Finance for the greater good

John E. Kaye

- Published

- Home, Sustainability

Jim Coupe, Managing Director of Skipton International, discusses the firm’s commitment to the UN’s Principles for Responsible Banking, and why others should follow

Recent statistics on the global climate emergency are sobering, and it’s time for organisations to stop the talking and embrace the advice being given in adopting solid working practices for the good of us all. The United Nations Environment Programme Finance Initiative (UNEP FI) is a force for change that all financial organisations can – and should – consider joining.

UNEP FI: Vision statement

- To create a financial sector that positively impacts and serves people and planet.

Mission statement

- To accelerate the global development of financial institutions that integrate sustainability as a value creation driver and which contribute to the UN sustainable development goals.

In our world of finance, growing the business sustainably means striking a sometimes-delicate balance between profitability, asset growth, building capital and investing in the future (including, systems, branches, people, communities and perhaps also the wider movement). There are also potential conflicts to manage between the interests of savers and borrowers.

Skipton International has become the first Channel Island-based organisation in the banking sector to commit to UNEP FI, further strengthening its efforts towards a sustainable future. To enhance our current sustainability strategy, Skipton International now aligns itself to the UNEP FI’s Principles for Responsible Banking, which creates best working practice on topics from climate and the environment, to gender equality and financial inclusion.

Skipton’s commitment to the Principles for Responsible Banking is an important step towards aligning the banking sector with the UN Paris Agreement on Climate Change and Sustainable Development Goals. Nearly 250 banks across the world have joined this movement for change, which asks signatories to analyse their impact on people and the planet, set and implement targets and publicly report on their progress. The initiative aligns itself to the United Nation’s Sustainable Development Goals and the Paris Climate Agreement.

In 2020 we released our first Sustainability Report, communicating targets to our customers, stakeholders and the public. It looked to prioritise four of the UN’s Sustainable Development Goals: Building sustainable cities and communities; Offering decent work and economic growth; Undertaking responsible consumption; and, Supporting peace, justice and strong institutions. We have set ourselves firm targets to reduce paper consumption by 33% per customer by 2022, and offset 125% of our carbon footprint, becoming annually carbon negative. We have also committed to increasing the amount of time our colleagues volunteer for charitable work during office hours by 300% in 2022, allowing them to give back to our communities.

We are always looking for ways to build upon our existing goals and to give back more to the environment than we take, so signing up to this initiative was a natural progression for Skipton. By following the UN’s Principles for Responsible Banking, Skipton will be aligning itself to international best practice, while supporting Guernsey’s Green Finance agenda internationally. We are keen to develop the idea of responsible banking whilst considering the needs of our customers and that means being a good corporate citizen. We hope this will inspire others to follow suit.

About the author

Jim Coupe has been at the helm of Skipton International for the last decade. During his tenure, the Guernsey-licenced bank has seen huge growth and adopted a number of positive changes, none more so than embracing an ethos of sustainability, diversity and accessibility.

For further information:

www.skiptoninternational.com

RECENT ARTICLES

-

Strong ESG records help firms take R&D global, study finds

Strong ESG records help firms take R&D global, study finds -

How residence and citizenship programmes strengthen national resilience

How residence and citizenship programmes strengthen national resilience -

Global leaders enter 2026 facing a defining climate choice

Global leaders enter 2026 facing a defining climate choice -

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change -

China’s BYD overtakes Tesla as world’s largest electric car seller

China’s BYD overtakes Tesla as world’s largest electric car seller -

UK education group signs agreement to operate UN training centre network hub

UK education group signs agreement to operate UN training centre network hub -

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing -

Oxford to host new annual youth climate summit on UN World Environment Day

Oxford to host new annual youth climate summit on UN World Environment Day -

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan -

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns -

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests -

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement -

Historic motorsport confronts its energy future

Historic motorsport confronts its energy future -

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation -

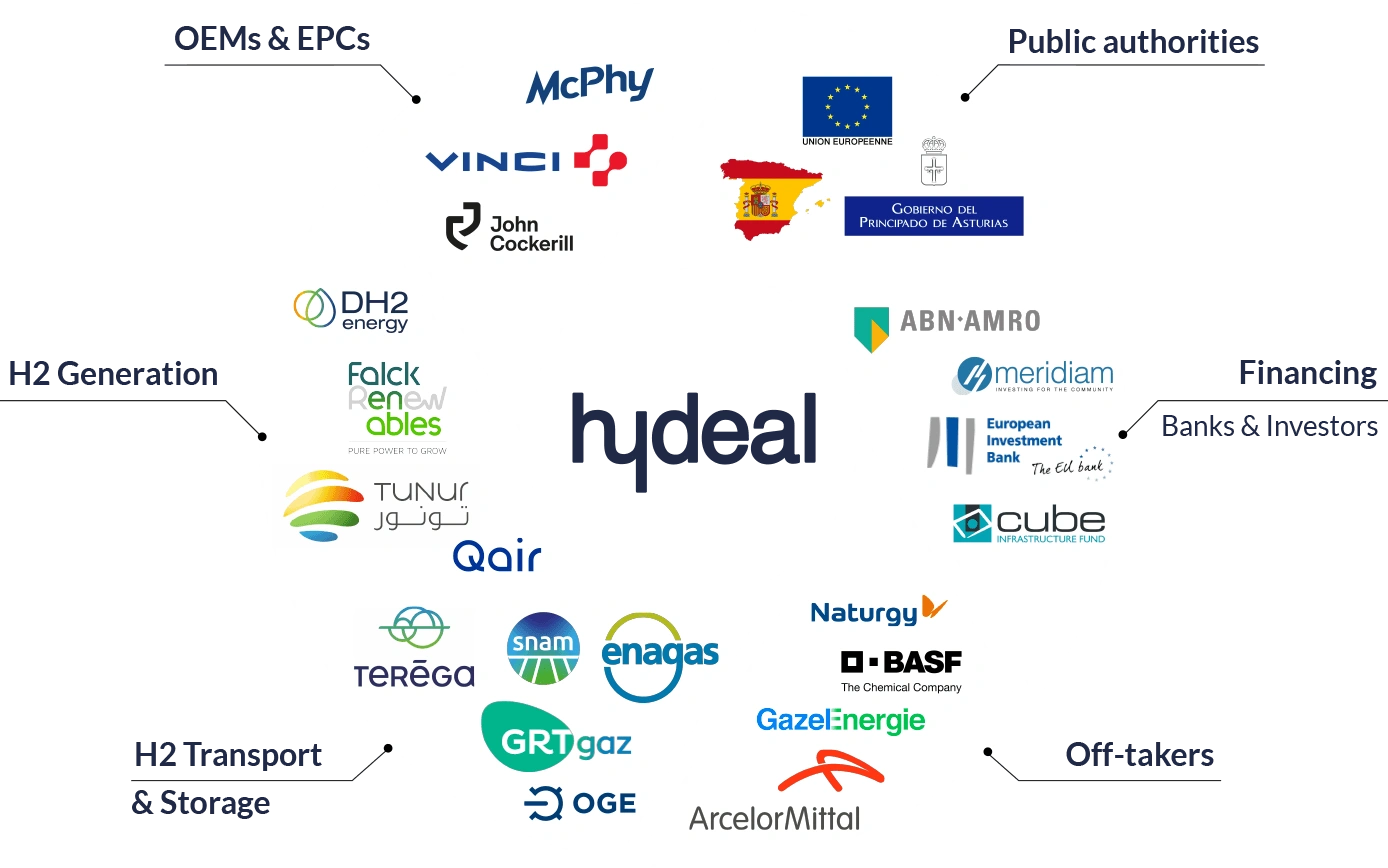

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe -

Fabric of change

Fabric of change -

Courage in an uncertain world: how fashion builds resilience now

Courage in an uncertain world: how fashion builds resilience now -

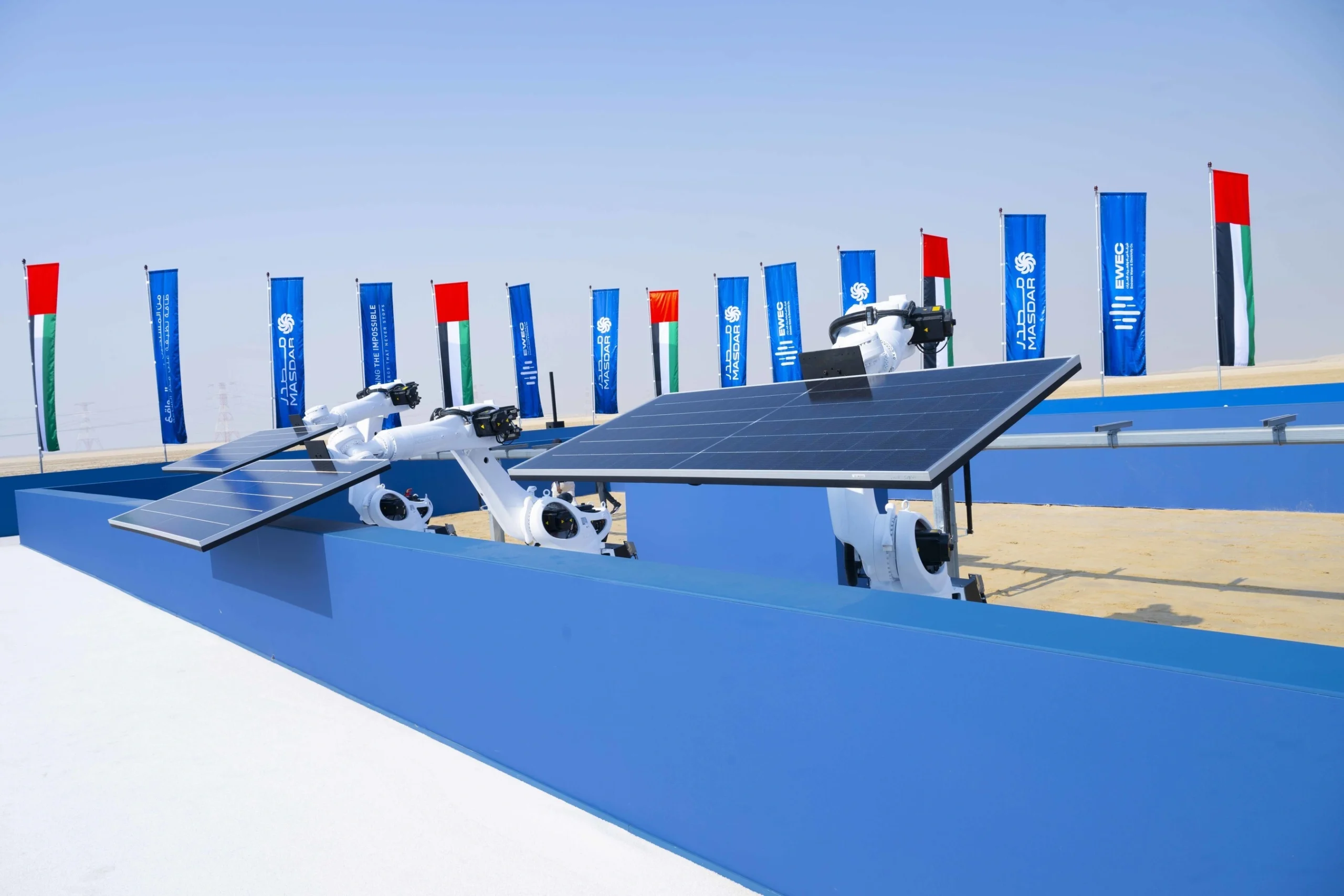

UAE breaks ground on world’s first 24-hour renewable power plant

UAE breaks ground on world’s first 24-hour renewable power plant -

China’s Yancheng sets a global benchmark for conservation and climate action

China’s Yancheng sets a global benchmark for conservation and climate action -

Inside Iceland’s green biotechnology revolution

Inside Iceland’s green biotechnology revolution -

Global development banks agree new priorities on finance, water security and private capital ahead of COP30

Global development banks agree new priorities on finance, water security and private capital ahead of COP30 -

UK organisations show rising net zero ambition despite financial pressures, new survey finds

UK organisations show rising net zero ambition despite financial pressures, new survey finds -

Gulf ESG efforts fail to link profit with sustainability, study shows

Gulf ESG efforts fail to link profit with sustainability, study shows -

Redress and UN network call for fashion industry to meet sustainability goals

Redress and UN network call for fashion industry to meet sustainability goals -

World Coastal Forum leaders warn of accelerating global ecosystem collapse

World Coastal Forum leaders warn of accelerating global ecosystem collapse