The longstanding legacy of Banque Misr

John E. Kaye

- Published

- Banking & Finance, Home

With a firm commitment to the prosperity of Egypt, and values that embrace ESG principles, Banque Misr is well placed to build on its prestigious history

Banque Misr was established by the pioneering economist Mohamed Talaat Harb Pasha in 1920, who spearheaded the concept of investing national savings and directing them towards economic and social development. Banque Misr therefore became the first bank to be wholly owned by Egyptians.

Since its inception, Banque Misr has focused on the establishment of companies in various fields, including textiles, insurance, transportation, aviation, and the film industry, and has continued to support all their activities at a steady rate. Banque Misr currently owns shares in 162 projects, including financial, industrial, tourism, housing, agriculture and food, and general services, in addition to projects in the fields of communication and information technology.

Utilising the latest technology

Led by Chairman Mohamed El-Etreby, Banque Misr is a true pioneer in the region, and became the first bank in Egypt and North Africa to comply with PCI data security standards, upon obtaining the latest version of the global Payment Card Industry Data Security Standard (PCI DSS 3.2.1) certification. Utilising the latest technology in the banking sector, Banque Misr is constantly looking to expand customer access to banking services. Today, Banque Misr is proud to offer one of Egypt’s largest ATM networks, located across all areas of Egypt.

Banque Misr’s role is visible in all economic fields due to its geographic outreach. The bank has more than 22,000 employees, serving a large base of more than 17 million customers across Egypt, with a total paid-in capital amounting to EGP50bn ($1.62bn as of Dec 2023).

The bank has more than 800 electronically integrated local branches located nationwide to provide the best and most accessible services to customers. Banque Misr also values its regional and international presence, which includes its five branches in the United Arab Emirates and one in France.

In addition, the bank’s international presence includes subsidiaries in Lebanon and Germany, as well as representative offices in China, Russia, South Korea, and Italy and a global network of correspondents.

Awards and recognition

Banque Misr Won 90 awards and advanced positions from major international institutions in 2023. It was commended by numerous global organisations in 2023 for its extraordinary accomplishments and efforts in various areas, including financing large corporations and SMEs. It was also recognised for its corporate social responsibility initiatives, internal auditing, banking products and services for companies and financial institutions, digital innovation, treasury and correspondent management, and more.

These awards validate Banque Misr’s trustworthiness and customer focus. The bank continually improves its services to maintain long-term success and effectively meet customer needs. Banque Misr’s values and strategies reflect its commitment to Egypt’s sustainable development and prosperity.

Further information

banquemisr.com

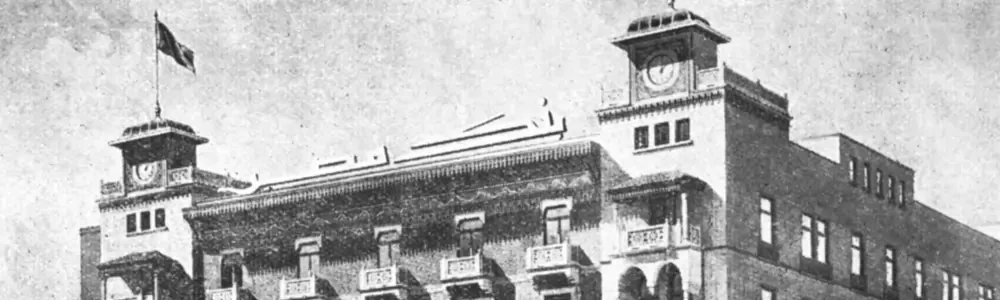

Main image: The bank’s head office in Cairo was designed by renowned Italian architect Antonio Lasciac and opened for business in 1927

RECENT ARTICLES

-

Managing cross-border risks in B2B e-commerce

Managing cross-border risks in B2B e-commerce -

J.P. Morgan launches first tokenised money market fund on public blockchain

J.P. Morgan launches first tokenised money market fund on public blockchain -

Aberdeen agrees to take over management of £1.5bn in closed-end funds from MFS

Aberdeen agrees to take over management of £1.5bn in closed-end funds from MFS -

Enterprise asset management market forecast to more than double by 2035

Enterprise asset management market forecast to more than double by 2035 -

EU Chamber records highest number of entries for 2025 China Sustainable Business Awards

EU Chamber records highest number of entries for 2025 China Sustainable Business Awards -

Inside Liechtenstein’s strategy for a tighter, more demanding financial era

Inside Liechtenstein’s strategy for a tighter, more demanding financial era -

‘Stability, scale and strategy’: Christoph Reich on Liechtenstein’s evolving financial centre

‘Stability, scale and strategy’: Christoph Reich on Liechtenstein’s evolving financial centre -

Bridging tradition and transformation: Brigitte Haas on leading Liechtenstein into a new era

Bridging tradition and transformation: Brigitte Haas on leading Liechtenstein into a new era -

Liechtenstein in the Spotlight

Liechtenstein in the Spotlight -

Fiduciary responsibility in the balance between stability and global dynamics

Fiduciary responsibility in the balance between stability and global dynamics -

Neue Bank’s CEO on stability, discipline and long-term private banking

Neue Bank’s CEO on stability, discipline and long-term private banking -

Research highlights rise of 'solopreneurs' as technology reshapes small business ownership

Research highlights rise of 'solopreneurs' as technology reshapes small business ownership -

Philipp Kieber on legacy, leadership and continuity at Interadvice Anstalt

Philipp Kieber on legacy, leadership and continuity at Interadvice Anstalt -

Building global-ready funds: how South African managers are scaling through offshore platforms

Building global-ready funds: how South African managers are scaling through offshore platforms -

Global billionaire wealth hits record as relocation and inheritance accelerate, UBS finds

Global billionaire wealth hits record as relocation and inheritance accelerate, UBS finds -

Human resources at the centre of organisational transformation

Human resources at the centre of organisational transformation -

Liechtenstein lands AAA rating again as PM hails “exceptional stability”

Liechtenstein lands AAA rating again as PM hails “exceptional stability” -

Lusaka Securities Exchange surges ahead on reform momentum

Lusaka Securities Exchange surges ahead on reform momentum -

PROMEA leads with ESG, technology and trust in a changing Swiss market

PROMEA leads with ESG, technology and trust in a changing Swiss market -

Why collective action matters for pensions and the planet

Why collective action matters for pensions and the planet -

Structuring success with Moore Stephens Jersey

Structuring success with Moore Stephens Jersey -

PIM Capital sets new standards in cross-jurisdiction fund solutions

PIM Capital sets new standards in cross-jurisdiction fund solutions -

Innovation, advisory and growth: Banchile Inversiones in 2024

Innovation, advisory and growth: Banchile Inversiones in 2024 -

Digitalization, financial inclusion, and a new era of banking services: Uzbekistan’s road to WTO membership

Digitalization, financial inclusion, and a new era of banking services: Uzbekistan’s road to WTO membership -

Fermi America secures $350m in financing led by Macquarie Group

Fermi America secures $350m in financing led by Macquarie Group