How experience feeds into ESG investor behaviour

John E. Kaye

- Published

- Home, Sustainability

New research reveals that shareholders are more likely to support eco-initiatives if they have experienced climate disasters

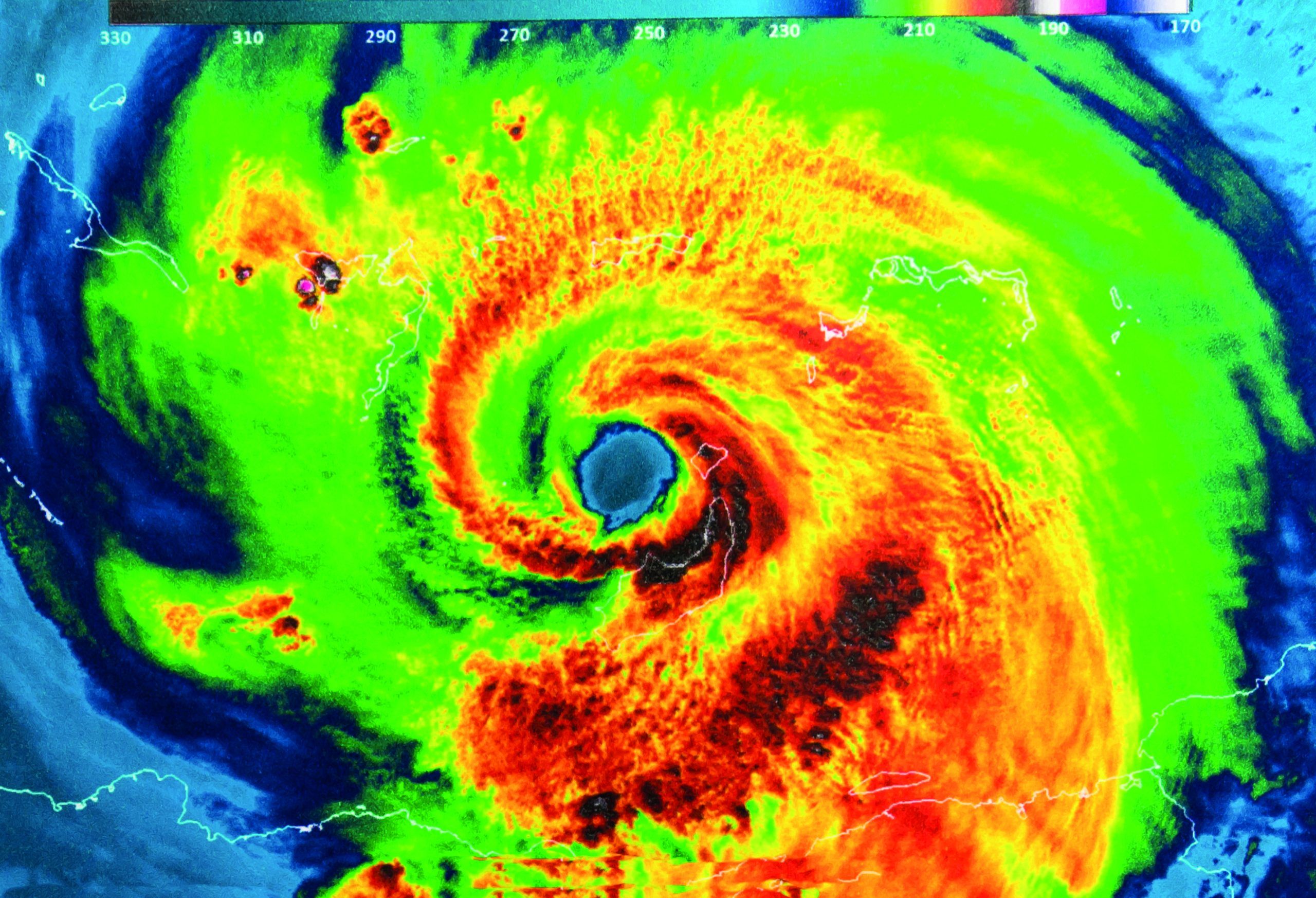

Shareholders in locations recently hit by climate-related disasters such as hurricanes are far more likely to support environmental proposals, by as much as 38%, even when such proposals risk decreasing firm value, according to new research from the Rotterdam School of Management Erasmus University (RSM).

The study, undertaken by Dr Guosong Xu at RSM and Dr Eliezer Fich at Drexel University, sought to bring greater understanding to two key questions at the crux of encouraging corporations to better support environmental protection efforts: whether shareholder beliefs about climate change alter their support for environmental proposals, and whether those proposals affect a firm’s value.

According to Dr Xu: “Climate change related proposals have increased steadily in recent years, reflecting growing investor demand for corporate accountability. However, despite their popularity, these proposals commonly receive insufficient support. According to a report by the UN, just 2.8% received enough votes to pass during stockholder meetings held from 2006 to 2020. Our study seeks to better understand why these initiatives receive such little support, and what it takes to pass them successfully.”

The researchers speculate that such a lack of voting support is driven by stockholders’ perception that climate-change is not an immediate concern. Belief, they say, plays an important role in investor behaviour. The researchers analysed mutual funds’ voting records of US firms according to the Institutional Shareholder Services (ISS) Voting Analytics database, between 2006 and 2020. They then mapped each funds headquarters to the Census 2010 county Federal Information Processing Standards (FIPS) code, to identify hurricane locations. By doing this, the researchers were able to base their findings on more than 357,000 voting observations made by shareholders of US-based firms.

Dr Xu and Dr Fich made several key discoveries. Firstly, funds in areas hit by a hurricane were significantly more likely to vote for an environmental proposal in the immediate aftermath of the event, as were funds located in other hurricane-prone locations. The difference in investor support was as much as 38% higher in such locations.

Reverting back to old ways

However, the effect was, for many, temporary, with most investors returning to their previous stances and reversing their support for such schemes within three years. Notably, the researchers say that fund characteristics such as size, performance, flows, attitudes towards environmental, social and corporate governance (ESG) issues had little impact on their research findings. Those instances where unconditional support was found for climate proposals did not differ among funds located either inside or outside of hurricane-prone locations in the years without a hurricane strike. Therefore, shareholders’ changed perceptions about climate risks were the most likely reason for their increased support for pro-environmental initiatives after a hurricane strike.

Lastly, once climate-related proposals were passed, firm performance typically weakens. In analysing whether ESG-related proposals created value for firms, the researchers discovered that companies that approved environmental proposals also typically exhibited lower long-term stock returns and accounting underperformance.

The researchers say their work adds important information to the ongoing debate on the role of corporations in global environmental protection, by highlighting the role of investor psychology in altering shareholders’ perceptions about climate risks and, consequently, their support for corporate environmental policies.

RECENT ARTICLES

-

Strong ESG records help firms take R&D global, study finds

Strong ESG records help firms take R&D global, study finds -

How residence and citizenship programmes strengthen national resilience

How residence and citizenship programmes strengthen national resilience -

Global leaders enter 2026 facing a defining climate choice

Global leaders enter 2026 facing a defining climate choice -

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change -

China’s BYD overtakes Tesla as world’s largest electric car seller

China’s BYD overtakes Tesla as world’s largest electric car seller -

UK education group signs agreement to operate UN training centre network hub

UK education group signs agreement to operate UN training centre network hub -

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing -

Oxford to host new annual youth climate summit on UN World Environment Day

Oxford to host new annual youth climate summit on UN World Environment Day -

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan -

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns -

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests -

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement -

Historic motorsport confronts its energy future

Historic motorsport confronts its energy future -

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation -

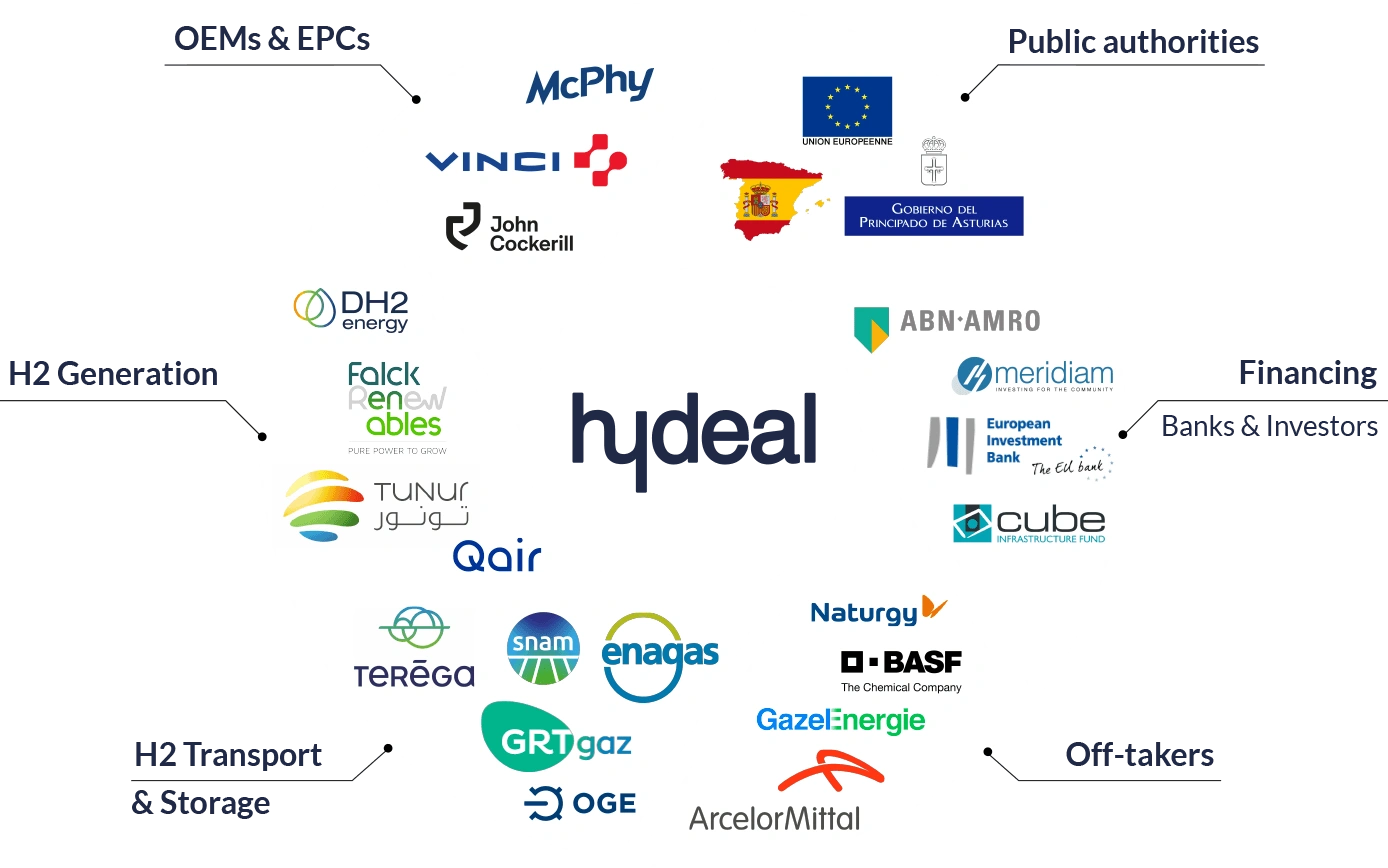

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe -

Fabric of change

Fabric of change -

Courage in an uncertain world: how fashion builds resilience now

Courage in an uncertain world: how fashion builds resilience now -

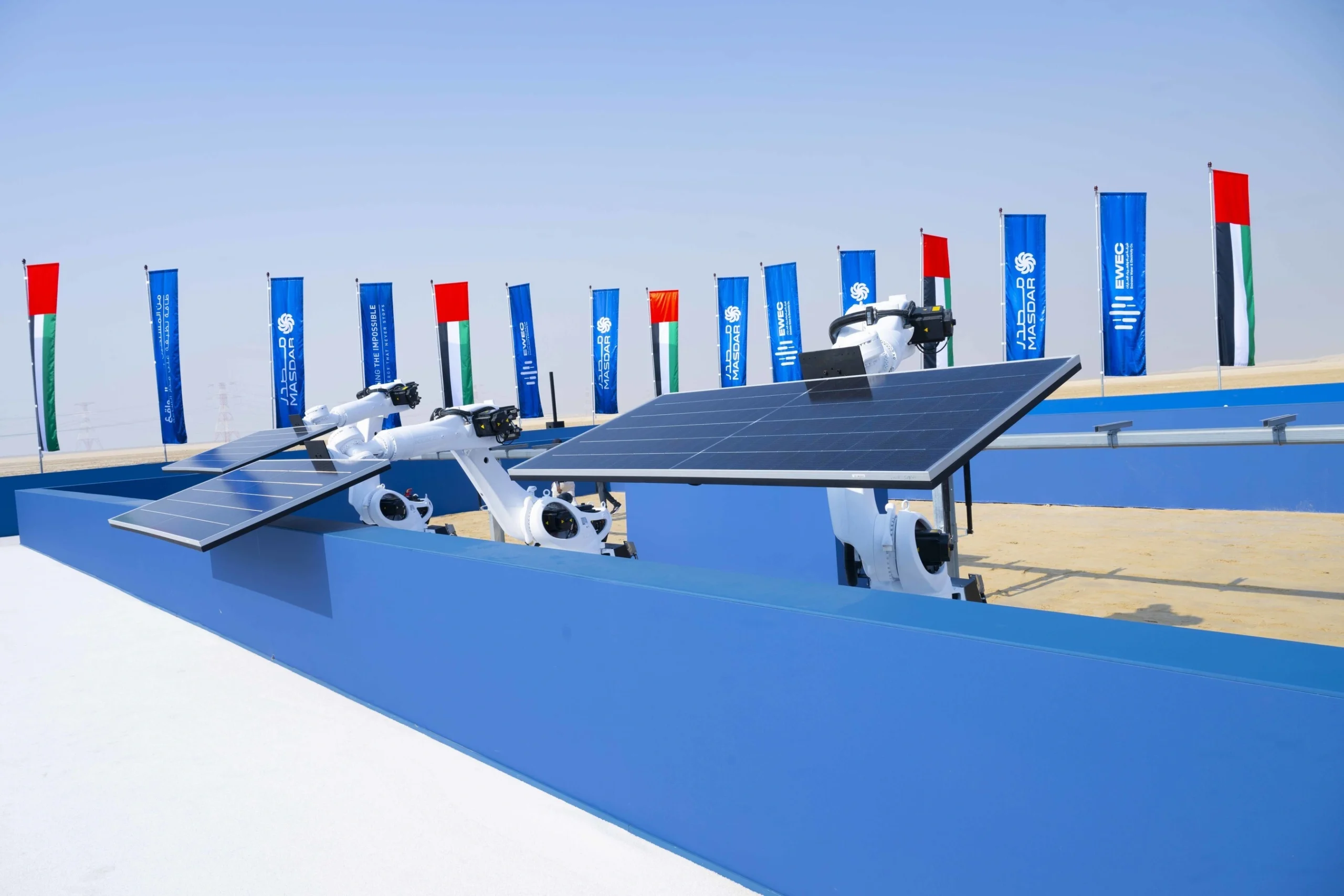

UAE breaks ground on world’s first 24-hour renewable power plant

UAE breaks ground on world’s first 24-hour renewable power plant -

China’s Yancheng sets a global benchmark for conservation and climate action

China’s Yancheng sets a global benchmark for conservation and climate action -

Inside Iceland’s green biotechnology revolution

Inside Iceland’s green biotechnology revolution -

Global development banks agree new priorities on finance, water security and private capital ahead of COP30

Global development banks agree new priorities on finance, water security and private capital ahead of COP30 -

UK organisations show rising net zero ambition despite financial pressures, new survey finds

UK organisations show rising net zero ambition despite financial pressures, new survey finds -

Gulf ESG efforts fail to link profit with sustainability, study shows

Gulf ESG efforts fail to link profit with sustainability, study shows -

Redress and UN network call for fashion industry to meet sustainability goals

Redress and UN network call for fashion industry to meet sustainability goals -

World Coastal Forum leaders warn of accelerating global ecosystem collapse

World Coastal Forum leaders warn of accelerating global ecosystem collapse