Westbrooke Associates Unveils Transformative Ventures in REITs and Assisted Living

John E. Kaye

- Published

- Home, Lifestyle, Real Estate

Westbrooke Associates Unveils Transformative Ventures in REITs and Assisted Living

In the ever-shifting landscape of investments where predictability is often elusive, one financial titan stands tall—Real Estate Investment Trusts (REITs). Picture this: long-term leases, reliable income and a commitment to distributing a whopping 90% of annual profits to shareholders in the form of dividends. It’s no wonder REITs have become the darling of investors, promising not just returns but a financial journey steeped in stability and wealth creation.

Your gateway to distinctive investment opportunities, Westbrooke Associates is renowned for promoting affordable, accessible and rewarding ventures with an impressive track record. Catering to professional investors, institutional investors and venture capital firms seeking early to medium-growth companies, the brokerage prides itself on continuous innovation, tirelessly identifying new and sustainable investment avenues.

A Convenient and Liquid Investment Option

Real Estate Investment Trusts (REITs) are one such example of Westbrooke Associates’ innovative approach. Moreover, these investment trusts enjoy special status for tax advantages. Traded on the London Stock Exchange, REITs present a convenient and liquid investment option.

Under the UK REIT regime, 75% of a company’s assets must be properties available for rent, with an equivalent portion of profits derived from rental income. The reliability of REIT income stems from long-term leases with tenants, making them popular among income investors. REITs are mandated to distribute a minimum of 90% of annual profits to shareholders as dividends, further enhancing their appeal.

Westbrooke Associates: Your Strategic Move Toward Financial Prosperity

At the heart of Westbrooke Associates’ latest offering lies the Assisted Living Project (ALP), an initiative designed to provide investors with a stable and secure income stream. As such, 6,500,000 Ordinary shares have been released to encourage £6.5 million worth of investment into ALP to acquire and lease properties to reputable housing community benefit societies (CBS). Thus setting the stage for a unique investment opportunity.

The project involves acquiring properties with multiple units and leasing them to CBSs and councils for a minimum of 25 years. These lease agreements, funded by the Department for Work and Pensions (DWP) and indexed to pay rental income at 1% above inflation, provide a robust foundation for sustained returns. The properties are fully managed, operated and occupied by the housing CBSs on behalf of the company.

An Attractive Investment Avenue

Once a property is leased to a CBS, the Assisted Living Project aims to replicate the success, gradually accumulating multiple assisted living properties under its banner. Operating as a Real Estate Investment Trust (REIT), ALP enables investors to pool resources, which the company strategically deploys to acquire income-generating assets. REITs, offer liquidity and accessibility, making them an attractive investment avenue.

Adding a touch of distinction to the Assisted Living Project is none other than entrepreneur, philanthropist and author, Duncan Bannatyne. As the Non-Executive Director of ALP, Bannatyne seamlessly aligns with the project’s values. His contribution towards the growth and success of the Assisted Living Project underscores the credibility and promise that Westbrooke Associates brings to the table.

Through the Assisted Living Project, investors are not just putting their money into properties; they are investing in a vision that aims to redefine the landscape of assisted living and deliver sustainable, rewarding returns.

Explore this investment option in more detail and delve into a spectrum of tax-efficient investment opportunities by visiting https://westbrookeassociates.com/ or calling Westbrooke Associates on 0203 745 0294.

FACEBOOK | TWITTER | INSTAGRAM | LINKEDIN | YOUTUBE | VIMEO | PINTEREST

RECENT ARTICLES

-

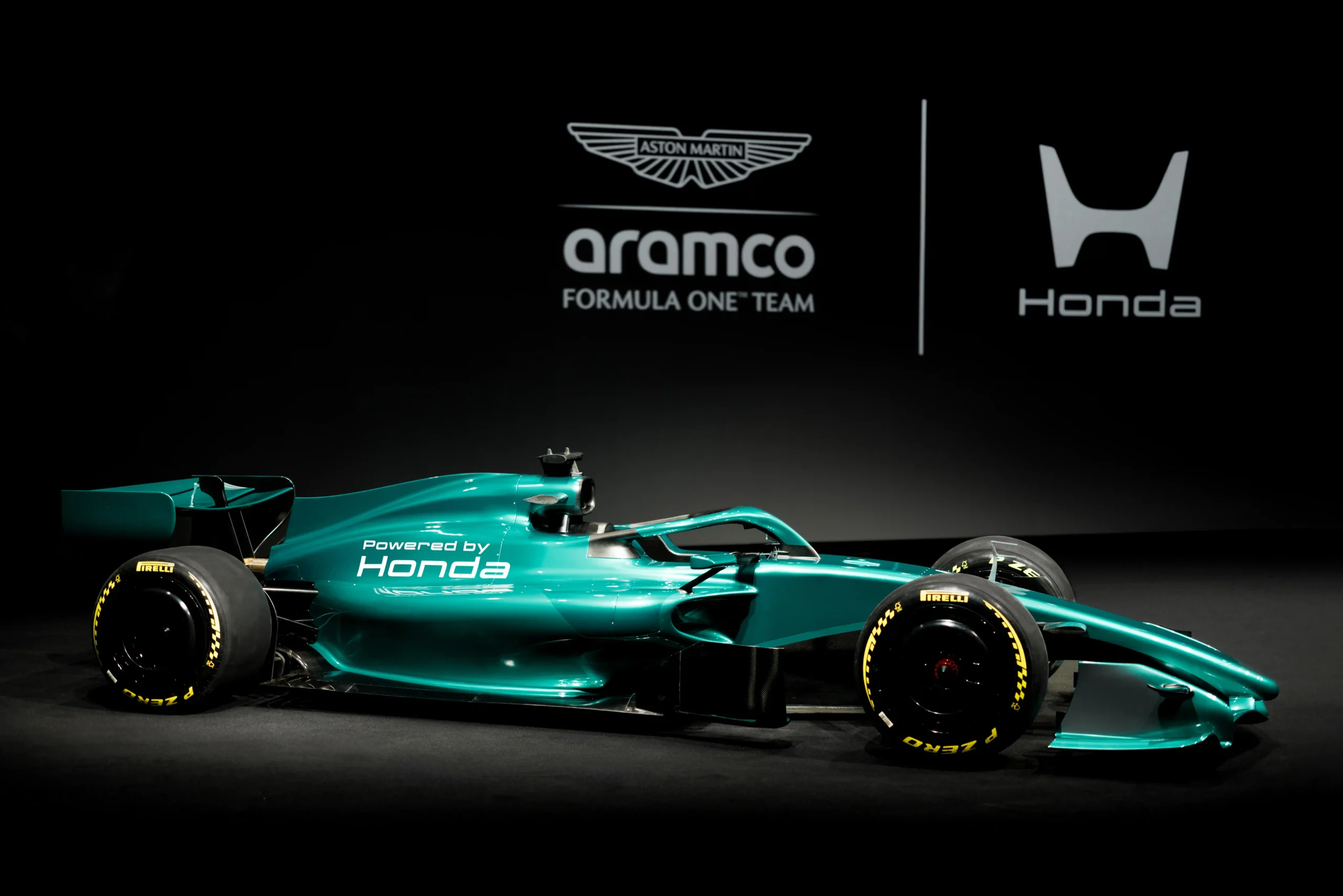

A new green dawn: inside Aston Martin’s turbulent start to Formula 1’s 2026 revolution

A new green dawn: inside Aston Martin’s turbulent start to Formula 1’s 2026 revolution -

WPSL targets £16m-plus in global sponsorship drive with five-year SGI partnership

WPSL targets £16m-plus in global sponsorship drive with five-year SGI partnership -

Need some downtime? Head to Nerja for some serious decompression

Need some downtime? Head to Nerja for some serious decompression -

How a book becomes a ‘bestseller' (and it’s not what you think)

How a book becomes a ‘bestseller' (and it’s not what you think) -

Fipronil: the silent killer in our waterways

Fipronil: the silent killer in our waterways -

Addiction remains misunderstood despite clear medical consensus

Addiction remains misunderstood despite clear medical consensus -

New guide to the NC500 calls time on 'tick-box tourism'

New guide to the NC500 calls time on 'tick-box tourism' -

Bon anniversaire, Rétromobile: Paris’ great motor show turns 50

Bon anniversaire, Rétromobile: Paris’ great motor show turns 50 -

Ski hard, rest harder: inside Europe’s new winter-wellness boom

Ski hard, rest harder: inside Europe’s new winter-wellness boom -

Baden-Baden: Europe’s capital of the art of living

Baden-Baden: Europe’s capital of the art of living -

Salzburg in 2026: celebrating 270 years of Mozart’s genius

Salzburg in 2026: celebrating 270 years of Mozart’s genius -

Sea Princess Nika – the ultimate expression of Adriatic elegance on Lošinj

Sea Princess Nika – the ultimate expression of Adriatic elegance on Lošinj -

Hotel Bellevue, Lošinj, Croatia – refined wellness by the Adriatic

Hotel Bellevue, Lošinj, Croatia – refined wellness by the Adriatic -

Padstow beyond Stein is a food lover’s dream

Padstow beyond Stein is a food lover’s dream -

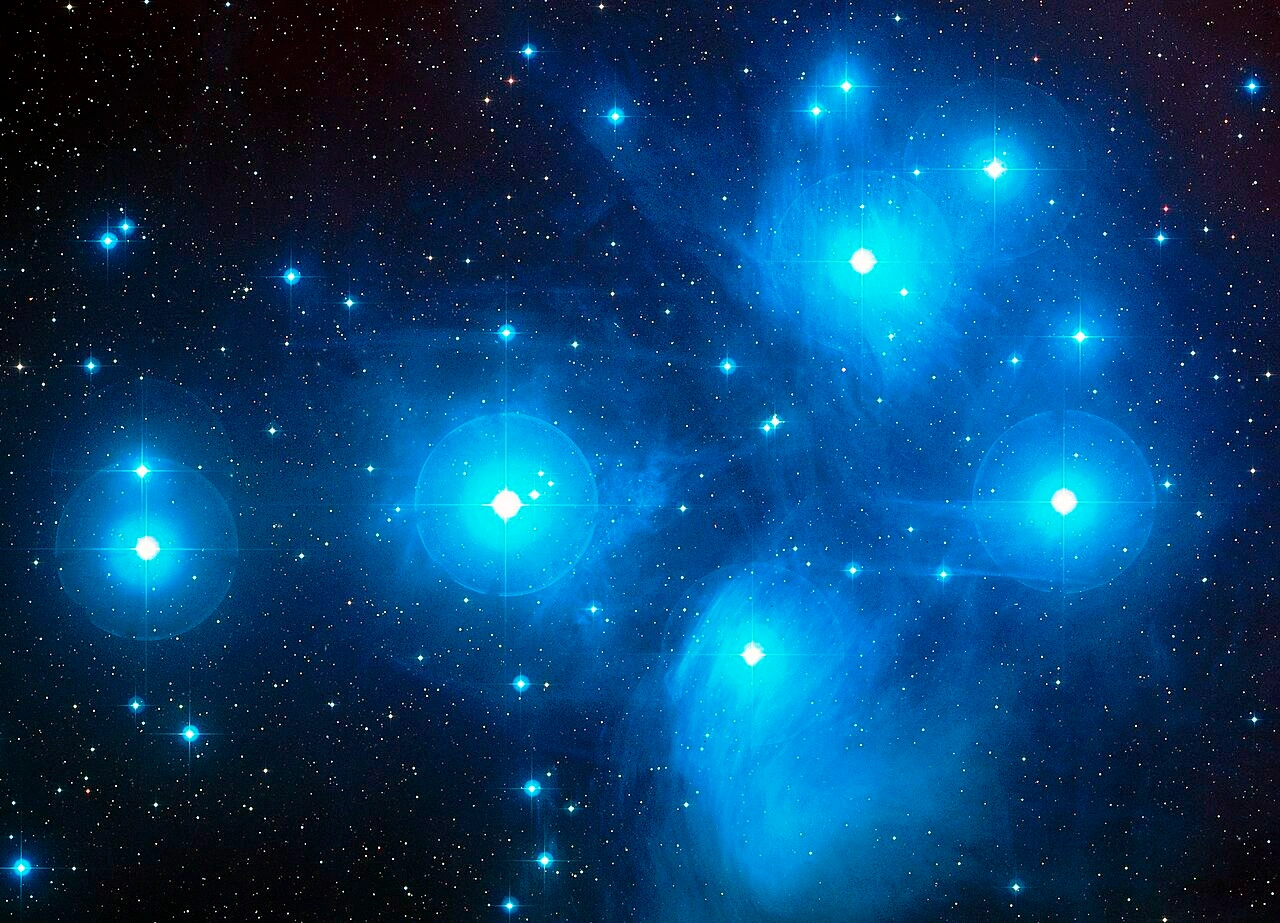

Love really is in the air. How to spot a sky full of heart-stealing stars this Valentine's Day

Love really is in the air. How to spot a sky full of heart-stealing stars this Valentine's Day -

Cora Cora Maldives – freedom, luxury and a celebration of island life

Cora Cora Maldives – freedom, luxury and a celebration of island life -

Hotel Ambasador: the place to stay in Split

Hotel Ambasador: the place to stay in Split -

Maslina Resort, Hvar – mindful luxury in the heart of the Adriatic

Maslina Resort, Hvar – mindful luxury in the heart of the Adriatic -

The bon hiver guide to Paris

The bon hiver guide to Paris -

Villa Mirasol – timeless luxury and discreet elegance on the island of Lošinj

Villa Mirasol – timeless luxury and discreet elegance on the island of Lošinj -

Lošinj’s Captain’s Villa Rouge sets a new standard in private luxury hospitality

Lošinj’s Captain’s Villa Rouge sets a new standard in private luxury hospitality -

Villa Nai 3.3: A Michelin-recognised haven on Dugi Otok

Villa Nai 3.3: A Michelin-recognised haven on Dugi Otok -

The European road test: The Jeep Wrangler Rubicon

The European road test: The Jeep Wrangler Rubicon -

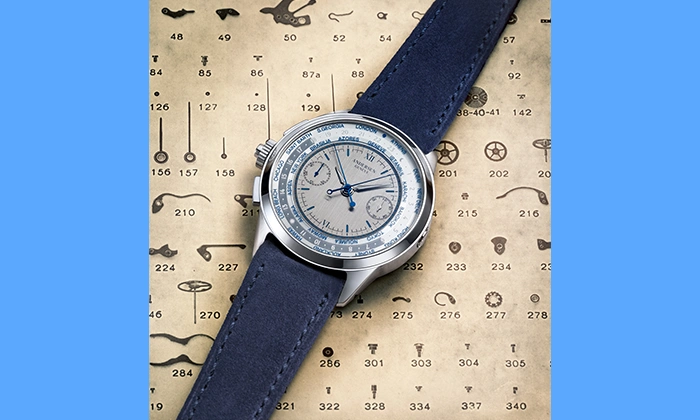

Rattrapante Mondiale – Split-Seconds Worldtimer

Rattrapante Mondiale – Split-Seconds Worldtimer -

Adaaran Select Meedhupparu & Prestige Water Villas: a Raa Atoll retreat

Adaaran Select Meedhupparu & Prestige Water Villas: a Raa Atoll retreat