Where challenges become opportunities

John E. Kaye

- Published

- Home, Sustainability

Latin American companies have plenty of room for improving their corporate sustainability practices and can make ESG a driver of competitiveness, says Rosmary Lozano of Credicorp Capital Asset Management

Responsible investment – the incorporation of ESG factors in investment – has expanded globally at a signifi cant pace in recent years. Initially championed by investors from developed markets (DM), there is now a broader consensus around the benefi ts of this approach. However, some investors are sceptical about the implementation of ESG strategies in emerging markets (EM). Companies in EM face additional challenges to those in DM, and it may appear that they are not as interested in ESG performance. Sustainability is sometimes perceived as a luxury, only aff ordable aft er achieving a certain level of growth and development. As such, how can investors implement a responsible and sustainable approach in such regions? Specifi cally, in Latin America, how can we invest responsibly and sustainably in a context highly dependent on extractive industries, prone to social and political unrest, and institutional challenges?

It is already known that companies in EM and Latin America lag those in DM in ESG ratings. But responsible investment is more than excluding issuers or selecting best-in-class ESG performers. Responsible investment also encompasses strategies as ESG integration and active ownership. Integrating ESG analysis into the traditional assessment of fundamentals and valuation has proven to reduce downside risks and foster returns from identifying new trends and opportunities. Considering the challenges in the region, ESG is more of a necessity rather than an amenity when investing in Latin America.

ESG integration as a source of alpha generation

ESG integration improves our understanding of the opportunities and risks faced by the companies under review, including identifying structural trends among and within sectors. As active investors, we seek to incorporate the ESG-related risks and upside potential adequately into the pricing of the securities. Responsible investment is a source of alpha generation as much as a tool for risk mitigation. Th e fi nal objective is to generate superior returns for our clients.

The current ESG performance of the issuers is as relevant as the potential for improvement in the future. Latin American companies have plenty of room for improving their corporate sustainability practices and make ESG a driver of competitiveness. Regional challenges are also opportunities, as demonstrated by the Covid-19 emergency, which catalysed a faster catch-up in the tech sector. According to MSCI, the Latin American stock index has a higher percentage of ESG leaders than the remaining EM since 2019. However, the share of laggards in Latin America also increased in the past years. To separate the wheat from the chaff , investors need a deep knowledge of the issuers in the Latin American context and an actively managed strategy.

At Credicorp Capital Asset Management, we aim to have a robust understanding of the companies in which we invest, their value-chain, and their relationship with their key stakeholders. A proprietary research team combines macroeconomic, industry, and ESG analysis to identify sound investment ideas. Our well-established and on-the-ground presence in the region provides access to the management of companies and an extensive network of local and regional experts from the private and public sectors. These resources inform our investment process to identify the alternatives that will generate more value for our portfolios over the long-term.

The Credicorp Capital Latin American Equity Fund is a perfect example of the success of this approach. The fund was designed in 2018 with ESG integration as a pillar of the investment philosophy. As of the end of July 2021, the fund had consistently outperformed its benchmark, accumulating over 23% of alpha since inception. “Our ESG capabilities are recognised outside of the region. As a result, since 2019, we advise East Capital, a global firm specialised in EM and frontier markets, in the search for opportunities in Latin America and active ownership for its Global EM Sustainable strategy,” says Santiago Arias, Head of Equities at Credicorp Capital Asset Management.

Contributing to building the ESG ecosystem through active ownership

As responsible investors, we seek to foster the advance of the ESG performance of our investments. Active ownership practices like engagement and voting are tools to communicate our expectations to the companies and influence them to improve their reporting, transparency, and management of ESG and financial issues. Investors stewardship allows us to raise awareness of the importance of sustainability among Latin American issuers. Successful engagements generate financial returns and positive social and environmental impact. In this way, from our role in the financial and capital markets, we can contribute to the sustainable development of the region.

Investors in the region are coming together to conduct collaborative engagements as well. For instance, Credicorp Capital Asset Management and a group of PRI signatories signed a petition to Colombian issuers encouraging them to improve their sustainability reporting based on global best practices and standards. The PRI has been paramount in the expansion of responsible investment in Latin America in recent years. Sustainability challenges, such as biodiversity loss and deforestation, to name a few, need a coordinated response from a system perspective, including companies, investors, academicians, and policymakers. As such, we complement our direct engagements with companies with participation in other initiatives targeting both the private and public sector, like CDP and the Investor Policy Dialogue on Deforestation Initiative in Brazil.

There is a long way to go in responsible investment in the region. Since 2020, we have reinforced our commitment, formalising and extending our ESG practices. We published our Responsible Investment Policy and joined the PRI. Also, our team of over 150 professionals completed training on ESG fundamentals. Recognising this journey, our clients nominated us to participate in the ALAS20 award in Chile, Colombia, and Peru for the first time in 2021. We will continue to advance our responsible and sustainable investment practices to generate superior returns for our clients and promote the sustainable development of Latin America.

For further information:

Sign up to The European Newsletter

RECENT ARTICLES

-

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing -

Oxford to host new annual youth climate summit on UN World Environment Day

Oxford to host new annual youth climate summit on UN World Environment Day -

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan -

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns -

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests -

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement -

Historic motorsport confronts its energy future

Historic motorsport confronts its energy future -

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation -

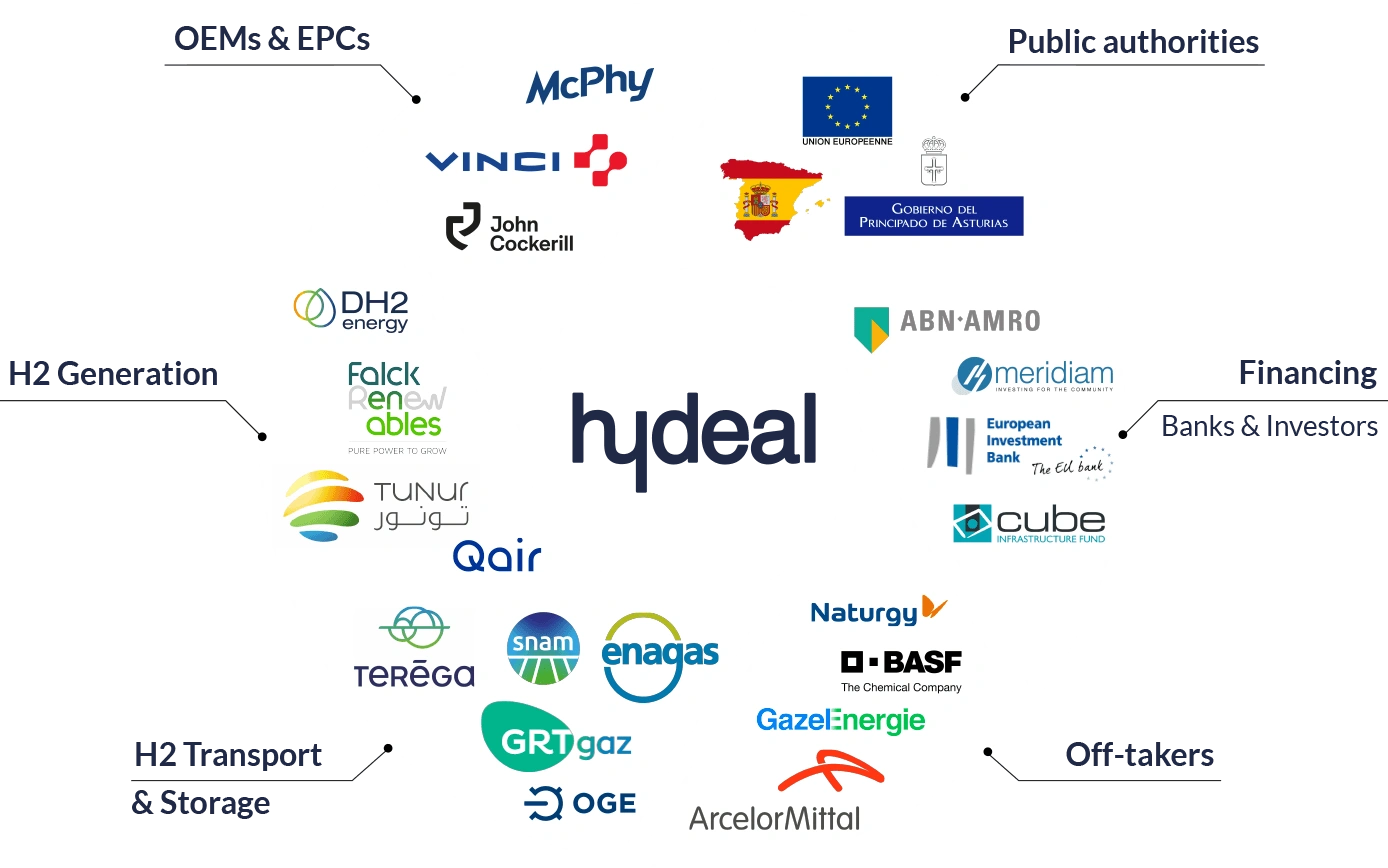

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe -

Fabric of change

Fabric of change -

Courage in an uncertain world: how fashion builds resilience now

Courage in an uncertain world: how fashion builds resilience now -

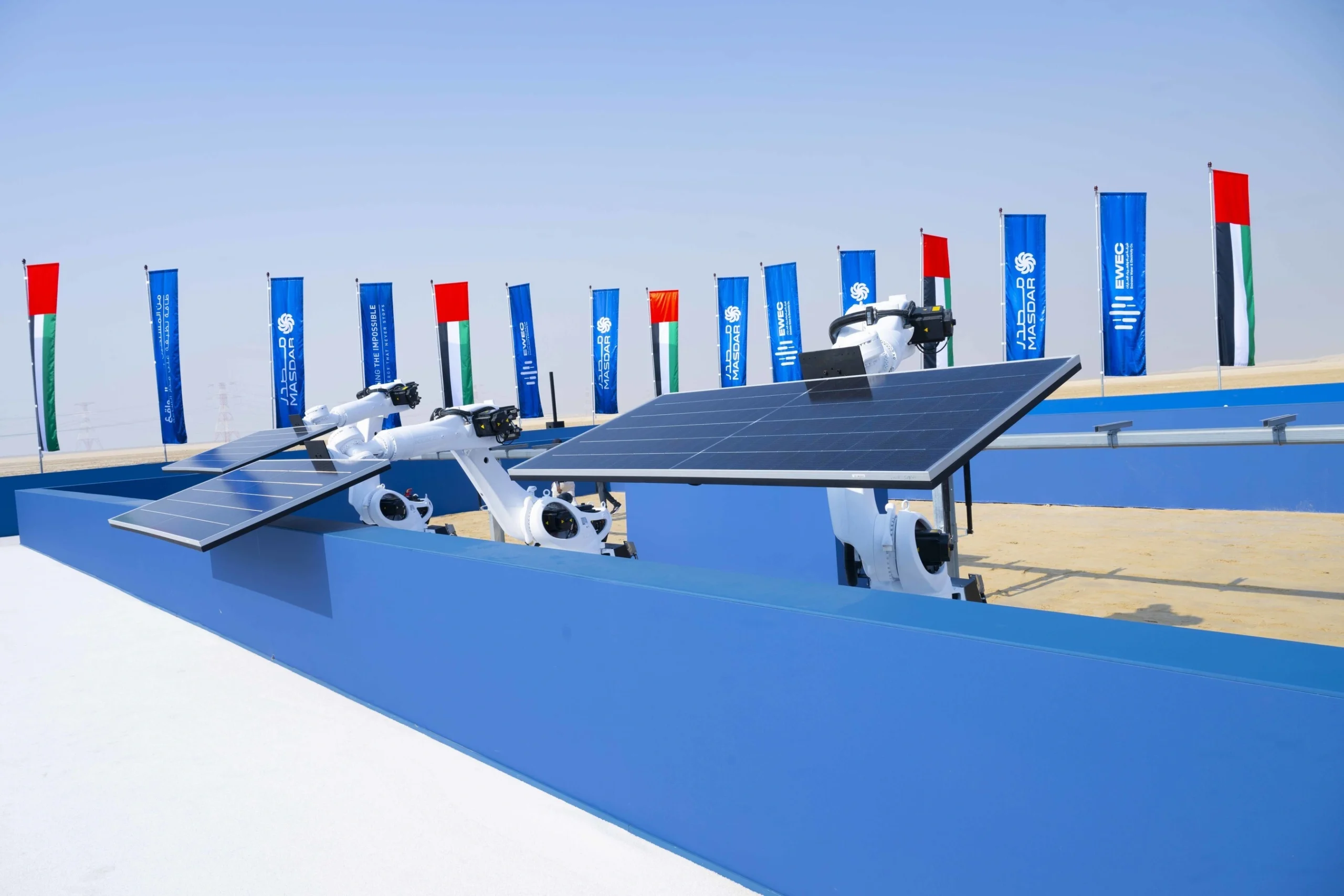

UAE breaks ground on world’s first 24-hour renewable power plant

UAE breaks ground on world’s first 24-hour renewable power plant -

China’s Yancheng sets a global benchmark for conservation and climate action

China’s Yancheng sets a global benchmark for conservation and climate action -

Inside Iceland’s green biotechnology revolution

Inside Iceland’s green biotechnology revolution -

Global development banks agree new priorities on finance, water security and private capital ahead of COP30

Global development banks agree new priorities on finance, water security and private capital ahead of COP30 -

UK organisations show rising net zero ambition despite financial pressures, new survey finds

UK organisations show rising net zero ambition despite financial pressures, new survey finds -

Gulf ESG efforts fail to link profit with sustainability, study shows

Gulf ESG efforts fail to link profit with sustainability, study shows -

Redress and UN network call for fashion industry to meet sustainability goals

Redress and UN network call for fashion industry to meet sustainability goals -

World Coastal Forum leaders warn of accelerating global ecosystem collapse

World Coastal Forum leaders warn of accelerating global ecosystem collapse -

Miliband: 'Great British Energy will be self-financing by 2030'

Miliband: 'Great British Energy will be self-financing by 2030' -

New ranking measures how Europe’s biggest retailers report on sustainability

New ranking measures how Europe’s biggest retailers report on sustainability -

Music faces a bum note without elephant dung, new research warns

Music faces a bum note without elephant dung, new research warns -

Scientists are racing to protect sea coral with robots and AI as heatwaves devastate reefs

Scientists are racing to protect sea coral with robots and AI as heatwaves devastate reefs -

Munich unveils new hydrogen lab as Europe steps up green energy race

Munich unveils new hydrogen lab as Europe steps up green energy race -

Seaweed and wind turbines: the unlikely climate double act making waves in the North Sea

Seaweed and wind turbines: the unlikely climate double act making waves in the North Sea