How to get the best health insurance in Germany

John E. Kaye

Expats in Germany must understand the difference between public and private healthcare systems, and why private insurance is a must. Daniel Weiss, MD of Versicherungsbüro Weiss has the details

Germany’s health insurance system is not only considered to be one of the most comprehensive healthcare systems in the world, but is also unique in the way it is set up. Germany is the only country in Europe where two systems of health insurance exist side-by side. This means that as a resident you can either be insured through public or private health insurance. To make things even more complex, you can also have a mix of both and combine public health insurance with supplemental insurances through private health insurance carriers.

Since health insurance is mandatory in Germany, you will have to deal with this at some point when moving to the country. Comparing the benefits between public and private health insurance, and understanding which system is right for you can prove difficult. Especially when you are new to the country and language skills are limited. However, health insurance should not be simply bought from the cheapest provider as it provides important financial support in times of illness and coverage can differ vastly. It therefore is essential to understand the system correctly and ideally get individual consultation from an experienced independent insurance broker to have your options explained properly.

Public health insurance in a nutshell

About 90 % of all residents are members of the government health system. There are currently around 120 public health insurance providers in Germany. All of them must adhere to government regulations on the benefits they offer, resulting in nearly benefits identical for every member.

The contribution is based solely on income and any employer must pay half of the health insurance contribution. Publicly insured persons pay 14.6% of their income for health insurance, plus the additional contribution of the respective health insurance provider as well as the also mandatory nursing-care, resulting in a total premium of 18.5% per month of your income. The contributions range from around 200€ to 900€. People who earn little also pay little and high earners pay a higher premium.

Private coverage: A must within the public system

As a social health system, Germany’s public health system is facing enormous challenges in the years to come. Due to the demographic developments, the number of older members that need medical care steadily increases, but they pay little into the health insurance system as pensioners. Consequently, the costs for other members will rise, but the benefits will not increase at the same rate.

On the contrary, a lot of coverage has been cut out by reforms in the past years and politicians have abolished the reimbursement of over-the-counter medicines and cut subsidies for dentures, to name but two examples. Additionally, the system as such is inflexible because the social aspect of providing nearly the same benefits for everyone can easily turn into a disadvantage for members with specific problems. It is nearly impossible to get access to the latest medical treatments through public health insurance, it can take months to get an appointment with a medical specialist and payments for glasses simply do not exist.

If you want to have extra service that goes beyond the legally prescribed care, you have to pay for it yourself. Therefore, it is highly recommended to increase public health coverage with private insurances to be able to have access to better medical treatments and to be able to cater the health care to fit the individual’s needs.

Accessing private health care

By having private health insurance, you are considered a private patient and can therefore expect a higher level of service. Medical service providers prefer private patients because they can charge higher fees for the treatment from the private health insurance and therefore have a (high) financial incentive to treat as many privately insured people as possible and to treat them in the best possible way. This leads to a number of advantages for you as a private patient such as, having access to more doctors, getting an appointment faster and seeing doctors who speak your native language.

Access to private healthcare in Germany is strictly regulated, but is often beneficial, financially but more importantly from a coverage perspective, given that you fulfil the entry criteria. Students, civil servants, self-employed and employees whose salary exceeds the annual income threshold of €64,350 gross per year are allowed to opt out of public care and join private health insurance.

If you are employed, your employer also has to pay 50% of your contributions, as with public health care – up to a maximum of approximately €459 per month for health and nursing care combined. If you are self-employed, you will have to cover the entire premium yourself.

Contrary to the public health insurance, the costs are not dependent on your income, but are based on the level of benefits chosen as well as on the entry age and any pre-existing medical conditions. Private health insurance plans can also be individualised – so you are only paying for what is important to you.

How to find the most suitable plans

However, the more choices you have, the more difficult a decision can be – this also applies to private health insurance. Almost all of the 40 private health insurance providers offer different plans. In order to find the best fit for you, we strongly recommend seeking help of an expert in order to understand the scope of coverage offered by each plan, and to avoid unpleasant surprises if you need to make use of your insurance.

About Versicherungsbüro Weiss

As an independent insurance broker, specialising in expats and customers from all over the world, Versicherungsbüro Weiss is perfectly positioned to answer all your healthcare questions. A second-generation family-run business, Versicherungsbüro Weiss provides individual consultations tailored to your requirements. Their entire team is fluent in English and can be reached via email, phone, or by WhatsApp and Zoom.

For further information:

www.versicherungsbuero-weiss.com

[email protected]

RECENT ARTICLES

-

Addiction remains misunderstood despite clear medical consensus

Addiction remains misunderstood despite clear medical consensus -

New guide to the NC500 calls time on 'tick-box tourism'

New guide to the NC500 calls time on 'tick-box tourism' -

Bon anniversaire, Rétromobile: Paris’ great motor show turns 50

Bon anniversaire, Rétromobile: Paris’ great motor show turns 50 -

Ski hard, rest harder: inside Europe’s new winter-wellness boom

Ski hard, rest harder: inside Europe’s new winter-wellness boom -

Baden-Baden: Europe’s capital of the art of living

Baden-Baden: Europe’s capital of the art of living -

Salzburg in 2026: celebrating 270 years of Mozart’s genius

Salzburg in 2026: celebrating 270 years of Mozart’s genius -

Sea Princess Nika – the ultimate expression of Adriatic elegance on Lošinj

Sea Princess Nika – the ultimate expression of Adriatic elegance on Lošinj -

Hotel Bellevue, Lošinj, Croatia – refined wellness by the Adriatic

Hotel Bellevue, Lošinj, Croatia – refined wellness by the Adriatic -

Padstow beyond Stein is a food lover’s dream

Padstow beyond Stein is a food lover’s dream -

Love really is in the air. How to spot a sky full of heart-stealing stars this Valentine's Day

Love really is in the air. How to spot a sky full of heart-stealing stars this Valentine's Day -

Cora Cora Maldives – freedom, luxury and a celebration of island life

Cora Cora Maldives – freedom, luxury and a celebration of island life -

Hotel Ambasador: the place to stay in Split

Hotel Ambasador: the place to stay in Split -

Maslina Resort, Hvar – mindful luxury in the heart of the Adriatic

Maslina Resort, Hvar – mindful luxury in the heart of the Adriatic -

The bon hiver guide to Paris

The bon hiver guide to Paris -

Villa Mirasol – timeless luxury and discreet elegance on the island of Lošinj

Villa Mirasol – timeless luxury and discreet elegance on the island of Lošinj -

Lošinj’s Captain’s Villa Rouge sets a new standard in private luxury hospitality

Lošinj’s Captain’s Villa Rouge sets a new standard in private luxury hospitality -

Villa Nai 3.3: A Michelin-recognised haven on Dugi Otok

Villa Nai 3.3: A Michelin-recognised haven on Dugi Otok -

The European road test: The Jeep Wrangler Rubicon

The European road test: The Jeep Wrangler Rubicon -

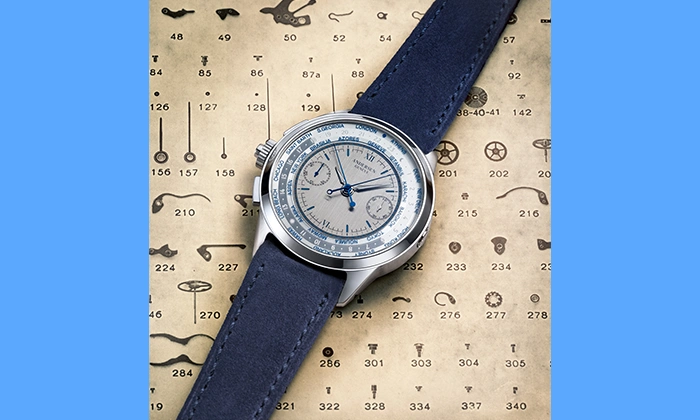

Rattrapante Mondiale – Split-Seconds Worldtimer

Rattrapante Mondiale – Split-Seconds Worldtimer -

Adaaran Select Meedhupparu & Prestige Water Villas: a Raa Atoll retreat

Adaaran Select Meedhupparu & Prestige Water Villas: a Raa Atoll retreat -

Heritance Aarah: an island escape crafted for exceptional family and couples’ stays

Heritance Aarah: an island escape crafted for exceptional family and couples’ stays -

Stanley Johnson in Botswana: a return to the wild heart of Southern Africa

Stanley Johnson in Botswana: a return to the wild heart of Southern Africa -

Germany’s Jewellery Museum in Pforzheim unveils landmark exhibition on dining culture

Germany’s Jewellery Museum in Pforzheim unveils landmark exhibition on dining culture -

The European's Luxury Report Supplement is out now

The European's Luxury Report Supplement is out now -

This city is Hollywood’s Mediterranean playground — and now is the time to visit

This city is Hollywood’s Mediterranean playground — and now is the time to visit