How market concentration is creating new risks and opportunities

John E. Kaye

- Published

- Banking & Finance

U.S tech giants have driven market growth for years, but their dominance now poses risks for investors. With global indices heavily weighted toward a handful of companies, diversification into emerging markets offers a smarter, more balanced approach, writes Mario Fisher, Head of Quantitative Research at Old Mutual Investment Group

Over the past few years, the spotlight on US tech stocks and their meteoric performance has highlighted concern around dominance of US equities in global benchmarks. This dominance has been driven by the US tech sector, and increasing concentration in global equity markets, a factor that has evolved into a rising risk for global investors seeking diversification.

The global selloff triggered by the launch of China’s AI tool, DeepSeek, underscores the current heightened risks in US equities and the precarious strategy of global investors with disproportionate exposure to these markets. This is particularly pertinent as geopolitical tensions and global competition in cutting-edge technologies intensify, with many global investors lacking the global diversification needed to soften the blow of a US economic and market downturn.

The changing dynamics of global markets

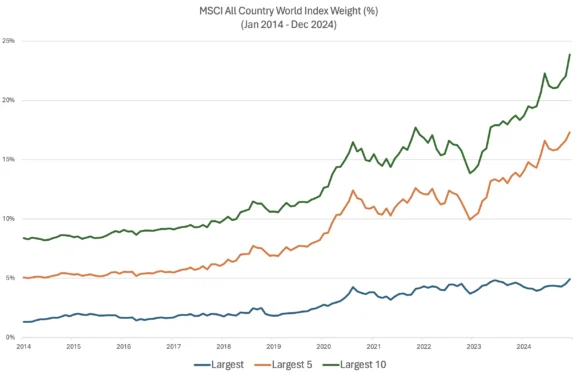

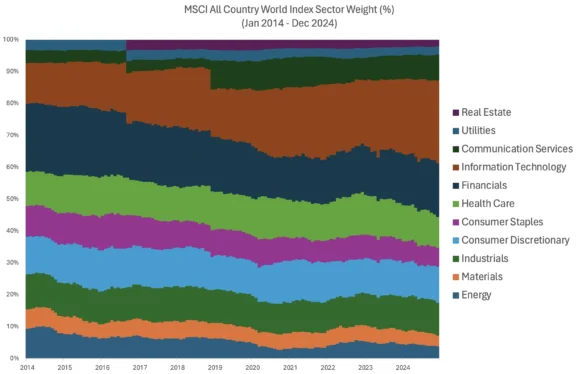

Over the last decade, the MSCI World Index’s top 25 weights have experienced noticeable shifts, largely driven by growth in large-cap technology companies and the changing dynamics of global markets. The outsized returns from mega-cap stocks have not only led to a significant increase in the concentration of market-capitalisation-weighted indexes, but also to concentration in specific Global Industry Classification Standard (GICS) sectors and the companies within certain sectors.

In the past, sectors such as industrials and energy have been concentrated, however, their index weights were not as relatively high as the current 25% weight of information technology (IT). In recent years, the top 10 stocks by weight in the index triggered higher concentration within and across global sector exposures. For example, concentration in the global tech sector increased because of Apple, Microsoft and NVIDIA, in the consumer-discretionary sector because of Amazon and Tesla, and in the communication-services sector because of Alphabet and Meta, all ultimately belonging to the US tech sector.

The growth of major US tech giants and their global market dominance has come at the expense of other regions like Europe and Japan, who have seen their relative weights shrink over time. US companies now represent approximately 73% of the index, which is a significant rise from about 50% a decade ago.

Aside from the fact that equity markets are currently plagued by geopolitical concerns, assumptions about growth and interest rate projections, most concerning for investors is that US stocks are trading at historically high valuation levels. On this basis, returns from US stocks over the medium to long term will probably be subdued. A lack of diversification in global portfolios exposes investors to the increasing risk posed by US equities, as a downturn could disproportionately affect returns.

Emerging opportunities

While one of the core benefits of global investing is diversification, most global equity strategies often have a bias toward developed market (DM) stocks, where there is a plethora of stocks to invest in from across the globe.

Higher volatility or risk is often cited as the key reason for the omission of emerging market (EMs) stocks; however, little is said about the diversification benefits and growth potential that investors can get from having such exposure.

Unlike the MSCI World Index, which only includes DMs, the MSCI All Country World Index (ACWI) represents large and mid-cap companies across DM and EM countries. The index covers approximately 85% of the global investable equity opportunity set and is more diversified than the MSCI World index predominantly due to the countries they represent, such as China, India, Brazil and South Africa, and their sector exposure.

The MSCI ACWI’s exposure to EMs also gives it more sector diversification and more geographic exposure, as EMs are often driven by different economic factors than DMs.

Both the MSCI ACWI and MSCI World indices are market-cap weighted, meaning that companies with higher market capitalisations have a larger weight in the index. However, because the MSCI ACWI includes EMs, it captures the growth potential of large-cap companies in these regions, adding another layer of diversification in terms of the types of companies and industries.

The inclusion of EMs also introduces sector diversity. MSCI ACWI still has a large weight in technology, however, the addition of countries like China, India, and Brazil means more exposure to sectors like consumer goods, energy, and materials, which are not as dominant in the developed world.

The current case for emerging markets

In recent years, EMs have undoubtedly lagged their DM peers. With President Trump’s tariff policy casting an increasing shadow over the region, confidence in EM prospects for a rebound is declining further.

However, while EMs offer only 20% of global market value, they contribute around 45% of global GDP. And if you look at energy consumption and carbon emissions, over 60% is consumed in EMs, with EMs land area at over 80% and population closer to 90% of the global population. What is striking is that all these factors are the fundamental drivers of productivity. Therefore, we should naturally expect that over the coming decades the market cap of EMs will also positively change.

Emerging markets diversification in practice

Our Old Mutual Global Managed Alpha Equity Strategy, launched in 2017, is an ideal case study for why investors should consider EMs exposure in global portfolios, particularly against the current global market backdrop and rising dominance of US tech.

The strategy uses a systematic model which allows for a widened opportunity set – adopting the MSCI All Country World Index (ACWI) as our benchmark instead of the MSCI World Index. This is one of the fund’s key differentiators from other global funds.

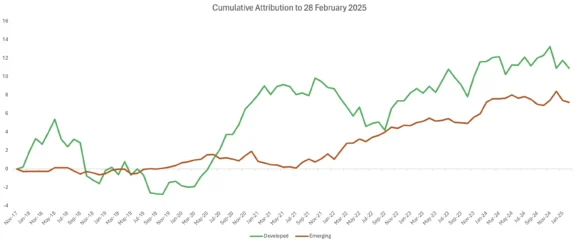

EM market counters that exhibited the relevant factor drivers. In the below chart we have split the excess return that the fund achieved since inception into stocks from DMs and stocks from EMs.

Potential double whammy

From this data, it is evident that an expanded universe, covering both DMs and EMs, can be a real benefit to a systematic model – even in a tough environment. Importantly, the Old Mutual Global Managed Equity Alpha Fund’s performance has shown that it is not reliant on a recovery in EMs. However, it is worth noting that if EMs do reverse the current trend and stage a recovery off a low relative base, this could be an additional tailwind for a fund that uses the ACWI, as opposed to most global equity strategies exposed to a DM-only universe, and it could therefore see better returns.

Further information

www.oldmutualinvest.com

RECENT ARTICLES

-

Managing cross-border risks in B2B e-commerce

Managing cross-border risks in B2B e-commerce -

J.P. Morgan launches first tokenised money market fund on public blockchain

J.P. Morgan launches first tokenised money market fund on public blockchain -

Aberdeen agrees to take over management of £1.5bn in closed-end funds from MFS

Aberdeen agrees to take over management of £1.5bn in closed-end funds from MFS -

Enterprise asset management market forecast to more than double by 2035

Enterprise asset management market forecast to more than double by 2035 -

EU Chamber records highest number of entries for 2025 China Sustainable Business Awards

EU Chamber records highest number of entries for 2025 China Sustainable Business Awards -

Inside Liechtenstein’s strategy for a tighter, more demanding financial era

Inside Liechtenstein’s strategy for a tighter, more demanding financial era -

‘Stability, scale and strategy’: Christoph Reich on Liechtenstein’s evolving financial centre

‘Stability, scale and strategy’: Christoph Reich on Liechtenstein’s evolving financial centre -

Bridging tradition and transformation: Brigitte Haas on leading Liechtenstein into a new era

Bridging tradition and transformation: Brigitte Haas on leading Liechtenstein into a new era -

Liechtenstein in the Spotlight

Liechtenstein in the Spotlight -

Fiduciary responsibility in the balance between stability and global dynamics

Fiduciary responsibility in the balance between stability and global dynamics -

Neue Bank’s CEO on stability, discipline and long-term private banking

Neue Bank’s CEO on stability, discipline and long-term private banking -

Research highlights rise of 'solopreneurs' as technology reshapes small business ownership

Research highlights rise of 'solopreneurs' as technology reshapes small business ownership -

Philipp Kieber on legacy, leadership and continuity at Interadvice Anstalt

Philipp Kieber on legacy, leadership and continuity at Interadvice Anstalt -

Building global-ready funds: how South African managers are scaling through offshore platforms

Building global-ready funds: how South African managers are scaling through offshore platforms -

Global billionaire wealth hits record as relocation and inheritance accelerate, UBS finds

Global billionaire wealth hits record as relocation and inheritance accelerate, UBS finds -

Human resources at the centre of organisational transformation

Human resources at the centre of organisational transformation -

Liechtenstein lands AAA rating again as PM hails “exceptional stability”

Liechtenstein lands AAA rating again as PM hails “exceptional stability” -

Lusaka Securities Exchange surges ahead on reform momentum

Lusaka Securities Exchange surges ahead on reform momentum -

PROMEA leads with ESG, technology and trust in a changing Swiss market

PROMEA leads with ESG, technology and trust in a changing Swiss market -

Why collective action matters for pensions and the planet

Why collective action matters for pensions and the planet -

Structuring success with Moore Stephens Jersey

Structuring success with Moore Stephens Jersey -

PIM Capital sets new standards in cross-jurisdiction fund solutions

PIM Capital sets new standards in cross-jurisdiction fund solutions -

Innovation, advisory and growth: Banchile Inversiones in 2024

Innovation, advisory and growth: Banchile Inversiones in 2024 -

Digitalization, financial inclusion, and a new era of banking services: Uzbekistan’s road to WTO membership

Digitalization, financial inclusion, and a new era of banking services: Uzbekistan’s road to WTO membership -

Fermi America secures $350m in financing led by Macquarie Group

Fermi America secures $350m in financing led by Macquarie Group