Digitalization, financial inclusion, and a new era of banking services: Uzbekistan’s road to WTO membership

Max Johnson

- Published

- Banking & Finance, Opinion & Analysis

As Uzbekistan advances toward WTO membership, digitalisation is reshaping its banking system and widening access to finance. Max Johnson, a member of ANORBANK’s Supervisory Board, explores how reform, innovation and a young, connected population are propelling the country into a new era of financial inclusion

In 2005, a journey across Central Asia as a young Oxford undergraduate left a lasting impression. Travelling overland from Istanbul to Beijing with Peter Hopkirk’s The Great Game and a well-worn Lonely Planet in hand, I discovered a region of striking potential and unforgettable hospitality. Uzbekistan, in particular, stood out as a country poised for transformation. Two decades later, that early encounter has come full circle as I join the Supervisory Board of ANORBANK. A lifelong student of Russian and, more recently, Mandarin during my years in China, I had long sought an opportunity to return to Central Asia in a meaningful way.

Before embarking on this professional journey, I pause to take a thoughtful look at Uzbekistan in 2025 – a nation brimming with energy, ambition, and transformation.

The world today is experiencing accelerated digital transformation. Technological innovations are reshaping the way people live, work, study, and manage their finances. In this paradigm, emerging economies face a unique opportunity to leverage digitalisation to achieve sustainable economic growth, reduce inequality, and expand access to financial services. Uzbekistan is a vivid example of a country that is actively moving in this direction.

Uzbekistan is a country with a young and growing population, currently numbering over 38 million. Rising levels of urbanisation, education, and mobility are making infrastructure and technology an integral part of many citizens’ lives. More broadly, Uzbekistan has been implementing robust economic reforms and is expected to become a member of the WTO soon. The country has also made significant progress with its 2019 PPP law and the 2021 amendments.

The government of Uzbekistan is actively pursuing market reforms, improving the investment climate, and developing infrastructure and transport corridors. Its geographical location at the heart of Central Asia makes Uzbekistan a natural participant in new “Silk Road” projects.

Uzbekistan combines a rich history with a dynamic present. The younger generation is increasingly drawn to new professions, technological skills, and entrepreneurship. This generation of “digital natives” is creating demand for modern services and more open interaction with both the state and businesses.

In recent years, Uzbekistan’s banking sector has undergone significant changes. More and more clients are switching to remote service channels: mobile applications, online banking, and remote account opening.

These transformations are underpinned by the ambitious reform agenda of the President of the Republic of Uzbekistan, Mr. Shavkat Mirziyoyev, who has set the country on a trajectory of accelerated modernization since assuming office in 2016. His administration and the government have prioritised economic liberalization, modernization of the financial sector, attraction of international capital, and the development of a competitive digital economy as core pillars of the national strategy.

A series of landmark state programs most notably the “Digital Uzbekistan – 2030” strategy are driving improvements in internet infrastructure, expanding fintech capabilities, and promoting financial inclusion, particularly in rural and underserved communities. Alongside this flagship initiative, several complementary strategies are transforming the financial landscape:

- National Development Strategy 2022–2026 outlines a comprehensive vision for sustainable growth, emphasizing digital governance, competitive markets, and institutional modernisation.

- Banking Sector Reform Strategy (2020–2025) aims to increase efficiency and competition by gradually privatising state-owned banks, introducing international corporate governance standards, and creating favorable conditions for private investment.

- E-Government Transformation Program is digitising key public services from e-ID and e-taxation to online business registration, strengthening transparency, reducing bureaucracy, and facilitating greater integration between state institutions, banks, and fintechs.

- National Payment System Modernization has expanded instant payments, introduced QR-based transactions, and promoted interoperability between financial institutions, accelerating the shift toward a cashless economy.

- Financial Literacy and Inclusion Initiatives target youth, women, and rural populations, improving trust in the banking system and encouraging the use of formal financial services.

Another strategic priority has been the conversion of the shadow economy into the formal sector. This has involved legalising informal business activities, simplifying tax procedures, incentivising digital payments, and improving financial transparency. As a result, a growing share of economic activity has shifted from cash-based transactions to formal financial channels, broadening the tax base and deepening financial intermediation.

At the same time, Uzbekistan has made notable progress in attracting international capital and integrating with global financial markets. Several Uzbek banks and state entities have successfully issued Eurobonds on international platforms such as the London Stock Exchange (LSE), raising funds to support infrastructure and financial sector development. Importantly, these issuances have taken place not only in foreign currencies such as USD and EUR but also in the national currency, the Uzbek soum (UZS) a landmark step demonstrating growing investor confidence and the maturing of domestic financial markets.

Together, these reforms and initiatives are reshaping Uzbekistan’s economic landscape, bringing more economic activity out of the shadows, expanding access to modern banking services, and integrating the country more deeply into the global economy.

The success of digitalisation is driven by demographics, the demand for new services, and pressure from global standards. Banks that have moved away from the “branch + cash desk” model are now focusing on digital architectures, automation, API solutions, and partnerships with fintech.

Extraordinarily, according to the latest Global Findex research, the share of adults in Uzbekistan with a bank account has risen to about 60% almost double compared to 2017.

However, the use of formal financial instruments such as bank savings or formal loans remains relatively low.

At the same time, there has been significant growth in remote banking users: over the past five years their number increased 4.7 times, with a 23.1% rise in just the last year.

Uzbekistan is experiencing steady improvements in internet connectivity, supported by the rapid spread of mobile and smartphone usage. While urban areas are leading this growth, rural regions are also seeing consistent progress, supported by targeted financial literacy initiatives in underserved communities.

In Asia, and for example in Eastern Europe, we have seen how digital banks and neobanks have driven rapid growth in financial inclusion: enabling people to access banking products, loans, and investments for the first time through mobile apps, without visiting branches.

Today, Uzbekistan is at a stage where the combined efforts of government, regulators, and the private sector can quickly accelerate this transition.

Uzbekistan’s WTO accession process which has accelerated significantly since 2020 is acting as a powerful catalyst for these transformations. WTO membership is expected to strengthen the rule of law, open new export markets, attract foreign direct investment, and stimulate competition within the banking and fintech sectors. This external anchor complements domestic reform efforts, ensuring that regulatory modernisation aligns with global best practices.

Banks such as ANORBANK are demonstrating that a digital bank can be a driver of financial inclusion, helping people transition from cash to transparent and convenient financial solutions.

The bank’s success would not have been possible without the strategic vision of its founder, Kahramonjon Olimov, who was one of the first to bet on digital banking when the market was just emerging. His focus on innovation and client-centricity enabled the bank to take a leading position. ANORBANK has actively engaged with regulators to shape a modern fintech ecosystem, contributing to policy discussions on open banking, cybersecurity, and consumer protection. This proactive stance has strengthened the bank’s reputation as a trusted partner in Uzbekistan’s digital future.

Today, Uzbekistan stands on the threshold of a new digital era. The banking system plays a key role in making the economy more inclusive, transparent, and modern.

I am convinced that our country now has a unique opportunity to replicate the success of nations that, within just one generation, have profoundly transformed their financial systems ensuring sustainable economic growth and opening the way for millions of people to reach a new level of prosperity and opportunity.

It is an honor for me to be part of this process as a member of the Supervisory Board of ANORBANK. I am confident that the experience accumulated in Asia and Europe will help me contribute to the bank’s development and to making Uzbekistan a regional leader in digital finance.

Do you have news to share or expertise to contribute? The European welcomes insights from business leaders and sector specialists. Get in touch with our editorial team to find out more.

Main image: Lara Jameson/Pexels

RECENT ARTICLES

-

The new gender divide is already reshaping Europe’s future leaders

The new gender divide is already reshaping Europe’s future leaders -

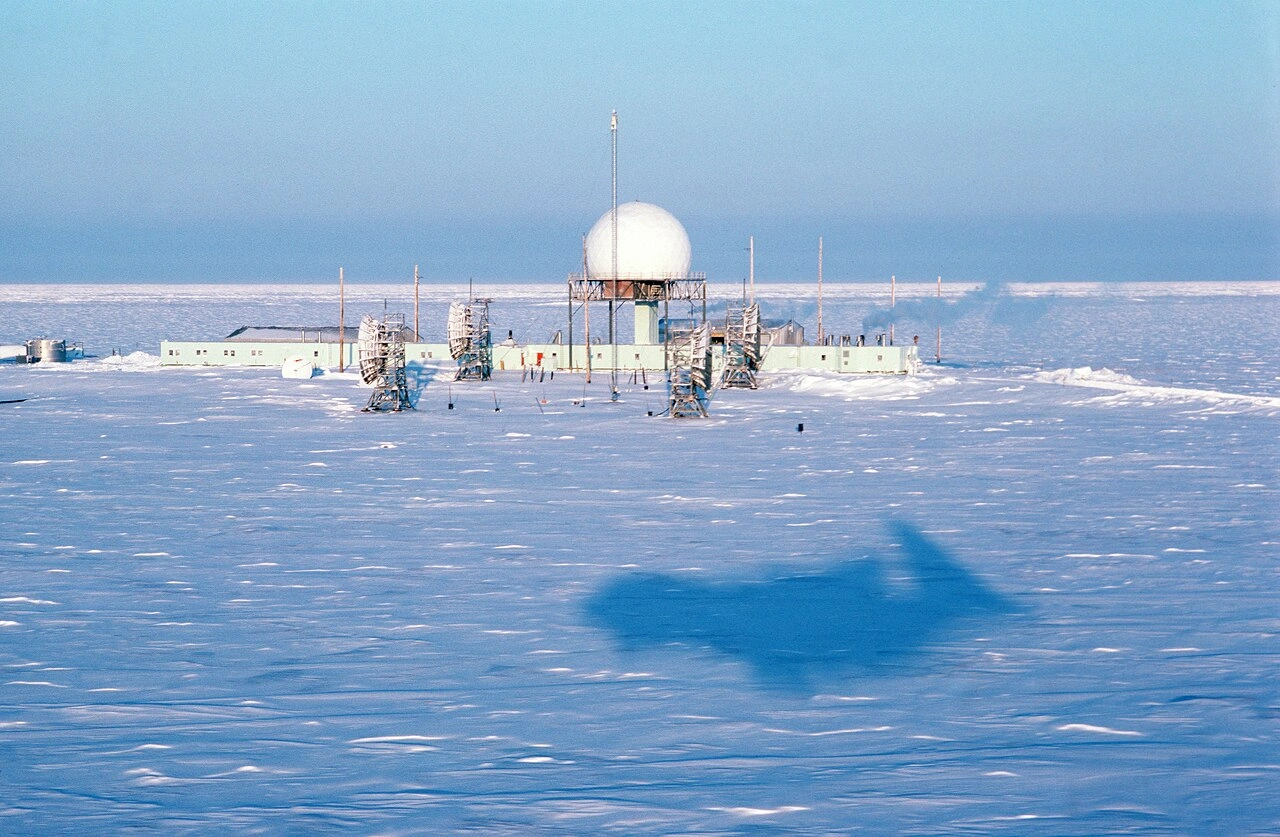

The Arctic’s unfinished cold war

The Arctic’s unfinished cold war -

Highway robbery: how the UK’s post-Brexit electric car policy blew a fuse

Highway robbery: how the UK’s post-Brexit electric car policy blew a fuse -

Nokia built the brains for the AI network revolution — so why is American capital leading the charge?

Nokia built the brains for the AI network revolution — so why is American capital leading the charge? -

What the UK SEND reform whitepaper means and what it might take to deliver it

What the UK SEND reform whitepaper means and what it might take to deliver it -

Europe cannot call itself ‘equal’ while disabled citizens are still fighting for access

Europe cannot call itself ‘equal’ while disabled citizens are still fighting for access -

Is Europe regulating the future or forgetting to build it? The hidden flaw in digital sovereignty

Is Europe regulating the future or forgetting to build it? The hidden flaw in digital sovereignty -

The era of easy markets is ending — here are the risks investors can no longer ignore

The era of easy markets is ending — here are the risks investors can no longer ignore -

Is testosterone the new performance hack for executives?

Is testosterone the new performance hack for executives? -

Can we regulate reality? AI, sovereignty and the battle over what counts as real

Can we regulate reality? AI, sovereignty and the battle over what counts as real -

NATO gears up for conflict as transatlantic strains grow

NATO gears up for conflict as transatlantic strains grow -

Facial recognition is leaving the US border — and we should be concerned

Facial recognition is leaving the US border — and we should be concerned -

Wheelchair design is stuck in the past — and disabled people are paying the price

Wheelchair design is stuck in the past — and disabled people are paying the price -

Why Europe still needs America

Why Europe still needs America -

Why Europe’s finance apps must start borrowing from each other’s playbooks

Why Europe’s finance apps must start borrowing from each other’s playbooks -

Why universities must set clear rules for AI use before trust in academia erodes

Why universities must set clear rules for AI use before trust in academia erodes -

The lucky leader: six lessons on why fortune favours some and fails others

The lucky leader: six lessons on why fortune favours some and fails others -

Reckon AI has cracked thinking? Think again

Reckon AI has cracked thinking? Think again -

The new 10 year National Cancer Plan: fewer measures, more heart?

The new 10 year National Cancer Plan: fewer measures, more heart? -

The Reese Witherspoon effect: how celebrity book clubs are rewriting the rules of publishing

The Reese Witherspoon effect: how celebrity book clubs are rewriting the rules of publishing -

The legality of tax planning in an age of moral outrage

The legality of tax planning in an age of moral outrage -

The limits of good intentions in public policy

The limits of good intentions in public policy -

Are favouritism and fear holding back Germany’s rearmament?

Are favouritism and fear holding back Germany’s rearmament? -

What bestseller lists really tell us — and why they shouldn’t be the only measure of a book’s worth

What bestseller lists really tell us — and why they shouldn’t be the only measure of a book’s worth -

Why mere survival is no longer enough for children with brain tumours

Why mere survival is no longer enough for children with brain tumours