Achieve the ideal work-life balance

John E. Kaye

Locate Guernsey is an agency funded by the island’s government to promote Guernsey as a destination of choice for the relocation of individuals and businesses. The European spoke to the agency’s Director, Jo Stoddart about the island’s superb quality of life and how the flexible legislative infrastructure is tailor-made for business success.

Could you describe the role of Locate Guernsey and how it helps companies and individuals settle into the jurisdiction?

Jo Stoddart: Locate Guernsey provides a single point of contact within the island’s government for those considering relocating here. We facilitate access to key decision-makers within the States of Guernsey and provide free information and advice to assist with business and personal relocation enquiries, helping them connect with the right people to make informed decisions. We also provide opportunities for new arrivals to integrate into island life, build new networks, become involved in the community and make the most of all that Guernsey offers.

Why, in practical terms, is Guernsey such a popular choice for inward relocation?

JS: Guernsey combines a commercial hub that enables businesses to flourish with stunning beaches, panoramic cliff-top walks and vibrant culture. Relocating here is easy – there are no minimum income requirements, meaning holders of UK or EEA passports can simply buy or rent an Open Market Part A home and live and work in the island as such indefinitely. For holders of other passports, the island has special immigration routes for investors and entrepreneurs. Tax is straightforward; personal income tax is levied at the flat rate of 20% and there are caps on the amount of income tax payable by residents. New arrivals can benefit from a tax cap of £50,000 for their first four years living in Guernsey, subject to certain conditions. The island has no inheritance, estate or gifts taxes, no wealth tax, no taxes on capital gains and no VAT or sales taxes.

What will the UK’s departure from the EU mean for the island?

JS: Guernsey has never been part of the EU, so although we benefit from a special relationship through Protocol 3 of the Accession Treaty, this does not have any impact on services. Brexit will therefore have no direct impact on Guernsey’s financial services industries and a limited impact on trade in goods, which represents only a modest part of the island’s economy.

What long-term benefits will being in Guernsey confer on those inbound companies?

JS: Guernsey is a stable, low-tax jurisdiction offering quality professional services and a highly skilled workforce, underpinned by safety and a beautiful environment. With GDP per capita amongst the highest in the world, an independent government and mature legal system, Guernsey offers a dynamic business environment and an exceptional opportunity to achieve that elusive work-life balance. ν

Further information

RECENT ARTICLES

-

Addiction remains misunderstood despite clear medical consensus

Addiction remains misunderstood despite clear medical consensus -

New guide to the NC500 calls time on 'tick-box tourism'

New guide to the NC500 calls time on 'tick-box tourism' -

Bon anniversaire, Rétromobile: Paris’ great motor show turns 50

Bon anniversaire, Rétromobile: Paris’ great motor show turns 50 -

Ski hard, rest harder: inside Europe’s new winter-wellness boom

Ski hard, rest harder: inside Europe’s new winter-wellness boom -

Baden-Baden: Europe’s capital of the art of living

Baden-Baden: Europe’s capital of the art of living -

Salzburg in 2026: celebrating 270 years of Mozart’s genius

Salzburg in 2026: celebrating 270 years of Mozart’s genius -

Sea Princess Nika – the ultimate expression of Adriatic elegance on Lošinj

Sea Princess Nika – the ultimate expression of Adriatic elegance on Lošinj -

Hotel Bellevue, Lošinj, Croatia – refined wellness by the Adriatic

Hotel Bellevue, Lošinj, Croatia – refined wellness by the Adriatic -

Padstow beyond Stein is a food lover’s dream

Padstow beyond Stein is a food lover’s dream -

Love really is in the air. How to spot a sky full of heart-stealing stars this Valentine's Day

Love really is in the air. How to spot a sky full of heart-stealing stars this Valentine's Day -

Cora Cora Maldives – freedom, luxury and a celebration of island life

Cora Cora Maldives – freedom, luxury and a celebration of island life -

Hotel Ambasador: the place to stay in Split

Hotel Ambasador: the place to stay in Split -

Maslina Resort, Hvar – mindful luxury in the heart of the Adriatic

Maslina Resort, Hvar – mindful luxury in the heart of the Adriatic -

The bon hiver guide to Paris

The bon hiver guide to Paris -

Villa Mirasol – timeless luxury and discreet elegance on the island of Lošinj

Villa Mirasol – timeless luxury and discreet elegance on the island of Lošinj -

Lošinj’s Captain’s Villa Rouge sets a new standard in private luxury hospitality

Lošinj’s Captain’s Villa Rouge sets a new standard in private luxury hospitality -

Villa Nai 3.3: A Michelin-recognised haven on Dugi Otok

Villa Nai 3.3: A Michelin-recognised haven on Dugi Otok -

The European road test: The Jeep Wrangler Rubicon

The European road test: The Jeep Wrangler Rubicon -

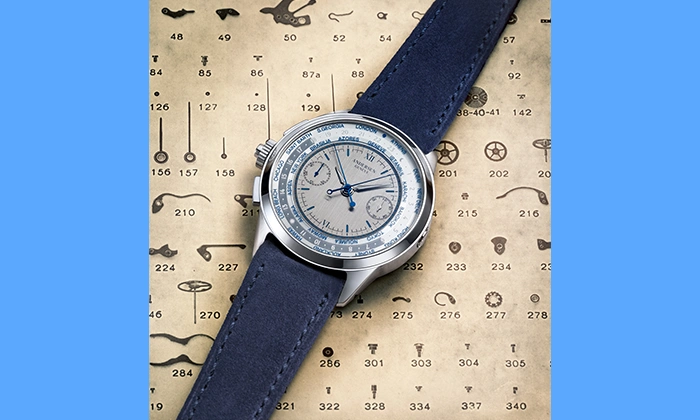

Rattrapante Mondiale – Split-Seconds Worldtimer

Rattrapante Mondiale – Split-Seconds Worldtimer -

Adaaran Select Meedhupparu & Prestige Water Villas: a Raa Atoll retreat

Adaaran Select Meedhupparu & Prestige Water Villas: a Raa Atoll retreat -

Heritance Aarah: an island escape crafted for exceptional family and couples’ stays

Heritance Aarah: an island escape crafted for exceptional family and couples’ stays -

Stanley Johnson in Botswana: a return to the wild heart of Southern Africa

Stanley Johnson in Botswana: a return to the wild heart of Southern Africa -

Germany’s Jewellery Museum in Pforzheim unveils landmark exhibition on dining culture

Germany’s Jewellery Museum in Pforzheim unveils landmark exhibition on dining culture -

The European's Luxury Report Supplement is out now

The European's Luxury Report Supplement is out now -

This city is Hollywood’s Mediterranean playground — and now is the time to visit

This city is Hollywood’s Mediterranean playground — and now is the time to visit