Why the pursuit of fair taxation makes us poorer

Harry Margulies

- Published

- Opinion & Analysis

Everyone claims to want a fairer society, yet few can define what ‘fairness’ means. In the first in a series on equity, taxation, and growth, our Business and Regulation correspondent Harry Margulies asks whether a moral ideal can ever be written into economic law — and what happens when societies try

Everyone claims to want a fairer society, yet few agree on what “fair” actually means. In public debate, fairness no longer describes a principle but a feeling — invoked by whoever wishes to claim the moral high ground. What feels just to one person can feel punitive to another.

So can a feeling as elastic as fairness ever be translated into the fixed language of tax law?

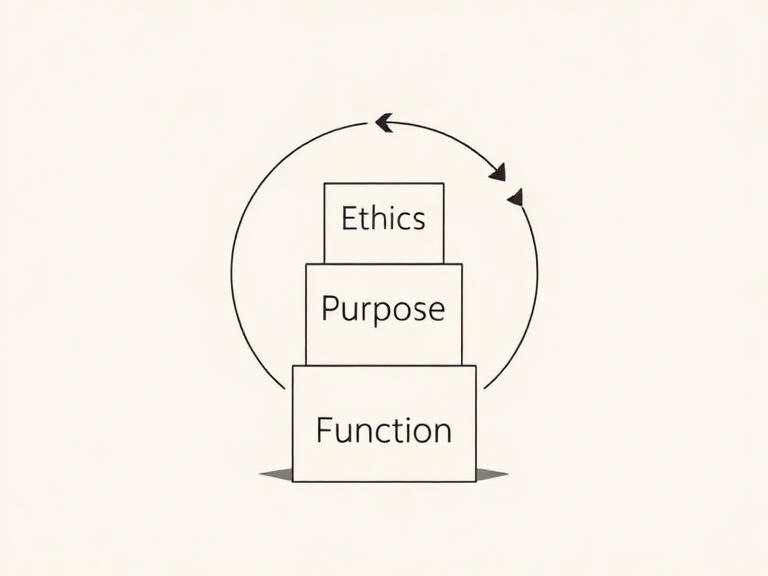

McGill University draws a helpful distinction between equality and equity. Equality demands the same starting line for everyone. Equity, by contrast, “denotes fairness and justice in both process and outcome,” sometimes requiring differential treatment or resource redistribution to achieve parity. In short, equality says: give everyone the same opportunity; equity says: move the starting line until everyone finishes together. That distinction sits at the heart of every modern argument about taxation and virtue itself.

Across a series of articles, I intend to examine whether perceived fairness can coexist with the goal of economic growth and a higher standard of living for all. Future instalments will address why capital gains are taxed less than income, why corporate taxes have fallen, why very high marginal rates reduce productivity, and why protecting consumers—the role every citizen shares—is more important than privileging workers as a class. I will also explore the tax advantages available mainly to the wealthy and ask whether they distort or sustain prosperity.

One premise, which I first discussed as a young man with the then Swedish Prime Minister on television, is that tax systems offer the same deductions to everyone, but not everyone can use them. “If all of your income goes towards bread and milk, you do not have the same opportunity to take advantage.” It was a simple observation, but it revealed the truth that life itself is unequal. The real question is whether tax can make it fairer.

People are born with different privileges: beauty, intelligence, business acumen, emotional stability, good health. These advantages cannot be taxed into equality, and any attempt to do so risks suppressing the very productivity on which fairness ultimately depends. Redistribution, however well-intentioned, requires an economy from which to redistribute; without capital, there is no prosperity to share.

One of the most persistent misconceptions is that capital is the enemy of labour. The Swedish social-democratic finance minister Ernst Wigforss argued the opposite a century ago: capital is the friend of labour. The more abundant capital becomes, the cheaper it becomes; the more it is invested in productivity; and the more wages rise. Workers today do not work harder than those at the dawn of the industrial age. They simply work with more capital. Productivity—made possible by investment—is what raises living standards.

Yet in the modern moral economy, capital is increasingly viewed with suspicion. Fairness has become performative, a kind of virtue signalling in which moral posture replaces economic understanding. The public display of fairness feels good; it signals compassion, justice, moral clarity. But fairness that ignores reality is little more than theatre. When politicians invoke it, it often serves as a moral performance rather than a plan for growth. In Canada, for example, the Trudeau government framed increases in top income and capital-gains taxes as a matter of fairness. The gesture resonated online but achieved little for productivity or long-term prosperity. Trudeau’s successor quietly reversed the change, probably in recognition of that fact.

To test how the public perceives fairness, I posted a question on X: “To those who want a more equitable society: would you accept new billionaires in return for your standard of living doubling?” Out of 1,902 votes and 152,000 views, only 55 per cent said yes. The remaining 45 per cent preferred to keep a lower standard of living rather than tolerate new billionaires in the neighbourhood. I do not believe them. As one respondent remarked, “An even better question would be: if you want a more equitable society, would you agree to be paid the same as the cleaning lady at your workplace?” It was a reminder that what people say and what they do are often different—and that fairness remains, as ever, in the eye of the beholder.

Behind much of the modern rhetoric about fairness lies a deeper discomfort with prosperity itself. People want rising living standards but not the visible inequality that comes with success. They want to consume, but they do not always wish to produce. Yet if capital is treated as immoral, if profit is punished in the name of virtue, the result will not be equality but decline. Productivity creates the resources from which fairness can even be attempted.

A tax system cannot make life fair. It can only fund the conditions that make fairness possible: opportunity, education, stability, and growth. To treat capital as the enemy of fairness is to forget that capital is what pays for fairness in the first place.

Harry Margulies is a journalist, author, commentator, and public intellectual whose work interrogates religion, politics, and morality with sharp wit and fearless clarity. A second-generation Holocaust survivor, he was born in Austria and spent time in an Austrian refugee camp before moving to Sweden. Educated by Orthodox rabbis throughout his childhood, he ultimately abandoned faith in his teens—a journey that has shaped his lifelong commitment to secularism, critical thinking, and freedom of expression. His latest book, Is God Real? Hell Knows, has been described by ABBA’s Björn Ulvaeus as “funny, sharp, and unafraid.”

READ MORE: ‘How free global cities could reshape the future of migration‘. With more than 123 million people displaced worldwide and traditional solutions faltering, the concept of ‘Free Global Cities’ could transform refugees from passive recipients of aid into active contributors to thriving, resilient communities, argues Dr. Christian H. Kaelin, Chairman at Henley & Partners.

Do you have news to share or expertise to contribute? The European welcomes insights from business leaders and sector specialists. Get in touch with our editorial team to find out more.

Main image: Nataliya Vaitkevich/Pexels

Sign up to The European Newsletter

RECENT ARTICLES

-

Trump reminds Davos that talk still runs the world

Trump reminds Davos that talk still runs the world -

Will Trump’s Davos speech still destroy NATO?

Will Trump’s Davos speech still destroy NATO? -

Philosophers cautioned against formalising human intuition. AI is trying to do exactly that

Philosophers cautioned against formalising human intuition. AI is trying to do exactly that -

Life’s lottery and the economics of poverty

Life’s lottery and the economics of poverty -

On a wing and a prayer: the reality of medical repatriation

On a wing and a prayer: the reality of medical repatriation -

Ai&E: the chatbot ‘GP’ has arrived — and it operates outside the law

Ai&E: the chatbot ‘GP’ has arrived — and it operates outside the law -

Keir Starmer, Wes Streeting and the Government’s silence: disabled people are still waiting

Keir Starmer, Wes Streeting and the Government’s silence: disabled people are still waiting -

The fight for Greenland begins…again

The fight for Greenland begins…again -

Failure is how serious careers in 2026 will be shaped

Failure is how serious careers in 2026 will be shaped -

Poland’s ambitious plans to power its economic transformation

Poland’s ambitious plans to power its economic transformation -

Europe’s space ambitions are stuck in political orbit

Europe’s space ambitions are stuck in political orbit -

New Year, same question: will I be able to leave the house today?

New Year, same question: will I be able to leave the house today? -

A New Year wake-up call on water safety

A New Year wake-up call on water safety -

The digital euro is coming — and Europe should be afraid of what comes with it

The digital euro is coming — and Europe should be afraid of what comes with it -

Make boards legally liable for cyber attacks, security chief warns

Make boards legally liable for cyber attacks, security chief warns -

Why Greece’s recovery depends on deeper EU economic integration

Why Greece’s recovery depends on deeper EU economic integration -

Why social media bans won’t save our kids

Why social media bans won’t save our kids -

This one digital glitch is pushing disabled people to breaking point

This one digital glitch is pushing disabled people to breaking point -

Japan’s heavy metal-loving Prime Minister is redefining what power looks like

Japan’s heavy metal-loving Prime Minister is redefining what power looks like -

Why every system fails without a moral baseline

Why every system fails without a moral baseline -

The many lives of Professor Michael Atar

The many lives of Professor Michael Atar -

Britain is finally having its nuclear moment - and it’s about time

Britain is finally having its nuclear moment - and it’s about time -

Forget ‘quality time’ — this is what children will actually remember

Forget ‘quality time’ — this is what children will actually remember -

Shelf-made men: why publishing still favours the well-connected

Shelf-made men: why publishing still favours the well-connected -

European investors with $4tn AUM set their sights on disrupting America’s tech dominance

European investors with $4tn AUM set their sights on disrupting America’s tech dominance