Consumer rights and wrongs in a digital age: why the law no longer protects the public

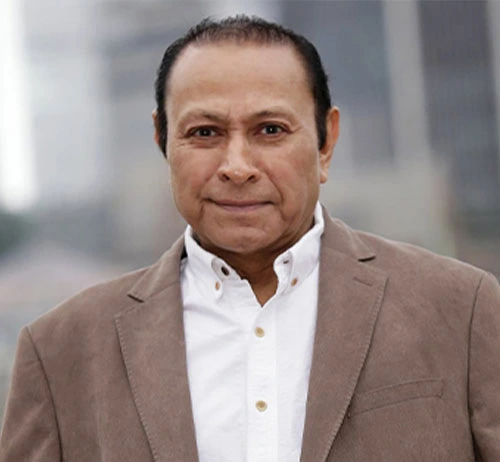

Dr Raj Joshi

- Published

- Opinion & Analysis

Opaque pricing, exploitative subscriptions and AI-driven sales tactics have transformed the customer experience into a battleground of rights and redress – yet the law has failed to keep pace. A comprehensive overhaul is needed to protect consumers and restore accountability across the digital economy, writes barrister Dr Raj Joshi

Britain’s high streets are vanishing fast, and the independent retailer is nearing extinction. Visiting a physical shop to try out camera equipment or test new technology is becoming a rarity. In its place, the age of online shopping has ushered in a world of bots, outsourced call centres, and faceless virtual chats. Today, the gatekeepers to service – and complaints – are often algorithms or scripted agents operating under invented names. Speaking to an actual person is tightly controlled, and even then, customer service staff are rarely permitted to deviate from uniform scripts, where accountability is routinely deflected by stock phrases.

Online marketplaces, meanwhile, offer little in the way of protection when disputes arise. The process for returning faulty goods – let alone securing a refund – is often needlessly complex and opaque. Customers are forced to navigate labyrinthine systems dictated by the platform itself, with the entire experience seemingly designed to deter. Liability is dodged through careful wording, and customers are routinely met with language that casts the seller as the wronged party, while obliging the buyer to propose a resolution.

At the heart of this lies a simple truth: the legislation is no longer fit for purpose. The Consumer Rights Act 2015 was introduced to ensure fairness and transparency in trade, but it belongs to another era. It was the year the Conservatives won a general election, Jeremy Clarkson allegedly punched a producer, and Sepp Blatter stepped down as FIFA president amid a corruption scandal. Apple launched its first watch, Samsung released the Galaxy S6, and Volkswagen was caught manipulating emissions software.

Since then, the digitalisation of commerce has transformed how we live and shop. Online platforms now dominate. AI-powered services, subscription-based models and dynamic pricing are part of everyday life. Yet the law has failed to keep pace. The Competition and Markets Authority (CMA) estimates that unresolved consumer disputes cost UK shoppers over £54 billion a year.

“Speaking to an actual person is tightly controlled, and even then, customer service staff are rarely permitted to deviate from uniform scripts.”

For many, the shopping experience has become one of frustration and fatigue – especially when it comes to returning goods or pursuing compensation for items not fit for purpose. Section 75 of the Consumer Credit Act, which enables claims against credit card providers in certain cases, remains poorly understood and inconsistently applied. As the Financial Ombudsman has observed: “We receive thousands of complaints from consumers who have their claims for reimbursement rejected by their credit provider.” Between July and December last year, the Ombudsman dealt with 141,846 complaints – a 49% rise on the same period in 2023. The main culprits? Banking fraud, credit affordability disputes, and motor finance commission cases.

Consumers today must navigate a digital minefield of obscure pricing and exploitative practices. Take subscriptions: around four in five UK adults now hold at least one, yet Citizens Advice reports that 13 million people – more than a quarter of UK adults – accidentally signed up for a subscription over the past year. These range from fitness apps and meal kits to pet supplies and magazines, and the cost of unused subscriptions is estimated to be £688 million annually. This is largely down to manipulative sign-up mechanisms, automatic renewals, and penalties for cancellation – all buried in small print.

In sectors such as entertainment, hospitality, transport and telecommunications, “drip pricing” has become widespread. A consumer sees one price advertised, only to find additional charges such as “admin fees” or delivery costs added at the checkout. Government figures suggest this tactic costs the public around £2.2 billion a year. Similarly, “dynamic pricing” – where prices rise based on demand – is marketed as flexible but often feels like opportunistic profiteering. The most high-profile recent example came with Ticketmaster’s sale of Oasis’s 2025 reunion tickets, which jumped from £148 to £355 without warning.

“The Consumer Rights Act must be updated to define digital purchases, online transactions, subscription services, and AI pricing models in clear legal terms.”

Amid these widespread abuses, the solutions are not complicated – but they do require more than guidance or voluntary codes of conduct. Vulnerable groups, including the elderly and those on lower incomes, are disproportionately affected. Terms and conditions are often hidden or indecipherable, compounding the sense of powerlessness many consumers feel.

While the Digital Markets, Competition and Consumers Act 2024 (DMCCA) is a welcome start – introducing fines of up to £300,000 or 10% of global turnover for breaches, banning fake reviews, and aiming to eliminate drip pricing – it doesn’t go far enough. A modernised consumer rights framework is urgently needed.

The Consumer Rights Act must be updated to define digital purchases, online transactions, subscription services, and AI pricing models in clear legal terms. There should be enforceable rules on transparent pricing, fair contract terms, and easy cancellation options – especially for online subscriptions. Major platforms such as Amazon and eBay must be made responsible for the conduct of third-party sellers operating under their banner. Sellers should be verified, legally accountable, and required to provide clearly accessible information about consumers’ rights.

“We need a comprehensive reform of consumer law – not just tweaks and updates, but a full-scale overhaul that aligns our legal protections with the reality of modern life.”

We are already subject to exaggerated marketing claims, algorithmic price manipulation and misleading environmental or scarcity-based messaging. These tactics – used to generate artificial urgency or mislead buyers – should be banned outright, just as advertising is subject to regulatory standards. If products and services are promoted in bad faith, the law should treat them no differently.

Currently, there is no single, accessible route for consumers to resolve disputes – especially those involving digital transactions or overseas sellers. Courts are costly, time-consuming, and require a degree of legal literacy that many do not have. There must be a unified system of Alternative Dispute Resolution for all consumer matters, enshrined in law and tailored for the digital age. Delivered online, this system could replace the need for costly hearings and would act as a deterrent in itself.

In the context of a worsening cost-of-living crisis, basic consumer protections should be non-negotiable. Price clarity, accessible billing terms, and plain-English notices about upcoming changes must become standard – not just for the digitally literate, but for everyone. Banks and credit providers should be required to list subscriptions separately and issue annual statements that reveal the true long-term cost of weekly or monthly charges. Automatic renewals should be accompanied by visible countdowns – updated weekly for two months in advance – so consumers have time to act.

The CMA’s powers must also be expanded to investigate online platforms and AI-based pricing models. Penalties for violations should be swift, direct, and meaningful, without the need for drawn-out legal processes.

In short, we need a comprehensive reform of consumer law – not just tweaks and updates, but a full-scale overhaul that aligns our legal protections with the reality of modern life. A new consumer charter – clear, enforceable and inclusive – would foster greater trust, ensure fairer competition, and offer protection not just for today’s consumers, but for the future digital economy as well.

Raj Joshi is a senior barrister and former chair of the Society of Black Lawyers. He was named among the Top 10 Asian Lawyers in the UK and the 100 Most Influential Asians in the UK. He has advised the Judicial Studies Board, and served as an adjudicator, campaigner, and legal advisor across multiple institutions tackling race, justice, and equality.

Main image: Ivan Samkov/Pexels

RECENT ARTICLES

-

The era of easy markets is ending — here are the risks investors can no longer ignore

The era of easy markets is ending — here are the risks investors can no longer ignore -

Is testosterone the new performance hack for executives?

Is testosterone the new performance hack for executives? -

Can we regulate reality? AI, sovereignty and the battle over what counts as real

Can we regulate reality? AI, sovereignty and the battle over what counts as real -

NATO gears up for conflict as transatlantic strains grow

NATO gears up for conflict as transatlantic strains grow -

Facial recognition is leaving the US border — and we should be concerned

Facial recognition is leaving the US border — and we should be concerned -

Wheelchair design is stuck in the past — and disabled people are paying the price

Wheelchair design is stuck in the past — and disabled people are paying the price -

Why Europe still needs America

Why Europe still needs America -

Why Europe’s finance apps must start borrowing from each other’s playbooks

Why Europe’s finance apps must start borrowing from each other’s playbooks -

Why universities must set clear rules for AI use before trust in academia erodes

Why universities must set clear rules for AI use before trust in academia erodes -

The lucky leader: six lessons on why fortune favours some and fails others

The lucky leader: six lessons on why fortune favours some and fails others -

Reckon AI has cracked thinking? Think again

Reckon AI has cracked thinking? Think again -

The new 10 year National Cancer Plan: fewer measures, more heart?

The new 10 year National Cancer Plan: fewer measures, more heart? -

The Reese Witherspoon effect: how celebrity book clubs are rewriting the rules of publishing

The Reese Witherspoon effect: how celebrity book clubs are rewriting the rules of publishing -

The legality of tax planning in an age of moral outrage

The legality of tax planning in an age of moral outrage -

The limits of good intentions in public policy

The limits of good intentions in public policy -

Are favouritism and fear holding back Germany’s rearmament?

Are favouritism and fear holding back Germany’s rearmament? -

What bestseller lists really tell us — and why they shouldn’t be the only measure of a book’s worth

What bestseller lists really tell us — and why they shouldn’t be the only measure of a book’s worth -

Why mere survival is no longer enough for children with brain tumours

Why mere survival is no longer enough for children with brain tumours -

What Germany’s Energiewende teaches Europe about power, risk and reality

What Germany’s Energiewende teaches Europe about power, risk and reality -

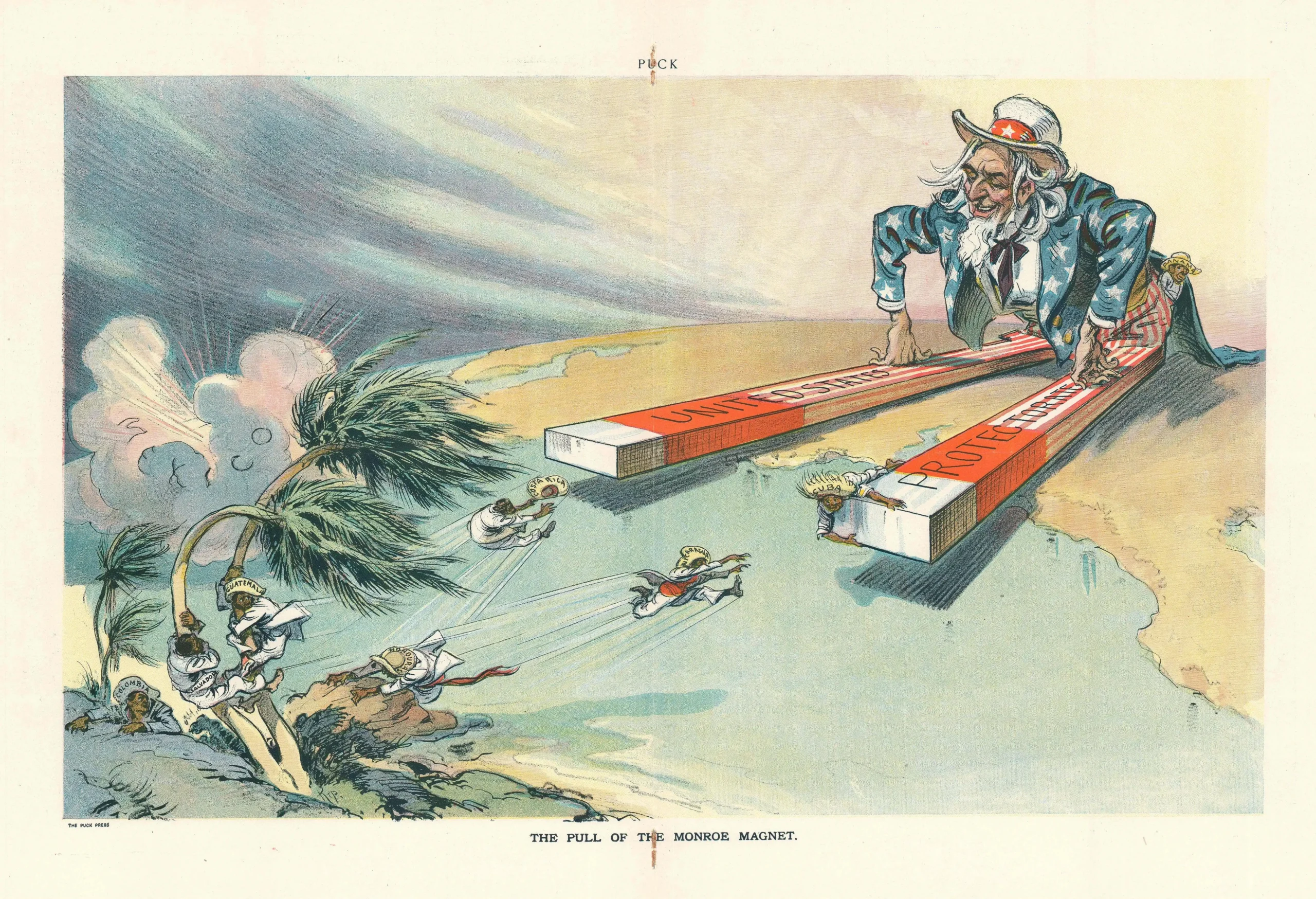

What the Monroe Doctrine actually said — and why Trump is invoking it now

What the Monroe Doctrine actually said — and why Trump is invoking it now -

Love with responsibility: rethinking supply chains this Valentine’s Day

Love with responsibility: rethinking supply chains this Valentine’s Day -

Why the India–EU trade deal matters far beyond diplomacy

Why the India–EU trade deal matters far beyond diplomacy -

Why the countryside is far safer than we think - and why apex predators belong in it

Why the countryside is far safer than we think - and why apex predators belong in it -

What if he falls?

What if he falls? -

Trump reminds Davos that talk still runs the world

Trump reminds Davos that talk still runs the world