Decision-making factors when establishing a foundation

John E. Kaye

- Published

- Banking & Finance, Liechtenstein

In a major new study, H.S.H. Prince Michael of Liechtenstein, President of Liechtenstein Finance, explains how foundation planning is evolving, why legal certainty, transparency and long-term stability are now more important to founders than tax, and why location matters more and more

Founders today are driven by a wide range of motivations – from giving back to society, to preserving family wealth or ensuring smooth succession. While the legal form of a foundation can vary, the common aim is to use assets for a long-term purpose. Founders are not restricted to the legal system of their home country and can choose from several jurisdictions in the German-speaking region, each with its own legal and tax framework. Across all regions, the most critical factors when selecting a foundation location, according to our research, are legal certainty and political or economic stability. These considerations are highly valued by both private-benefit and charitable foundations, although the emphasis may differ slightly between the two.

Contrary to common assumptions, tax advantages are no longer the primary factor when choosing a foundation location. According to a survey conducted by Liechtenstein Finance in collaboration with FAZ Business Media, just 37% of respondents considered taxation a decisive factor.

The study gathered responses from 336 founders and senior managers of charitable and private-benefit foundations based in Germany, Austria, and Switzerland. Instead of focusing on tax, most respondents in our research prioritised the long-term viability and legal reliability of the foundation’s structure.

Despite the significant legal implications involved in permanently transferring assets to a foundation, only 22% of those surveyed in our study believed that the choice of jurisdiction had a strong impact on a foundation’s long-term success, although respondents in Switzerland and Austria showed slightly greater sensitivity to this issue than those in Germany.

Decision-Making Process

Establishing a foundation is a long-term legal commitment that typically unfolds over three phases: the initial idea, the planning and consultation stage, and the detailed implementation. Most founders, according to our research, seek professional advice during this process, particularly when refining the foundation’s purpose, governance model and legal form. The question of location often arises during these consultations and is influenced not only by legal and financial considerations, but also by cultural and personal factors.

While cost-related aspects such as setup and ongoing operational expenses are taken into account, they tend to play a secondary role for most founders. According to our study, proximity to one’s place of residence or business, trust in the jurisdiction, and existing personal connections are often more significant. In Germany and Austria, nearly 60% of respondents prioritise geographic proximity, whereas respondents in Switzerland tend to be more internationally oriented.

Sustainability is becoming an increasingly important factor in foundation planning. Around 60% of respondents in our survey expect its relevance to grow, especially in relation to the foundation’s purpose, investment strategy and environmental impact. This trend is less pronounced in Austria, where foundations are more commonly used for private wealth preservation.

Founders often carry out their own research using specialist media and informal networks before seeking expert advice. The availability of reliable information is generally rated positively across the DACH region, with Liechtenstein receiving the highest marks and Austria slightly behind in our study.

Legal Framework

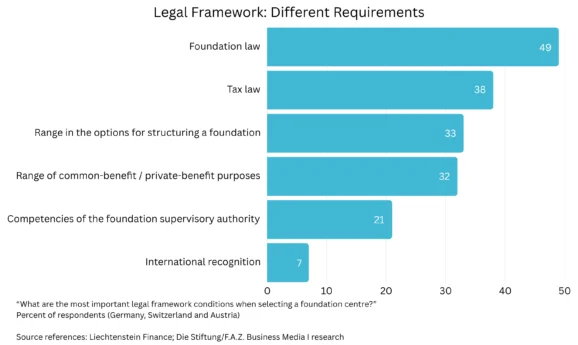

The legal framework is a central factor in determining a foundation’s location, especially as civil law requirements – such as those governing foundation and donor law – can vary significantly between jurisdictions. National foundation laws define how foundations are established, structured and operated, and determine which purposes (charitable, private-benefit, or both) are legally permitted. Germany, for example, allows both types, although most foundations there are charitable. Switzerland is known for its charitable foundations but is considered less suitable for private-benefit structures. Liechtenstein is noted for its liberal foundation law and for accommodating charitable, private-benefit, and mixed-purpose foundations. For this reason, nearly 60% of representatives of private foundations in our research identify foundation law as a key factor.

Tax law also plays a role, although its importance varies. It is more significant for private-benefit foundations – with two-thirds of their representatives in our survey citing it as important – compared to only a third of charitable foundation representatives. This is largely because charitable foundations typically enjoy favourable tax treatment across all jurisdictions. Austria, which was once a popular location for private foundations due to beneficial tax rules, has seen a decline in popularity following legal reforms that reduced these advantages.

Supervision by public authorities is a less decisive factor, with only around a quarter of respondents in our study identifying it as important. However, the nature and extent of oversight vary: Germany and Switzerland operate structured systems of public supervision, while Austria relies more on internal auditors. In Liechtenstein, non-profit foundations are subject to state supervision. All locations have in common that private foundations are subject to reduced or no supervision.

Flexibility in expressing and preserving the founder’s wishes is another key consideration. Nearly half of respondents in our research value the ability to enshrine their intentions in the foundation’s statutes. Jurisdictions differ in terms of how much post-establishment flexibility they allow. Austria and Liechtenstein offer broad rights of amendment and revocation, while Germany and Switzerland impose stricter conditions. However, excessive flexibility can compromise the perceived permanence of asset separation, which may lead to tax disadvantages.

Financial Centre

The financial centre also plays a vital role in a foundation’s success, particularly for those without internal asset management resources. Foundations rely on returns from their capital to carry out their work, making the reputation and stability of the financial centre an important consideration. In jurisdictions such as Liechtenstein – where the minimum capital requirement is €30,000 – founders have wide discretion over investment strategy, which is typically set out in the foundation statutes. Nevertheless, our study recommends professional guidance from auditors, lawyers and tax advisers to ensure sound financial management.

Nearly 60% of surveyed founders and managers in our research consider the reputation of the financial centre and the oversight of its institutions to be crucial. This is particularly important given the long-term investment horizons of most foundations, which increasingly favour equities as returns from bonds continue to decline. International recognition and global integration – including adherence to OECD standards and a comprehensive network of tax treaties – are particularly valued in Switzerland.

Trustees also play a key role in foundation governance. Their professional competence, transparency, and clearly defined responsibilities are especially critical in private-benefit foundations, where control and trust are more sensitive issues. More than 60% of respondents in our study said trustee competence was a major factor when choosing a location.

Foundations frequently outsource asset management to specialist providers. The qualities most valued in these providers, according to our respondents, are relevant experience, the ability to develop tailored investment strategies, and personalised support. This is especially true for non-profit foundations, 80% of which prioritise direct and personal service. Sustainability is gaining traction here too: half of all respondents now expect their financial service providers to be well-versed in sustainable and impact investing.

Further information:

RECENT ARTICLES

-

Managing cross-border risks in B2B e-commerce

Managing cross-border risks in B2B e-commerce -

J.P. Morgan launches first tokenised money market fund on public blockchain

J.P. Morgan launches first tokenised money market fund on public blockchain -

Aberdeen agrees to take over management of £1.5bn in closed-end funds from MFS

Aberdeen agrees to take over management of £1.5bn in closed-end funds from MFS -

Enterprise asset management market forecast to more than double by 2035

Enterprise asset management market forecast to more than double by 2035 -

EU Chamber records highest number of entries for 2025 China Sustainable Business Awards

EU Chamber records highest number of entries for 2025 China Sustainable Business Awards -

Inside Liechtenstein’s strategy for a tighter, more demanding financial era

Inside Liechtenstein’s strategy for a tighter, more demanding financial era -

‘Stability, scale and strategy’: Christoph Reich on Liechtenstein’s evolving financial centre

‘Stability, scale and strategy’: Christoph Reich on Liechtenstein’s evolving financial centre -

Bridging tradition and transformation: Brigitte Haas on leading Liechtenstein into a new era

Bridging tradition and transformation: Brigitte Haas on leading Liechtenstein into a new era -

Liechtenstein in the Spotlight

Liechtenstein in the Spotlight -

Fiduciary responsibility in the balance between stability and global dynamics

Fiduciary responsibility in the balance between stability and global dynamics -

Neue Bank’s CEO on stability, discipline and long-term private banking

Neue Bank’s CEO on stability, discipline and long-term private banking -

Research highlights rise of 'solopreneurs' as technology reshapes small business ownership

Research highlights rise of 'solopreneurs' as technology reshapes small business ownership -

Philipp Kieber on legacy, leadership and continuity at Interadvice Anstalt

Philipp Kieber on legacy, leadership and continuity at Interadvice Anstalt -

Building global-ready funds: how South African managers are scaling through offshore platforms

Building global-ready funds: how South African managers are scaling through offshore platforms -

Global billionaire wealth hits record as relocation and inheritance accelerate, UBS finds

Global billionaire wealth hits record as relocation and inheritance accelerate, UBS finds -

Human resources at the centre of organisational transformation

Human resources at the centre of organisational transformation -

Liechtenstein lands AAA rating again as PM hails “exceptional stability”

Liechtenstein lands AAA rating again as PM hails “exceptional stability” -

Lusaka Securities Exchange surges ahead on reform momentum

Lusaka Securities Exchange surges ahead on reform momentum -

PROMEA leads with ESG, technology and trust in a changing Swiss market

PROMEA leads with ESG, technology and trust in a changing Swiss market -

Why collective action matters for pensions and the planet

Why collective action matters for pensions and the planet -

Structuring success with Moore Stephens Jersey

Structuring success with Moore Stephens Jersey -

PIM Capital sets new standards in cross-jurisdiction fund solutions

PIM Capital sets new standards in cross-jurisdiction fund solutions -

Innovation, advisory and growth: Banchile Inversiones in 2024

Innovation, advisory and growth: Banchile Inversiones in 2024 -

Digitalization, financial inclusion, and a new era of banking services: Uzbekistan’s road to WTO membership

Digitalization, financial inclusion, and a new era of banking services: Uzbekistan’s road to WTO membership -

Fermi America secures $350m in financing led by Macquarie Group

Fermi America secures $350m in financing led by Macquarie Group