Creating human touches in a digital world

John E. Kaye

- Published

- Banking & Finance, Technology

Michael Plimsoll, Sitecore’s Senior Director of Financial Services, describes why customer experience is the key to unlocking the power of digital across financial services

The pandemic has driven a rapid acceleration in the adoption of digital – akin to two years of transformation in two months. This has seen digital evolve from a supporting channel in financial services to the primary interface. With the resulting change in customer behaviour, every organisation, even those further along on their digital journey, is playing catch up. Every financial entity faces the competing pressures of trying to meet the needs of consumers, while ensuring that their systems, processes, and people can adapt.The financial services industry (FSI) must embrace the digital imperative. To prosper, organisations need to reorientate their business and become more customer-centric. Digital technology, organisational changes, and innovation must be viewed through this lens. For financial organisations to thrive, they need to be able to deliver human touches. To do this requires introducing digital-first products and services that are flexible and personalised. Every financial organisation must be cognisant of the digital reality where the customer experience is the key to unlocking the power of digital.

The new normal

In our new normal, customers are more informed, increasingly mobile, expect consistent service across channels, and loyalty has eroded. In addition, the competitive landscape has evolved, with the threat from fintechs now superseded by “big tech” that are rolling out innovative digital banking solutions by harnessing the vast vaults of user data they are privy to.

Financial organisations are struggling with the reality that digital transformation is easier said than done. Modernising legacy infrastructure, which the majority of the FSI still rely on, is no small undertaking, and most initiatives are in their infancy. However, established firms can’t hope to compete with new entrants that can quickly and easily add innovative digital features unless they transform their technology infrastructure.

Regulation is another disruptive element that is fueling innovation and accelerating change. Legislation, including Open Banking and the Payment Services Directive, are increasing the number of new propositions and enhancing how organisations can help customers manage their finances.

These factors are creating a perfect storm that is disrupting the financial services industry. The days of customers adapting to financial institutions are firmly in the rear-view mirror. Instead, financial organisations must adapt to the customer and meet the changing preferences, demands, and expectations

A roadmap for digital success

For financial organisations to capitalise on the digital reality, they must put in place the building blocks so they can refine the customer experience to keep pace with changing demands. This can be achieved by focusing on the following:

Understand customers through data

The world has changed, and so have customer expectations making it vital to understand behaviours in real-time. This requires data which is essential to deliver great customer experiences that drive loyalty and retention. A recent Gartner survey found that customer data is now the number one investment priority for the FSI and that harnessing the full potential of customer and transaction data is vital for creating a remarkable experience. Financial brands need to collect data on every customer interaction and embrace AI to make intelligent decisions in real-time.

With concerns increasing around data privacy, the experience brands deliver will determine if customers will opt-in and share data. To secure first-party data, you need to create trust through experiences.

Financial institutions must understand how behaviours have changed, the channels customers engage on, and the tasks they perform. The insights from real-time data are vital and banks need to invest in the appropriate infrastructure to capture this information.

Personalisation: The key to driving sales

The customer journey is no longer linear but involves a myriad of touchpoints and channels. For financial organisations to prosper, they need to move beyond transactions to deliver personalised digital experiences to increase loyalty and retention. Customers have various ways to commence interactions rather than visiting a branch, be it on a smartphone, via social media, or through email or ATMs. The challenge for financial institutions is that customers expect to keep these interactions consistent and frictionless when switching channels. However, in reality, for the vast majority of consumers, this is not the case.

The new digital reality requires promoting digital services to the right people through better personalisation and ensuring a seamless experience across channels. To do this, firms need to identify patterns, understand behaviour, and target consumers with digital capabilities. This requires the personalisation of all messages, from acquisition through to service. For example, if a customer has previously visited the branch to deposit cheques, you need to identify and target them with content introducing a remote cheque deposit feature. Hyper personalisation is vital, and most banks are still at the early stages of putting in place the technology that facilitates this

Always digital first

As customers increasingly rely on digital channels, every organisation must embrace a digital-first mindset. As financial enterprises develop new services, they should replicate the physical experience in a more scalable digital way. Creating new mobile and digital features for consumers like AI-powered chatbots through to fully automated application processes increases digital adoption by enhancing existing experiences.

Intuitive digital tools are key to increasing customer adoption. Banks should focus on making the experience as friction-free and seamless as possible to inspire the consumer to buy something or upgrade.

A digital-first approach not only improves the experience, it shifts customers from branches and offices to digital channels. By digitising back-office processes, financial organisations benefit by reducing costs through automation and process enhancement.

Now is the time to accelerate digital adoption and focus on the customer. In financial services, every facet of digital technology, organisational change, and innovation must be customer-centric and experience driven. The financial brands that have reorientated around the customer are more agile and better equipped to meet the changed behaviours and preferences. In turn, they are reaping the rewards financially and setting themselves up for long-term success in a digital-first world.

About Michael Plimsoll

Sitecore’s Senior Director of Financial Services, Mike Plimsoll is a seasoned, innovative marketer focused on driving efficiencies and improved ROI through the enhanced use of data, analytics and content marketing. He currently leads the Industry Strategy & Marketing team globally at Sitecore; responsible for defining and delivering the GTM Strategy per industry and driving growth and value for customers across key stages of their lifecycle. Prior to this, he worked for Adobe in the Product & Industry Marketing team, responsible for Financial Services across EMEA.

Sign up to The European Newsletter

RECENT ARTICLES

-

AI innovation linked to a shrinking share of income for European workers

AI innovation linked to a shrinking share of income for European workers -

Europe emphasises AI governance as North America moves faster towards autonomy, Digitate research shows

Europe emphasises AI governance as North America moves faster towards autonomy, Digitate research shows -

Surgeons just changed medicine forever using hotel internet connection

Surgeons just changed medicine forever using hotel internet connection -

Curium’s expansion into transformative therapy offers fresh hope against cancer

Curium’s expansion into transformative therapy offers fresh hope against cancer -

What to consider before going all in on AI-driven email security

What to consider before going all in on AI-driven email security -

GrayMatter Robotics opens 100,000-sq-ft AI robotics innovation centre in California

GrayMatter Robotics opens 100,000-sq-ft AI robotics innovation centre in California -

The silent deal-killer: why cyber due diligence is non-negotiable in M&As

The silent deal-killer: why cyber due diligence is non-negotiable in M&As -

South African students develop tech concept to tackle hunger using AI and blockchain

South African students develop tech concept to tackle hunger using AI and blockchain -

Automation breakthrough reduces ambulance delays and saves NHS £800,000 a year

Automation breakthrough reduces ambulance delays and saves NHS £800,000 a year -

ISF warns of a ‘corporate model’ of cybercrime as criminals outpace business defences

ISF warns of a ‘corporate model’ of cybercrime as criminals outpace business defences -

New AI breakthrough promises to end ‘drift’ that costs the world trillions

New AI breakthrough promises to end ‘drift’ that costs the world trillions -

Watch: driverless electric lorry makes history with world’s first border crossing

Watch: driverless electric lorry makes history with world’s first border crossing -

UK and U.S unveil landmark tech pact with £250bn investment surge

UK and U.S unveil landmark tech pact with £250bn investment surge -

International Cyber Expo to return to London with global focus on digital security

International Cyber Expo to return to London with global focus on digital security -

Cybersecurity talent crunch drives double-digit pay rises as UK firms count cost of breaches

Cybersecurity talent crunch drives double-digit pay rises as UK firms count cost of breaches -

Investors with €39bn AUM gather in Bologna to back Italy’s next tech leaders

Investors with €39bn AUM gather in Bologna to back Italy’s next tech leaders -

Axians and Nokia expand partnership to strengthen communications infrastructure across EMEA

Axians and Nokia expand partnership to strengthen communications infrastructure across EMEA -

Forterro buys Spain’s Inology to expand southern Europe footprint

Forterro buys Spain’s Inology to expand southern Europe footprint -

Singapore student start-up wins $1m Hult Prize for education platform

Singapore student start-up wins $1m Hult Prize for education platform -

UK businesses increase AI investment despite economic uncertainty, Barclays index finds

UK businesses increase AI investment despite economic uncertainty, Barclays index finds -

Speed-driven email security: effective tactics for phishing mitigation

Speed-driven email security: effective tactics for phishing mitigation -

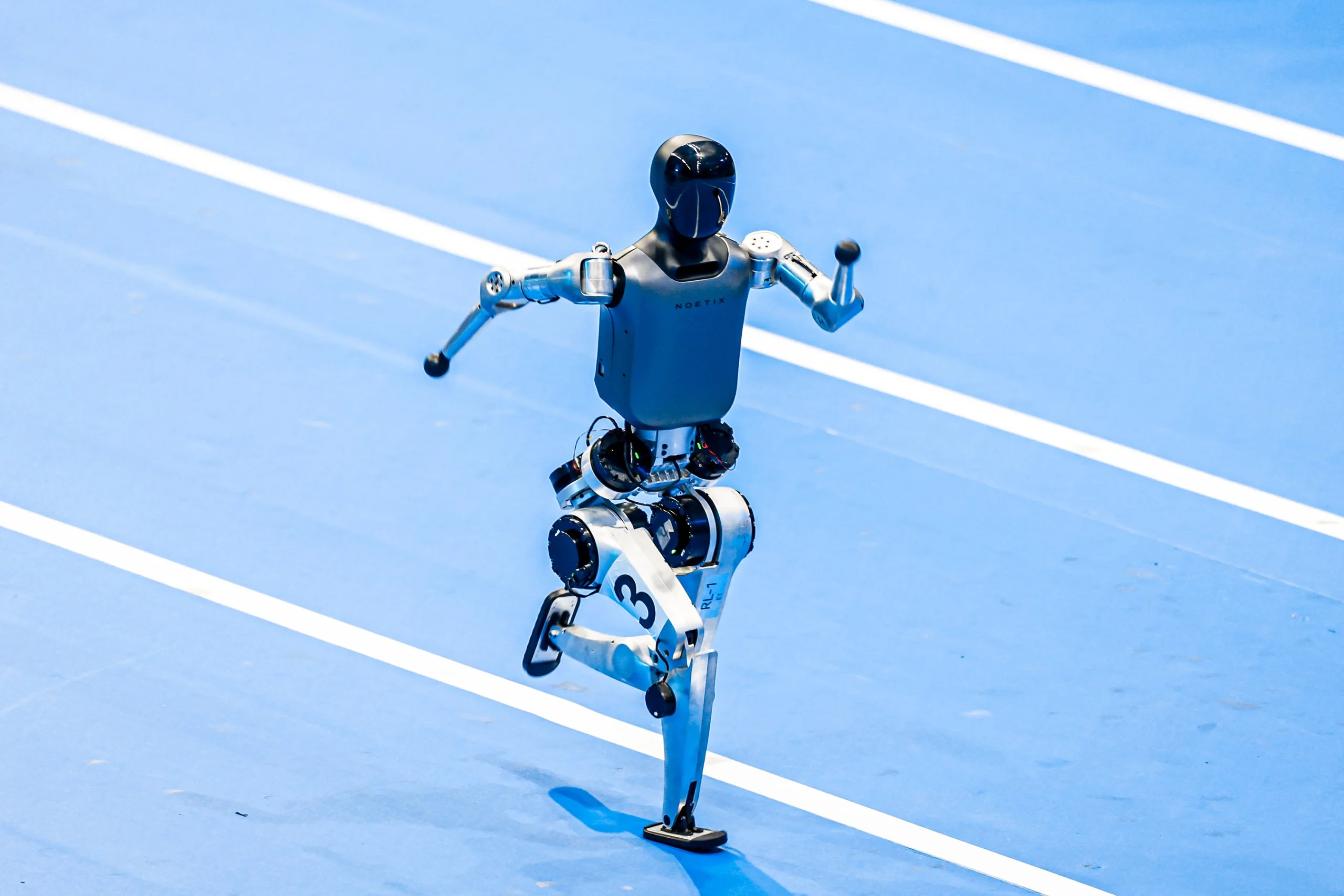

Short circuit: humanoids go for gold at first 'Olympics for robots'

Short circuit: humanoids go for gold at first 'Olympics for robots' -

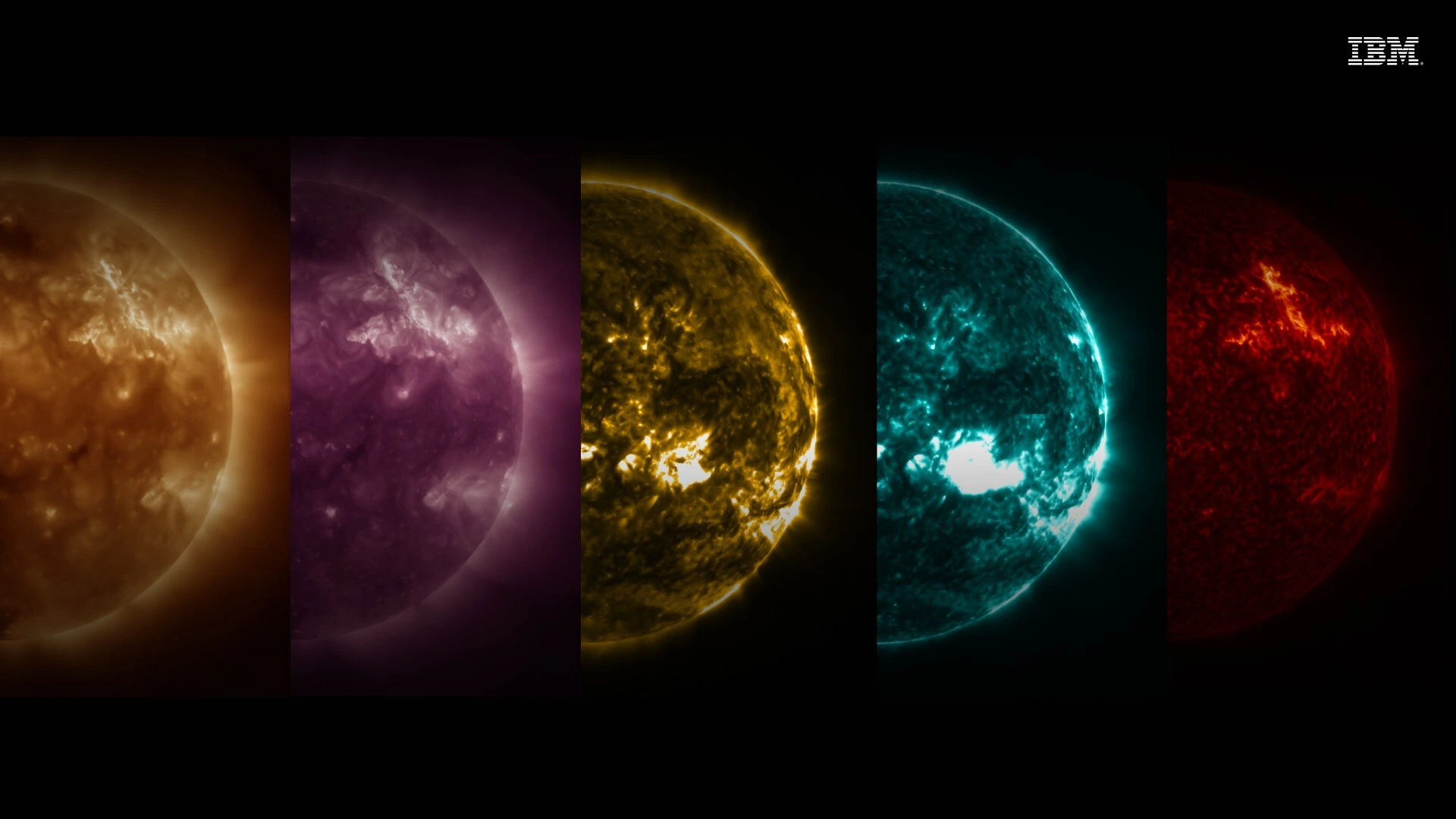

New IBM–NASA AI aims to forecast solar flares before they knock out satellites or endanger astronauts

New IBM–NASA AI aims to forecast solar flares before they knock out satellites or endanger astronauts -

AI is powering the most convincing scams you've ever seen

AI is powering the most convincing scams you've ever seen -

British firm Skyral to help Mongolia tackle pollution with AI traffic modelling

British firm Skyral to help Mongolia tackle pollution with AI traffic modelling