Philanthropy: Advantage Liechtenstein

John E. Kaye

- Published

- Banking & Finance, Home, Liechtenstein, Sustainability

More and more wealthy individuals are making a sustained commitment to the public good by setting up charitable foundations and trusts. Liechtenstein offers attractive framework conditions for this – even for somewhat smaller assets

Only recently, Jeff Bezos announced that he would donate a large part of his $124 billion fortune. The fourth richest man in the world wants to use it to support projects that slow down global warming or counteract the polarisation of American society. With his announcement, Bezos has followed in the footsteps of philanthropists such as Microsoft founder Bill Gates or investor legend George Soros. Accordingly, the worldwide attention for the Amazon founder was great.

Whether climate protection, society, culture or education, wealthy individuals are committed to a wide variety of issues worldwide – often through foundations and trusts that are set up exclusively for this purpose. Of the 91 countries surveyed, Liechtenstein is the best location for such a philanthropic vehicle, at least according to the latest “Global Philanthropy Environment Index 2022”.

Revised foundation law as the cornerstone

The Principality’s leading position worldwide is no coincidence. The foundation stone was already laid in 2009 with the comprehensively revised foundation law. This guarantees that founders have as much freedom as possible in structuring the foundation and its purpose. At the same time, it meets all international standards and tax regulations. In particular, the lack of geographical restrictions on funding activities and the designation of beneficiaries in comparison to other countries is a major set the Liechtenstein model apart from its peers. It is therefore not surprising that the majority of the distributions of many charitable foundations and trusts domiciled in the Principality benefit foreign institutions, organisations and individuals.

However, it is not only the great liberalism that makes the location in the small state attractive beyond the country’s borders. The short distances within the administration are also praised in the corresponding surveys. There is hardly any other place where you can get the necessary information and high-quality services so easily and quickly – in several languages, mind you. The regulatory, political, economic and socio-cultural environment that philanthropists and their foundations find in Liechtenstein is also highly appreciated. Thanks to these framework conditions with a high degree of legal security, private autonomy and clear rules, the country offers the medium- and long-term security that is particularly close to the hearts of philanthropists and their charitable foundations. Another unique selling point: as a member of the European Economic Area (EEA) and thanks to the customs and currency union with its border neighbour Switzerland, the country is closely linked to the driving economic forces on the old continent.

In recent years, the philanthropic foundation sector in Liechtenstein has grown significantly and stabilised at a high level. The location has also benefited from the growing charitable foundation sector throughout Europe. Liechtenstein currently has around 1400 charitable foundations and trusts that are active in many different sectors. Recently, a clear trend towards sustainability has been observed – both in terms of the purpose of the assets and in the context of asset management.

Not only for ultra-rich philanthropists

Among the best-known foundations from the region are the Hilti Foundation or the Medicor Foundation. Many vehicles, however, prefer to work away from the public eye. The reason given for this reticence is, for example, the express wish of the philanthropists themselves. Precise data on the assets managed by charitable foundations and their annual distributions are therefore difficult to collect. The fact is that a certain amount of assets is required for the establishment of a philanthropic foundation so that the costs incurred for asset management, taking into account the regulatory requirements, do not consume the available funds over the years. Industry insiders speak of around 2 million Swiss francs.

Liechtenstein offers an alternative for somewhat less well-heeled philanthropists through the so-called Protected Cell Company, or PCC for short. A PCC can be set up with any legal entity, be it a foundation, public limited company or limited liability company. It consists of a core and any number of independent cells, the administration of which is carried out jointly. In the case of a charitable PCC foundation, which can be set up with a share capital amount of 30,000 Swiss francs or euros, assets starting at around 200,000 Swiss francs or euros can already be dedicated to a cell of the foundation; it is, so to speak, the Liechtenstein form of an umbrella foundation. In the segments, the donated funds of the various donors are carefully segregated from the other cells, which is of great importance in the event of bankruptcy or other claims by third parties against a foundation. One cell is not liable for the other. An additional plus point for philanthropists: the individual segments can bear the names of the donors or designate their purpose. The new corporate form has received a lot of support, so that already about 25 such PCCs have been founded in the last six years.

For Jeff Bezos’ billion-dollar fortune, PCCs are probably not a necessity. But he could certainly consider Liechtenstein as a location for his philanthropic efforts.

For further information:

RECENT ARTICLES

-

Strong ESG records help firms take R&D global, study finds

Strong ESG records help firms take R&D global, study finds -

How residence and citizenship programmes strengthen national resilience

How residence and citizenship programmes strengthen national resilience -

Global leaders enter 2026 facing a defining climate choice

Global leaders enter 2026 facing a defining climate choice -

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change -

China’s BYD overtakes Tesla as world’s largest electric car seller

China’s BYD overtakes Tesla as world’s largest electric car seller -

UK education group signs agreement to operate UN training centre network hub

UK education group signs agreement to operate UN training centre network hub -

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing -

Oxford to host new annual youth climate summit on UN World Environment Day

Oxford to host new annual youth climate summit on UN World Environment Day -

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan -

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns -

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests -

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement -

Historic motorsport confronts its energy future

Historic motorsport confronts its energy future -

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation -

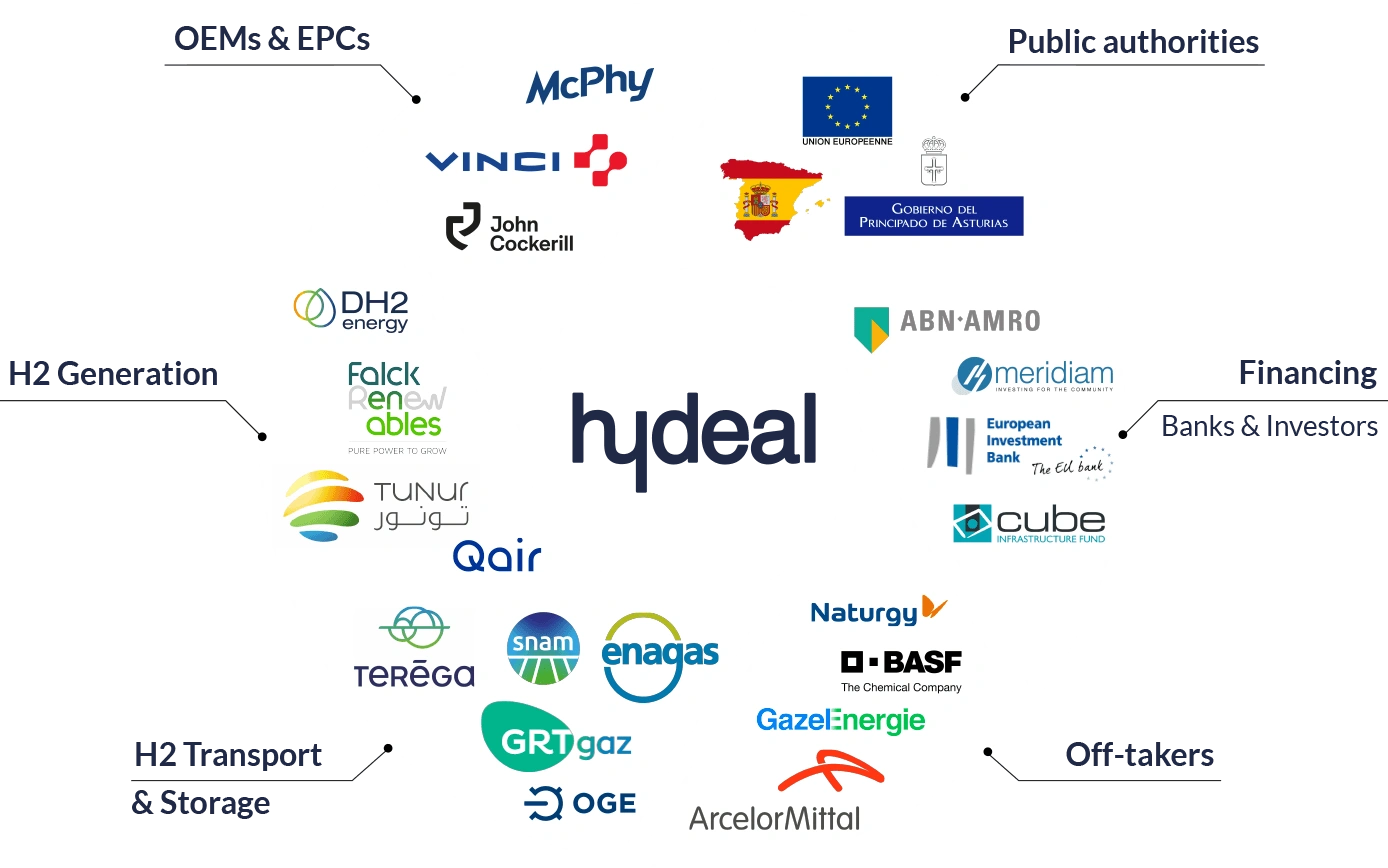

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe -

Fabric of change

Fabric of change -

Courage in an uncertain world: how fashion builds resilience now

Courage in an uncertain world: how fashion builds resilience now -

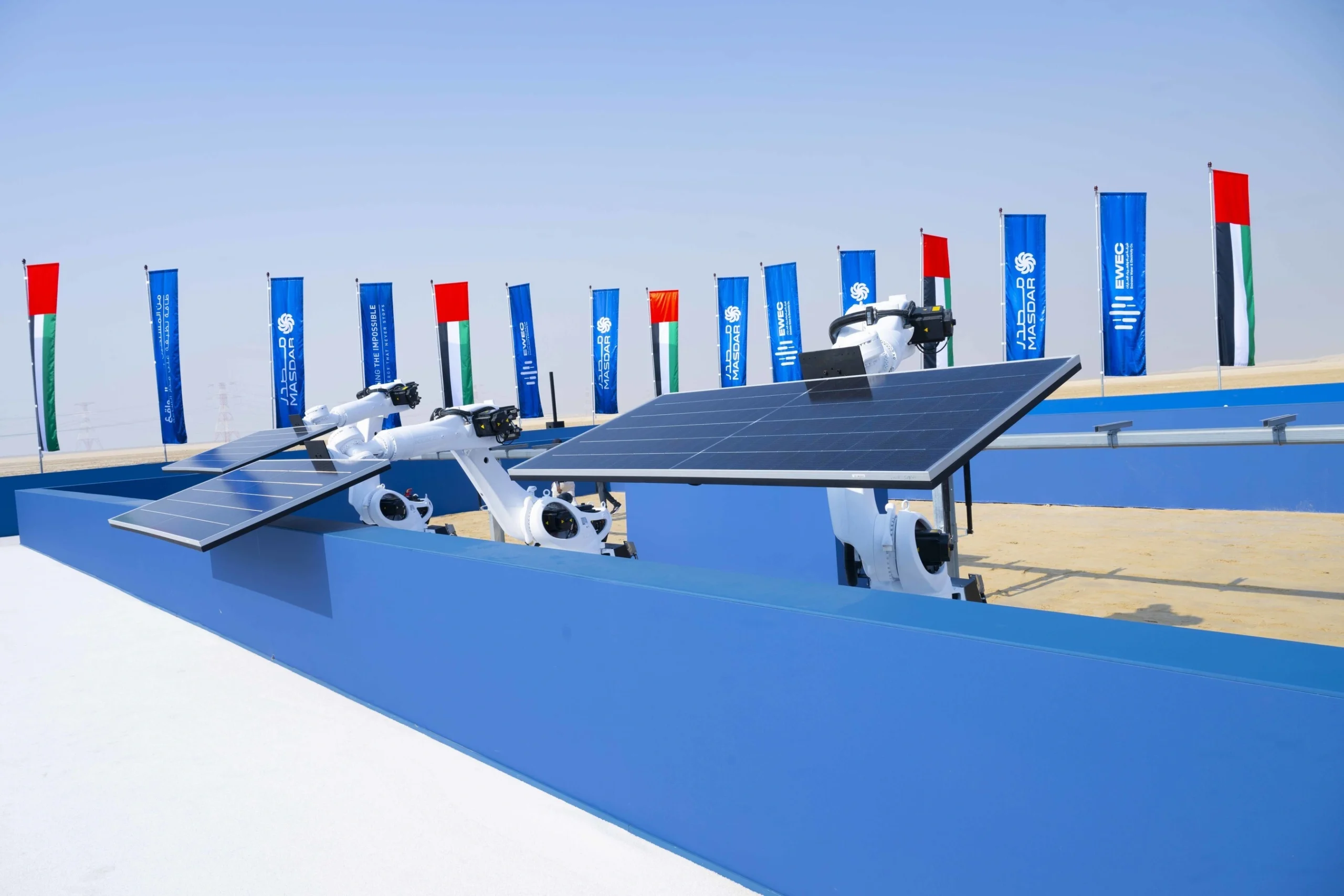

UAE breaks ground on world’s first 24-hour renewable power plant

UAE breaks ground on world’s first 24-hour renewable power plant -

China’s Yancheng sets a global benchmark for conservation and climate action

China’s Yancheng sets a global benchmark for conservation and climate action -

Inside Iceland’s green biotechnology revolution

Inside Iceland’s green biotechnology revolution -

Global development banks agree new priorities on finance, water security and private capital ahead of COP30

Global development banks agree new priorities on finance, water security and private capital ahead of COP30 -

UK organisations show rising net zero ambition despite financial pressures, new survey finds

UK organisations show rising net zero ambition despite financial pressures, new survey finds -

Gulf ESG efforts fail to link profit with sustainability, study shows

Gulf ESG efforts fail to link profit with sustainability, study shows -

Redress and UN network call for fashion industry to meet sustainability goals

Redress and UN network call for fashion industry to meet sustainability goals -

World Coastal Forum leaders warn of accelerating global ecosystem collapse

World Coastal Forum leaders warn of accelerating global ecosystem collapse