Making Green Drive Irreversible

John E. Kaye

- Published

- Home, Sustainability

Claudio Descalzi, Eni CEO, hankers to turn the Italian oil and gas firm Eni into a greener business, concentrating on clean low-carbon products to build a wide customer base which he believes can steady the ship and attract investors more than ever.

Descalzi informed Reuters that he wants to ensure Eni will play a role in the energy transition which he believes has accelerated in the wake of the coronavirus crisis.

“In these next 3 years I want to trace a completely irreversible path for the group,” Descalzi said.

The veteran oil executive, who was in charge of upstream business at Eni before taking over the top spot in 2014, is looking to create a slimmer and more flexible company that can switch very rapidly to meet market conditions but which has a clear long-term direction.

“What’s clear is we need to deliver different kinds of energy products to our clients,” he said.

Earlier this year, Eni pledged to slash its greenhouse gas emissions by 80% in one of the most ambitious clean-up drives in an industry pressured by investors to go green.

In order to do this, there needs to be less oil and more gas in its portfolio, build its renewable capacity, convert refineries to biofuels and step up forestry and carbon capture projects.

“The impact of COVID-19 will be with us for a year or two and that’s why we worked extra fast on our new re-organisation,” Descalzi said.

Eni split its business in two this month, creating a division to focus on clean energy to prepare for a decarbonised future.

The plans come as the oil and gas sector faces a collapse in demand following the coronavirus epidemic and uncertainty over longer-term demand as governments battle climate change.

Descalzi dismissed concerns that pivoting away from oil could undermine returns since the new “Energy Evolution” businesses are less capital intensive and less risky with some 80% of the new energy in OECD countries.

The group intends to introduce new raw materials to feed its bio-refineries and power stations including biogas, animal fats, and inorganic waste as it looks to develop the clean products it says will increase its customer base from 9 million to more than 20 million by 2050.

“We’re getting 15% returns on our bio-refineries and that will grow further when we take palm oil out of the mix by end 2022,” Descalzi said. “So we can compare the returns to upstream business – only with lower risk.”

CARBON HUB

Eni is also betting on large-scale carbon capture, utilisation and storage (CCUS) investments to help clean up the gas that will feature large in its fossil fuel portfolio as oil is wound down after 2025.

In January, the energy giant announced an agreement with ADNOC to develop CCUS facilities in Abu Dhabi and Descalzi said there are plans for carbon storage at Liverpool Bay in Britain.

That is in addition to large-scale investments around Ravenna, the Italian town close to the Adriatic Sea, where the group has a power plant, chemical production and offshore gas reserves.

“We want to create one of the biggest CO2 hubs in the world,” he said.

Eni’s plans also include developing its own renewable energy business where the aim is to install 15 gigawatts (GW) of capacity by 2030, from 0.2 GW last year, before taking it to more than 55 GW in 2050.

“On the Energy Evolution front our aim is to grow organically but we don’t rule out small affordable M&A if the right opportunity comes along,” he said.

Reported by Stephen Jewkes

Sourced Reuters

For more Energy news follow The European Magazine.

RECENT ARTICLES

-

Strong ESG records help firms take R&D global, study finds

Strong ESG records help firms take R&D global, study finds -

How residence and citizenship programmes strengthen national resilience

How residence and citizenship programmes strengthen national resilience -

Global leaders enter 2026 facing a defining climate choice

Global leaders enter 2026 facing a defining climate choice -

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change -

China’s BYD overtakes Tesla as world’s largest electric car seller

China’s BYD overtakes Tesla as world’s largest electric car seller -

UK education group signs agreement to operate UN training centre network hub

UK education group signs agreement to operate UN training centre network hub -

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing -

Oxford to host new annual youth climate summit on UN World Environment Day

Oxford to host new annual youth climate summit on UN World Environment Day -

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan -

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns -

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests -

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement -

Historic motorsport confronts its energy future

Historic motorsport confronts its energy future -

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation -

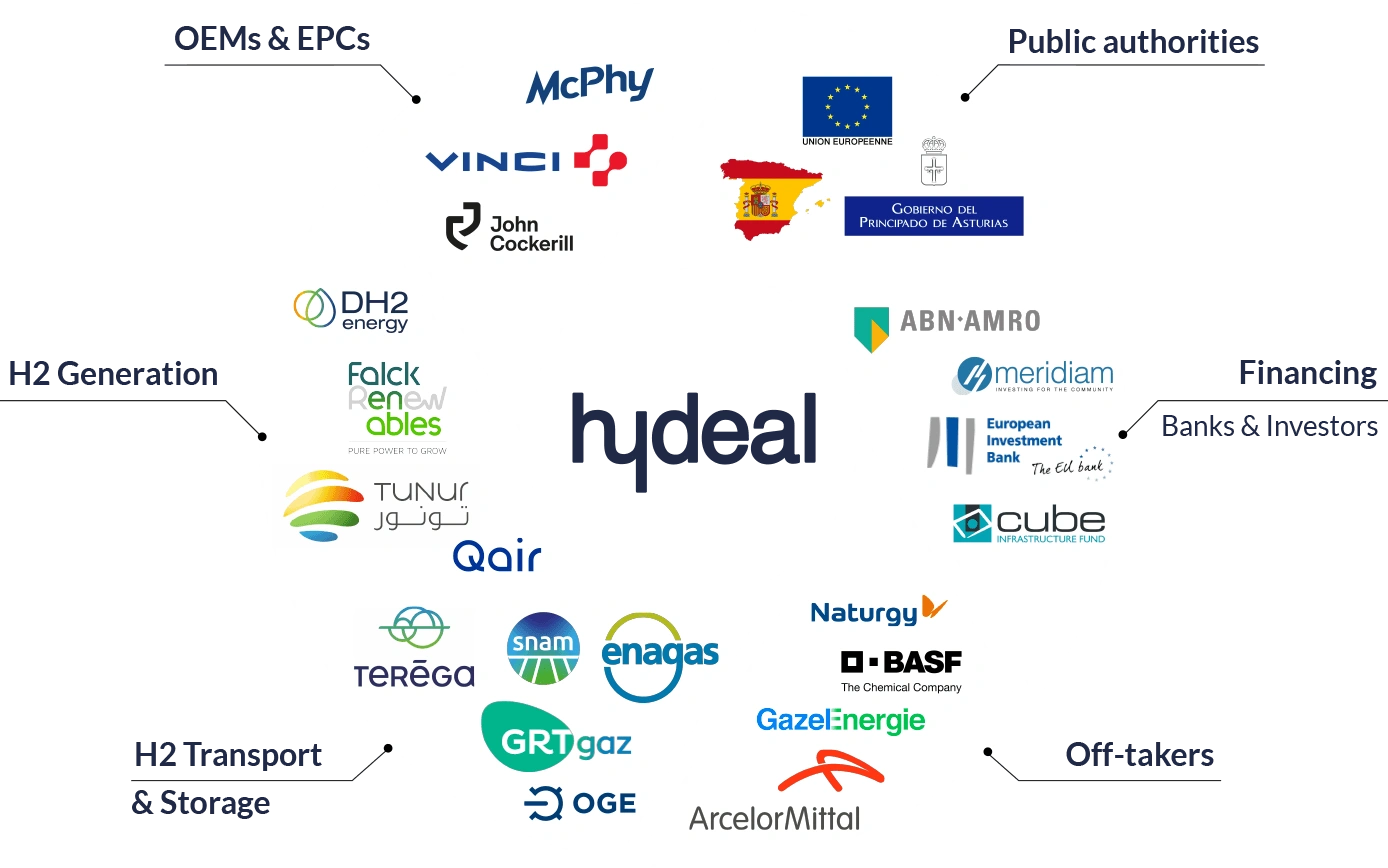

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe -

Fabric of change

Fabric of change -

Courage in an uncertain world: how fashion builds resilience now

Courage in an uncertain world: how fashion builds resilience now -

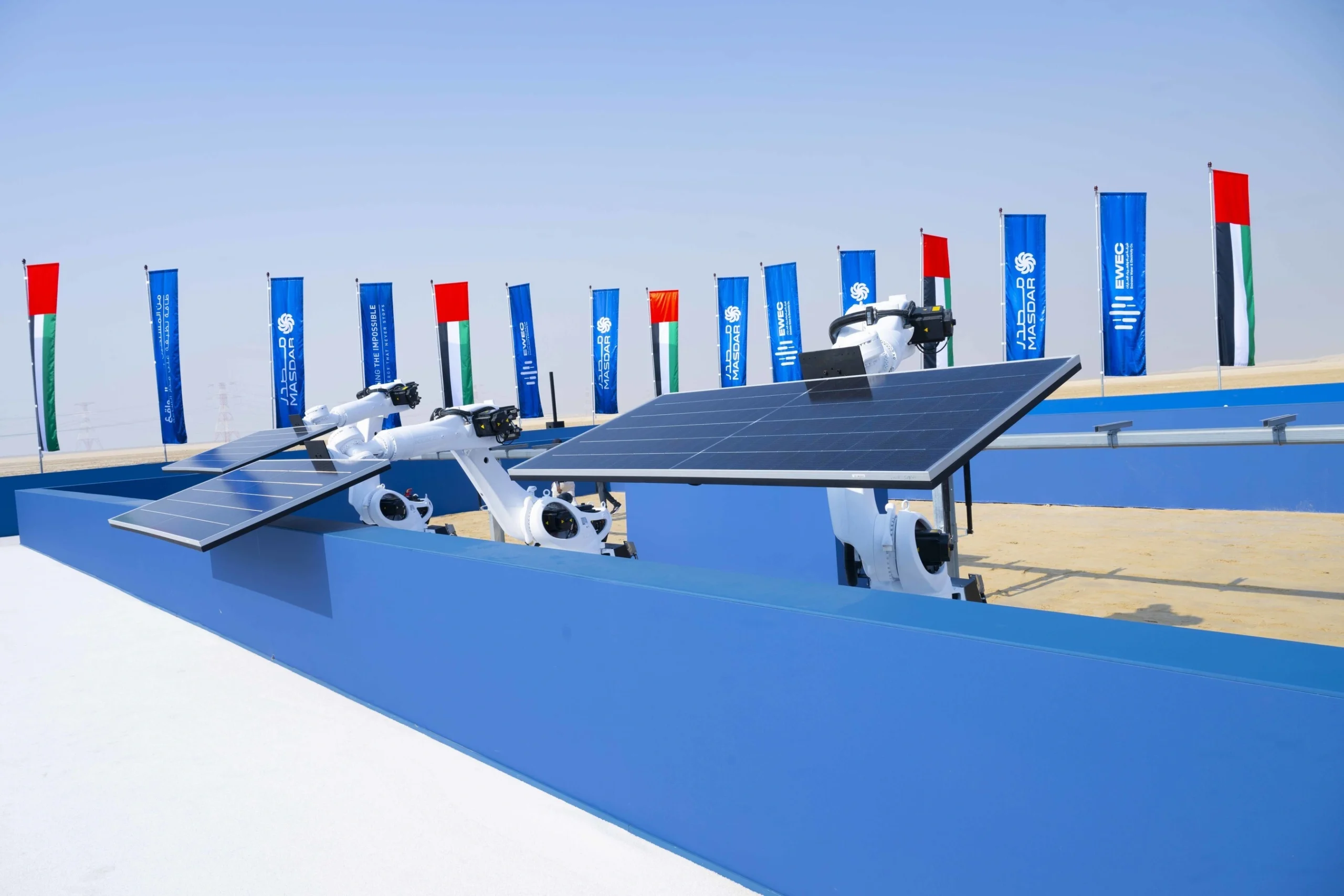

UAE breaks ground on world’s first 24-hour renewable power plant

UAE breaks ground on world’s first 24-hour renewable power plant -

China’s Yancheng sets a global benchmark for conservation and climate action

China’s Yancheng sets a global benchmark for conservation and climate action -

Inside Iceland’s green biotechnology revolution

Inside Iceland’s green biotechnology revolution -

Global development banks agree new priorities on finance, water security and private capital ahead of COP30

Global development banks agree new priorities on finance, water security and private capital ahead of COP30 -

UK organisations show rising net zero ambition despite financial pressures, new survey finds

UK organisations show rising net zero ambition despite financial pressures, new survey finds -

Gulf ESG efforts fail to link profit with sustainability, study shows

Gulf ESG efforts fail to link profit with sustainability, study shows -

Redress and UN network call for fashion industry to meet sustainability goals

Redress and UN network call for fashion industry to meet sustainability goals -

World Coastal Forum leaders warn of accelerating global ecosystem collapse

World Coastal Forum leaders warn of accelerating global ecosystem collapse