$9.55tn private capital funds to finance transition to renewable energy

John E. Kaye

- Published

- Home, News, Sustainability

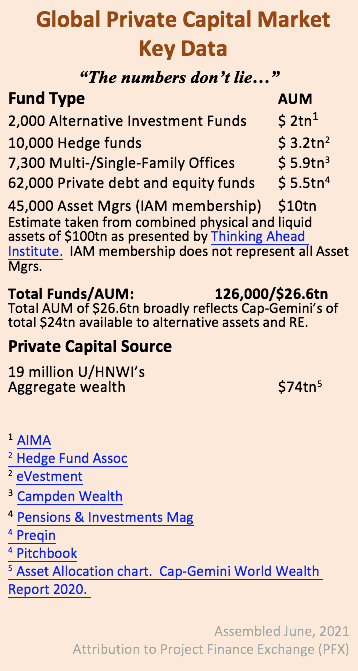

It is not generally known that there are currently thousands of shovel-ready renewable energy projects, worldwide. They range across solar, wind, waste-to-energy and other sectors with deal values $5m to $5bn+. Unfortunately, most of them have no channel through which they can access the vast amount of capital available to them, creating a constant barrier to the terawatts of clean energy they are poised to bring on-stream. But, now, the structure is in place to unleash up to $9.55tn of private capital directly into those projects. Current energy-policymaking ‘groupthink’ is to load transition costs entirely onto consumers but now, with the launch of the Project Finance Exchange (PFX), they should ‘think again!’ The numbers don’t lie…

“There is no shortage of money worldwide, but it is not finding its way to where it is most needed” says Fatih Birol, Executive Director, International Energy Agency (IEA).

In June this year Mr Birol has highlighted the necessity for the most deeply liquid and now, with the launch of the Project Finance Exchange (PFX), most accessible global capital market, Private Capital, to step up and fill the transition finance gap. To clarify Mr Birol’s comment, there is “…no shortage of money…” because there is an abundant $9.55tn private capital available for investment in what are defined by the market as ‘alternative assets’, with renewable energy the clear favourite. This vast capital reserve is managed and allocated by 126,000+ funds serving a market of thousands of projects at any one time. But the market grew to be so crowded, fragmented and opaque it became virtually impossible for projects and funds to identify each other. Whilst there has been a growing private capital ‘market’ since its genesis more than two decades ago, there has never been a private capital ‘marketplace’, with the built-in privacy that private capital demands, through which projects and funds can seamlessly connect and engage. That is why money has not been “…finding its way to where it is most needed.”

The market fragmentation has now been overcome and structure introduced with the opening in April this year of the Project Finance Exchange (PFX). Private capital available from ‘first mover’ funds so far registered with PFX is over $30bn with transactions now in progress. PFX offers its registered funds 40 market sectors to invest and lend into, but renewable energy is their clear favourite. The numbers don’t lie…

Key data

- $9.55tn of private capital available. Source: Cap-Gemini World Wealth Report 2020 (Pages 7 & 12). 14.2% of total $74trillion owned by 19million U/HNWI’s worldwide for allocation to alternative assets, of which renewable energy is the preferred investment.

- 126,000 alternative investment, hedge, private debt/equity funds, asset managers and family offices managing and allocating this capital. ‘First mover’ PFX investor registration data show that renewable energy is the preferred investment. Source: PFX.

Project Finance

From the 1950’s to mid-2000’s project finance was exclusive to mega-$ infrastructure and construction projects funded by top-tier banks and other institutions. This ended when those institutions were mostly drained of their liquidity in the 2008 banking meltdown. ‘Project finance’ is still widely perceived as being out of reach of ‘smaller’ deals (sub-$500m). In fact, it is now dominated by far more flexible private capital funds handling deal values as low as sub-$10million, with no upper limit.

But the defining tenet still prevails: lending is predicated on the track record and financial stability of whoever is contracted to buy the output from the built project, and not on forecasts in a business plan or prospectus. For energy, this means the project’s PPA (Power Purchase Agreement), which will usually be with the national or regional grid.

Project finance can be defined as lending against revenues from a yet-to-be-built asset, which banks are prevented from doing by their own regulations. But, for private investors, this unique structure delivers the long-term risk-mitigated returns they seek. It also leaves project principals be they teams, companies, local or national government free and clear of any financial liability.

How to Finance Renewable Energy Projects

An Op-Ed by our chairman was published in the July ‘21 edition of EPCWorld, a magazine for EPC (Engineering Procurement and Construction) contractors who build the projects. How to Finance Renewable Energy Projects focuses on waste-to-energy and is written for a ‘trade’ audience but clearly explains how to finance renewable energy projects with private capital. PFX enables the global renewables industry to turn to the private capital market, with liquidity rivalling that of any institutional capital market, to finance their projects.

PFX Comment on COP-26 and transition financing

PFX Chairman David Rose says: “The IPCC Report of August 2021 called for ‘…immediate, rapid and large-scale reductions (in emissions)…if targets ratified in the 2015 Paris Agreement are not to be breached’. According to one renewable energy industry association there are over 1,000 projects in the U.S. alone with deal values from $10m to $5bn+, all stalled because they can’t find their way to suitable investors. This can be reasonably extrapolated to 5,000 worldwide. The numbers don’t lie and over 126,000 private capital fund managers stand ready, willing and eager to finance these projects. Through PFX funds can now seamlessly connect and engage with projects and unleash the vast reserve of $9.55tn private capital into mitigating the climate emergency. PFX is free to use for projects and free to register for funds. We are cutting through all the talk, targets and pledges and facilitating all those cash-starved projects, with potentially terawatts of clean energy, to be brought on-stream now. We have the capacity to accommodate any number of deals, with privacy assured for both projects and funds.”

RECENT ARTICLES

-

Deepfake celebrity ads drive new wave of investment scams

Deepfake celebrity ads drive new wave of investment scams -

WATCH: Red Bull pilot lands plane on moving freight train in aviation first

WATCH: Red Bull pilot lands plane on moving freight train in aviation first -

Europe eyes Australia-style social media crackdown for children

Europe eyes Australia-style social media crackdown for children -

These European hotels have just been named Five-Star in Forbes Travel Guide’s 2026 awards

These European hotels have just been named Five-Star in Forbes Travel Guide’s 2026 awards -

McDonald’s Valentine’s ‘McNugget Caviar’ giveaway sells out within minutes

McDonald’s Valentine’s ‘McNugget Caviar’ giveaway sells out within minutes -

Europe opens NanoIC pilot line to design the computer chips of the 2030s

Europe opens NanoIC pilot line to design the computer chips of the 2030s -

Zanzibar’s tourism boom ‘exposes new investment opportunities beyond hotels’

Zanzibar’s tourism boom ‘exposes new investment opportunities beyond hotels’ -

Gen Z set to make up 34% of global workforce by 2034, new report says

Gen Z set to make up 34% of global workforce by 2034, new report says -

The ideas and discoveries reshaping our future: Science Matters Volume 3, out now

The ideas and discoveries reshaping our future: Science Matters Volume 3, out now -

Lasers finally unlock mystery of Charles Darwin’s specimen jars

Lasers finally unlock mystery of Charles Darwin’s specimen jars -

Strong ESG records help firms take R&D global, study finds

Strong ESG records help firms take R&D global, study finds -

European Commission issues new cancer prevention guidance as EU records 2.7m cases in a year

European Commission issues new cancer prevention guidance as EU records 2.7m cases in a year -

Artemis II set to carry astronauts around the Moon for first time in 50 years

Artemis II set to carry astronauts around the Moon for first time in 50 years -

Meet the AI-powered robot that can sort, load and run your laundry on its own

Meet the AI-powered robot that can sort, load and run your laundry on its own -

Wingsuit skydivers blast through world’s tallest hotel at 124mph in Dubai stunt

Wingsuit skydivers blast through world’s tallest hotel at 124mph in Dubai stunt -

Centrum Air to launch first European route with Tashkent–Frankfurt flights

Centrum Air to launch first European route with Tashkent–Frankfurt flights -

UK organisations still falling short on GDPR compliance, benchmark report finds

UK organisations still falling short on GDPR compliance, benchmark report finds -

Stanley Johnson appears on Ugandan national television during visit highlighting wildlife and conservation ties

Stanley Johnson appears on Ugandan national television during visit highlighting wildlife and conservation ties -

Anniversary marks first civilian voyage to Antarctica 60 years ago

Anniversary marks first civilian voyage to Antarctica 60 years ago -

Etihad ranked world’s safest airline for 2026

Etihad ranked world’s safest airline for 2026 -

Read it here: Asset Management Matters — new supplement out now

Read it here: Asset Management Matters — new supplement out now -

Breakthroughs that change how we understand health, biology and risk: the new Science Matters supplement is out now

Breakthroughs that change how we understand health, biology and risk: the new Science Matters supplement is out now -

The new Residence & Citizenship Planning supplement: out now

The new Residence & Citizenship Planning supplement: out now -

Prague named Europe’s top student city in new comparative study

Prague named Europe’s top student city in new comparative study -

BGG expands production footprint and backs microalgae as social media drives unprecedented boom in natural wellness

BGG expands production footprint and backs microalgae as social media drives unprecedented boom in natural wellness