Energy industry perceive a strong demand post-COVID

John E. Kaye

- Published

- Home, Sustainability

Following the COVID-19 crisis, the energy and gas industry has seen no change to the strong long-run outlook for demand. However, the industry expects a supply shortfall in the coming four years as the pandemic lockdowns and oil price collapse lead to delays on gas projects.

Gas producers, buyers, liquefied natural gas (LNG) developers and a major contractor have openly expressed their concerns about the long run of fuel. Fuel will stll be needed to back up wind and solar power, replace coal-fired power, and produce hydrogen globally.

“We see the need for substantial investment in new projects and new liquefaction,” Exxon Mobil Corp’s Australia Chairman Nathan Fay said at Credit Suisse’s annual Australian Energy Conference.

However, lingering unreliability following the record crash in LNG prices this year, way below $2 per million British thermal units (mmBtu) means only the lowest cost LNG projects will go ahead, major producers said.

At this moment in time, more than 140 million tonnes of projects worldwide have been deferred. In Australia and Papua New Guinea alone, five are on hold – Exxon’s expansion of PNG LNG twinned with Total SA’s Papua LNG, Woodside Petroleum’s Scarborough and Browse, and Santos Ltd’s Barossa.

“It’s everything to play for – so a very bullish outlook on gas,” said Martin Houston, vice chairman of U.S. LNG developer Tellurian, which recently deferred a final investment decision on its U.S. Driftwood LNG project to 2021.

Japan’s major contractor to LNG projects, Chiyoda said work has largely dried up and there would need to be stability in the market before developers move ahead with projects.

“To be perfectly honest, we don’t see any green shoots right now,” said Chiyoda Oceania’s president Andrew Tan.

Royal Dutch Shell sees short term concerns weighing on everyone’s decisions about new projects.

“I’m sure all companies, all operators or producers across the globe are going to be focused on that affordability question just because of the uncertainty they see in the macro markets,” said Shell Australia Chair Tony Nunan.

Research firm Rystad Energy said with gas prices around the world still trading near $2 per mmBtu, LNG developers with all but the lowest costs will hold off on new projects.

“But that will again cause a shortfall for the LNG market four or five years down the road,” Rystad’s head of analysis, Per Magnus Nysveen told the conference.

By Sonali Paul

Sourceds Reuters

For more Energy news follow The European Magazine.

RECENT ARTICLES

-

Strong ESG records help firms take R&D global, study finds

Strong ESG records help firms take R&D global, study finds -

How residence and citizenship programmes strengthen national resilience

How residence and citizenship programmes strengthen national resilience -

Global leaders enter 2026 facing a defining climate choice

Global leaders enter 2026 facing a defining climate choice -

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change -

China’s BYD overtakes Tesla as world’s largest electric car seller

China’s BYD overtakes Tesla as world’s largest electric car seller -

UK education group signs agreement to operate UN training centre network hub

UK education group signs agreement to operate UN training centre network hub -

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing -

Oxford to host new annual youth climate summit on UN World Environment Day

Oxford to host new annual youth climate summit on UN World Environment Day -

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan -

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns -

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests -

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement -

Historic motorsport confronts its energy future

Historic motorsport confronts its energy future -

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation -

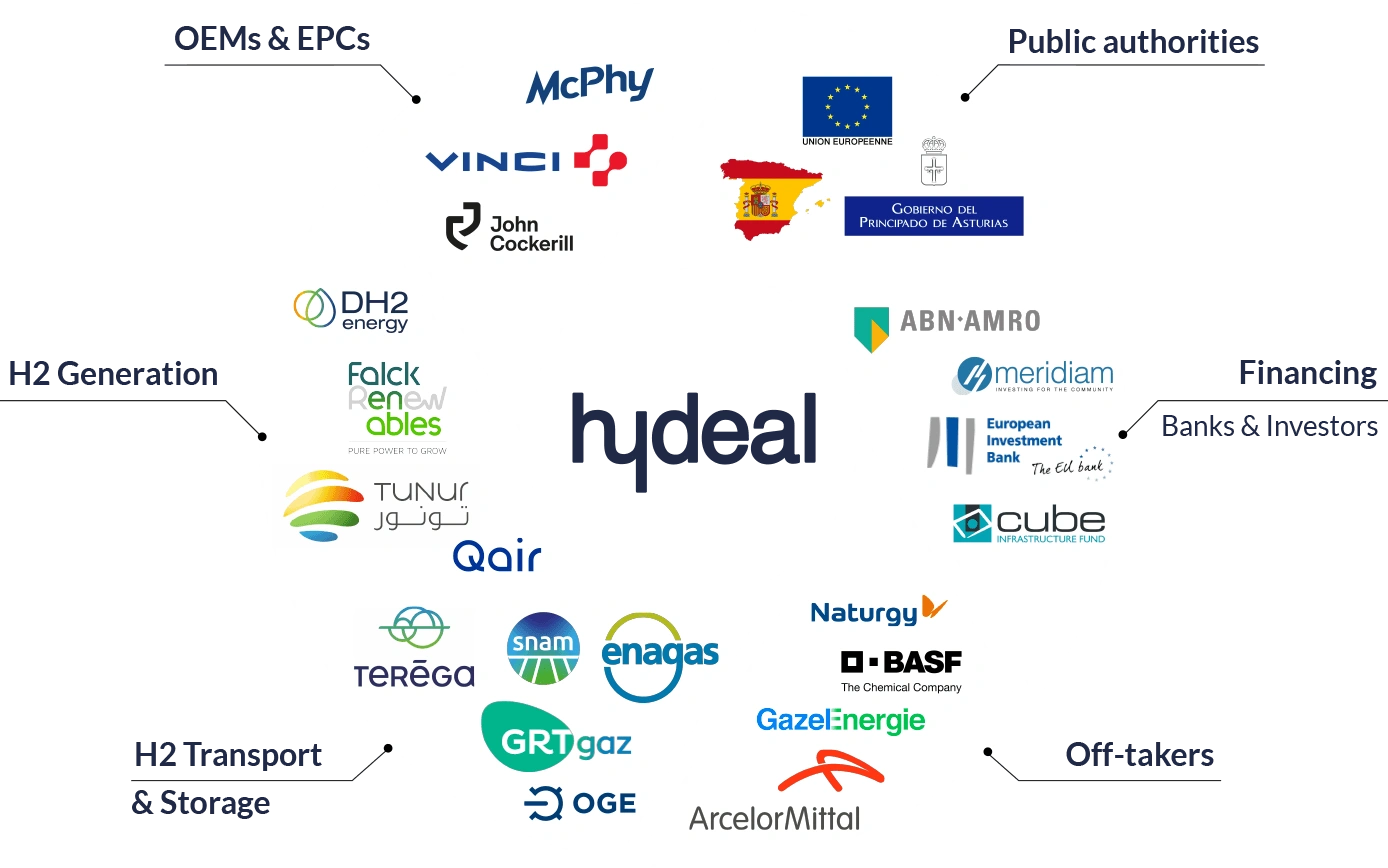

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe -

Fabric of change

Fabric of change -

Courage in an uncertain world: how fashion builds resilience now

Courage in an uncertain world: how fashion builds resilience now -

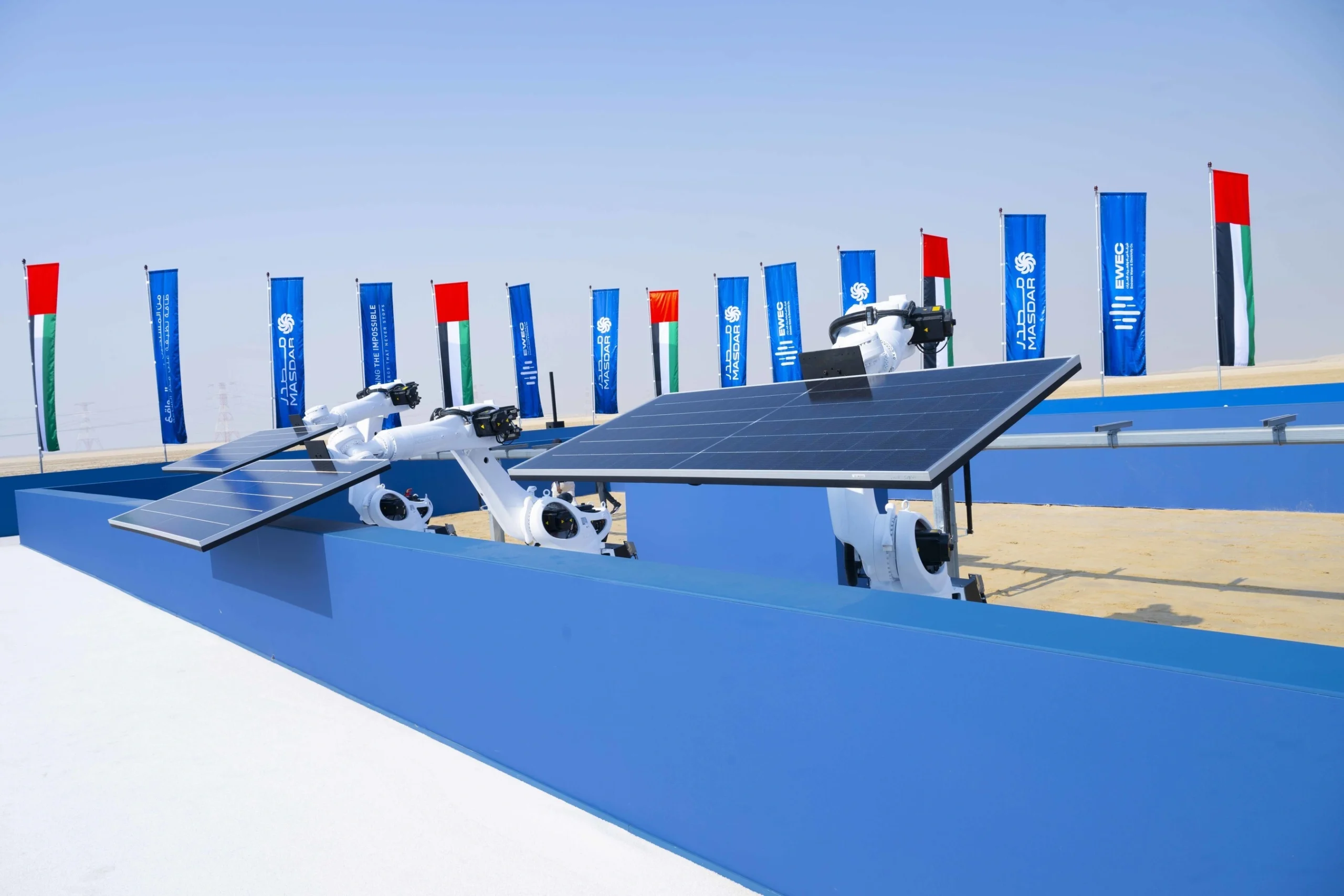

UAE breaks ground on world’s first 24-hour renewable power plant

UAE breaks ground on world’s first 24-hour renewable power plant -

China’s Yancheng sets a global benchmark for conservation and climate action

China’s Yancheng sets a global benchmark for conservation and climate action -

Inside Iceland’s green biotechnology revolution

Inside Iceland’s green biotechnology revolution -

Global development banks agree new priorities on finance, water security and private capital ahead of COP30

Global development banks agree new priorities on finance, water security and private capital ahead of COP30 -

UK organisations show rising net zero ambition despite financial pressures, new survey finds

UK organisations show rising net zero ambition despite financial pressures, new survey finds -

Gulf ESG efforts fail to link profit with sustainability, study shows

Gulf ESG efforts fail to link profit with sustainability, study shows -

Redress and UN network call for fashion industry to meet sustainability goals

Redress and UN network call for fashion industry to meet sustainability goals -

World Coastal Forum leaders warn of accelerating global ecosystem collapse

World Coastal Forum leaders warn of accelerating global ecosystem collapse