Financial centre Liechtenstein – thinking in generations

John E. Kaye

- Published

- Banking & Finance, Home, Liechtenstein, Sustainability

Over the course of the last century, state sovereignty in combination with close ties to the economically successful and politically stable Switzerland as well as integration into the European Union through EEA membership fostered unprecedented economic growth in Liechtenstein and allowed the Principality to become one of the wealthiest and most heavily industrialised nations in the world.

Locational Advantages

Liechtenstein has been a member of the European Economic Area (EEA) since 1995. For Liechtenstein-based companies, this ensures unrestricted market access to 30 states and around 500 million people in Europe. The free movement of goods, people, services and capital simplifies business relations with Europe. EEA membership means that the statutory operating conditions in force in Liechtenstein are the same as those in EU countries.

Since 1924, the customs and currency union with Switzerland has secured access to the neighbouring state. The Principality of Liechtenstein is an outstanding location for financial services providers and their clients. They benefit from political continuity and economic stability. Analysts at Standard & Poor’s have for years awarded Liechtenstein an AAA rating and underscore the stable outlook.

Promotion of Innovation

Liechtenstein’s business-friendly company law offers wide-ranging opportunities and remains to this day a role model for other financial centres. In addition to conventional legal forms such as the stock corporation, foundations, protected cell companies or – uniquely in continental Europe – trusts can also be set up. In order to promote innovations, the Liechtenstein Venture Cooperative has also been created, which is specifically aimed at financial market innovations and brings together ideas, work and capital for innovations.

In addition, the digital revolution and in particular new financial technologies are great innovation drivers for the international financial sector. Here too, the Liechtenstein financial centre is positioning itself at the forefront of the competition for the best FinTech solutions. Investors are supported by the government and Liechtenstein’s Financial Market Authority (FMA), which are promoting innovations in the FinTech field through various innovations. The FMA’s Regulatory Laboratory serves as a port-of-call for start-ups and established financial services providers who have questions relating to the FinTech field. The FMA is guided by the principle that regulations must comply with European standards and must be used and configured so that innovative business models can be realised, while ensuring client protection.

Through its “Innovation Clubs” the government also offers a state innovation process for improving economic operating conditions. If necessary, amendments of statutory and in particular of supervisory operating conditions can be reviewed and proposed for implementation.

Legal & tax conformity

Liechtenstein pursues a clear strategy of tax conformity and plays an active role in the relevant bodies. Implementation of the standards was positively received by the Global Forum. Liechtenstein is continuously and actively expanding the network of bilateral double taxation conventions.

Transparency and Stability

At the international level, the introduction of the Automatic Exchange of Information (AEOI) as well as various double taxation conventions and tax information treaties, inter alia with Germany, Switzerland, Austria as well as the USA, safeguard legal security and recognition. Banks, insurers, fiduciaries, investment fund companies, asset managers and common-benefit foundations all value the Liechtenstein financial centre. The Principality of Liechtenstein is stable and sovereign, its financial centre is transparent, secure and professional.

Liechtenstein was one of the first states to commit itself to the applicable international standards on transparency and tax cooperation and pursues a clear strategy of tax compliance. This is underscored inter alia by the Liechtenstein Declaration and the Financial Centre Strategy of the Government. The country plays an active part in the relevant OECD and Global Forum bodies and is a recognised partner within the international community. Implementation of the standards pertaining to the exchange of tax information in Liechtenstein was positively received by the Global Forum.

Sustainability and philanthropy

Acting in a responsible, sustainable manner is a central component of Liechtenstein’s culture. Liechtenstein is establishing itself as a respected, sustainable and stable financial centre.

In December 2015 a new era was initiated at the Climate Conference in Paris when all member states of the UN agreed to support a new climate convention. This convention is also setting the future direction of the financial sector. After all, it too is affected by climate change and the associated risks. If it does not focus its investments on sustainably oriented companies and sectors in good time, then climate change could destroy assets.

Sustainable Products and Services

Sustainability is tangible in Liechtenstein. Liechtenstein is one of the most sustainable and innovative countries in the world. In 2020 Liechtenstein was ranked the 12th most sustainable country in the worldwide Global Sustainable Competitiveness Index of 180 countries around the world. The Liechtenstein financial centre has traditionally placed particular importance on the need to accept responsibility and to show commitment in the field of sustainability and has nurtured this through various activities and initiatives as well as special niche products. Sustainability plays an important role in Liechtenstein’s financial centre. It promotes the development of cutting-edge products and structures that take account of the sense of responsibility shown by clients towards society and the environment.

Socially Responsible Investment

This form of investment considers not only economic but also ecological, ethical, governance and social aspects. This enables investors to achieve a kind of ‘double return’: they generate an economic return and at the same time can sustainably promote their missions. Through the asset management of foundations and non-profit organisations, such sustainable investments offer the option of supporting the purpose of the recipient institutions.

Impact Investment

Sustainable investments are more than just an investment style or product category. For an increasing number of investors, they are becoming a personal mission and a different way of dealing with money. Their goal is the so-called impact that the investment makes. The question of the targeted impact of the investment on social, ecological, ethical or even governance goals of the investors is central to their motivation. Microfinance investment funds, green building investment funds or sustainable forest investments are examples that are already available on the market. Climate change is likely to continue playing a key role here.

Philanthropy – financial products for common-benefit purposes

In today’s world, the traditional philanthropic concept of merciful charity is undergoing changes. This means wealthy individuals are not necessarily donating less but are increasingly linking their donations to clear targets (venture philanthropy). In addition, an increasing number of organisations are discovering another way to do “good things” in the form of investment.

Liechtenstein offers the best location worldwide for charitable foundations and philanthropic engagement. This is the result of the Global Philanthropy Environment Index (GPEI) 2022, published by the Lilly Family School of Philanthropy at Indiana University published in March 2022.

| Liechtenstein Finance Finance e.V. is an Association organised under private law, whose members are the government of the Principality of Liechtenstein and the Liechtenstein financial centre associations. The purpose of the Association is to raise the profile of the Liechtenstein financial centre at home and abroad by providing information on the special features and strengths of the centre. Members of the association are: • The government of the Principality of Liechtenstein • Liechtenstein Bankers Association • Liechtenstein Institute of Professional Trustees and Fiduciaries • Association of Independent Asset Managers in Liechtenstein • Liechtenstein Investment Fund Association • Liechtenstein Insurance Association • Liechtenstein Chamber of Lawyers • Liechtensteinische Wirtschaftsprüfer-Vereinigung • Association of Liechtenstein charitable Foundations and Trusts e.V. • CFA Society Liechtenstein Further information www.finance.li Without subtitles finance.li/wp-content/uploads/2021/11/Finanzplatz_Erklaervideo_2021_EN.mp4 With subtitles finance.li/wp-content/uploads/2021/11/Finanzplatz_Erklaervideo_2021_EN_Untertitel.mp4 |

RECENT ARTICLES

-

Strong ESG records help firms take R&D global, study finds

Strong ESG records help firms take R&D global, study finds -

How residence and citizenship programmes strengthen national resilience

How residence and citizenship programmes strengthen national resilience -

Global leaders enter 2026 facing a defining climate choice

Global leaders enter 2026 facing a defining climate choice -

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change -

China’s BYD overtakes Tesla as world’s largest electric car seller

China’s BYD overtakes Tesla as world’s largest electric car seller -

UK education group signs agreement to operate UN training centre network hub

UK education group signs agreement to operate UN training centre network hub -

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing -

Oxford to host new annual youth climate summit on UN World Environment Day

Oxford to host new annual youth climate summit on UN World Environment Day -

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan -

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns -

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests -

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement -

Historic motorsport confronts its energy future

Historic motorsport confronts its energy future -

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation -

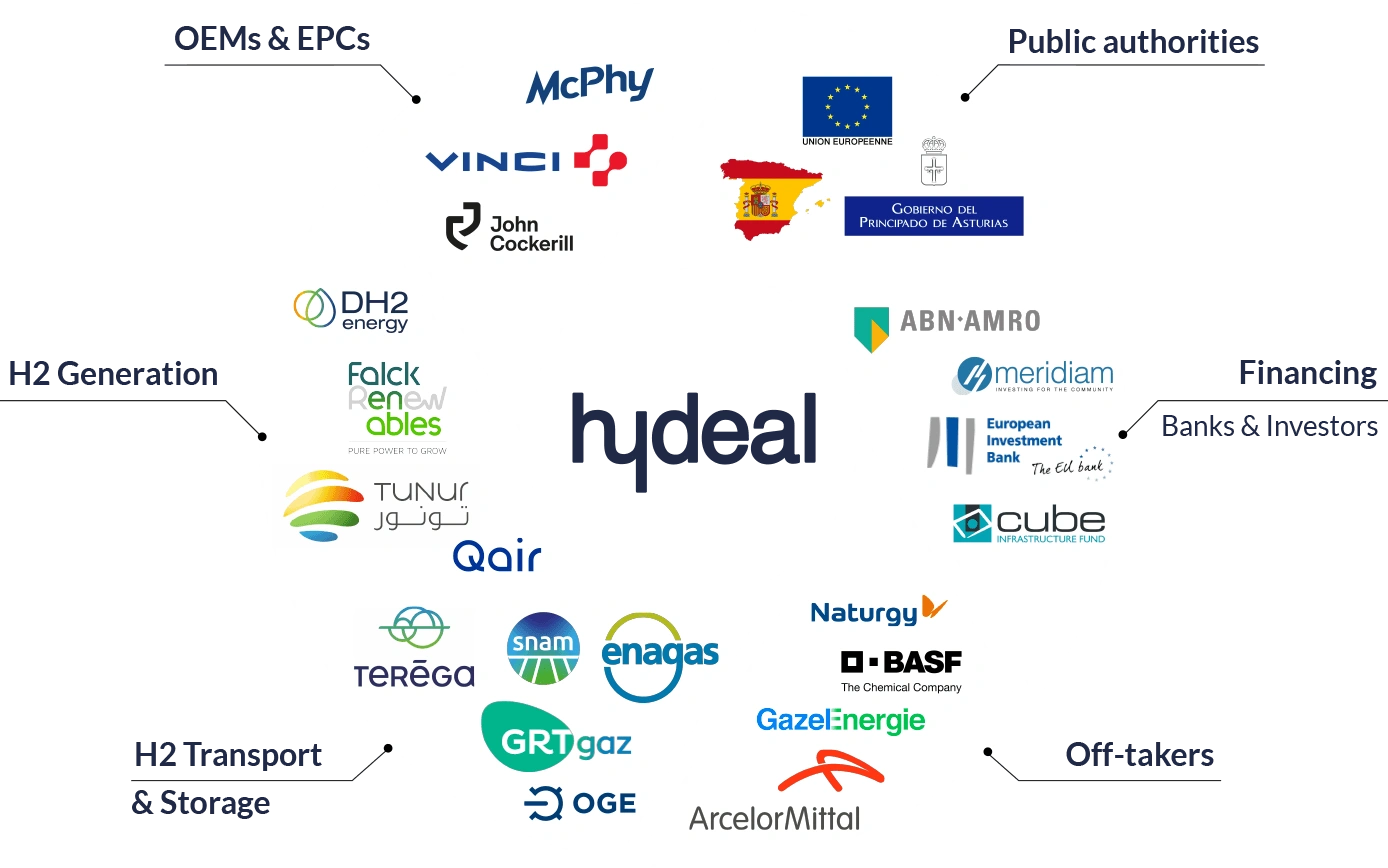

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe -

Fabric of change

Fabric of change -

Courage in an uncertain world: how fashion builds resilience now

Courage in an uncertain world: how fashion builds resilience now -

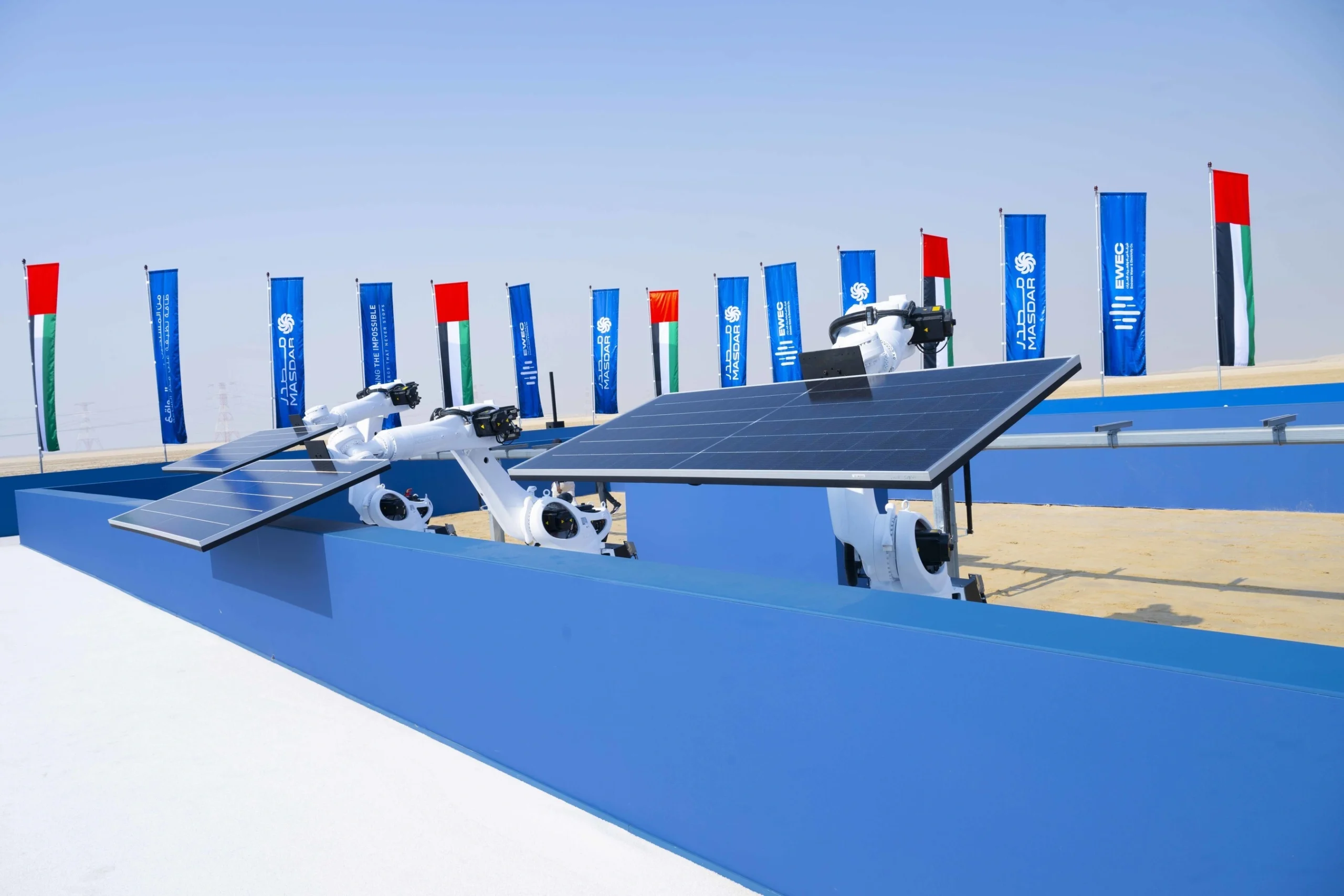

UAE breaks ground on world’s first 24-hour renewable power plant

UAE breaks ground on world’s first 24-hour renewable power plant -

China’s Yancheng sets a global benchmark for conservation and climate action

China’s Yancheng sets a global benchmark for conservation and climate action -

Inside Iceland’s green biotechnology revolution

Inside Iceland’s green biotechnology revolution -

Global development banks agree new priorities on finance, water security and private capital ahead of COP30

Global development banks agree new priorities on finance, water security and private capital ahead of COP30 -

UK organisations show rising net zero ambition despite financial pressures, new survey finds

UK organisations show rising net zero ambition despite financial pressures, new survey finds -

Gulf ESG efforts fail to link profit with sustainability, study shows

Gulf ESG efforts fail to link profit with sustainability, study shows -

Redress and UN network call for fashion industry to meet sustainability goals

Redress and UN network call for fashion industry to meet sustainability goals -

World Coastal Forum leaders warn of accelerating global ecosystem collapse

World Coastal Forum leaders warn of accelerating global ecosystem collapse