A sustainable future shaped by responsible investment

John E. Kaye

- Published

- Banking & Finance, Home, Sustainability

ESG investment is not just good for humanity, it also benefits the bottom-line, says Chairman and CEO of Resource Group Hisham Itani.

The global investment landscape is changing in several ways, and the transition towards sustainable investments is ushering in this change. The growing need to balance ethical goals with financial objectives is leading many investors to weigh non-financial considerations in the investment decision process. In short, environmental, sustainable, and corporate governance scrutiny (ESG) has become a leading and contemporary investment criterion.

The shift towards emphasis on sustainability is driven by several considerations. Globally, there is growing traceable evidence of the financial impact of ESG issues, such as the increasing availability of responsible investment products, and the pressure from regulators and other stakeholders for companies to disclose more information on their ESG performance. Climate change is also a critical matter, as extreme weather events become more common and impact businesses and economies. Furthermore, as the global population rises, the planet’s resources are strained. These are all real global issues that have made long-term ecological balance a necessity.

ESG investing is not just good for humanity, it also impacts the bottom-line. A study by Morgan Stanley Capital International found that over a 10-year period, companies in the MSCI World Index (an extensive global stock index that measures large and mid-cap equity performance across 23 developed economies) with strong ESG ratings outperformed those with weak ESG ratings by 2.7 percentage points per year on average. PwC also estimates that developing the right structure and mechanisms for sustainable investments in the Middle East and Africa can help unlock major opportunities for the region: $2tn in economic growth and more than one million jobs by 2030. Evidently, sustainable investing is no longer a niche strategy, it has become mainstream.

A matter of purpose

While critics may argue that ESG investing is a new form of stakeholder capitalism that runs contrary to the spirit of capitalism, we must not forget that the purpose of business is to serve the greater good. Investments should not just be profit-driven; they must also be ethical and serve a higher purpose.

Our world is flawed by the effects of “zero-sum capitalism”, where profits have been the ultimate goal. ESG investing presents a comforting prospect in the way profits are made and shared. We are aware that there are still many challenges to be addressed if the investment sector is to play its part in addressing the UN’s Sustainable Development Goals. There is no clear-cut solution to these challenges, but we are confident that sustainable investment can be a powerful tool in the fight against climate change, poverty and inequality. With more and more companies and investors incorporating ESG in their equations, we are likely to see more progress in this area in the years to come.

Further information

RECENT ARTICLES

-

Strong ESG records help firms take R&D global, study finds

Strong ESG records help firms take R&D global, study finds -

How residence and citizenship programmes strengthen national resilience

How residence and citizenship programmes strengthen national resilience -

Global leaders enter 2026 facing a defining climate choice

Global leaders enter 2026 facing a defining climate choice -

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change -

China’s BYD overtakes Tesla as world’s largest electric car seller

China’s BYD overtakes Tesla as world’s largest electric car seller -

UK education group signs agreement to operate UN training centre network hub

UK education group signs agreement to operate UN training centre network hub -

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing -

Oxford to host new annual youth climate summit on UN World Environment Day

Oxford to host new annual youth climate summit on UN World Environment Day -

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan -

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns -

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests -

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement -

Historic motorsport confronts its energy future

Historic motorsport confronts its energy future -

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation -

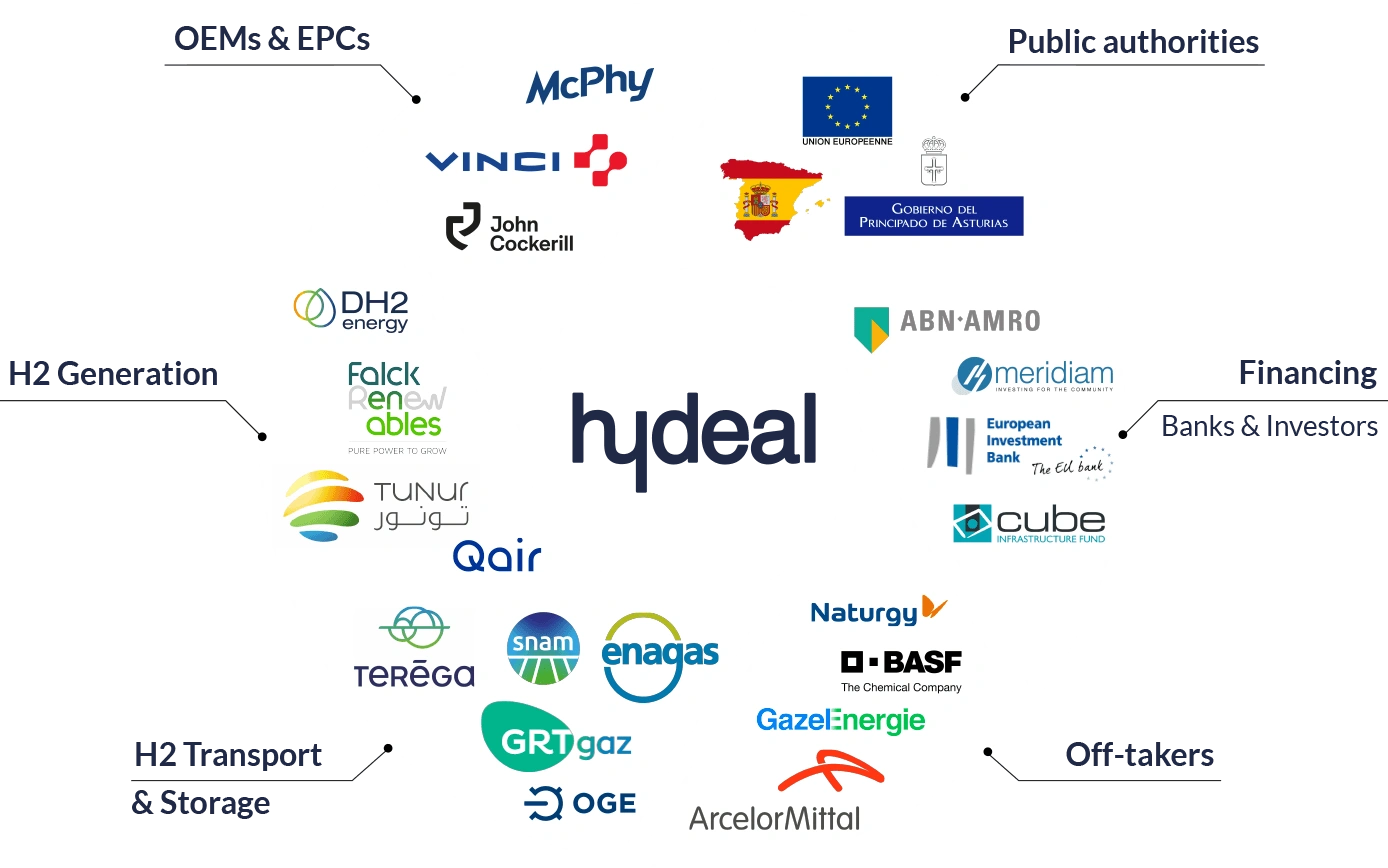

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe -

Fabric of change

Fabric of change -

Courage in an uncertain world: how fashion builds resilience now

Courage in an uncertain world: how fashion builds resilience now -

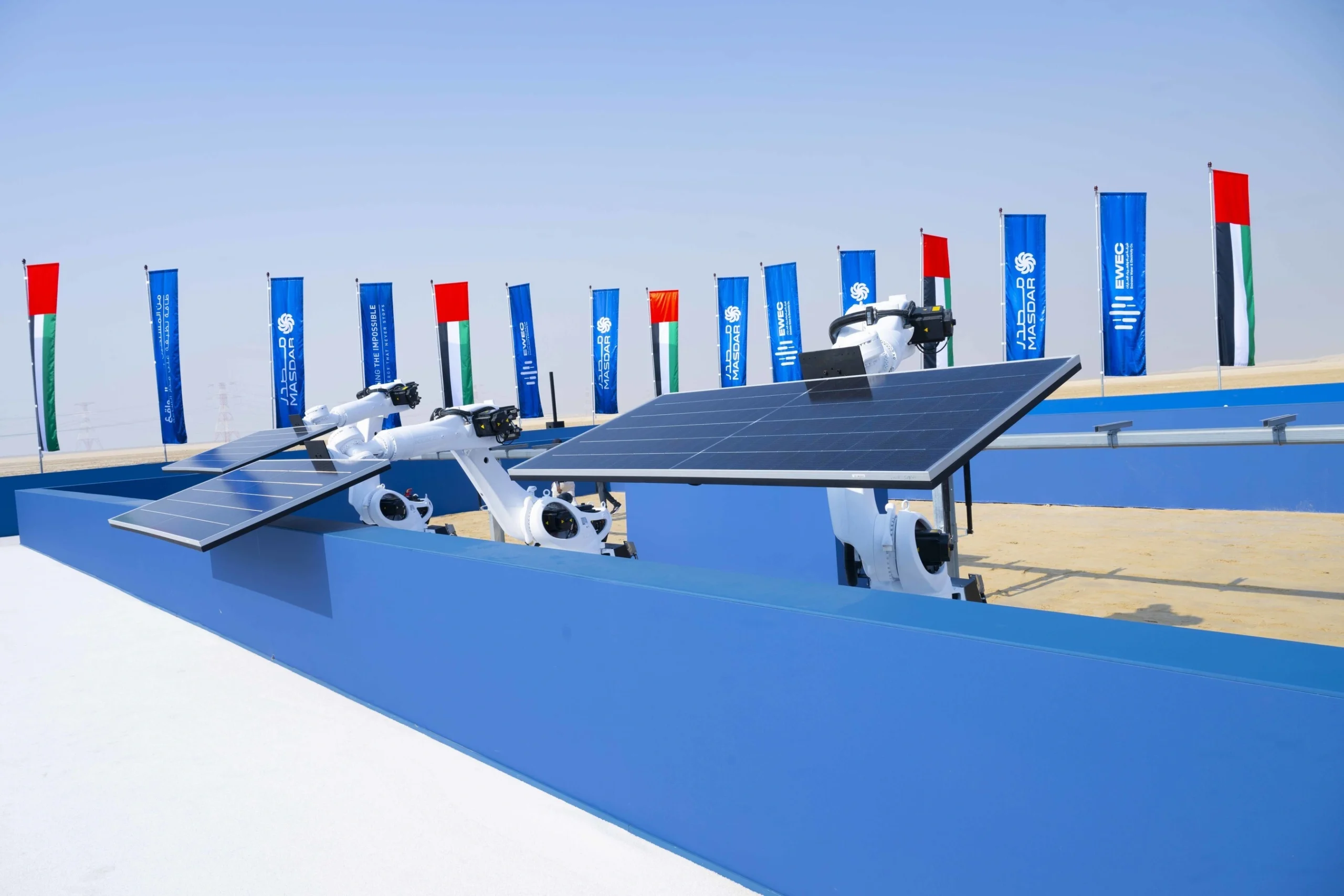

UAE breaks ground on world’s first 24-hour renewable power plant

UAE breaks ground on world’s first 24-hour renewable power plant -

China’s Yancheng sets a global benchmark for conservation and climate action

China’s Yancheng sets a global benchmark for conservation and climate action -

Inside Iceland’s green biotechnology revolution

Inside Iceland’s green biotechnology revolution -

Global development banks agree new priorities on finance, water security and private capital ahead of COP30

Global development banks agree new priorities on finance, water security and private capital ahead of COP30 -

UK organisations show rising net zero ambition despite financial pressures, new survey finds

UK organisations show rising net zero ambition despite financial pressures, new survey finds -

Gulf ESG efforts fail to link profit with sustainability, study shows

Gulf ESG efforts fail to link profit with sustainability, study shows -

Redress and UN network call for fashion industry to meet sustainability goals

Redress and UN network call for fashion industry to meet sustainability goals -

World Coastal Forum leaders warn of accelerating global ecosystem collapse

World Coastal Forum leaders warn of accelerating global ecosystem collapse