How residence and citizenship programmes strengthen national resilience

Dr Juerg Steffen

- Published

- Sustainability

As multiple crises test nations simultaneously, countries that systematically invest in adaptability and attract global talent through residence and citizenship programmes are positioning themselves for sustainability in an uncertain world, writes Dr Juerg Steffen, Chief Executive Officer at Henley & Partners

At a time when geopolitical fractures, climate disruption, and technological transformation arrive faster than governments can respond, the determinants of national power are being rewritten. The Global Investment Risk and Resilience Index, developed by Henley & Partners and AlphaGeo, provides the first systematic framework for measuring what now matters most: a nation’s capacity to absorb shocks and adapt without sacrificing sovereignty or prosperity. By assessing both exposure to crises and the ability to respond, the index reveals which countries are genuinely prepared for sustained volatility — and which face compounding vulnerabilities that constrain their autonomy.

Switzerland, Denmark, Norway, Singapore, and Sweden lead the rankings not through size or military strength but through institutional quality, innovation ecosystems, and governance structures that enable rapid adaptation. At the opposite end of the index are Lebanon, Haiti, and Pakistan — countries that face high exposure with limited adaptive capacity, a combination that perpetuates vulnerability. What separates these positions is resilience, which the index demonstrates has become the decisive factor in preserving national independence.

Countries lacking fiscal autonomy forfeit economic gains to service debt, struggle to fund infrastructure and education, and lose their best talent. This cycle weakens governance capacity and economic prospects. Breaking it requires what the index’s top performers demonstrate: access to non-debt capital, and policies that attract rather than repel human and financial resources. This is where strategic residence and citizenship programmes become relevant, not only as a revenue mechanism but as a policy tool for enhancing resilience.

Malta’s experience following the 2008 financial crisis demonstrates this approach in practice. In its six years of operation, the Malta Individual Investor Programme, designed by Henley & Partners and operated under government concession, generated over EUR 1.13 billion in contributions and over EUR 500 million in property purchases, government stock investments, and donations. More significantly, it enabled Malta to achieve some of the European Union’s highest growth rates and lowest unemployment levels while recording budget surpluses for the first time in decades — outcomes that traditional deficit financing could not have delivered. The index recognises this as the deployment of non-debt capital towards productive investment, precisely the fiscal autonomy that underpins resilience.

The Caribbean demonstrates how this approach can alter national trajectories. When newly independent St. Kitts and Nevis faced economic collapse as its sugar industry declined, the dual-island nation’s reformed citizenship programme enabled it to restructure its economy. When the pandemic struck, the country had achieved nearly a decade of budget surpluses and reduced public debt below the regional target of 60% of GDP while accumulating large government deposits. As Premier and Minister of Finance of Nevis, Mark Brantley, observed, what saved the nation during the Covid-19 crisis was its citizenship programme, which enabled it to build fiscal independence — exactly the adaptive capacity the index measures.

Neighbouring Antigua and Barbuda used its citizenship programme revenues to retire hundreds of millions in IMF debt and reduce its debt-to-GDP ratio by a third within four years. In the southern Caribbean, Grenada’s citizenship programme has allowed the country to pursue transformation from a position of national autonomy rather than debt dependency — a model of sovereign resilience through strategic openness. The programme generated 88% of non-tax revenue in 2024, enabling the government to maintain budget surpluses and lower public debt even after Hurricane Beryl’s devastation.

These examples reflect how well-structured residence and citizenship programmes can reduce vulnerability while building response capacity. Traditional investment and donation pathways provide capital for infrastructure and development. Merit-based citizenship routes attract exceptional talent whose contributions in business, science, academia, the arts, or innovation advance national priorities. Unlike conventional naturalisation, which requires lengthy residence or financial investments, these discretionary programmes allow governments to recruit specific talent aligned with development priorities — the calibre of human capital that distinguishes resilient nations in the Global Investment Risk and Resilience Index.

This dual approach is illustrated by Montenegro’s citizenship programme, which operated from 2019 to 2022. It contributed EUR 117.8 million to development funds and EUR 43.5 million to the budget, while development projects attracted EUR 251 million in luxury hotel investments. The President of Montenegro, Jakov Milatović, recognised the programme would help make the country the regional leader in allocation for innovation, and during 2024 alone EUR 3.2 million was directed to project financing through the Innovation Fund of Montenegro. This adaptive capacity separates resilient nations from vulnerable ones.

What emerges from the index is a fundamental insight about sovereignty in the current context. Resilience determines national success more than wealth, size, or political structure. The countries that will thrive recognise this reality and respond by reforming policy to attract capital and talent to strengthen sovereignty rather than retreating into protectionism. This means systematically investing in adaptive capacity, maintaining the institutional quality and openness that globally mobile individuals seek, and viewing residence and citizenship policy as a strategic tool for national positioning.

Programme success demands rigorous implementation. The four-tier due diligence process developed by Henley & Partners is regarded as the benchmark for best practice in residence and citizenship programmes worldwide, combining standard know-your-client procedures, enhanced due diligence, and risk assessment tools with verification through international databases including Interpol and Europol. Programmes must emphasise strict separation between government processing and private client services, with design aligned to national development objectives — whether climate resilience, innovation funding, or talent attraction through merit-based routes.

The alternative — closing borders and limiting engagement — leads inevitably towards the vulnerabilities visible at the bottom of the Global Investment Risk and Resilience Index rankings. For governments willing to reform policy, residence and citizenship programmes offer a proven pathway. In a world of persistent turbulence, the nations that strategically invest in such capabilities while maintaining the highest standards will be better positioned for future shocks. As the index makes clear, this approach to building resilience through openness, adaptability, and partnership defines sovereignty in the 21st century.

Further information

Produced with support from Henley & Partners. To find out more about the firm’s Global Investment Risk and Resilience Index and its residence and citizenship advisory services, visit henleyglobal.com.

READ MORE: ‘Global leaders enter 2026 facing a defining climate choice‘. The climate and energy decisions taken during 2025 have limited the broad options now facing governments to two, setting up a decisive moment for global policy in 2026, writes Gary W. Yohe.

Do you have news to share or expertise to contribute? The European welcomes insights from business leaders and sector specialists. Get in touch with our editorial team to find out more.

RECENT ARTICLES

-

Strong ESG records help firms take R&D global, study finds

Strong ESG records help firms take R&D global, study finds -

How residence and citizenship programmes strengthen national resilience

How residence and citizenship programmes strengthen national resilience -

Global leaders enter 2026 facing a defining climate choice

Global leaders enter 2026 facing a defining climate choice -

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change -

China’s BYD overtakes Tesla as world’s largest electric car seller

China’s BYD overtakes Tesla as world’s largest electric car seller -

UK education group signs agreement to operate UN training centre network hub

UK education group signs agreement to operate UN training centre network hub -

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing -

Oxford to host new annual youth climate summit on UN World Environment Day

Oxford to host new annual youth climate summit on UN World Environment Day -

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan -

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns -

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests -

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement -

Historic motorsport confronts its energy future

Historic motorsport confronts its energy future -

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation -

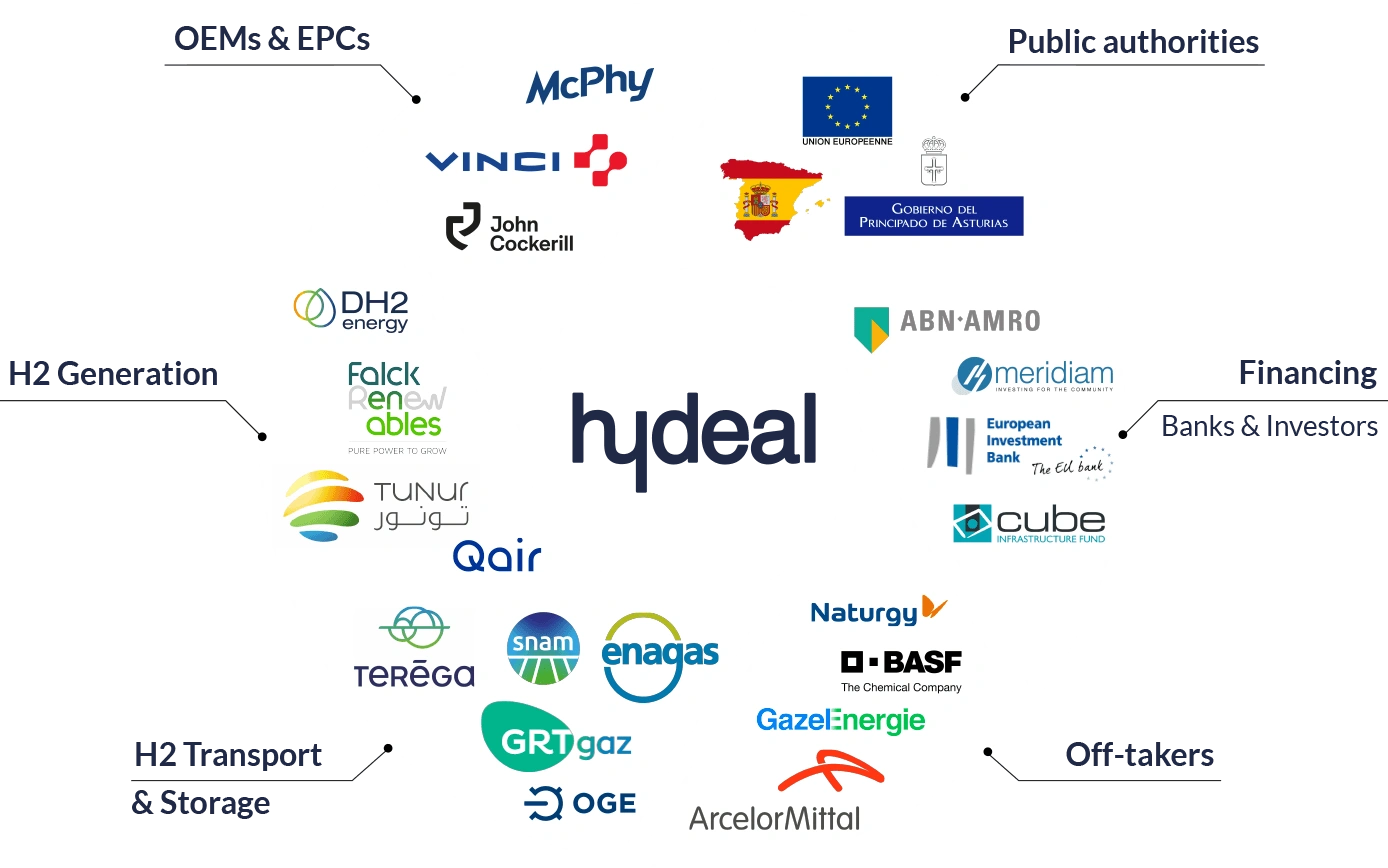

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe -

Fabric of change

Fabric of change -

Courage in an uncertain world: how fashion builds resilience now

Courage in an uncertain world: how fashion builds resilience now -

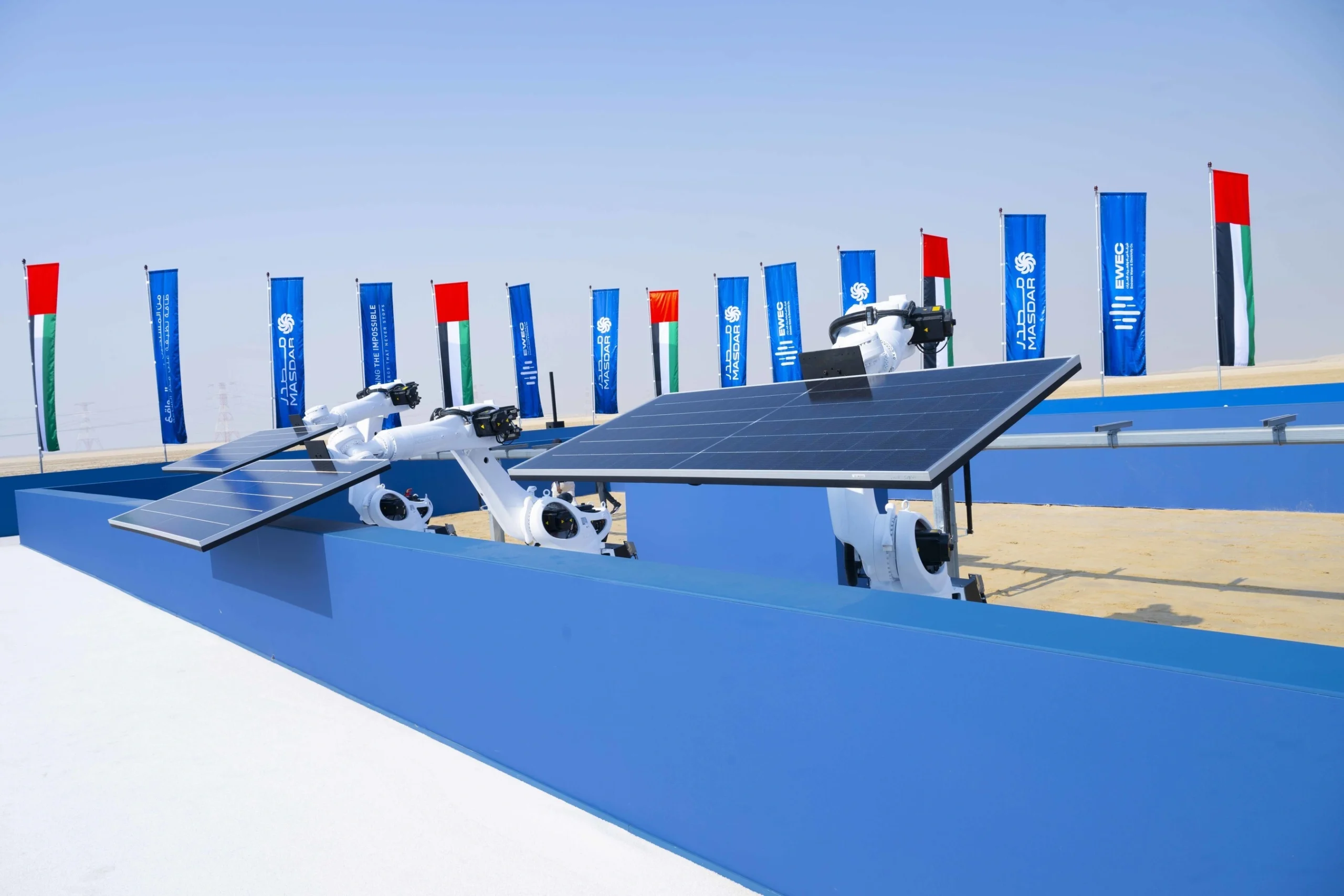

UAE breaks ground on world’s first 24-hour renewable power plant

UAE breaks ground on world’s first 24-hour renewable power plant -

China’s Yancheng sets a global benchmark for conservation and climate action

China’s Yancheng sets a global benchmark for conservation and climate action -

Inside Iceland’s green biotechnology revolution

Inside Iceland’s green biotechnology revolution -

Global development banks agree new priorities on finance, water security and private capital ahead of COP30

Global development banks agree new priorities on finance, water security and private capital ahead of COP30 -

UK organisations show rising net zero ambition despite financial pressures, new survey finds

UK organisations show rising net zero ambition despite financial pressures, new survey finds -

Gulf ESG efforts fail to link profit with sustainability, study shows

Gulf ESG efforts fail to link profit with sustainability, study shows -

Redress and UN network call for fashion industry to meet sustainability goals

Redress and UN network call for fashion industry to meet sustainability goals -

World Coastal Forum leaders warn of accelerating global ecosystem collapse

World Coastal Forum leaders warn of accelerating global ecosystem collapse