Oil prices surge on last day of roller-coaster month

John E. Kaye

- Published

- Home, Sustainability

On Thursday, oil prices jumped after numerous producers said they would cut output, and as signs of the U.S. crude glut was not growing as quickly as many had feared, the collapse has resulted in an upbeat close to one of the most volatile months for oil trading in history.

In April, fuel demand worldwide slumped about 30%. Even after major oil producers led by Saudi Arabia agreed to slash production by nearly 10 million barrels per day (bpd), U.S. crude futures closed on April 20 at a record low in negative territory.

The collapse in U.S. West Texas Intermediate (WTI) futures has made traders frantic to avoid taking delivery as the May front-month contract expired, forcing traders to pay $37.63 a barrel at settlement to get rid of their contracts.

Prices have recovered to a moderate extent but remain down over 60% since the start of the year.

On its last day as the front-month, Brent futures for June delivery rose $2.73, or 12%, to settle at $25.27 a barrel, while U.S. West Texas Intermediate (WTI) crude for June rose $3.78, or 25%, to settle at $18.84.

That was the highest close for Brent since April 20 and WTI since April 16.

Brent, the international benchmark, gained about 11% in April after falling more than 65% over the prior three months. WTI, meanwhile, fell for a fourth month in a row, dropping over 70% during that time, including an 8% loss in April.

The more actively traded Brent futures for July, which will soon be the front-month, gained about 9% to settle at $26.48 a barrel.

Volume in WTI futures on the New York Mercantile Exchange hit around 36 million contracts in April, which Refinitiv data puts as second only to the previous month’s 40.9 million record.

“Oil prices are looking very constructive because over the next month or two, supply will meet demand,” said Edward Moya, senior market analyst at OANDA in New York, noting oversupply worries are slowly easing with a steady stream of headlines of crude production cuts.

Western Europe’s largest oil producer, Norway, said it would lower output from June to December, cutting production for the first time in 18 years as it joined other major producers’ efforts to support prices and curb oversupply.

Royal Dutch Shell Plc, meanwhile, announced its first dividend cut since World War Two.

U.S. oil and gas company ConocoPhillips said it would sharply reduce oil production in coming weeks, aiming to shut in 35% of its total output by June.

Russian gas producer Novatek PAO said it plans to cut capital expenditure by a fifth this year, mainly for developing its oil projects, a company manager said on Thursday.

U.S. crude inventories grew by 9 million barrels last week to 527.6 million barrels, Energy Information Administration data showed, below the 10.6 million-barrel rise analysts had expected in a Reuters poll.

However, storage concerns continue to weigh with the International Energy Agency saying global capacity could peak by mid-June.

U.S. President Donald Trump said his administration would soon release a plan to help U.S. oil companies.

Nine companies including Chevron Corp and Exxon Mobil Corp have agreed to rent space to store 23 million barrels of crude in the U.S. emergency oil reserve.

By Scott DiSavino

Sourced Reuters

For more Energy news follow The European Magazine.

RECENT ARTICLES

-

Strong ESG records help firms take R&D global, study finds

Strong ESG records help firms take R&D global, study finds -

How residence and citizenship programmes strengthen national resilience

How residence and citizenship programmes strengthen national resilience -

Global leaders enter 2026 facing a defining climate choice

Global leaders enter 2026 facing a defining climate choice -

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change -

China’s BYD overtakes Tesla as world’s largest electric car seller

China’s BYD overtakes Tesla as world’s largest electric car seller -

UK education group signs agreement to operate UN training centre network hub

UK education group signs agreement to operate UN training centre network hub -

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing -

Oxford to host new annual youth climate summit on UN World Environment Day

Oxford to host new annual youth climate summit on UN World Environment Day -

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan -

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns -

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests -

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement -

Historic motorsport confronts its energy future

Historic motorsport confronts its energy future -

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation -

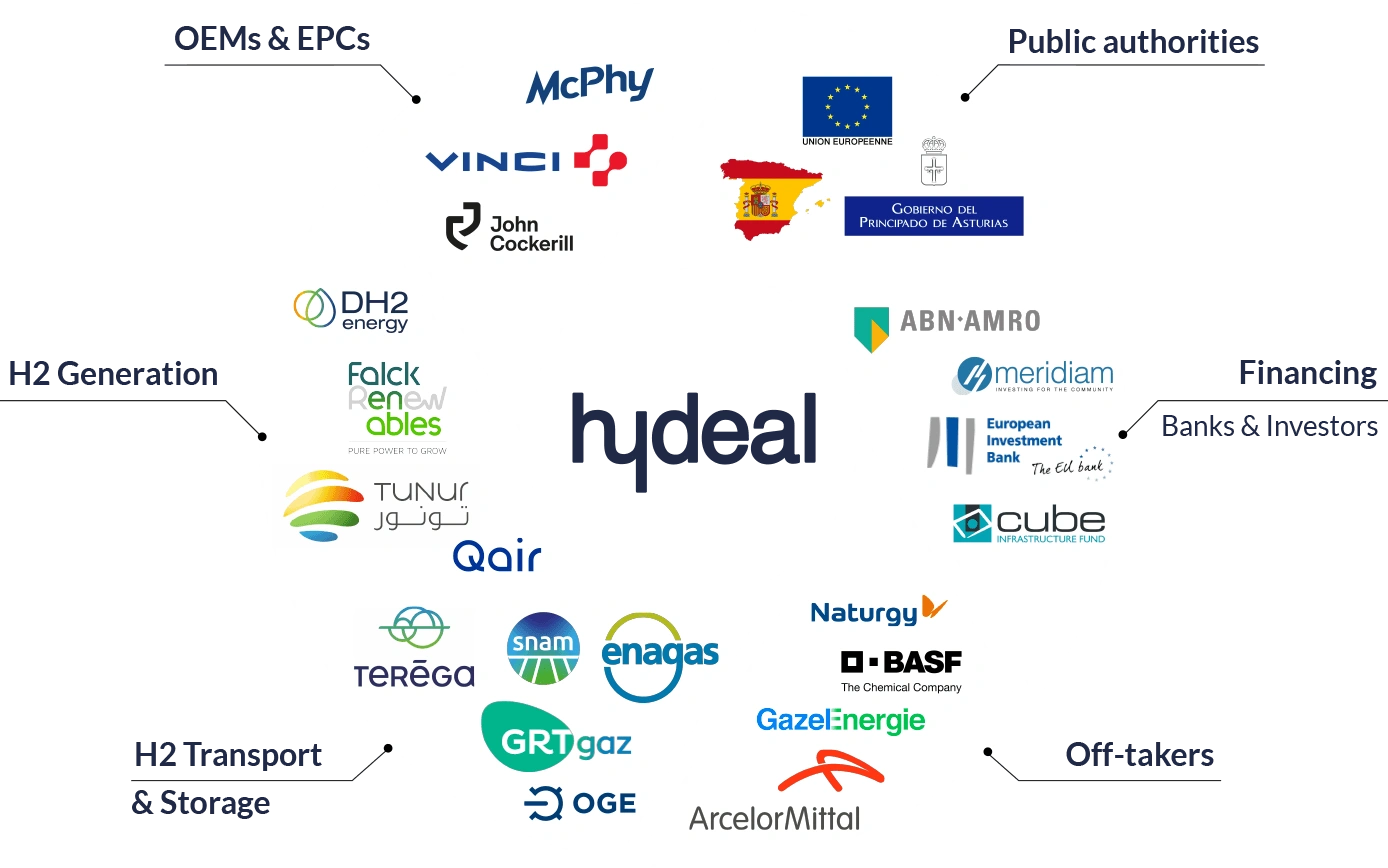

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe -

Fabric of change

Fabric of change -

Courage in an uncertain world: how fashion builds resilience now

Courage in an uncertain world: how fashion builds resilience now -

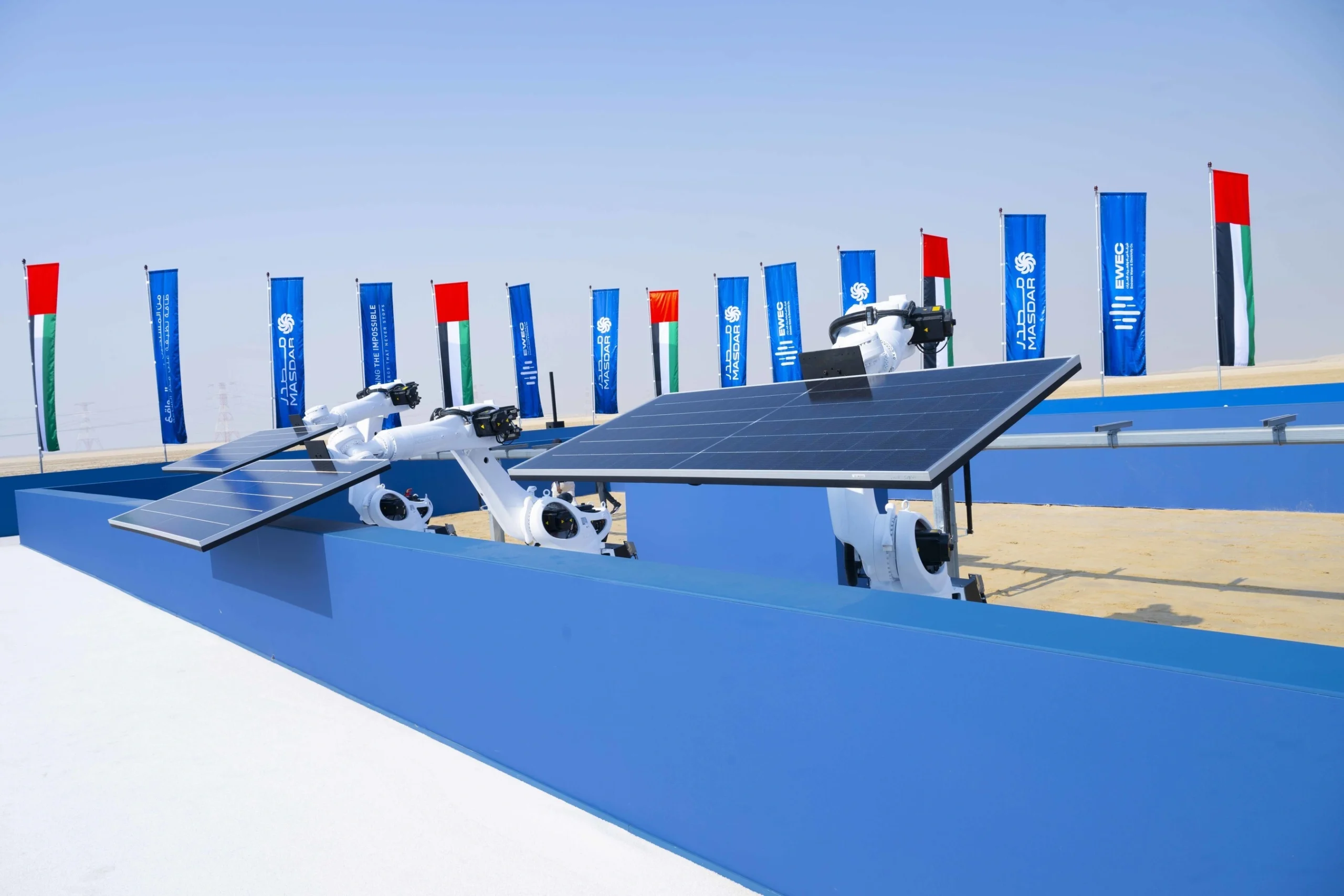

UAE breaks ground on world’s first 24-hour renewable power plant

UAE breaks ground on world’s first 24-hour renewable power plant -

China’s Yancheng sets a global benchmark for conservation and climate action

China’s Yancheng sets a global benchmark for conservation and climate action -

Inside Iceland’s green biotechnology revolution

Inside Iceland’s green biotechnology revolution -

Global development banks agree new priorities on finance, water security and private capital ahead of COP30

Global development banks agree new priorities on finance, water security and private capital ahead of COP30 -

UK organisations show rising net zero ambition despite financial pressures, new survey finds

UK organisations show rising net zero ambition despite financial pressures, new survey finds -

Gulf ESG efforts fail to link profit with sustainability, study shows

Gulf ESG efforts fail to link profit with sustainability, study shows -

Redress and UN network call for fashion industry to meet sustainability goals

Redress and UN network call for fashion industry to meet sustainability goals -

World Coastal Forum leaders warn of accelerating global ecosystem collapse

World Coastal Forum leaders warn of accelerating global ecosystem collapse