Driving startups to success

John E. Kaye

- Published

- Banking & Finance, Home, Sustainability

Investment from T Bridge Venture Partners has created new horizons for many startups across a variety of sectors

Founded by Fope Oluleye in 2017, T Bridge Venture Partners invests in startups across a diverse range of industries. Its interests are global, with companies from the UK, Europe, Africa, America and Asia all currently on the T Bridge portfolio. As an organisation, T Bridge believes in the power of collaboration, which often means ushering in experienced professionals to investee companies to help them grow and ultimately succeed.

Investment focus

T Bridge invests in companies from the seed stage up to series B funding, with a focus on the following sectors: property technology, consumer retail, fintech, renewable energy, TMT, and agritech. The renewable energy fund drives alternative energy initiatives in Africa through its subsidiary BrightStar Solar Global.

With sustainability at its core, BrightStar Solar Global is an essential part of T Bridge’s ESG strategy and underlines its long-term commitment to socially responsible investment.

Having established a partnership with BrightStar Solar Global through a £500m fund, T Bridge now supports the company’s mandate of producing 1000MW of renewable energy by 2022. BrightStar has signed up with the Nigerian government to produce electricity across the country; it already has a 30MW solar farm operational and has set its sights on generating another 300MW nationwide. BrightStar has signed a memorandum of understanding with a major bank to roll out solar installations at homes across Nigeria, in addition BrightStar aims to launch installations at businesses and industrial locations.

The company’s ambition is to become a key player in the renewable energy market in sub-Saharan Africa and beyond.

ESG: First on the agenda

As part of the investment process, T Bridge conducts a thorough evaluation to ascertain a company’s risk/reward profile. It pays particular attention to a company’s governance structure and practices as well as risks associated with environmental and social factors, where applicable. Proactive engagement with the board and management teams at companies in which T Bridge invests is an essential part of the process. Consistent with its approach as long-term investors, ESG issues are addressed from the outset.

The strategic outlook is geared towards companies that are seeking to have a positive impact on the environment, and T Bridge’s know-how in driving towards this is very much part of its current success. T Bridge welcomes companies that might be looking at ways to offset their carbon emissions, such as intensive manufacturing or oil companies. The company creates partnerships to leverage its expertise in renewable energy investment and seeks to have a positive impact on the future of our planet.

T Bridge believes that partnering with pension funds and oil and gas companies that seek to positively influence the ESG agenda, through investing in renewable energy, infrastructure can be mutually beneficial. It becomes even more crucial as large pension funds are moving away from companies that do not have a positive ESG policy, such as Norway’s pension fund divestment of £5.75bn of oil and gas stocks, and similarly PenSam a Danish pension fund worth £13bn that has removed 100% of oil and gas companies from its portfolio over the past three years in an effort to focus on companies that prioritise renewable energy and sustainability initiatives.

T Bridge’s partnership with BrightStar Solar Global is key to unlocking an impactful and positive ESG investment agenda. The company’s investment in renewable energy technologies maximises its expertise and aims to boost innovation within

the sector.

The road ahead

The past decade has witnessed a change in FDI policies as governments, particularly in emerging economies, have removed many restrictions on financial flows in and out of their countries. The greater mobility of capital, coupled with extensive privatisation has resulted in a five-fold rise in

private investment flows. Developing renewable energy in Africa is crucial to combatting climate change. Therefore it’s the vision of T Bridge Venture Capital to maximise investment opportunities in this area.

The decline in the oil market earlier on this year signalled a turning point towards green energy and created new opportunities. Through BrightStar Solar Global, T Bridge has a vision of generating renewable power for businesses, schools, and hospitals and

a series of partnerships are currently

being developed to identify and help those

seeking alternative power.

Over the coming years, in partnership T Bridge, BrightStar Solar Global is confident it will deliver its goal of generating 1000MW across sub-Saharan Africa, delivering to businesses, industrial locations, homes and public services. It’s a challenge that T Bridge Venture Partners embraces, as it builds on its recent momentum to create a world leading company. ν

Further information

RECENT ARTICLES

-

Strong ESG records help firms take R&D global, study finds

Strong ESG records help firms take R&D global, study finds -

How residence and citizenship programmes strengthen national resilience

How residence and citizenship programmes strengthen national resilience -

Global leaders enter 2026 facing a defining climate choice

Global leaders enter 2026 facing a defining climate choice -

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change -

China’s BYD overtakes Tesla as world’s largest electric car seller

China’s BYD overtakes Tesla as world’s largest electric car seller -

UK education group signs agreement to operate UN training centre network hub

UK education group signs agreement to operate UN training centre network hub -

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing -

Oxford to host new annual youth climate summit on UN World Environment Day

Oxford to host new annual youth climate summit on UN World Environment Day -

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan -

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns -

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests -

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement -

Historic motorsport confronts its energy future

Historic motorsport confronts its energy future -

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation -

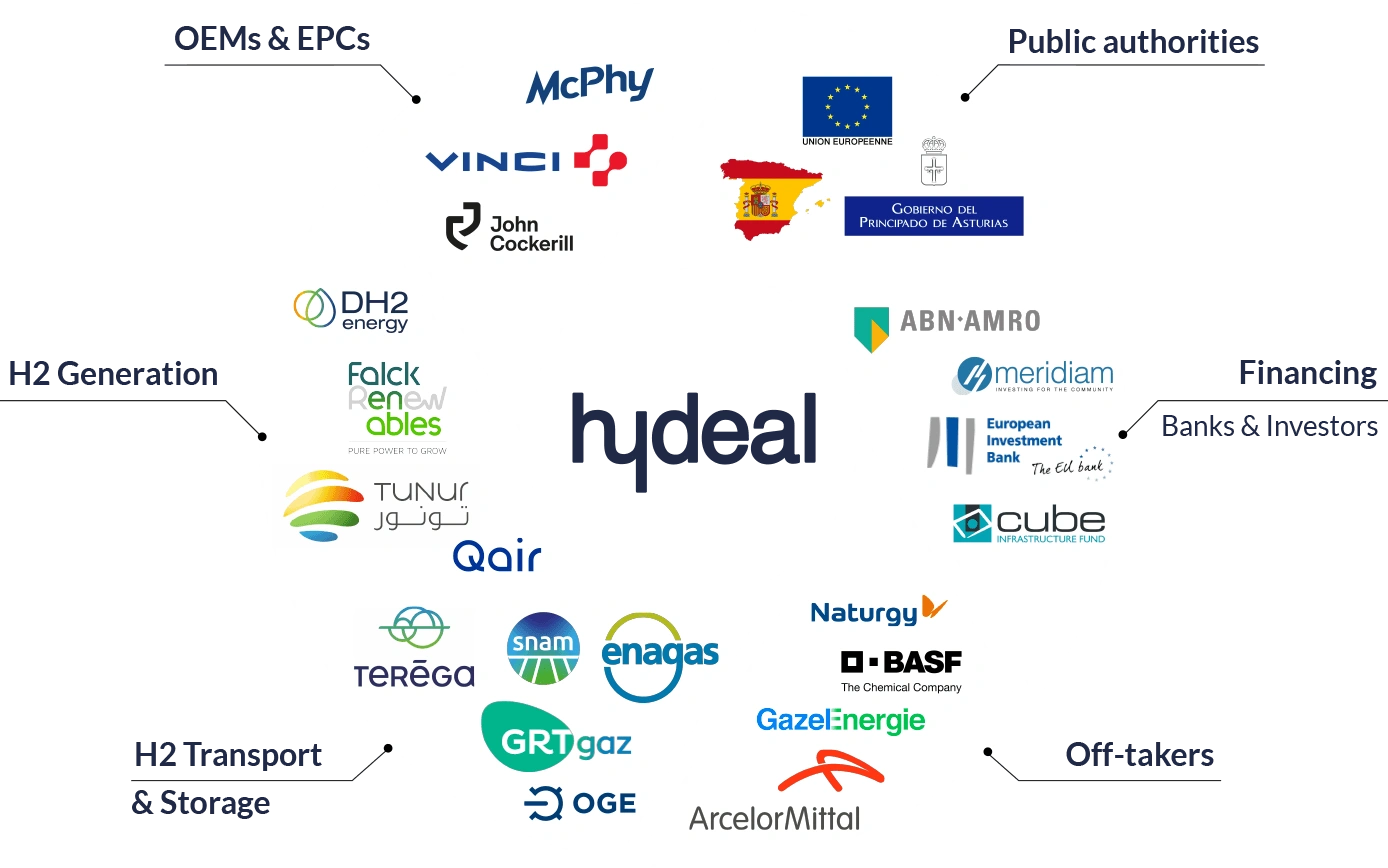

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe -

Fabric of change

Fabric of change -

Courage in an uncertain world: how fashion builds resilience now

Courage in an uncertain world: how fashion builds resilience now -

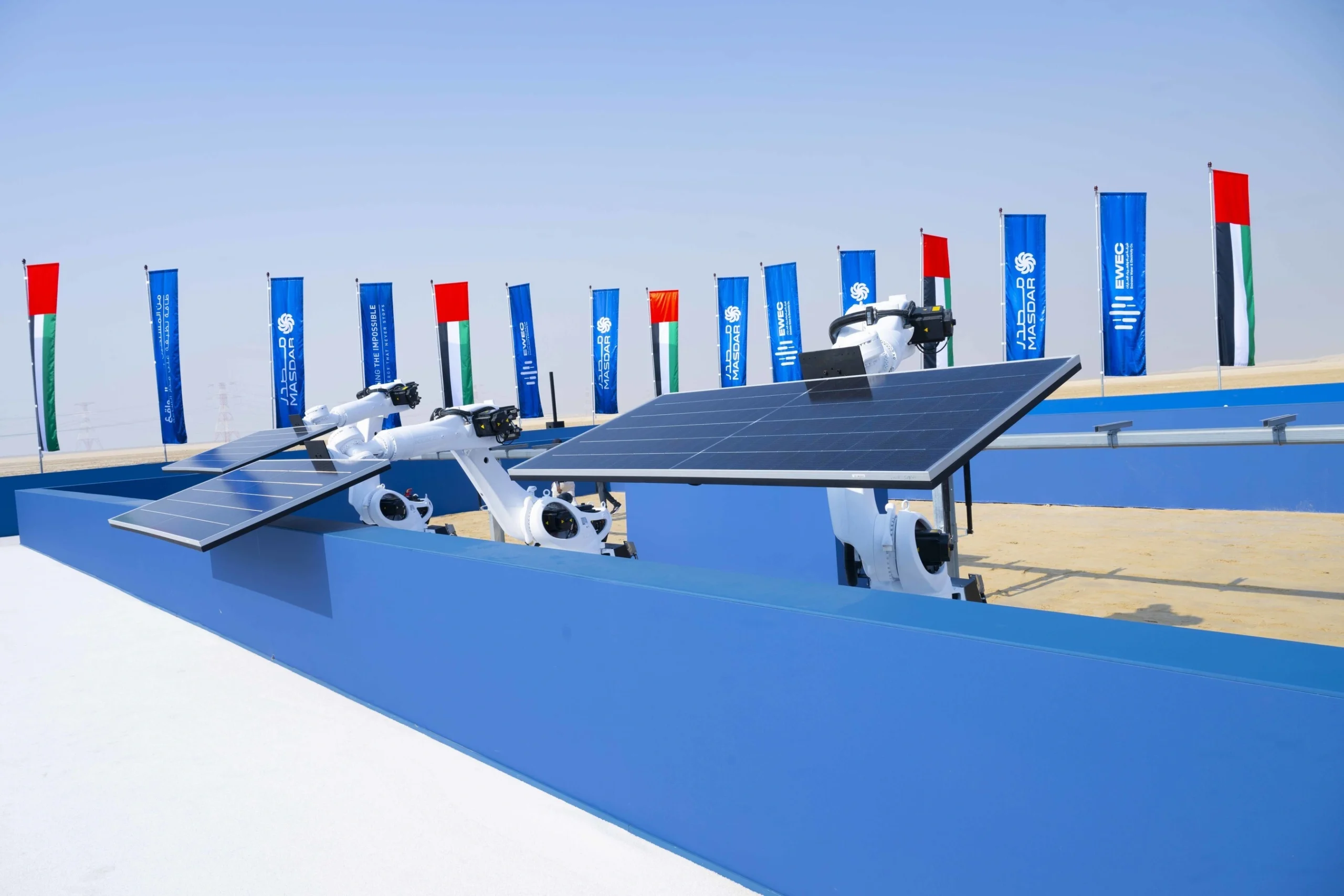

UAE breaks ground on world’s first 24-hour renewable power plant

UAE breaks ground on world’s first 24-hour renewable power plant -

China’s Yancheng sets a global benchmark for conservation and climate action

China’s Yancheng sets a global benchmark for conservation and climate action -

Inside Iceland’s green biotechnology revolution

Inside Iceland’s green biotechnology revolution -

Global development banks agree new priorities on finance, water security and private capital ahead of COP30

Global development banks agree new priorities on finance, water security and private capital ahead of COP30 -

UK organisations show rising net zero ambition despite financial pressures, new survey finds

UK organisations show rising net zero ambition despite financial pressures, new survey finds -

Gulf ESG efforts fail to link profit with sustainability, study shows

Gulf ESG efforts fail to link profit with sustainability, study shows -

Redress and UN network call for fashion industry to meet sustainability goals

Redress and UN network call for fashion industry to meet sustainability goals -

World Coastal Forum leaders warn of accelerating global ecosystem collapse

World Coastal Forum leaders warn of accelerating global ecosystem collapse