UK backs new generation of floating wind with Crown Estate leasing and £400m investment

John E. Kaye

- Published

- Sustainability

Equinor and Gwynt Glas selected for major Celtic Sea windfarms as The Crown Estate launches supply chain fund

The UK’s offshore wind sector has taken a major step forward with the confirmation of two large-scale floating wind projects in the Celtic Sea.

The Crown Estate has selected Equinor and Gwynt Glas – a joint venture between EDF Renewables UK and ESB – as preferred bidders to develop two sites off the coasts of Wales and South West England. Each site is expected to deliver 1.5GW of clean energy.

A third 1.5GW site is also in planning, with delivery arrangements to be confirmed by September. In total, the projects could generate enough electricity to power more than four million homes.

It marks the UK’s first major push into commercial-scale floating wind, a technology that allows turbines to be installed in deeper waters than fixed-bottom structures, unlocking new areas such as the Celtic Sea.

The new windfarms represent the first phase of a broader plan to open up the Celtic Sea to floating wind development. The Crown Estate has identified the potential to offer a further 4GW to 10GW of seabed capacity to developers before the end of the decade.

This additional leasing would expand the UK’s floating wind pipeline, building on the three initial projects announced this month and positioning the Celtic Sea as a long-term hub for clean energy growth.

Ben Brinded, Head of Investment at The Crown Estate, said the sector would not meet its full potential without targeted collaboration.

“We will not unlock the full economic, social and environmental benefits of offshore wind without collaboration and investment into the UK supply chain. Building out enabling infrastructure is critical if we are to accelerate deployment off our coasts, derisk projects for investors and create local economic opportunities.”

Alongside the leasing announcement, The Crown Estate has set out plans to invest up to £400 million in the UK’s offshore wind supply chain.

A new £350 million Supply Chain Investment Programme is being launched to support construction of port and supply chain infrastructure. A further £50 million is available via the Supply Chain Accelerator, which is currently in its second funding round.

The proposals were published in Powering Offshore Wind at the Global Offshore Wind conference in London.

Dan Labbad, Chief Executive of The Crown Estate, said the leasing marked the continuation of a 25-year journey that had positioned the UK as a world leader in offshore wind.

“It’s now 25 years since we first laid the foundations for a new market for offshore wind in the UK, creating the right conditions for a new technology to establish and grow into the world-leading industry we have today.

“The selection of EDF Renewables UK, ESB and Equinor to write the next chapter of this story in the Celtic Sea is an exciting reflection of how far we’ve come in that time, and a vote of confidence in this new technology and the long-term future of the UK market as a place to invest.

“The Crown Estate exists to create value for our country into the long term. Coupled with our investment of up to £400 million in the supply chain, the steps we have taken to establish floating offshore wind in the Celtic Sea mark a vital contribution to the UK’s energy resilience and growth, and countless opportunities for communities and businesses alike.”

According to research published last year, the leasing round could support the creation of 5,300 jobs and deliver a £1.4 billion boost to the UK economy.

The new windfarms are also expected to unlock new opportunities for apprenticeships and employment. As part of their submissions, the preferred bidders have committed to ensuring that at least 3.5% of the workforce consists of apprenticeships and that a minimum of 10% of employees aged 19–24 are not currently in education, employment or training.

Final assembly of turbines is likely to take place at Port Talbot and Bristol, according to plans submitted by the developers.

UK ministers said the new projects would deliver tangible economic benefits while accelerating the transition to clean power.

Energy Secretary Ed Miliband said: “Floating offshore wind will be transformative for economic growth in Wales and the South West, unlocking thousands of jobs in places like Port Talbot and Bristol, bolstering our energy security and delivering industrial renewal.

“The Celtic Sea has huge untapped potential to support our mission to become clean energy superpower, so we can get energy bills down for good through our Plan for Change.”

Jo Stevens, Secretary of State for Wales, said the move would secure long-term prosperity for the region. She added: “This is a hugely significant moment for the clean energy industry in Wales and one which will have a positive impact for generations to come.

“Floating offshore wind will help deliver the transition to clean energy, bring down bills for households and help secure the UK’s home-grown energy supply.

“Increased economic growth and thousands of new well-paid jobs will come from this huge vote of confidence in Wales’ energy industry and its workforce.”

The two developers also welcomed the announcement, highlighting their commitment to regional engagement and the role of floating wind in the UK’s net zero transition.

Matthieu Hue, CEO of EDF Renewables UK, said: “I am absolutely delighted to announce that we, together with our project partner ESB, have secured preferred Bidder status with The Crown Estate for an Agreement for Lease as part of the Round 5 Leasing Process.

“We look forward to further developing the Gwynt Glas offshore wind farm, helping the UK maintain a market leading position in floating wind and recognising the important role that floating wind can play in the UK’s ambition towards reaching net zero.”

And Jim Dollard, Executive Director at ESB, said the Celtic Sea represented a strategic opportunity for future collaboration, adding: “ESB, in partnership with our colleagues in EDFR, is delighted to have been successful in The Crown Estate Round 5 seabed allocation in the Celtic Sea. The Celtic Sea is of strategic importance to ESB given its location adjacent to Ireland and the opportunities to develop a floating offshore project in what we believe to be an ideal area bodes well for our ambitions to develop a portfolio of floating offshore wind projects in Ireland and UK to contribute to the net zero plans for both countries as well as those of ESB.”

Main image: George Becker/Pexels

RECENT ARTICLES

-

Strong ESG records help firms take R&D global, study finds

Strong ESG records help firms take R&D global, study finds -

How residence and citizenship programmes strengthen national resilience

How residence and citizenship programmes strengthen national resilience -

Global leaders enter 2026 facing a defining climate choice

Global leaders enter 2026 facing a defining climate choice -

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change -

China’s BYD overtakes Tesla as world’s largest electric car seller

China’s BYD overtakes Tesla as world’s largest electric car seller -

UK education group signs agreement to operate UN training centre network hub

UK education group signs agreement to operate UN training centre network hub -

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing -

Oxford to host new annual youth climate summit on UN World Environment Day

Oxford to host new annual youth climate summit on UN World Environment Day -

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan -

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns -

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests -

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement -

Historic motorsport confronts its energy future

Historic motorsport confronts its energy future -

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation -

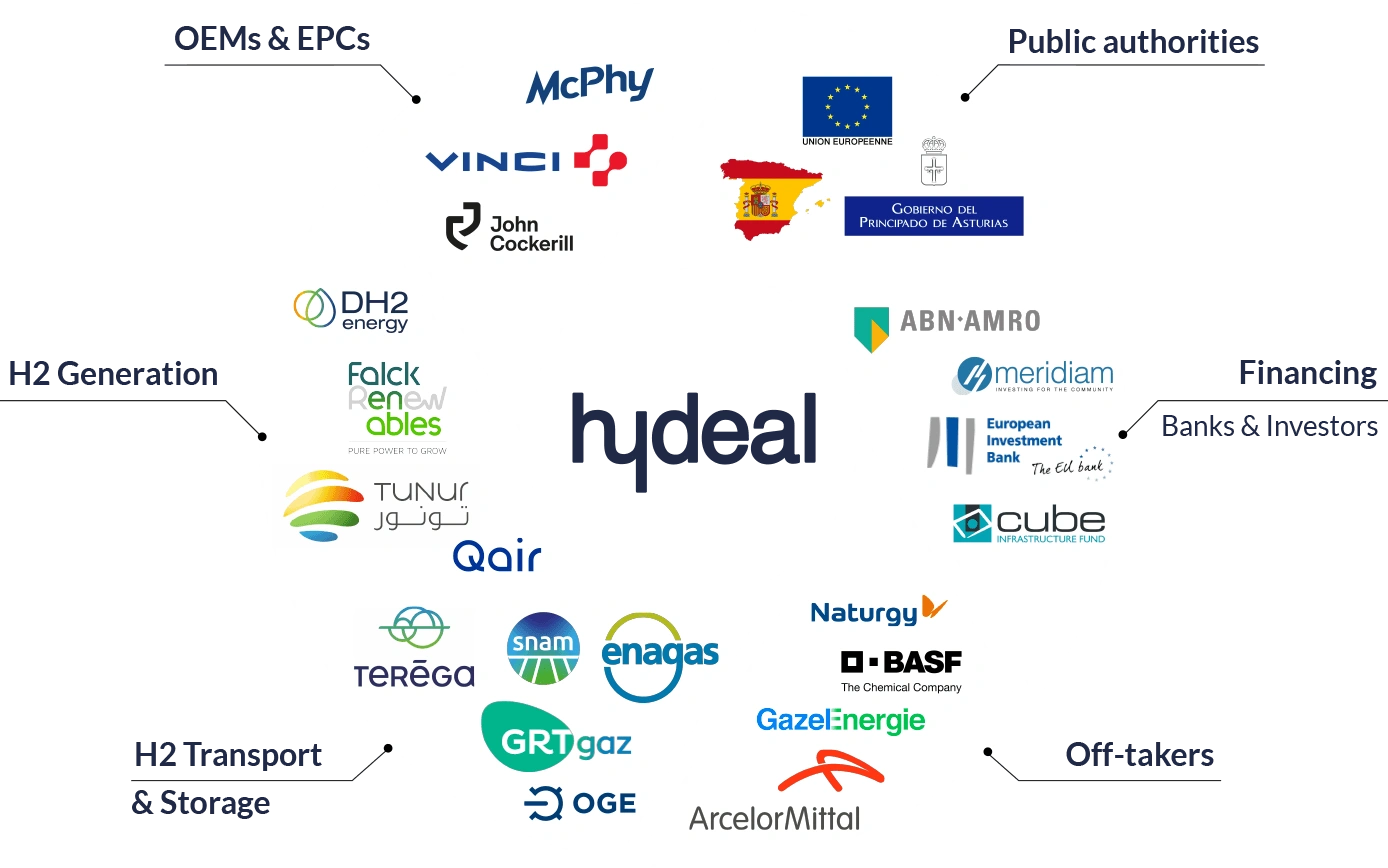

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe -

Fabric of change

Fabric of change -

Courage in an uncertain world: how fashion builds resilience now

Courage in an uncertain world: how fashion builds resilience now -

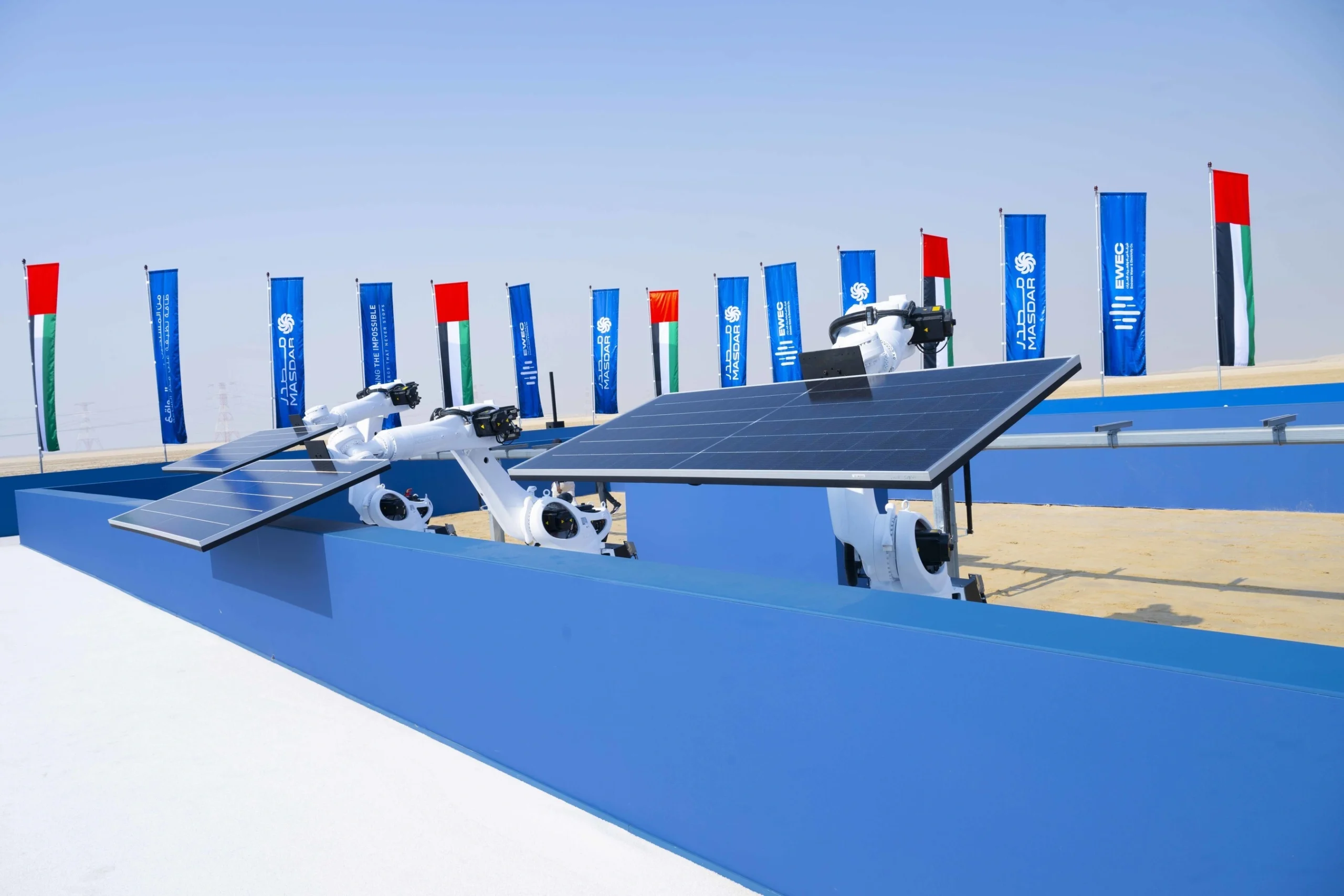

UAE breaks ground on world’s first 24-hour renewable power plant

UAE breaks ground on world’s first 24-hour renewable power plant -

China’s Yancheng sets a global benchmark for conservation and climate action

China’s Yancheng sets a global benchmark for conservation and climate action -

Inside Iceland’s green biotechnology revolution

Inside Iceland’s green biotechnology revolution -

Global development banks agree new priorities on finance, water security and private capital ahead of COP30

Global development banks agree new priorities on finance, water security and private capital ahead of COP30 -

UK organisations show rising net zero ambition despite financial pressures, new survey finds

UK organisations show rising net zero ambition despite financial pressures, new survey finds -

Gulf ESG efforts fail to link profit with sustainability, study shows

Gulf ESG efforts fail to link profit with sustainability, study shows -

Redress and UN network call for fashion industry to meet sustainability goals

Redress and UN network call for fashion industry to meet sustainability goals -

World Coastal Forum leaders warn of accelerating global ecosystem collapse

World Coastal Forum leaders warn of accelerating global ecosystem collapse