Why AI in digital banking is essential for a sustainable future

John E. Kaye

- Published

- Artificial Intelligence, Opinion & Analysis

Artificial intelligence is transforming digital banking, driving efficiency, reducing energy consumption, and enabling greener financial decisions. It’s a win-win situation in which everyone profits, writes tech expert, Mo Farmer

With sustainability now a core component of responsible business, industries everywhere are reimagining their roles in fostering a greener, more equitable future. Among these, banking—usually perceived as conservative and resistant to change—is emerging as a surprising frontrunner in this green transformation. And at the heart of this shift is artificial intelligence (AI), a technology that is proving indispensable in driving innovation and reshaping how financial institutions operate.

While the banking sector might not immediately come to mind when thinking about industries that have a negative environmental impact, there has long been a significant carbon footprint attached. For decades, banking has relied on physical infrastructure—paper-based transactions, sprawling branch networks, energy-intensive data centres—that have come at a huge environmental cost. A WWF and Greenpeace report, for instance, found that the UK’s largest banks and investors emitted 805 million tonnes of carbon per year in 2019—almost double the UK’s domestic emissions.

While digital banking itself represents a step forward in reducing this impact, AI is now taking this evolution further by optimising operations, enhancing efficiency and minimising waste. Through predictive analytics, artificial intelligence enables banks to better forecast customer needs and reduce unnecessary communication and overproduction of marketing materials. At the same time, chatbots, powered by natural language processing (NLP), are replacing resource-heavy call centres, cutting energy consumption and the environmental impact associated with physical office spaces in the process.

Moreover, AI is now playing a critical role in streamlining back-office operations. Processes that once required manual intervention such as fraud detection, compliance checks and loan underwriting, are now managed much more effectively and sustainably by AI-driven solutions. For example, AI algorithms can analyse vast datasets in real time, detecting fraudulent transactions or money-laundering activities without the need for cumbersome and costly human oversight. This not only ensures security but also eliminates inefficiencies, once again reducing the energy and material resources required to maintain these vital processes.

But the efficiencies delivered by AI don’t end there. A large proportion of banks’ carbon footprint come from data centres and other IT infrastructures, which are known to use up to 50 times more energy per square foot than traditional office spaces. Thanks to AI, though, energy use can be optimised by such things are smart cooling systems and algorithms that predict and reduce peak electricity consumption. And it’s a win-win situation, as the banks also save money in the process.

One of AI’s most impactful contributions to sustainability lies in its ability to enable green finance. Consumers and businesses alike are increasingly demanding that their money aligns with their values, with a 2022 report by cloud banking platform Mambu finding that more than half (58%) of consumers want more say over how and where their money is invested. Banks are responding by offering financial products that prioritise environmental, social and governance (ESG) concerns. Evaluating these factors, however, requires analysing complex and often unstructured data—a task that is, of course, perfectly suited to AI.

Through machine learning (ML) and big-data analytics, artificial intelligence can assess the sustainability credentials of companies and projects with unprecedented accuracy, in turn empowering banks to allocate their resources more responsibly and steering investments toward initiatives that genuinely contribute to a more sustainable future. From renewable energy projects to affordable housing developments, AI is ensuring that capital flows where it is needed most rather than into ventures that exacerbate ecological or social harm, such as the fossil fuel, mining or arms industries.

AI is also enhancing transparency in Environmental, Social, and Governance (ESG) reporting, an area that has historically been riddled with inconsistencies and ‘greenwashing’. By analysing patterns in financial data, corporate disclosures and even satellite images, AI can now verify the sustainability claims being made by organisations, protecting investors from misleading information while holding corporations accountable for their environmental and social impact.

But beyond green finance, AI in digital banking is now addressing one of the most significant barriers to global sustainability: financial inclusion. According to the World Bank, a staggering 1.4billion adults globally don’t have access to a bank account, meaning they are excluded from the opportunity to save securely, access credit or make digital transactions—all essential for staying afloat financially. By creating access to financial services, these low-income communities finally have the chance to build wealth and avoid the high-cost unregulated lenders who only reinforce the poverty trap.

Take credit scoring, for example. Traditional credit models often shut out individuals without a documented financial history, disproportionately affecting those in developing countries or marginalised communities. AI, however, can analyse alternative data sources such as mobile phone usage, utility bill payments and even social media activity to create accurate and fair credit profiles. This then allows banks to extend loans and other financial services to people who would otherwise be deemed too risky by conventional standards, including aspiring entrepreneurs who can then grow their business and help boost the local economy.

Of course, the integration of AI into digital banking is not without challenges. Concerns about data privacy, algorithmic bias and the ethical use of AI must be addressed to ensure that these technologies are deployed responsibly. Thankfully, the banking sector has shown a willingness to engage with these issues, recognising that public trust is essential for long-term success.

Moreover, the rapid pace of AI development demands ongoing investment in skills and infrastructure. Banks must ensure that their employees are equipped to work alongside AI systems and that their IT ecosystems are capable of supporting advanced technologies. Governments and regulatory bodies also have a role to play, creating frameworks that encourage innovation while safeguarding against potential risks.

Yet despite these challenges, the case for AI in digital banking as a driver of sustainability is clear and compelling. Artificial intelligence offers unprecedented opportunities to reduce waste, allocate resources more effectively and promote social equity—all while enhancing profitability and customer satisfaction. By embracing AI, banks position themselves as stewards of a sustainable future in which we all profit.

Muhammad ‘Mo’ Farmer, CEO of Appbank (challenger bank), founder and president of the British Institute of Technology, England (BITE), is a global expert in technology, education, and cybersecurity. He has educated thousands of entrepreneurs, advised governments and corporations, and collaborated with tech pioneers including Sir Tim Berners-Lee, inventor of the World Wide Web. He also leads the Global Nuclear Skills Institute in partnership with National Nuclear Laboratory and his contributions to research and investment have driven more than £10billion into the British economy.

Main image: Courtesy Panumas Nikhomkhai/Pexels

RECENT ARTICLES

-

The era of easy markets is ending — here are the risks investors can no longer ignore

The era of easy markets is ending — here are the risks investors can no longer ignore -

Is testosterone the new performance hack for executives?

Is testosterone the new performance hack for executives? -

Can we regulate reality? AI, sovereignty and the battle over what counts as real

Can we regulate reality? AI, sovereignty and the battle over what counts as real -

NATO gears up for conflict as transatlantic strains grow

NATO gears up for conflict as transatlantic strains grow -

Facial recognition is leaving the US border — and we should be concerned

Facial recognition is leaving the US border — and we should be concerned -

Wheelchair design is stuck in the past — and disabled people are paying the price

Wheelchair design is stuck in the past — and disabled people are paying the price -

Why Europe still needs America

Why Europe still needs America -

Why Europe’s finance apps must start borrowing from each other’s playbooks

Why Europe’s finance apps must start borrowing from each other’s playbooks -

Why universities must set clear rules for AI use before trust in academia erodes

Why universities must set clear rules for AI use before trust in academia erodes -

The lucky leader: six lessons on why fortune favours some and fails others

The lucky leader: six lessons on why fortune favours some and fails others -

Reckon AI has cracked thinking? Think again

Reckon AI has cracked thinking? Think again -

The new 10 year National Cancer Plan: fewer measures, more heart?

The new 10 year National Cancer Plan: fewer measures, more heart? -

The Reese Witherspoon effect: how celebrity book clubs are rewriting the rules of publishing

The Reese Witherspoon effect: how celebrity book clubs are rewriting the rules of publishing -

The legality of tax planning in an age of moral outrage

The legality of tax planning in an age of moral outrage -

The limits of good intentions in public policy

The limits of good intentions in public policy -

Are favouritism and fear holding back Germany’s rearmament?

Are favouritism and fear holding back Germany’s rearmament? -

What bestseller lists really tell us — and why they shouldn’t be the only measure of a book’s worth

What bestseller lists really tell us — and why they shouldn’t be the only measure of a book’s worth -

Why mere survival is no longer enough for children with brain tumours

Why mere survival is no longer enough for children with brain tumours -

What Germany’s Energiewende teaches Europe about power, risk and reality

What Germany’s Energiewende teaches Europe about power, risk and reality -

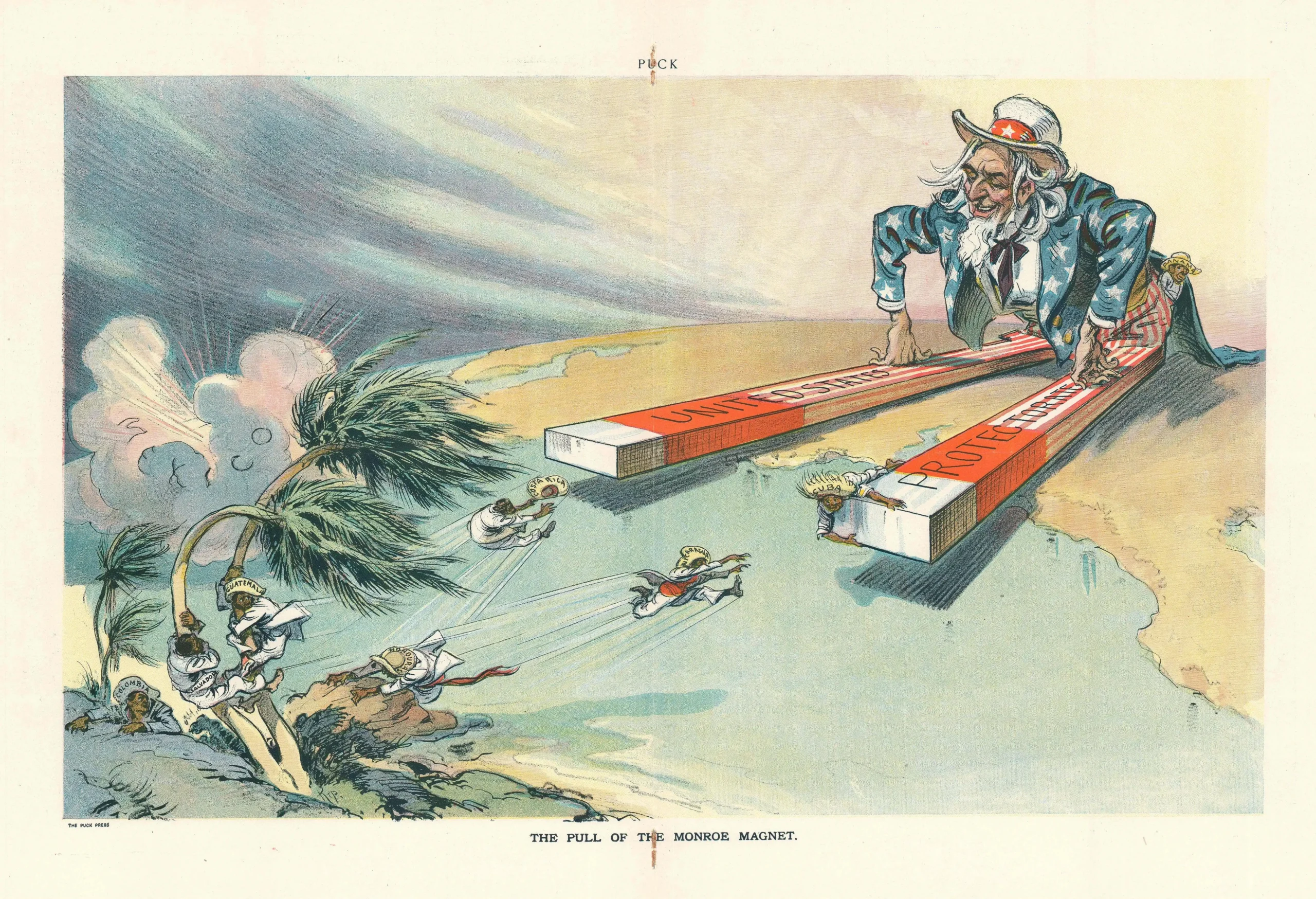

What the Monroe Doctrine actually said — and why Trump is invoking it now

What the Monroe Doctrine actually said — and why Trump is invoking it now -

Love with responsibility: rethinking supply chains this Valentine’s Day

Love with responsibility: rethinking supply chains this Valentine’s Day -

Why the India–EU trade deal matters far beyond diplomacy

Why the India–EU trade deal matters far beyond diplomacy -

Why the countryside is far safer than we think - and why apex predators belong in it

Why the countryside is far safer than we think - and why apex predators belong in it -

What if he falls?

What if he falls? -

Trump reminds Davos that talk still runs the world

Trump reminds Davos that talk still runs the world