JBR Capital unveils equity release trend in classic car market

John E. Kaye

- Published

- Lifestyle

JBR Capital, the UK’s leading independent high-end vehicle financier, has confirmed a 54 per cent increase in equity release and refinancing deals in 2018, compared to the previous year.

This trend is revealed as more and more classic car owners are turning to equity release to free up cash from their cars, to put towards other purchases and investments.

Equity release enables motorists to keep hold of their classic cars, either as long-term investments or part of cherished collections – even when the capital in these high-value vehicles is required elsewhere.

The staggering increase in this type of premium car finance, within a year, coincides with the growing value gap between the very best and less favourable examples of collectable classics.

Darren Selig, Executive Chairman at JBR Capital, said, “The classic car market didn’t grow in 2018 to the level of previous years, but we’re still seeing the very best cars hold if not increase their value, whereas poorer examples are no longer as desirable, so prices have stagnated and fallen.

“We’ve seen a big increase in equity release, as classic car owners want to release cash from their cars without having to sell them – both to benefit from the future value increase and to use their money for other things.

“One client, for example, released equity in his collection of classic Ferraris to free up cash for a property investment – a common use of capital among our clients. Thanks to our bespoke underwriting process, our client had access to the cash within a matter of days, enabling him to move quickly on his property purchase.” For more information on high-end vehicle finance, go to www.jbrcapital.com. JBR Capital offers tailored equity release, refinance, auction and restoration finance solutions.

Visit JBR Capital on stand C50 at The London Classic Car Show (14-17 February) where a rare right-hand drive Porsche 2.7 RS Lightweight valued at £1 million will be displayed, courtesy of Hexagon Classics.

Further information

www.jbrcapital.com

RECENT ARTICLES

-

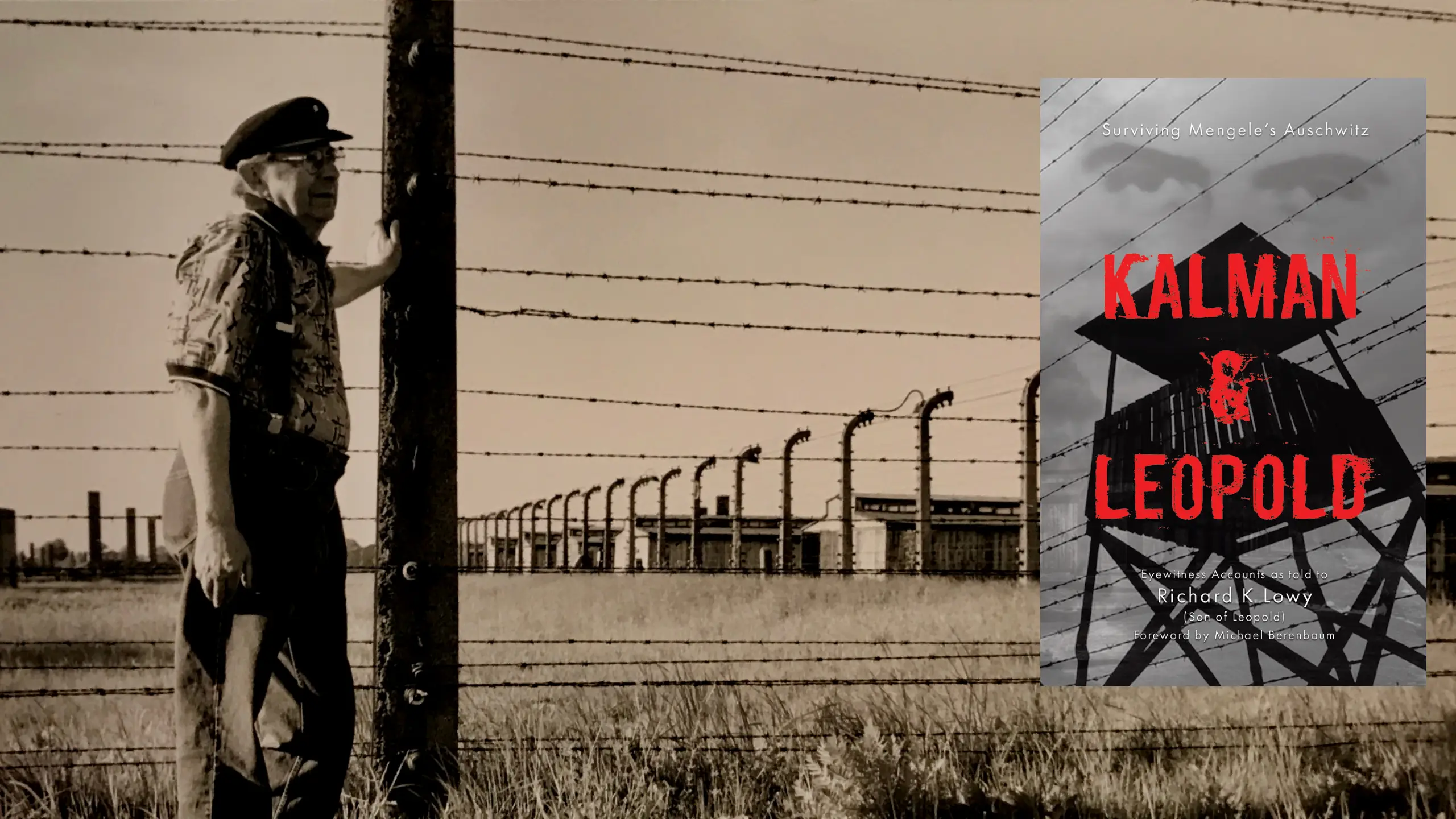

The European Reads: Kalman & Leopold: Surviving Mengele’s Auschwitz

The European Reads: Kalman & Leopold: Surviving Mengele’s Auschwitz -

The pearl of Africa: Stanley Johnson’s journey into Uganda’s wild heart

The pearl of Africa: Stanley Johnson’s journey into Uganda’s wild heart -

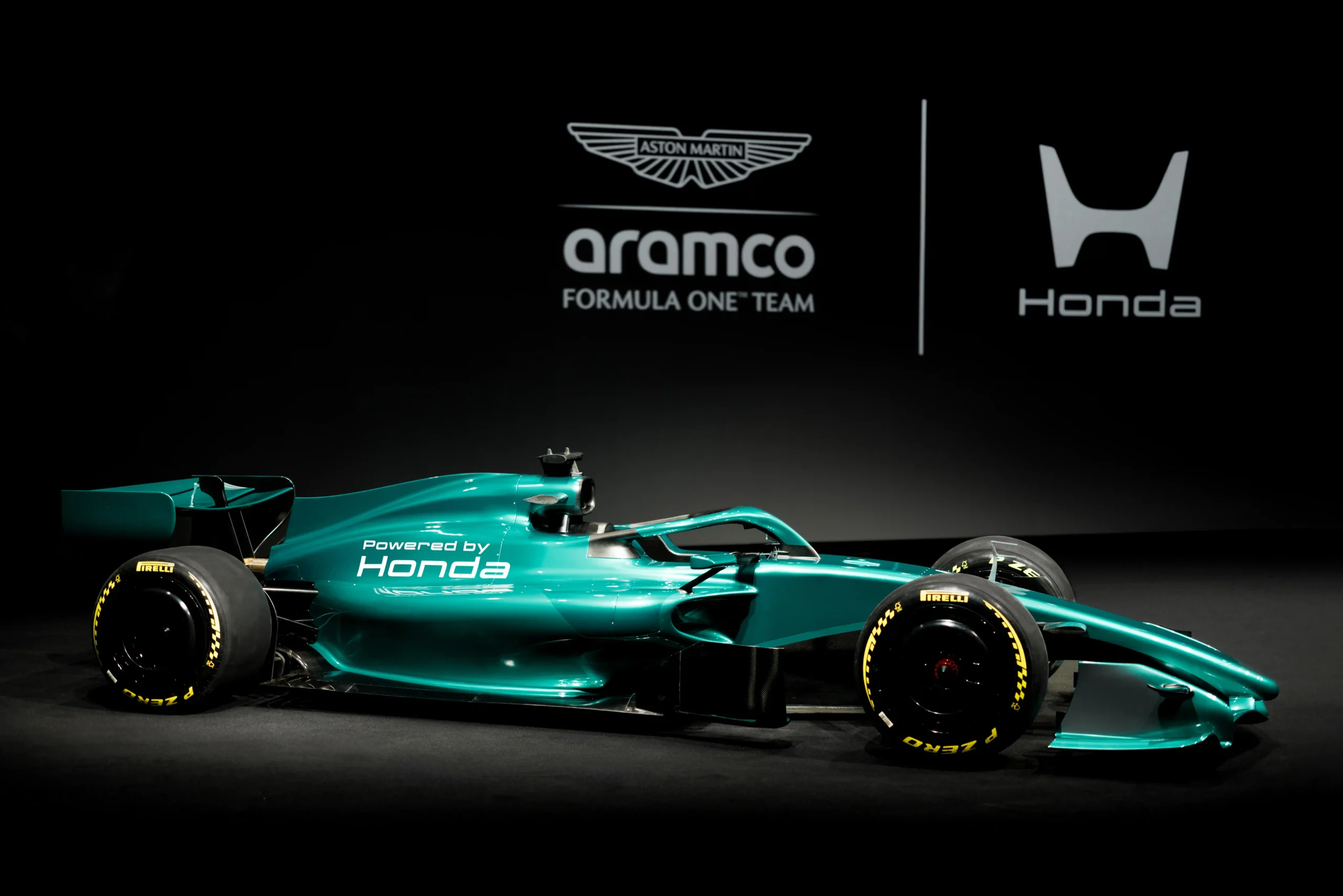

A new green dawn: inside Aston Martin’s turbulent start to Formula 1’s 2026 revolution

A new green dawn: inside Aston Martin’s turbulent start to Formula 1’s 2026 revolution -

WPSL targets £16m-plus in global sponsorship drive with five-year SGI partnership

WPSL targets £16m-plus in global sponsorship drive with five-year SGI partnership -

Need some downtime? Head to Nerja for some serious decompression

Need some downtime? Head to Nerja for some serious decompression -

How a book becomes a ‘bestseller' (and it’s not what you think)

How a book becomes a ‘bestseller' (and it’s not what you think) -

Fipronil: the silent killer in our waterways

Fipronil: the silent killer in our waterways -

Addiction remains misunderstood despite clear medical consensus

Addiction remains misunderstood despite clear medical consensus -

New guide to the NC500 calls time on 'tick-box tourism'

New guide to the NC500 calls time on 'tick-box tourism' -

Bon anniversaire, Rétromobile: Paris’ great motor show turns 50

Bon anniversaire, Rétromobile: Paris’ great motor show turns 50 -

Ski hard, rest harder: inside Europe’s new winter-wellness boom

Ski hard, rest harder: inside Europe’s new winter-wellness boom -

Baden-Baden: Europe’s capital of the art of living

Baden-Baden: Europe’s capital of the art of living -

Salzburg in 2026: celebrating 270 years of Mozart’s genius

Salzburg in 2026: celebrating 270 years of Mozart’s genius -

Sea Princess Nika – the ultimate expression of Adriatic elegance on Lošinj

Sea Princess Nika – the ultimate expression of Adriatic elegance on Lošinj -

Hotel Bellevue, Lošinj, Croatia – refined wellness by the Adriatic

Hotel Bellevue, Lošinj, Croatia – refined wellness by the Adriatic -

Padstow beyond Stein is a food lover’s dream

Padstow beyond Stein is a food lover’s dream -

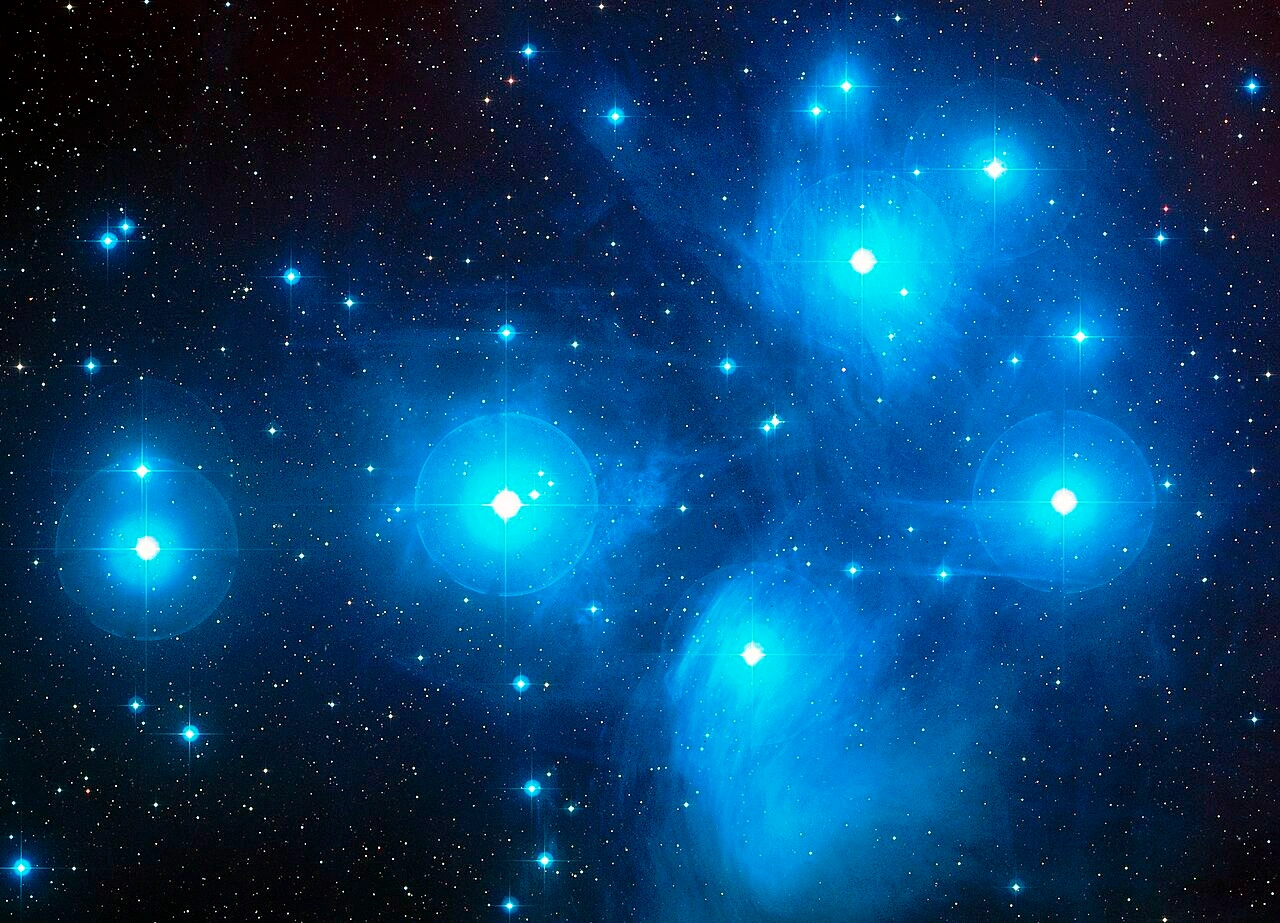

Love really is in the air. How to spot a sky full of heart-stealing stars this Valentine's Day

Love really is in the air. How to spot a sky full of heart-stealing stars this Valentine's Day -

Cora Cora Maldives – freedom, luxury and a celebration of island life

Cora Cora Maldives – freedom, luxury and a celebration of island life -

Hotel Ambasador: the place to stay in Split

Hotel Ambasador: the place to stay in Split -

Maslina Resort, Hvar – mindful luxury in the heart of the Adriatic

Maslina Resort, Hvar – mindful luxury in the heart of the Adriatic -

The bon hiver guide to Paris

The bon hiver guide to Paris -

Villa Mirasol – timeless luxury and discreet elegance on the island of Lošinj

Villa Mirasol – timeless luxury and discreet elegance on the island of Lošinj -

Lošinj’s Captain’s Villa Rouge sets a new standard in private luxury hospitality

Lošinj’s Captain’s Villa Rouge sets a new standard in private luxury hospitality -

Villa Nai 3.3: A Michelin-recognised haven on Dugi Otok

Villa Nai 3.3: A Michelin-recognised haven on Dugi Otok -

The European road test: The Jeep Wrangler Rubicon

The European road test: The Jeep Wrangler Rubicon