From reputational risk to competitive advantage

John E. Kaye

- Published

- Banking & Finance, Home, Sustainability

CEO of PROMEA Ricardo Garcia describes how in less than two years the company has made positive gains by doubling down on ESG initiatives

Expectation from stakeholders that ESG delivers results is a rising trend not only globally, but also in Switzerland. Surveys in the country suggest that almost half of the population expects pension funds to invest in a sustainable manner. And, as a pension fund with almost 10,000 insured persons, PROMEA finds itself at the centre of this debate. Against this backdrop, we conducted a survey among our clients to measure the relevance of sustainable investments in our own business. Surprisingly, the results were close those of the general public, when it comes to support for sustainable investments – almost half of those in our survey thought the practice to be important. The main difference is that the percentage opposed – or not believing sustainable investments to be of great importance – was smaller among our clients than among the general public.

A starting position

With these expectations in mind, PROMEA conducted an analysis on its own sustainability efforts. While sustainable practices in the company’s operations were traditionally strong, those on the investment side fell short compared to other Swiss pension funds.

The Climate Alliance Switzerland provides the only sustainability rating on Swiss pension funds that is representative in terms of breadth of coverage within this industry. According to the NGO, the sustainability rating within Swiss pension funds ranked in the lowest category and was even deteriorating. Coupled with the rising trend on the public and client expectations that ESG be a prominent factor in the investment portfolio, this outcome was seen as considerable reputational risk, leading to PROMEA’s board of trustees to start afresh.

PROMEA and the United Nations’ SDGs

We split this strategic stocktaking on two levels: the company’s operations and the company’s investments. PROMEA already had a good track record in operational sustainability. Nonetheless, the management team strived to improve it further, focussing on the United Nations Sustainable Development Goal #8 (Decent Work and Economic Growth) and #12 (Responsible Consumption and Production). In terms of SDG #8, PROMEA puts an emphasis on equal employment, offering purposeful jobs and an inclusive culture. The first ever certification as a ‘Great Place to Work’ in 2024 confirmed that we are on the right track. On SDG #12, our company was already highly circular and strengthened efforts by compensating the remaining carbon footprint. However, the biggest challenge for PROMEA lay in SDG #13, Climate Action.

Vital support of the board

To turn around the situation on Climate Action, the support of the board of directors was crucial, especially at the presidential level. Considering all of the board’s opinions was also important in order to build trust. With a supportive stance, the board of trustees decided to commit to a 1.5°C decarbonisation path by the end of 2022, in line with the Paris Climate Agreement. In addition, various positions taken by the board meant PROMEA having to outperform on all three ESG factors. As a consequence, we aligned the portfolio to the Paris Agreement within one year. At the same time, the board also specified the strict requirement to keep costs in check. In order to do so, we replaced active managers with passive ones, concentrated on fewer asset managers, employed cleared interest rates swaps and used contributions in kind where possible to name a few examples.

Saving money with sustainability

At the end of 2023 PROMEA was upgraded by the Climate Alliance Switzerland from the lowest rating to top 10 (from over 400 pension funds). On May 27 2024 the Swiss association of collective foundations ranked us fifth, only behind four visionaries in the sector. These ahead of us are dominated by institutions with an ESG-tradition spanning several decades. At the same time, rather than increasing costs for SDG #13 (Climate Action), we reduced our running portfolio management costs substantially. Thanks to our cost-efficient migration measures, the portfolio’s total expense ratio didn’t increase in 2023 despite having turned around more than half of all the portfolio.

What’s next?

Having aligned the portfolio to a 1.5°C path, the focus is now on how to have a bigger impact. To this effect, we strive to, for example to fund renewable energy, micro finance, sustainable construction, social housing, green bonds and green mortgages. What’s more, the board of trustees has decided to move the net zero goal forward from 2050 to 2040. With all this in mind, we have turned a reputational risk into a competitive advantage and look forward to a better future.

About the author

Having only joined PROMEA as CEO in the summer of 2022, Ricardo Garcia was awarded ‘Most Influential CEO in the Swiss Social Insurance Industry’ by CEO Monthly in 2024. Under his leadership, PROMEA also earned its first ever certification as ‘Great Place to Work’ in 2024 and became one of the most sustainable pension funds of Switzerland according to the Climate Alliance Switzerland.

Further information

www.promea.ch

RECENT ARTICLES

-

Strong ESG records help firms take R&D global, study finds

Strong ESG records help firms take R&D global, study finds -

How residence and citizenship programmes strengthen national resilience

How residence and citizenship programmes strengthen national resilience -

Global leaders enter 2026 facing a defining climate choice

Global leaders enter 2026 facing a defining climate choice -

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change -

China’s BYD overtakes Tesla as world’s largest electric car seller

China’s BYD overtakes Tesla as world’s largest electric car seller -

UK education group signs agreement to operate UN training centre network hub

UK education group signs agreement to operate UN training centre network hub -

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing -

Oxford to host new annual youth climate summit on UN World Environment Day

Oxford to host new annual youth climate summit on UN World Environment Day -

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan -

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns -

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests -

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement -

Historic motorsport confronts its energy future

Historic motorsport confronts its energy future -

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation -

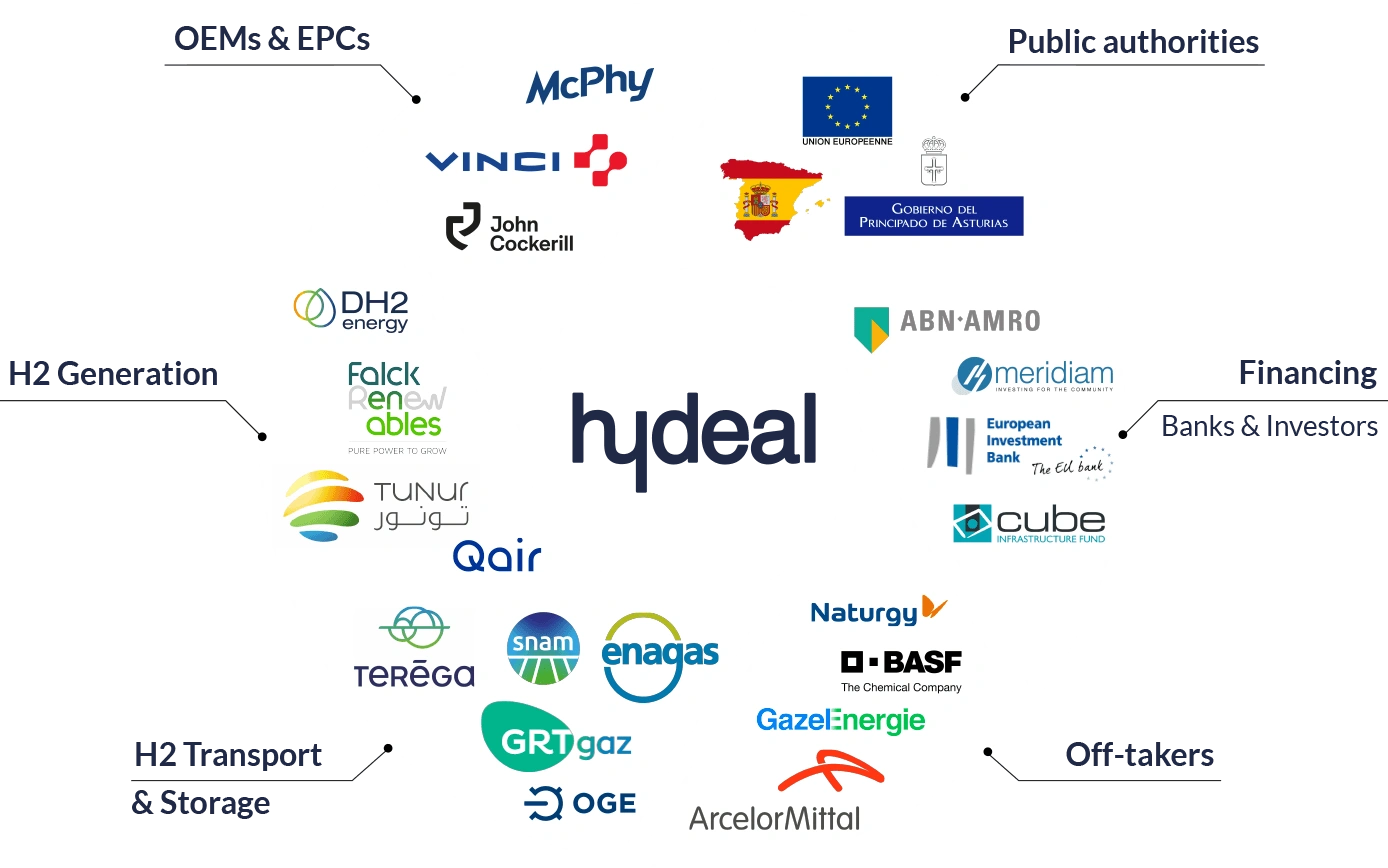

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe -

Fabric of change

Fabric of change -

Courage in an uncertain world: how fashion builds resilience now

Courage in an uncertain world: how fashion builds resilience now -

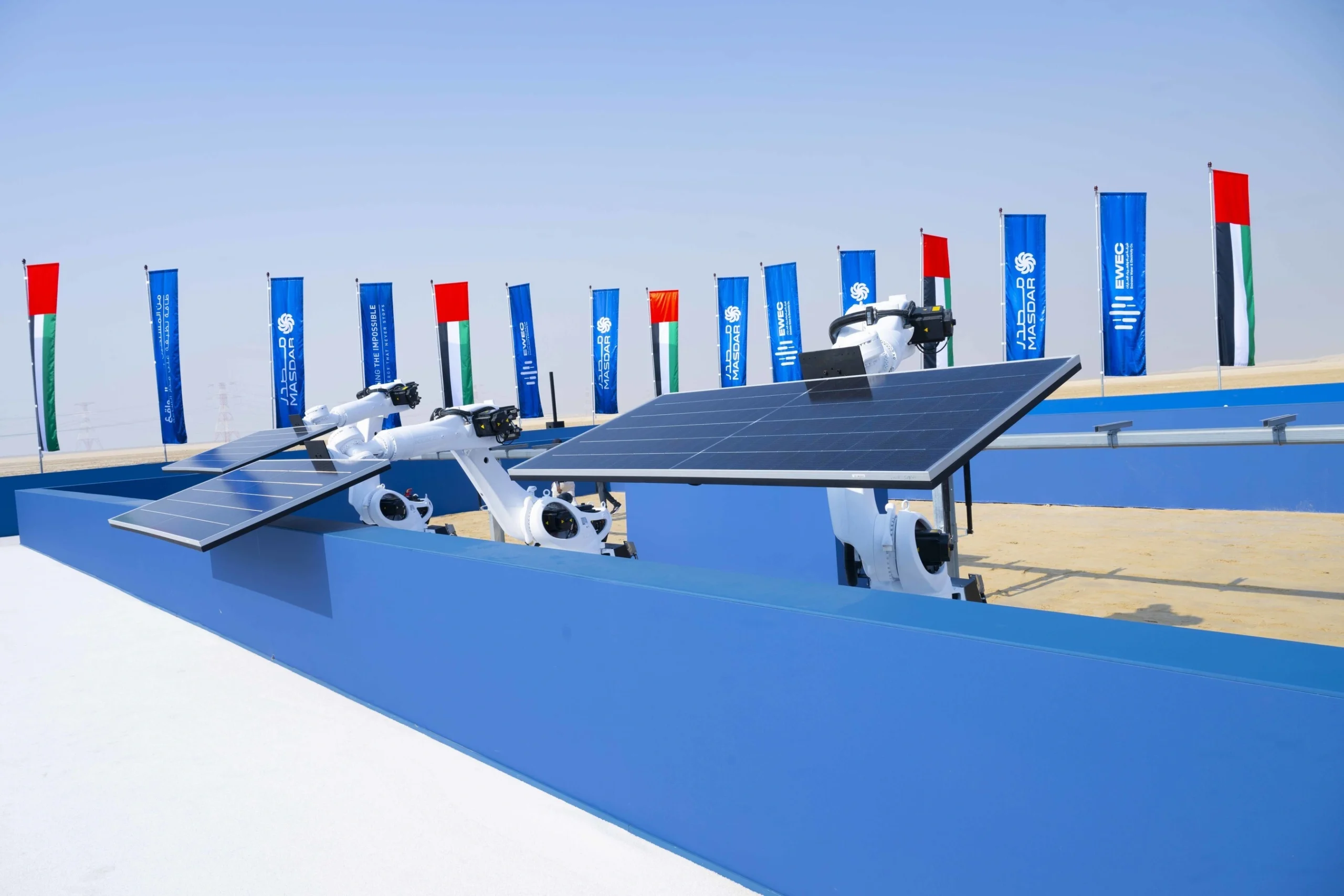

UAE breaks ground on world’s first 24-hour renewable power plant

UAE breaks ground on world’s first 24-hour renewable power plant -

China’s Yancheng sets a global benchmark for conservation and climate action

China’s Yancheng sets a global benchmark for conservation and climate action -

Inside Iceland’s green biotechnology revolution

Inside Iceland’s green biotechnology revolution -

Global development banks agree new priorities on finance, water security and private capital ahead of COP30

Global development banks agree new priorities on finance, water security and private capital ahead of COP30 -

UK organisations show rising net zero ambition despite financial pressures, new survey finds

UK organisations show rising net zero ambition despite financial pressures, new survey finds -

Gulf ESG efforts fail to link profit with sustainability, study shows

Gulf ESG efforts fail to link profit with sustainability, study shows -

Redress and UN network call for fashion industry to meet sustainability goals

Redress and UN network call for fashion industry to meet sustainability goals -

World Coastal Forum leaders warn of accelerating global ecosystem collapse

World Coastal Forum leaders warn of accelerating global ecosystem collapse