The benefits of seeing the bigger picture

John E. Kaye

- Published

- Executive Education, Home, Sustainability

Companies looking to boost ESG performance shouldn’t focus CEO incentives on short-term sales or long-term share price, but instead take a wider view, says Xavier Baeten of Vlerick Business School

Companies are taking ESG performance more seriously, there is no denying that. Whether it is Apple committing to using 100% sustainable green energy at their production facilities or eBay partnering with the US Postal Service to provide green shipping options, more and more large corporate firms are understanding their impact on society, and looking to implement initiatives that offset this impact, and have a positive impact on the environment.

And this increased focus on a firm’s ESG performance is not just anecdotal. Increasingly, firms are looking to implement more sustainability initiatives and rewarding their CEO for tackling this issue head on, and making it a key focus for their firm. The adage “what gets rewarded gets done” also counts for ESG. Over the last five years, across Europe’s leading CEOs, we’ve seen a 20% increase in CEOs having short-term incentives focused on ESG (from 40% to 60% of the firms), and in the long-term incentives have doubled from 10% to 27% of CEOs.

So, if firms are keen to boost ESG performance, and are offering incentives focused around the environment to CEOs in order to do so, surely this is only going to boost ESG performance? Well, that is not the case from our research into the leading European CEOs. Strangely enough, we actually found that CEOs with short-term incentives focused on the environment are more likely to be harmful to the firm’s wider ESG performance. But why is this? We think it is related to the newness of setting environmental targets, which creates dilemmas such as, what measures do you use? And where and how do you set targets? Boards are struggling with this. But of course, there is more than just environmental KPIs in incentive systems. So, I became interested in analysing which CEO incentives actually increase ESG performance, and which incentives negatively impact ESG.

This question was part of a wider study I conducted alongside my colleague Marthe Van Hove, a Research Associate at Vlerick Business School. As part of a yearly research project, we study the pay levels and incentives of the CEOs of the leading 600 European firms. This in-depth study looks into the CEOs of the STOXX Europe 600 – which includes firms such as Adidas, Santander, Unilever and Tesco. The study reviews not only the pay level, mix of incentives and criteria needed to hit these incentives for each CEO, but also how these have changed over time, and any wider trends in the market. For instance, we identified the impact that the Covid-19 pandemic had on CEO bonuses, finding that CEOs average remuneration dropped by 13% in 2020, down to €2.59m. Over this period, short-term incentives decreased for CEOs, whilst the average grant value of long-term incentives increased.

More specifically, we studied a number of CEO incentives and the direct impact these had on the ESG performance of firms, to understand which incentives helped to boost ESG initiatives. Ultimately, these findings will help firms to understand where they are going wrong with CEO incentivisation, and how to adapt it to focus on key ESG performance.

Digging into KPIs

CEOs are incentivised in a vast number of ways, and these incentives are broken down into a very specific percentage to incentivise specifically and effectively. Incentives are being driven by either financial measures or non-financial measures (and in a lot of cases a combination of both), designed to motivate the CEO to reach a very specific, focused target for the company. An important added value of our study is that it took a deep-dive into these so-called key performance indicators.

Regarding financial measures, these can be based on a number of key areas. The majority of firms include profit and sales focused incentives in their reward schemes, ensuring that the company is hitting these sales targets. Whilst financial measures can also focus around increasing their companies’ shares or economic profit, reducing their costs or debts, or specific accounting-based incentives.

But when it comes to non-financial measures, we have seen a huge array of measures, with these being implemented into more and more CEOs’ reward schemes, with firms to have a focus on other key issues besides profit or shares. Firms are building in non-financial measures such as, strategy and innovation related targets, quality and efficiency targets, legal and compliance targets, or targets revolved around the top management team.

Non-financial measures are always where ESG targets sit too – and there has been a rapid increase of ESG incentives for CEOs in the last decade or so, with more and more firms looking to focus on doing good. These incentives tend to focus around specific areas such as compliance, the environment, customers, employees and even suppliers.

What works? And what doesn’t?

So, which incentives actually boost a firm’s ESG performance? By utilising the data we gather on pay levels, pay structures and KPIs included in incentive systems of leading CEOs, we used an external database (Refinitiv) to gather information on the firms’ ESG performance. This database allowed us to identify an ESG score for all 600 firms, enabling us to identify trends in these CEO’s incentives, and which were having a direct impact on the ESG performance of the firm.

By breaking down ESG into the very specific initiatives for each letter of the acronym, we are able to identify exactly what incentives are impacted by what initiatives. Under environment, we reviewed incentives focused on resources, emissions and innovation. For social, we focused on the company’s workforce, human rights issues, the community and product responsibility. For governance, incentives around management, stakeholders, and CSR strategy.

Through this research, we identified three key short-term incentives that are negatively affecting ESG performance. Incentives based around sales, accounting and the environment all had a negative impact, reducing a firm’s ESG performance and holding them back from effectively contributing towards ESG goals. Remarkably, almost half of the 600 top European firms have CEOs with sales-based incentives, showcasing how the world’s biggest firms are hindering their own ESG performances inadvertently.

When reviewed under a long-term incentive scope, long-term incentives based on total shareholder return were also negatively hindering firm’s ESG performances too. Of course, many firms have both short-term incentives including sales KPIs, and long-term incentives including share price KPIs, clearly showing firms are both stopping themselves from achieving the greatest ESG performance possible, both in the short and long-term.

Positive impact

But there is a bright light at the end of the tunnel for ESG performance. Through our research, we identified a number of CEO incentives that were positively affecting ESG performance, and therefore tackling wider global goals, including the United Nations Sustainable Development Goals. From a short-term perspective, incentives focused around strategy, such as implementing a new digital strategy, positively impacted on ESG performance.

Surprisingly however, short-term accounting incentives reduced ESG performance; when incentives based around accounting were instead focused on the long-term, it actually had a positive impact on a firm’s ESG performance. Incentives based around the firm’s customers were also positively linked with ESG performance.

But not only is it CEOs incentives that had a huge impact on a firm’s ESG performance. We also identified a number of CEO and board characteristics linked with positive ESG performance. From a CEO perspective, the younger the CEO, the more likely they were to have a positive ESG performance, whilst female CEOs, and CEOs who were an inside hire also experienced strong ESG results.

And from a board perspective, firms were more likely to see a positive ESG performance if the average age was lower, and so was the tenure too. And for the sake of the firm, the size of the firm had an impact, with smaller firms tackling ESG better, whilst firms with smaller debts and total assets also had a greater ESG performance too.

Tackling ESG performance – and contributing to a wider, global ESG target – is becoming more and more important for large firms as they begin to understand their impact on both the planet and the people that inhabit it, and understand the position they are in to make positive changes. Yet, for many companies, it is difficult for them to either understand how to incentivise CEOs to contribute to ESG better, or find it difficult persuading them to do so. This research showcases the best practice ways for firms to encourage their CEOs to boost ESG performance – don’t overload them with short-term incentives (partly) based on sales targets, or long-term incentives based on share price. But do include strategic measures in short-term incentives.

About the author

Xavier Baeten is a Professor of Management Practice in Reward and Governance at Vlerick Business School. He heads the busines school’s Centre for Excellence in Strategic Rewards and the Executive Remuneration Research Centre

For further information:

www.vlerick.com/en

RECENT ARTICLES

-

Strong ESG records help firms take R&D global, study finds

Strong ESG records help firms take R&D global, study finds -

How residence and citizenship programmes strengthen national resilience

How residence and citizenship programmes strengthen national resilience -

Global leaders enter 2026 facing a defining climate choice

Global leaders enter 2026 facing a defining climate choice -

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change -

China’s BYD overtakes Tesla as world’s largest electric car seller

China’s BYD overtakes Tesla as world’s largest electric car seller -

UK education group signs agreement to operate UN training centre network hub

UK education group signs agreement to operate UN training centre network hub -

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing -

Oxford to host new annual youth climate summit on UN World Environment Day

Oxford to host new annual youth climate summit on UN World Environment Day -

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan -

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns -

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests -

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement -

Historic motorsport confronts its energy future

Historic motorsport confronts its energy future -

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation -

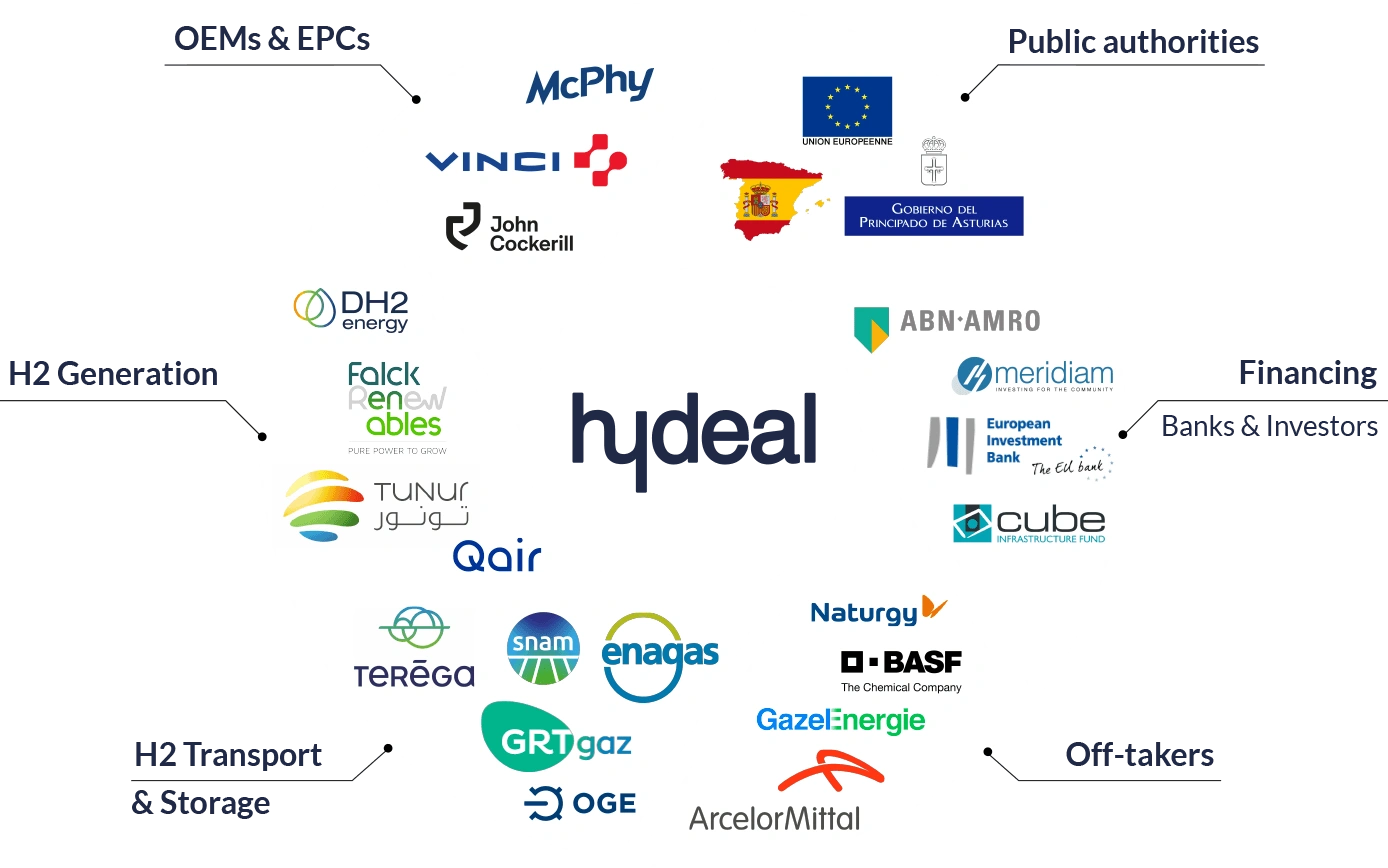

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe -

Fabric of change

Fabric of change -

Courage in an uncertain world: how fashion builds resilience now

Courage in an uncertain world: how fashion builds resilience now -

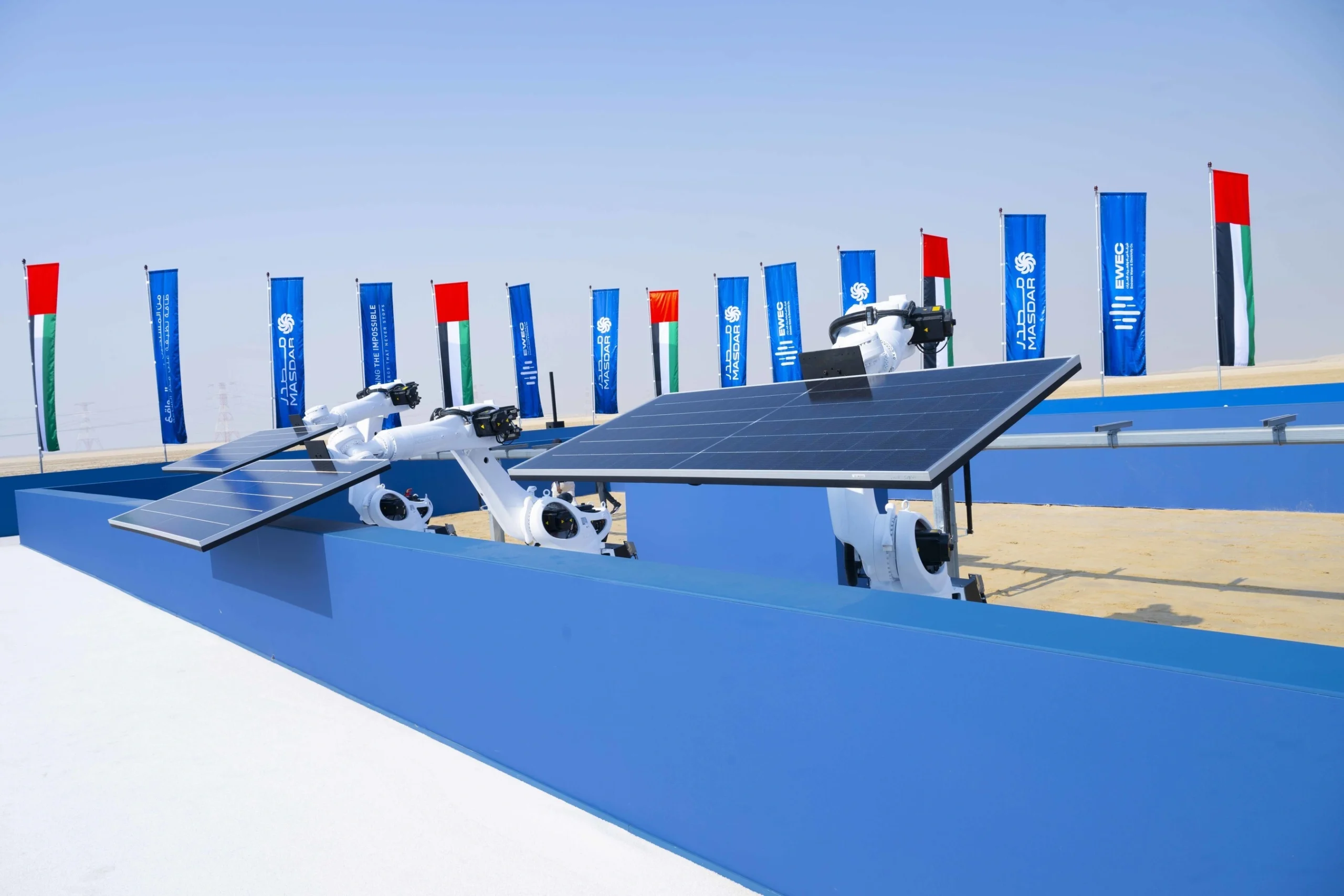

UAE breaks ground on world’s first 24-hour renewable power plant

UAE breaks ground on world’s first 24-hour renewable power plant -

China’s Yancheng sets a global benchmark for conservation and climate action

China’s Yancheng sets a global benchmark for conservation and climate action -

Inside Iceland’s green biotechnology revolution

Inside Iceland’s green biotechnology revolution -

Global development banks agree new priorities on finance, water security and private capital ahead of COP30

Global development banks agree new priorities on finance, water security and private capital ahead of COP30 -

UK organisations show rising net zero ambition despite financial pressures, new survey finds

UK organisations show rising net zero ambition despite financial pressures, new survey finds -

Gulf ESG efforts fail to link profit with sustainability, study shows

Gulf ESG efforts fail to link profit with sustainability, study shows -

Redress and UN network call for fashion industry to meet sustainability goals

Redress and UN network call for fashion industry to meet sustainability goals -

World Coastal Forum leaders warn of accelerating global ecosystem collapse

World Coastal Forum leaders warn of accelerating global ecosystem collapse