Scale up your support of nature

John E. Kaye

- Published

- Climate Change, Sustainability

The We Mean Business Coalition is bringing clarity to the voluntary carbon market by helping businesses who are unsure how to contribute, says CEO Maria Mendiluce

From inside an air-conditioned office, nature can feel far away. However, some leading companies know this is an illusion. They are recognising their success is highly dependent on the natural world and the protection and restoration of nature is essential to preserving a safe climate and stable environment where business can thrive.

A study from PWC revealed that 55% of global GDP is either moderately or highly dependent on nature. This is also true of 47% of companies listed on the London Stock Exchange. Never has it been so important for businesses to connect with the natural world. Globally, the planet is in crisis. We are in the midst of the world’s sixth mass extinction event, the first since the dinosaurs disappeared 65 million years ago. We have over-extracted our freshwater sources and are witnessing record-breaking wildfires. This is not a good environment for business.

But although corporate leaders clearly need a stable climate, this is not a one-way relationship. When professionals proactively include nature in their strategies, the world’s ecosystems can also benefit from business. The science says it would be impossible to avert the worst of the climate crisis without simultaneously investing in nature. However, there remains a colossal gap between the funding needed to conserve and restore nature and the financial flows currently underway.

As just one example, we’re $100-200bn short of the annual financing needed to meet the 2030 goals set out in the Kunming-Montreal Global Biodiversity Framework laid out at COP15.

Some forward-thinking companies are already leading the way in closing these huge gaps. In addition to directly cutting their greenhouse gas emissions, many compensate for the remainder with high-quality carbon credits purchased on the voluntary carbon markets (VCM). This has a dual purpose: it supports companies as they progress towards net zero while, at the same time, channeling finance to nature through carbon credits generated from conservation and restoration projects.

Open the VCM Knowledge Vault

However, the VCM can be confusing. Amid a sea of helpful and necessary regulation and guidance, many businesses simply don’t know where to start. But this needn’t be the case. It’s just a matter of knowing where to look. To solve this problem, We Mean Business Coalition has created a resource bank for business – the VCM Knowledge Vault. There are plenty of resources available to help business leaders navigate investments in the VCM. From the credit integrity-measuring Core Carbon Principles to the industry-standard guide to making green claims, the nature market doesn’t need to remain a mystery.

With reports, guidance, explainers and whitepapers, the VCM Knowledge Vault is your one-stop shop for guidance. Scale up your support of nature.

Further information

wemeanbusinesscoalition.org/VCM

RECENT ARTICLES

-

Strong ESG records help firms take R&D global, study finds

Strong ESG records help firms take R&D global, study finds -

How residence and citizenship programmes strengthen national resilience

How residence and citizenship programmes strengthen national resilience -

Global leaders enter 2026 facing a defining climate choice

Global leaders enter 2026 facing a defining climate choice -

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change -

China’s BYD overtakes Tesla as world’s largest electric car seller

China’s BYD overtakes Tesla as world’s largest electric car seller -

UK education group signs agreement to operate UN training centre network hub

UK education group signs agreement to operate UN training centre network hub -

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing -

Oxford to host new annual youth climate summit on UN World Environment Day

Oxford to host new annual youth climate summit on UN World Environment Day -

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan -

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns -

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests -

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement -

Historic motorsport confronts its energy future

Historic motorsport confronts its energy future -

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation -

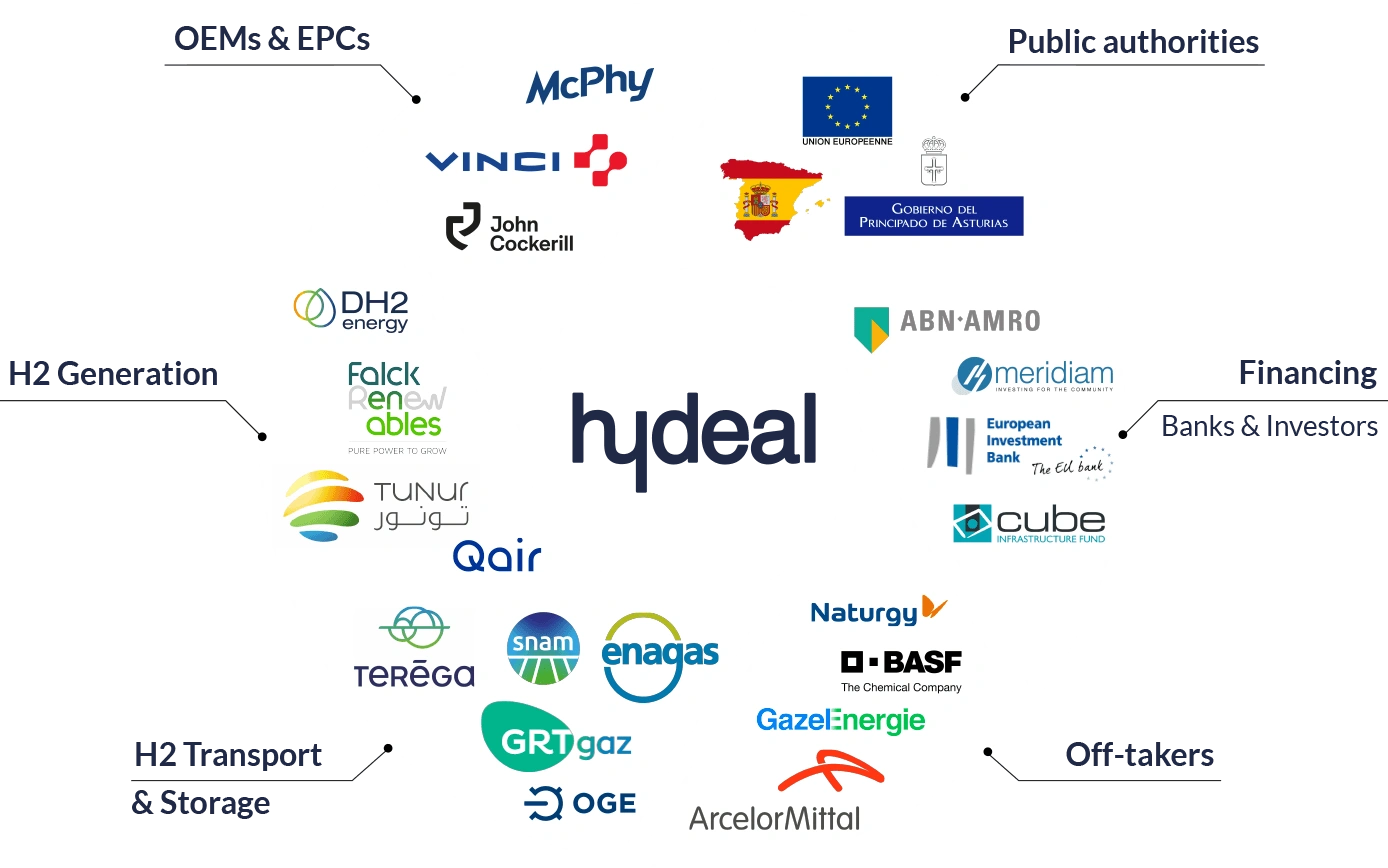

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe -

Fabric of change

Fabric of change -

Courage in an uncertain world: how fashion builds resilience now

Courage in an uncertain world: how fashion builds resilience now -

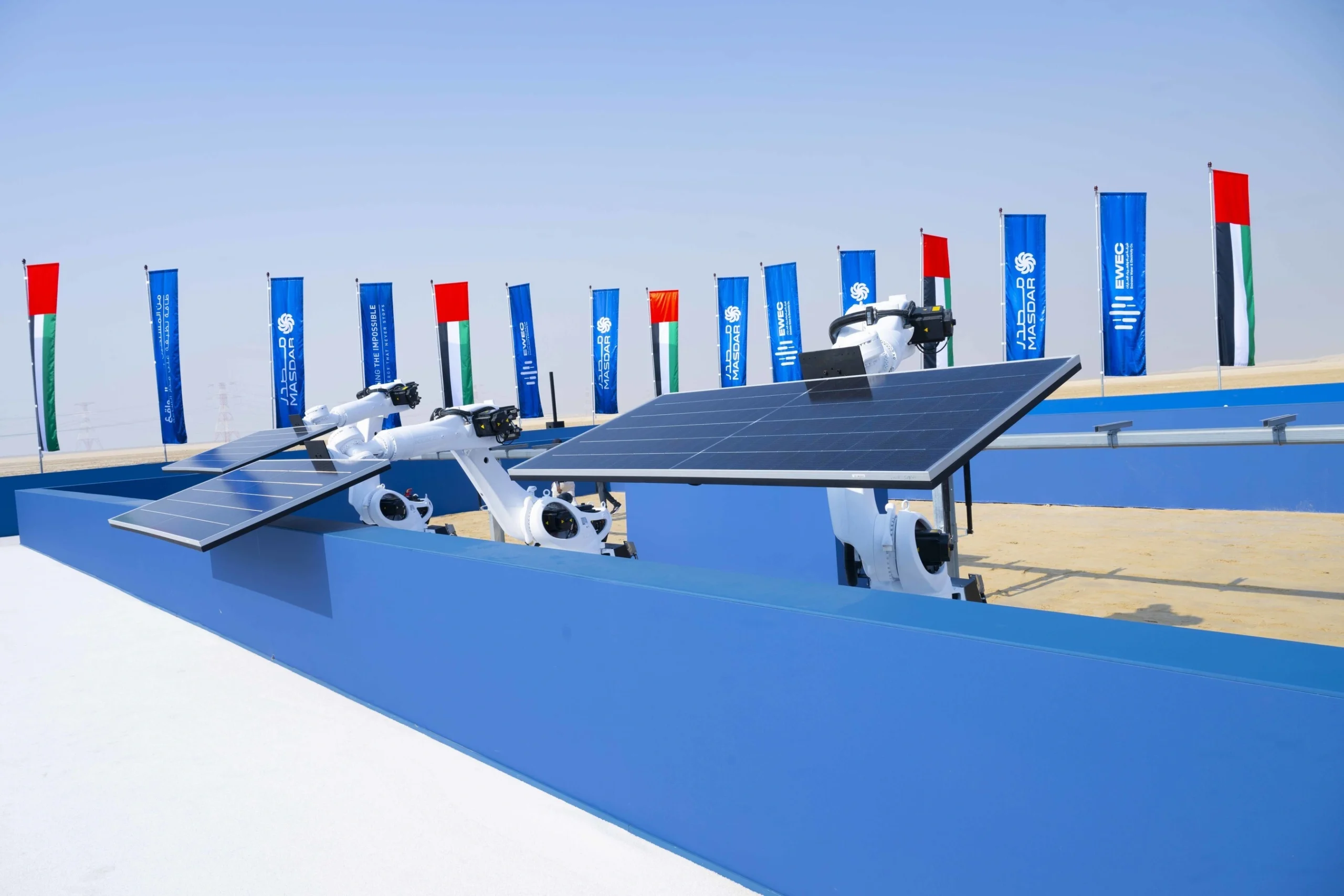

UAE breaks ground on world’s first 24-hour renewable power plant

UAE breaks ground on world’s first 24-hour renewable power plant -

China’s Yancheng sets a global benchmark for conservation and climate action

China’s Yancheng sets a global benchmark for conservation and climate action -

Inside Iceland’s green biotechnology revolution

Inside Iceland’s green biotechnology revolution -

Global development banks agree new priorities on finance, water security and private capital ahead of COP30

Global development banks agree new priorities on finance, water security and private capital ahead of COP30 -

UK organisations show rising net zero ambition despite financial pressures, new survey finds

UK organisations show rising net zero ambition despite financial pressures, new survey finds -

Gulf ESG efforts fail to link profit with sustainability, study shows

Gulf ESG efforts fail to link profit with sustainability, study shows -

Redress and UN network call for fashion industry to meet sustainability goals

Redress and UN network call for fashion industry to meet sustainability goals -

World Coastal Forum leaders warn of accelerating global ecosystem collapse

World Coastal Forum leaders warn of accelerating global ecosystem collapse