The urgent need to reduce emissions represents the largest business opportunity since the industrial revolution, and now is the time to seize it, says Paul Simpson of ERM

It is now eight years since the Paris Agreement was signed into force at COP21 bringing much hope and sending a clear signal to markets. The pact signalled that finally the world’s governments were going to lead an orderly transition to reduce emissions, stave off risk to humanity and the global economy, whilst unleashing a vast business opportunity. As we approach COP28 in Dubai it’s important to reflect on where we are and what we must do now.

In September we received the first output of the UN Global Stocktake, designed to assess progress, and highlight where the current focus should be to achieve the Paris goals. The Stocktake is required by the Paris Agreement to report progress toward those climate goals every five years and should be our compass for action.

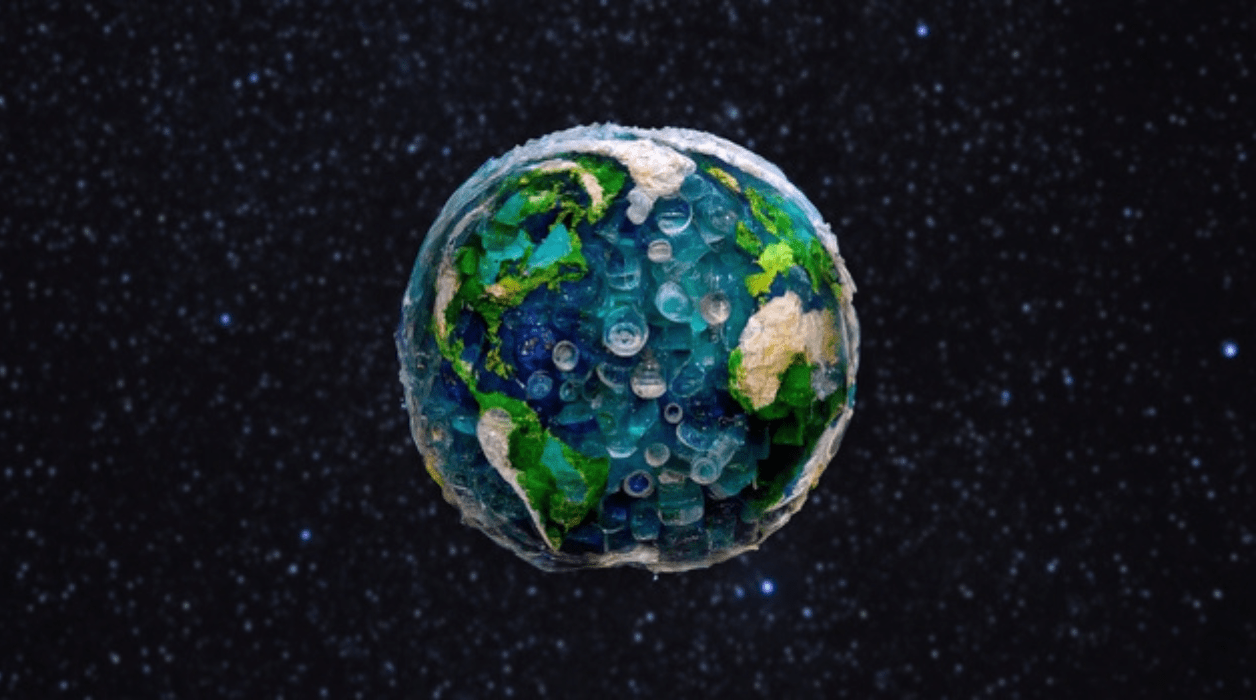

This was the first report, and the news is deeply concerning. Based on current commitments, we are on track to overshoot the goal of limiting warming to 1.5C, with predicted temperature increases of 2.4-2.6C by 2100 or earlier. We have just experienced the warmest five months in recorded history with global warming of c. 1.2C along with extreme weather events including massive wildfires and devastating floods across multiple geographies.

Imagine what awaits us in a world that’s warmed an additional c. 1.5 degrees C.

While these prospects are grim, the news isn’t entirely pessimistic. Without the current commitments and trajectory, we would be on pace to see 3.7-4.8C of warming — clearly catastrophic for humanity. The Paris Agreement is working to limit global warming. But the message is clear, we need to immediately move from ambition to action.

The first Global Stocktake is not merely a means of telling us where we are failing. It also provides a roadmap to help us get on track to slashing emissions and creating a climate-resilient future.

The report starkly illuminates the need for systemic transformation of every aspect of society, which is required to begin within just two years to be quick enough to halt the relentless rise of emissions seen since the Industrial Revolution. This is why COP28 is so important.

The report notes that the 2015 Paris agreement has driven action but says “much more is needed now on all fronts”. Crucially, it says it can be done as there are now sufficient cost-effective opportunities to address the 2030 emissions gap.

The “indispensable” actions required are “scaling up renewable energy and phasing out all unabated fossil fuels”, as well as ending the destruction of forests and reducing methane emissions, especially from oil and gas operations.

The report does not shy away from the scale of the challenge. “It is essential to unlock and redeploy trillions of dollars to meet global investment needs,” it says. In other words, it requires reengineering the global financial system.

The good news is that climate action is increasing rapidly around the world and the International Energy Agency says net zero emissions by 2050 is possible because of the rise of clean technology.

We have no choice but to act fast and at scale. Back in 2013, when I was CEO of CDP, we produced a report entitled ‘The 3% solution’, setting out that the world’s companies needed to reduce emissions by 3% per year to deliver a 2C world. With 1.5C becoming the new safe guardrail in 2018, after the Intergovernmental Panel on Climate Change (IPCC) 1.5C report, emissions need to reduce 45% from 2020 to 2030, which equates to 7% per year. Those reductions haven’t been met yet, so now the rate of required reductions is even higher. Every year of delay kicks the can down the road and means we must reduce emissions faster to meet the Paris goals. The fact that global emissions went down by around 8% during 2021, the first year of the COVID19 pandemic, illustrates the scale of transformation required.

This challenge, however, also presents an enormous opportunity to the global business system. The Organisation for Economic Co-operation and Development (OECD) estimates that if the economic benefits of avoiding climate damage are considered alongside the other benefits, acting on climate change could add almost 5% to GDP in G20 countries by 2050.

What is required is transformation of every system and sector of the global economy. ERM is working across industries to help them decarbonise at pace and scale. We are conducting in-depth assessments of companies’ potential physical and transition risks and opportunities using scenario analysis, covering topics ranging from the impacts of water scarcity to repurposing old assets for the new low carbon economy. We leverage our technical depth and breadth to develop end to end decarbonisation implementation strategies and help companies operationalise them.

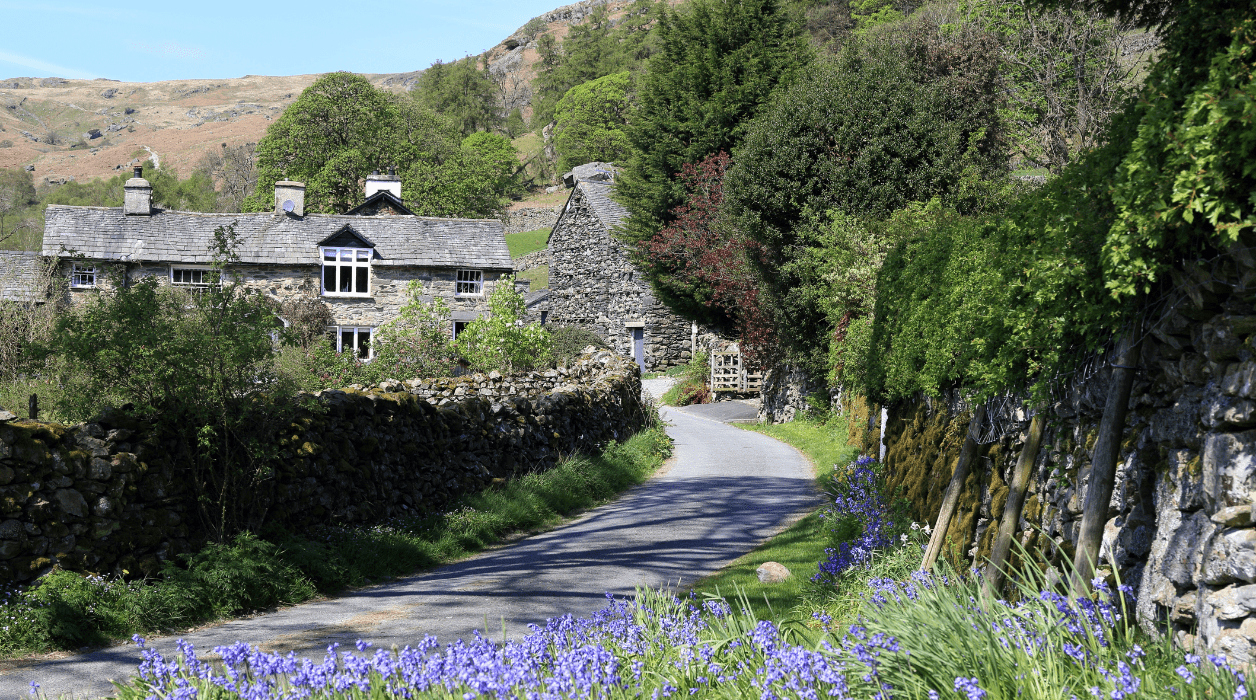

By way of example, ERM has led the hugely exciting and innovative Dolphyn hydrogen project focusing on the production of ultra-low carbon hydrogen at scale. The approach combines electrolysis, desalination and hydrogen production on a floating wind platform bringing hydrogen to shore via a pipeline to the sectors that need it most. This was born out of a need to find the lowest cost way to produce green hydrogen quickly and scale from offshore floating wind. The project supports the global energy transition and the green hydrogen economy and is the first-of-a-kind transformative solution for our society.

As the IEA has made clear, scaling renewable energy is essential and an enormous commercial opportunity. ERM is helping to pioneer new renewable technology and in the last year has facilitated over 900 renewable energy capital projects, more than double the previous year. This equates to more than 160GW of installed capacity, equivalent to reducing the annual carbon emissions of 36 million US households.

The need to reduce greenhouse gas emissions presents a compelling business opportunity because it aligns with environmental, social and economic imperatives. By addressing climate change, businesses can not only contribute to a more sustainable future but also position themselves to thrive in a changing economic landscape. The companies that put human, financial and technology capital into solving one of the greatest risks the world faces, will no doubt be the winners of transition and be the companies of the future. The transition to a net zero economy is in our grasp, now is the time to seize it.

Further information – www.erm.com

About The Author

Paul Simpson OBE is a Partner for Climate Change and Sustainability at the global environmental consultancy ERM. Prior to ERM Paul pioneered climate and environmental disclosure globally having co-founded CDP (Carbon Disclosure Project) in 2001 and spent 12 years as the CEO until 2022. Paul received an OBE for services to tackling climate change, in the 2022 Queens Jubilee Honours List.