China vs the world: can legacy carmakers survive the shockwave?

Mark G. Whitchurch

- Published

- Opinion & Analysis

At this year’s FT Future of the Car Summit and SMMT Test Day, one question dominated: how did Europe’s giants fall so far behind? Mark G. Whitchurch reports from the frontline of a motoring industry in flux —where tariffs, tech, and Chinese disruption are reshaping the global market

“Would you want to be a legacy car manufacturer in the current climate?” a respected PR manager asked me at an industry event last week. If it means trying to move forward with both hands tied behind your back and your head in the sand, then the answer is obvious.

That, it seems, is the unfortunate position Europe’s established vehicle manufacturers now find themselves in: under pressure from all sides, and being outpaced by a new generation of Chinese rivals.

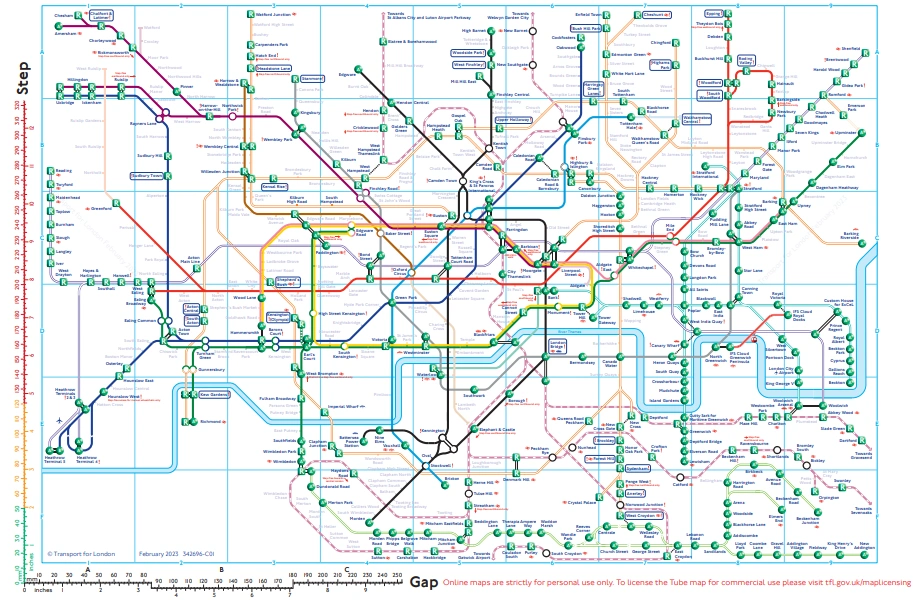

The week beginning 12 May saw two events that laid bare the state of the global car industry. In London, the FT Future of the Car Summit 2025 brought together 600 industry figures from over 50 countries, collectively representing 85% of global vehicle production. Meanwhile, at Millbrook proving ground near Bedford, the Society of Motor Manufacturers and Traders annual test day gave journalists and trade insiders a chance to get behind the wheel of the latest models and assess the state of play.

The conversations at both events pointed to the same sobering reality: legacy brands are struggling to adapt, and Chinese entrants are gaining ground fast.

To understand the current crisis, you need to rewind 25 years to the political awakening around climate change. Governments across the world began tightening emissions regulations, pushing internal combustion engines closer to obsolescence — in many cases faster than technology or infrastructure could realistically keep up.

Legacy manufacturers, particularly Toyota and Volkswagen, invested billions in research and development. But when Tesla arrived in 2009 with the Model S prototype, most of the industry shrugged it off instead of treating it as a serious disruptor.

The 2010s brought a burst of futuristic electric models from the established players. They looked good on paper, and some even sold well. But early adopters quickly ran into problems with limited charging infrastructure, disappointing battery life, and sharp depreciation. In reality, Electric Vehicles (EVs) remained the preserve of company car drivers and affluent professionals, not the mass-market motorists emissions rules were meant to reach.

Meanwhile, the German big three and others stuck to their long, complex, just-in-time production chains, reliant as they were on parts from multiple countries, currencies and suppliers. Much of the electrification tech came from Toyota. Most batteries came from China.

Then came COVID. A global semiconductor shortage threw production into chaos. Russia’s invasion of Ukraine ruptured supply chains further. Profits fell, and headlines followed: Volvo cutting jobs worldwide; Nissan shuttering seven factories.

All of this while China surged ahead.

Anyone who attended Goodwood Festival of Speed in 2024 couldn’t have missed the arrival of Chinese brands. They may need marketing polish, but their products match European rivals on quality and beat them on price.

Why China is winning

Chinese brands like BYD (Build Your Dreams) benefit from vertically integrated supply chains. Starting life as a battery company, BYD controls everything from raw material sourcing to vehicle assembly, all within close geographic range. That alone delivers enormous cost and speed advantages.

European brands, by contrast, still lack a domestic battery supply. Volkswagen and Porsche continue to rely heavily on CATL — China’s dominant battery manufacturer — for the supply of lithium-ion cells used in their electric vehicles, including the VW ID range. Batteries account for up to 40% of vehicle production costs, representing a structural weakness for the West, and a strategic advantage for China.

But China’s head start wasn’t accidental. Battery development was state-sponsored and began decades ago. Europe is now scrambling to catch up, with new factories planned in places like Somerset, England. But without significant government support, private ventures have struggled, as Porsche’s failed partnership with Northvolt shows.

Then there’s labour. Chinese firms benefit from low costs and fewer regulatory hurdles. In contrast, Europe’s legacy brands must manage entrenched unions and rightly robust employment protections, all while trying to compete on price.

BYD now outsells Volkswagen globally. Its ambitions include buses, vans, and commercial fleets. A new Hungarian plant is being built to circumvent import tariffs.

Chery, already selling in the UK via Omoda and Jaecoo, also plans to launch two more brands this year. With entry-level EVs starting around £25,000, Chery shifted nearly 10,000 units in the UK in 2025 alone.|

What options do legacy brands have?

To stand a chance of regaining market share and restoring profitability, legacy manufacturers must act quickly across multiple fronts.

Tariffs may offer temporary protection, but they carry considerable risk. With Chinese firms already establishing local assembly plants in Europe, duties could be sidestepped altogether. Worse still, retaliation from Beijing could hit European car exports and drive up the cost of Chinese-made batteries, on which many Western brands still depend.

A stronger solution may lie in targeted government support. European nations must actively back battery and electronics manufacturing at home, offering incentives to attract investment and reduce reliance on Chinese supply chains. However, even with domestic production, much of the raw material sourcing will remain tied to Chinese control — an issue that cannot be solved overnight.

Localising supply chains further might also help mitigate geopolitical and logistical risks. Reshoring component manufacturing and building end-to-end capabilities in Europe would allow greater control and reduce exposure to currency fluctuations and international shocks. This approach, however, will require difficult decisions, including large-scale restructuring, retraining, and in some cases, job losses.

Governments must also push for fairer global trade terms. A concerted effort to address subsidy imbalances and protect intellectual property through diplomatic and regulatory channels could help create a more level playing field for European producers.

At the same time, legacy carmakers should accelerate collaboration. Platform sharing and joint ventures with other manufacturers and technology firms can drive down costs and speed up development. Reinforcing brand identities — particularly those built on heritage, quality and craftsmanship — can help reconnect with consumers and compete against lower-priced alternatives.

Crucially, legacy brands must address falling public confidence in EVs. Poor charging infrastructure and high prices have alienated ordinary buyers. Coordinated public messaging and infrastructure upgrades are essential.

Environmental responsibility remains a central driver of innovation, and battery lifecycle management featured prominently at the FT Future of the Car Summit. Industry leaders stressed that current recycling rates for lithium-ion batteries remain alarmingly low — estimated at just 5%. Irene Feige, Head of Circular Economy at BMW Group, and Glencore’s Kunal Sinha both emphasised the need to design batteries with full circularity in mind, enabling repair, reuse and efficient end-of-life recycling.

Looking ahead, advances in battery technology may reshape the market entirely. Nissan CEO Makoto Uchida described solid-state batteries as a “game changer” while Pam Thomas, CEO of the Faraday Institution, called them the “Holy Grail” of energy storage, citing their potential to deliver higher energy density, faster charging, and longer lifespan. Production is expected to begin by 2028.

The summit also addressed shifting consumer behaviour, with a strong focus on affordability and flexibility. Renault CEO Luca de Meo argued that the European market urgently needs a sub-£20,000 electric vehicle, taking inspiration from Japan’s Kei car segment. Meanwhile, mobility firm ALD Automotive projected that within the next few years, up to 50% of all private lease business will move to subscription or pay-per-use models, reflecting a broader trend away from ownership and towards on-demand access.

SMMT test day

At Millbrook, the shift to electrification was unmissable. Of the 160 vehicles available to drive, only one had a manual gearbox — a 1960s classic Škoda wheeled out for nostalgic charm. The rest reflected the industry’s electric future, with a range of new models showcasing the different strategies manufacturers are using to navigate the transition.

MG, now owned by China’s SAIC Motor, is a clear example of how Chinese engineering is adapting to Western markets. The Cyberster — its new electric roadster — managed to feel both responsive and reassuring, hinting at how Chinese brands may soon compete on driver appeal as well as price.

German marques like BMW and Audi continue to hedge their bets with a mix of electric, hybrid and petrol offerings. BMW’s MINI Cooper S Works offered a reminder that the petrolhead spirit still has its place, while the Audi A6 Avant e-tron and RS e-tron GT showed that European brands can still deliver high-end EVs with flair, substance and cutting-edge tech.

Volvo and Polestar — Swedish in design but backed by Chinese parent company Geely — struck perhaps the most pragmatic balance, combining elegant styling with well-developed hybrid and electric systems. The updated XC90 hybrid stood out as a refined, real-world solution for drivers not yet ready to go fully electric.

Elsewhere, performance and character were still on display. The Abarth 600e proved that compact EVs can deliver genuine driving fun, while the Alfa Romeo Giulia Quadrifoglio, with its 510hp petrol V6, served as a defiant reminder that not every brand is ready to give up on combustion just yet. And thank God for that.

My car of the day? Surprisingly, not an electric one. The Alpine A110R — a petrol-powered machine — takes a different approach, countering the weight of modern safety kit with carbon-fibre wheels, body panels, and a stripped-out interior full of exposed carbon. The drive was a delight: sharp, nimble, and packed with power. Let’s hope that amid the charge to electric, manufacturers still find space to build cars that are this engaging to drive.

The road ahead

After spending time at both the FT Future of the Car Summit and SMMT Test Day, one thing became painfully clear to me: legacy manufacturers face a simple but brutal truth. If they’re to survive the next decade, they must find ways to cut production costs and pass those savings on to consumers. That means rethinking long-standing business models, streamlining supply chains, and embracing serious structural change.

Governments, too, have a role to play by backing European battery independence, supporting domestic innovation, and creating the conditions for fairer global competition.

And if the industry is serious about its climate goals, this goes beyond what powers the car. It’s really about the full lifecycle: from how materials are sourced to how batteries are recycled, and from the emissions created in production to what happens when a vehicle reaches the end of the road.

The car of the future needs to be cleaner, more affordable, and more intelligent — or Europe’s best-known names could be left idling on the hard shoulder.

Mark G. Whitchurch is a seasoned motoring journalist whose work—covering road tests, launch reports, scenic drives, major races, and event reviews—has appeared in The Observer, Daily Telegraph, Bristol Evening Post, Classic & Sports Car Magazine, Mini Magazine, Classic Car Weekly, AutoCar Magazine, and the Western Daily Press, among others. He won the Tourism Malaysia Regional Travel Writer of the Year in 2003 and is a member of The Guild of Motoring Writers.

Photos: Supplied

RECENT ARTICLES

-

Europe cannot call itself ‘equal’ while disabled citizens are still fighting for access

Europe cannot call itself ‘equal’ while disabled citizens are still fighting for access -

Is Europe regulating the future or forgetting to build it? The hidden flaw in digital sovereignty

Is Europe regulating the future or forgetting to build it? The hidden flaw in digital sovereignty -

The era of easy markets is ending — here are the risks investors can no longer ignore

The era of easy markets is ending — here are the risks investors can no longer ignore -

Is testosterone the new performance hack for executives?

Is testosterone the new performance hack for executives? -

Can we regulate reality? AI, sovereignty and the battle over what counts as real

Can we regulate reality? AI, sovereignty and the battle over what counts as real -

NATO gears up for conflict as transatlantic strains grow

NATO gears up for conflict as transatlantic strains grow -

Facial recognition is leaving the US border — and we should be concerned

Facial recognition is leaving the US border — and we should be concerned -

Wheelchair design is stuck in the past — and disabled people are paying the price

Wheelchair design is stuck in the past — and disabled people are paying the price -

Why Europe still needs America

Why Europe still needs America -

Why Europe’s finance apps must start borrowing from each other’s playbooks

Why Europe’s finance apps must start borrowing from each other’s playbooks -

Why universities must set clear rules for AI use before trust in academia erodes

Why universities must set clear rules for AI use before trust in academia erodes -

The lucky leader: six lessons on why fortune favours some and fails others

The lucky leader: six lessons on why fortune favours some and fails others -

Reckon AI has cracked thinking? Think again

Reckon AI has cracked thinking? Think again -

The new 10 year National Cancer Plan: fewer measures, more heart?

The new 10 year National Cancer Plan: fewer measures, more heart? -

The Reese Witherspoon effect: how celebrity book clubs are rewriting the rules of publishing

The Reese Witherspoon effect: how celebrity book clubs are rewriting the rules of publishing -

The legality of tax planning in an age of moral outrage

The legality of tax planning in an age of moral outrage -

The limits of good intentions in public policy

The limits of good intentions in public policy -

Are favouritism and fear holding back Germany’s rearmament?

Are favouritism and fear holding back Germany’s rearmament? -

What bestseller lists really tell us — and why they shouldn’t be the only measure of a book’s worth

What bestseller lists really tell us — and why they shouldn’t be the only measure of a book’s worth -

Why mere survival is no longer enough for children with brain tumours

Why mere survival is no longer enough for children with brain tumours -

What Germany’s Energiewende teaches Europe about power, risk and reality

What Germany’s Energiewende teaches Europe about power, risk and reality -

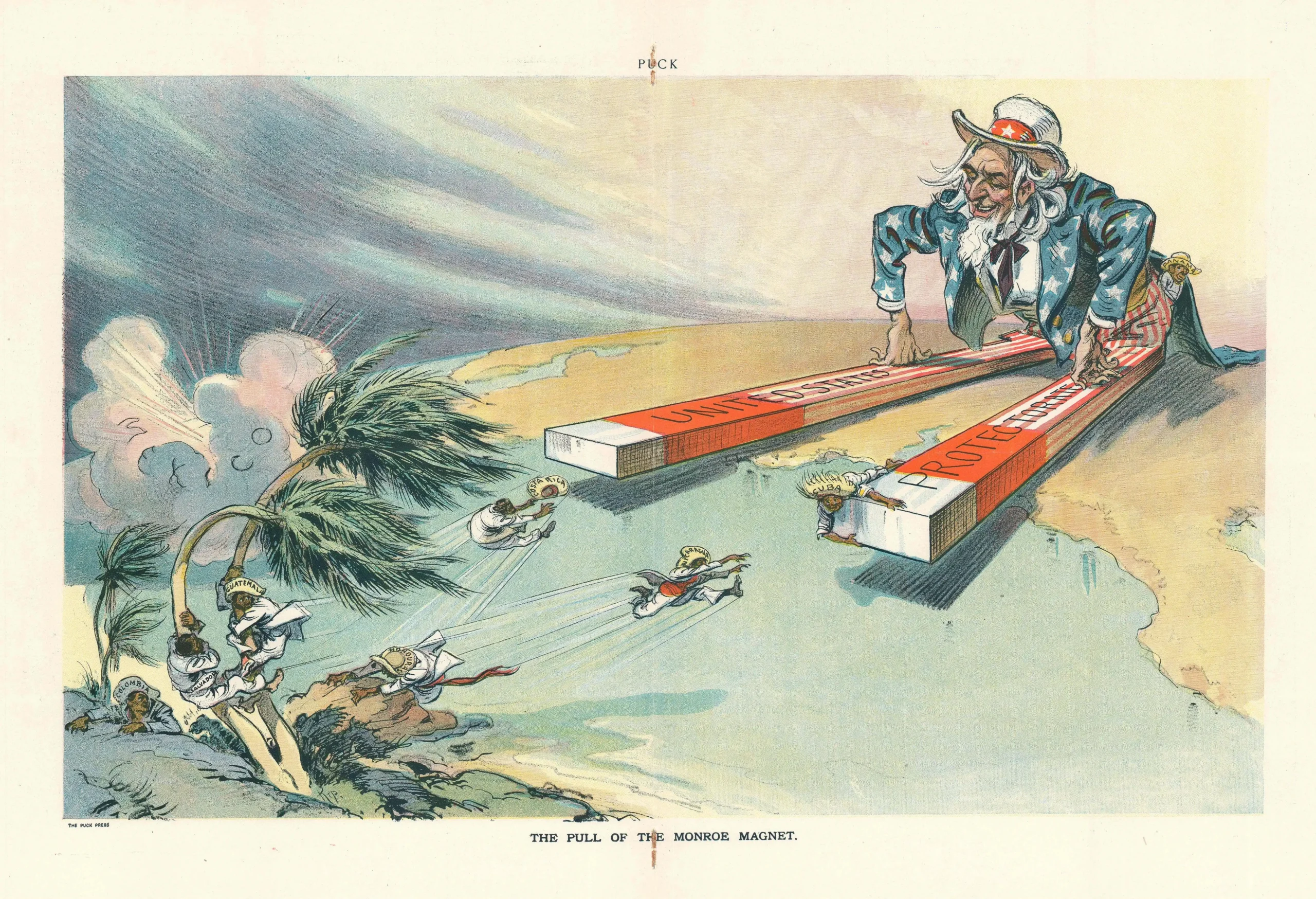

What the Monroe Doctrine actually said — and why Trump is invoking it now

What the Monroe Doctrine actually said — and why Trump is invoking it now -

Love with responsibility: rethinking supply chains this Valentine’s Day

Love with responsibility: rethinking supply chains this Valentine’s Day -

Why the India–EU trade deal matters far beyond diplomacy

Why the India–EU trade deal matters far beyond diplomacy -

Why the countryside is far safer than we think - and why apex predators belong in it

Why the countryside is far safer than we think - and why apex predators belong in it