Bluefield Solar income fund signs power purchase agreement with Entech Leader Limejump

John E. Kaye

- Published

- Home, Sustainability

Leading energy tech company Limejump has signed a fixed price short-term Power Purchase Agreement (PPA) with Bluefield Solar Income Fund (BSIF), one of the UK’s major investors in the country’s utility scale solar PV sector. Limejump will manage the power sale for a portfolio of four solar farms, through its pioneering Virtual Power Platform (VPP). It is the first time that Bluefield has agreed to a PPA with Limejump.

This continual support for asset development increases confidence in the UK sustainable energy generation asset investment sector, building the way towards a Carbon net-zero future.

Bluefield invests in a diversified portfolio of solar energy assets, each located within the UK, with a focus on utility scale, ground-mounted assets. By signing this agreement with Limejump, and utilising Limejump’s energy trading systems and expertise in energy management, Bluefield was pleased to add Limejump to its PPA counterparties.

Limejump’s Vice President of Sales, Joe McDonald said: “This latest PPA agreement, with a one of the country’s leading renewable investment funds, highlights our ability to work with different types of asset owners, as well as different generation types and sizes across the full energy spectrum. We are delighted that Bluefield has chosen to use us to take full advantage of our Virtual Power Platform.”

Bluefield’s Group Finance Director, Neil Wood said: “We were impressed with what Limejump had to offer. They were competitively priced and being a part of Shell, are a strong and credible counterparty. We are delighted to welcome Limejump as one of our PPA off-takers.”

For further information visit:

RECENT ARTICLES

-

Strong ESG records help firms take R&D global, study finds

Strong ESG records help firms take R&D global, study finds -

How residence and citizenship programmes strengthen national resilience

How residence and citizenship programmes strengthen national resilience -

Global leaders enter 2026 facing a defining climate choice

Global leaders enter 2026 facing a defining climate choice -

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change -

China’s BYD overtakes Tesla as world’s largest electric car seller

China’s BYD overtakes Tesla as world’s largest electric car seller -

UK education group signs agreement to operate UN training centre network hub

UK education group signs agreement to operate UN training centre network hub -

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing -

Oxford to host new annual youth climate summit on UN World Environment Day

Oxford to host new annual youth climate summit on UN World Environment Day -

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan -

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns -

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests -

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement -

Historic motorsport confronts its energy future

Historic motorsport confronts its energy future -

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation -

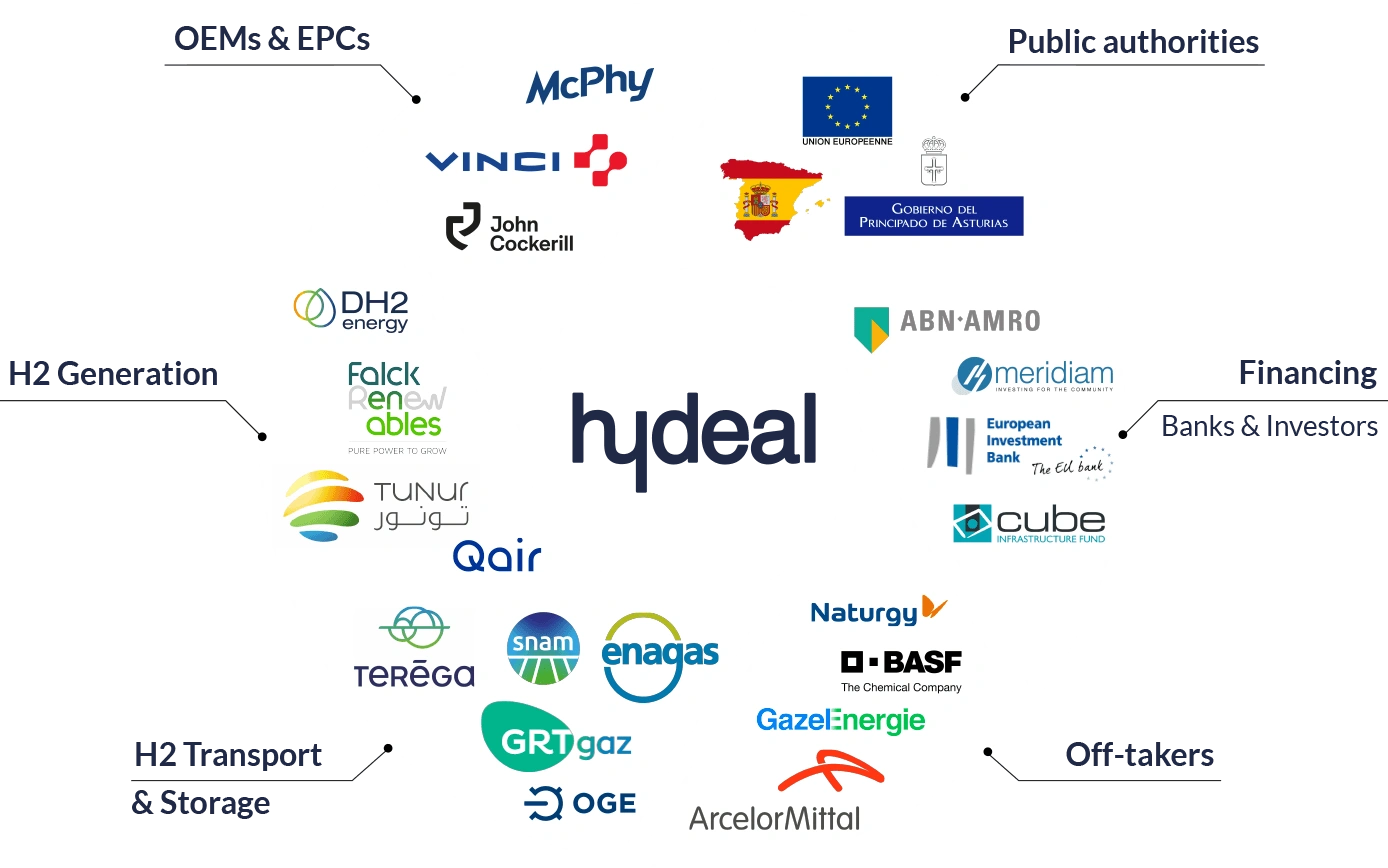

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe -

Fabric of change

Fabric of change -

Courage in an uncertain world: how fashion builds resilience now

Courage in an uncertain world: how fashion builds resilience now -

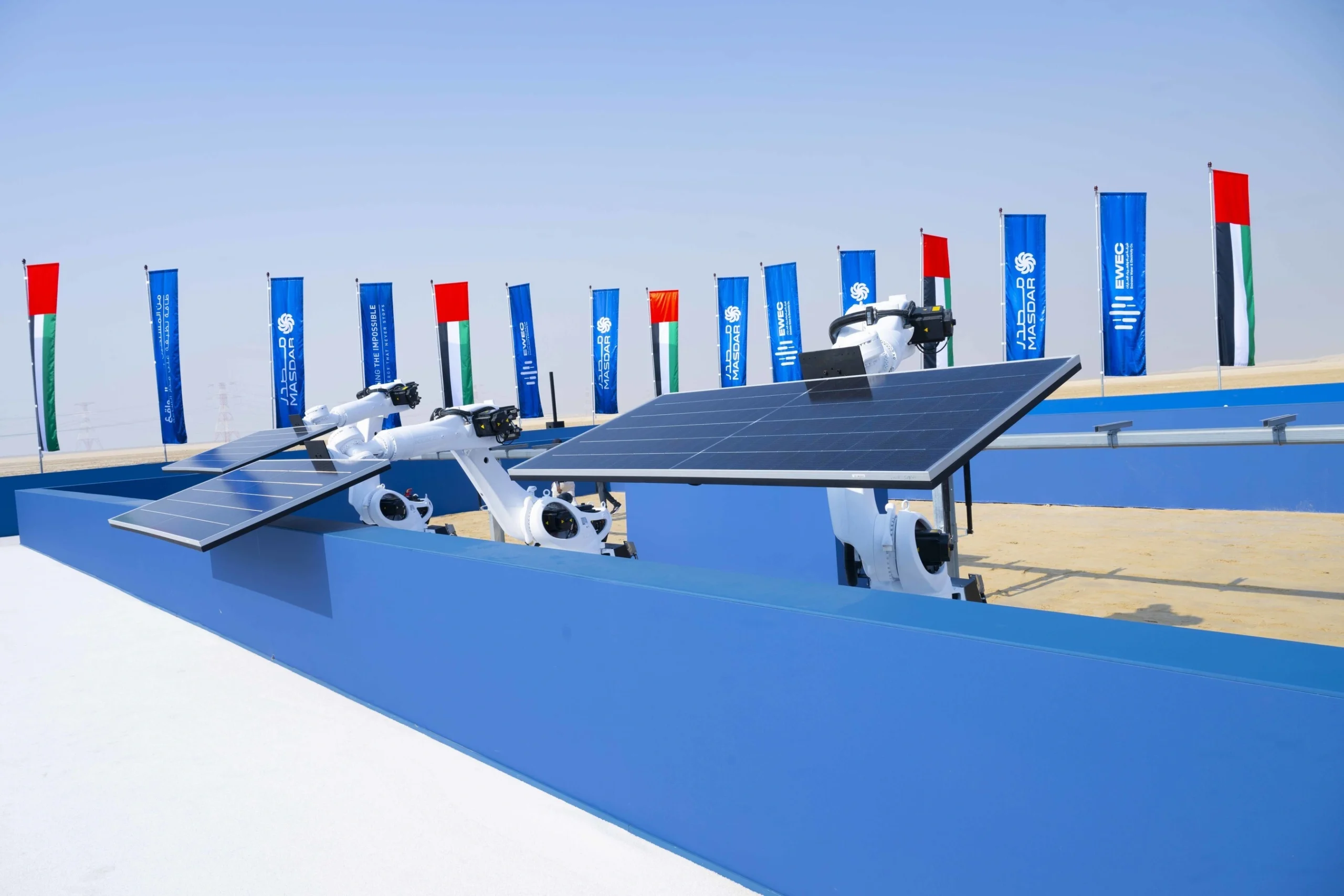

UAE breaks ground on world’s first 24-hour renewable power plant

UAE breaks ground on world’s first 24-hour renewable power plant -

China’s Yancheng sets a global benchmark for conservation and climate action

China’s Yancheng sets a global benchmark for conservation and climate action -

Inside Iceland’s green biotechnology revolution

Inside Iceland’s green biotechnology revolution -

Global development banks agree new priorities on finance, water security and private capital ahead of COP30

Global development banks agree new priorities on finance, water security and private capital ahead of COP30 -

UK organisations show rising net zero ambition despite financial pressures, new survey finds

UK organisations show rising net zero ambition despite financial pressures, new survey finds -

Gulf ESG efforts fail to link profit with sustainability, study shows

Gulf ESG efforts fail to link profit with sustainability, study shows -

Redress and UN network call for fashion industry to meet sustainability goals

Redress and UN network call for fashion industry to meet sustainability goals -

World Coastal Forum leaders warn of accelerating global ecosystem collapse

World Coastal Forum leaders warn of accelerating global ecosystem collapse