, the country’s biggest network of angel investors, said.

“In Europe there’s not really a unified market; there’s no unified regulation, although they always talk about it existing. But depending where you go, there are different understandings of its interpretation.”

Ehrhardt pointed to Switzerland, which sits outside the EU and therefore outside its regulatory sprawl, as a case study in agility and dynamism which the bloc can emulate. He highlighted that labour laws in Switzerland are far more flexible, allowing firms to hire and fire almost as easily as within the U.S system.

Ehrhardt also noted that Europe may receive an unexpected boost from the current U.S political climate, which he believes is pushing talent back across the Atlantic.

“It’s a trend I’ve been seeing a lot: people wanting to leave the US, because of uncertainty around their status under Trump. Specifically, Europeans who want to come back home… And also people who are just looking for more stability.”

Despite clear challenges ahead, the sentiment at Slush was resolutely bullish on Europe’s future prospects. The clear consensus was that the bloc’s weaknesses are structural but not insurmountable, and may even be imminently solvable.

The ingredients for a tech renaissance are there if Europe can better integrate its markets, deepen its capital pools and loosen the regulatory clamp that throttles scaling across twenty-seven jurisdictions. Switzerland offers a nearby example of what that might look like.

The U.S remains firmly on the throne, but the message from the thousands who braved Helsinki’s sleet was unmistakable: don’t write Europe off just yet.

Daniel Beurthe is an author and freelance writer based in London.

READ MORE: ‘Europe tightens grip on strategic space data as dependence on U.S tech comes under scrutiny‘. An Italian space-technology firm has partnered with Bologna-based Cubbit to create a sovereign European cloud infrastructure for Earth-observation data, as concerns mount over the continent’s reliance on U.S technology and the security of critical space information.

Do you have news to share or expertise to contribute? The European welcomes insights from business leaders and sector specialists. Get in touch with our editorial team to find out more.

RECENT ARTICLES

-

Are favouritism and fear holding back Germany’s rearmament?

Are favouritism and fear holding back Germany’s rearmament? -

What bestseller lists really tell us — and why they shouldn’t be the only measure of a book’s worth

What bestseller lists really tell us — and why they shouldn’t be the only measure of a book’s worth -

Why mere survival is no longer enough for children with brain tumours

Why mere survival is no longer enough for children with brain tumours -

What Germany’s Energiewende teaches Europe about power, risk and reality

What Germany’s Energiewende teaches Europe about power, risk and reality -

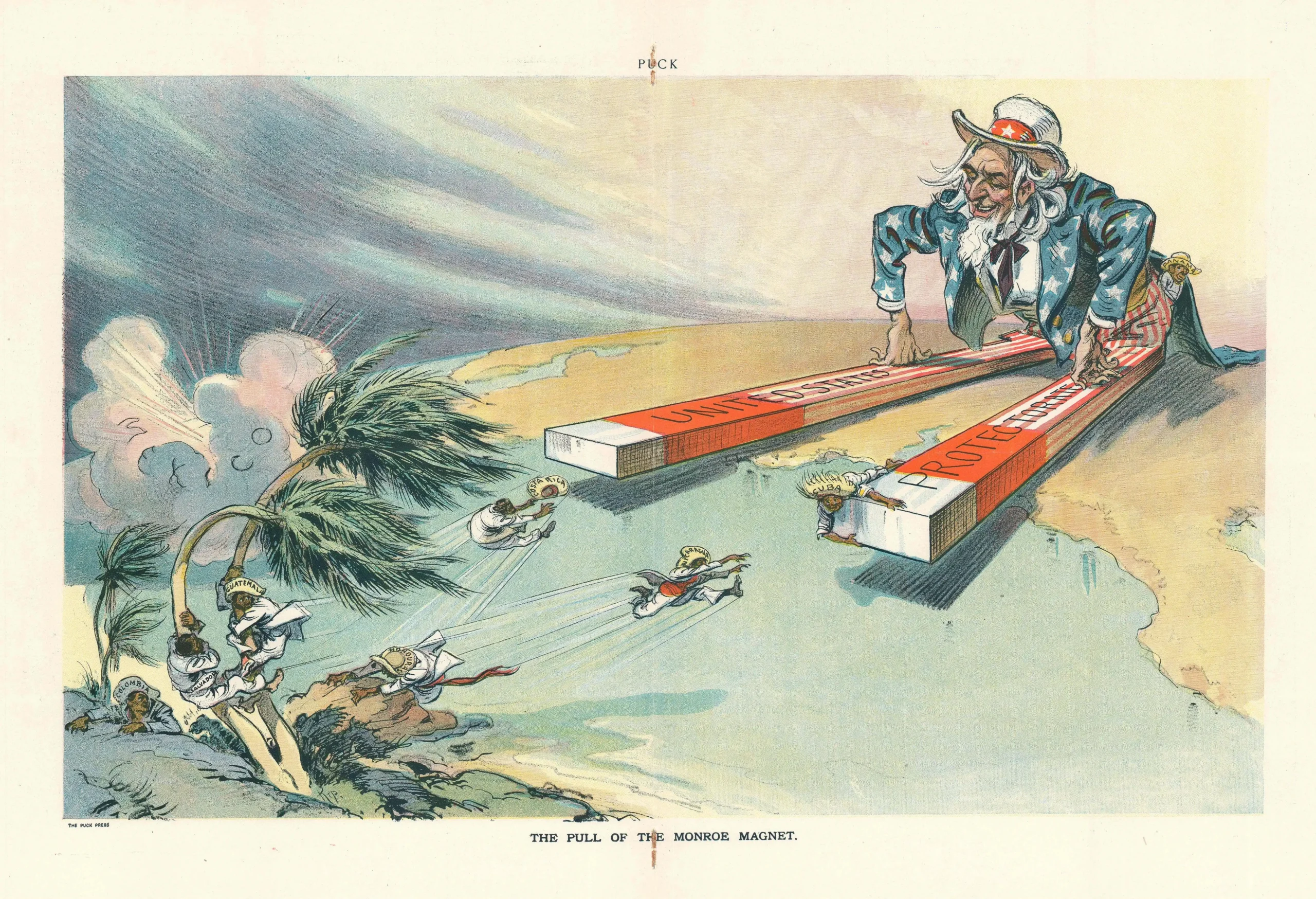

What the Monroe Doctrine actually said — and why Trump is invoking it now

What the Monroe Doctrine actually said — and why Trump is invoking it now -

Love with responsibility: rethinking supply chains this Valentine’s Day

Love with responsibility: rethinking supply chains this Valentine’s Day -

Why the India–EU trade deal matters far beyond diplomacy

Why the India–EU trade deal matters far beyond diplomacy -

Why the countryside is far safer than we think - and why apex predators belong in it

Why the countryside is far safer than we think - and why apex predators belong in it -

What if he falls?

What if he falls? -

Trump reminds Davos that talk still runs the world

Trump reminds Davos that talk still runs the world -

Will Trump’s Davos speech still destroy NATO?

Will Trump’s Davos speech still destroy NATO? -

Philosophers cautioned against formalising human intuition. AI is trying to do exactly that

Philosophers cautioned against formalising human intuition. AI is trying to do exactly that -

Life’s lottery and the economics of poverty

Life’s lottery and the economics of poverty -

On a wing and a prayer: the reality of medical repatriation

On a wing and a prayer: the reality of medical repatriation -

Ai&E: the chatbot ‘GP’ has arrived — and it operates outside the law

Ai&E: the chatbot ‘GP’ has arrived — and it operates outside the law -

Keir Starmer, Wes Streeting and the Government’s silence: disabled people are still waiting

Keir Starmer, Wes Streeting and the Government’s silence: disabled people are still waiting -

The fight for Greenland begins…again

The fight for Greenland begins…again -

Failure is how serious careers in 2026 will be shaped

Failure is how serious careers in 2026 will be shaped -

Poland’s ambitious plans to power its economic transformation

Poland’s ambitious plans to power its economic transformation -

Europe’s space ambitions are stuck in political orbit

Europe’s space ambitions are stuck in political orbit -

New Year, same question: will I be able to leave the house today?

New Year, same question: will I be able to leave the house today? -

A New Year wake-up call on water safety

A New Year wake-up call on water safety -

The digital euro is coming — and Europe should be afraid of what comes with it

The digital euro is coming — and Europe should be afraid of what comes with it -

Make boards legally liable for cyber attacks, security chief warns

Make boards legally liable for cyber attacks, security chief warns -

Why Greece’s recovery depends on deeper EU economic integration

Why Greece’s recovery depends on deeper EU economic integration