Building resilience into policy and business models will be integral to overcoming mounting global volatility, says Matthew Bell, Director at Frontier Economics

When historians, possibly sitting on Mars or inside space stations, look back on the 21st century what will they note as its defining feature? For the 19th century it was arguably industrialisation, for the 20th it was the re-shaping of the world order following two world wars. What will define the 21st century? Our experience over the first 20 years of this century suggest it will be instability or, more positively, resilience in the face of instability.

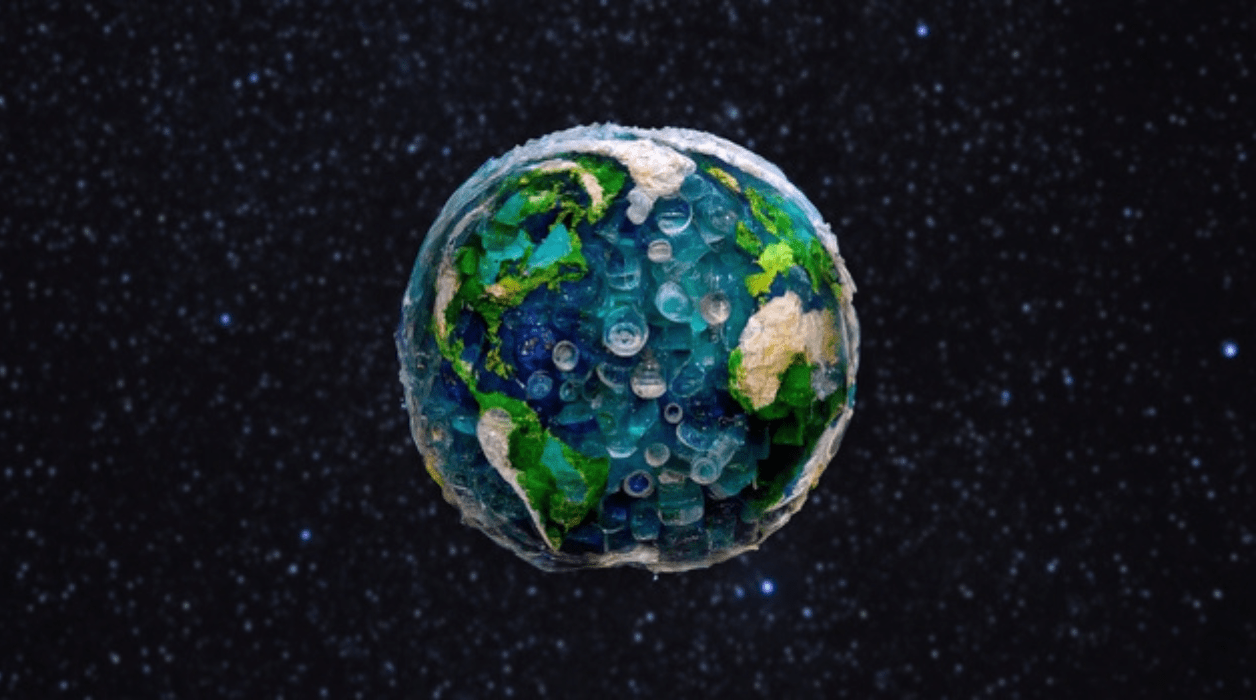

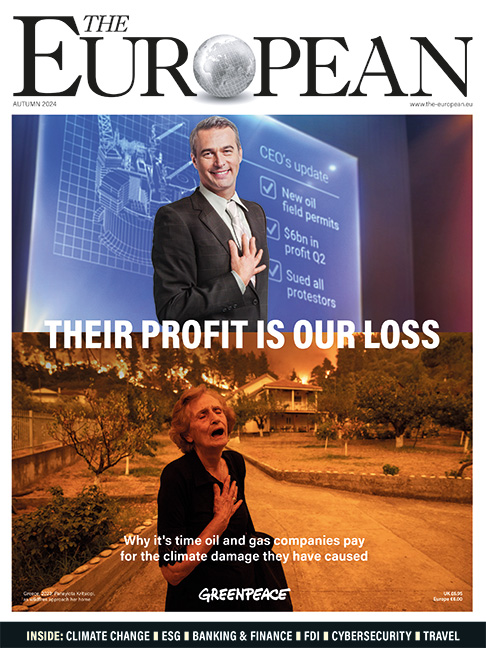

We are seeing a mounting number of examples of the scale of instability that potentially faces humanity over the coming decades: from record wildfires, to record energy costs. From Covid-19 to global supply-chain difficulties to melting Arctic sea ice to increased storms and flooding. But this is not intended to be a counsel of despair. Future historians should be looking back to understand how we overcame the instability just as we now look back at how we overcame the challenges of the industrial revolution or of the world wars.

Advancing our focus

If we are to succeed, then the 21st century will be known for advances in our understanding and implementation of mechanisms to make us more resilient. It will be the century where we move away from measuring and discussing central tendencies like average temperature or sea level rises, expected central forecasts for energy prices, GDP growth or salary, typical waiting times for hospital treatments, court hearings or the next generation of computers. Instead, we will focus on the variance around those averages, the chances of them being much better – or much worse – than anticipated by the average metric: what happens if temperature rises are 4°C rather than 2-3°C? If energy prices triple rather than rise somewhat? If people need to wait two years for hospital treatment rather than two months?

A focus on volatility – long studied in financial markets – will result in governments and companies focusing on how much they are willing to pay for resilience. In financial markets, the resilience of your portfolio of investments can be “purchased” by diversifying that portfolio. Diversification is often not an option (unless we really do colonise multiple planets very quickly) when it comes to broader threats. So resilience requires a focus on actions that will help to reduce the negative impacts and create positive changes should we end up “at the tails”: with outcomes far from the expected average.

The challenge of creating meaningful capacity

For some companies and some parts of government this is not new. The whole business model of insurance companies is built on thinking about low probability, high risk events, similarly parts of government departments involved in emergency planning do little more than work on those scenarios. However, that is very different to bringing such thinking and practice into the mainstream: always building more healthcare capacity than “typical” demand growth might imply, always investing in supply chains assuming there will be interruptions, building infrastructure (from energy to digital to transport) assuming floods will happen.

At either extreme, such an approach is very expensive: not doing enough results in high bills when we deviate from the “expected average”, building in resilience everywhere results in high bills up front. Navigating the middle ground successfully is the 21st century challenge.

What can world leaders, in business and government, do in response? The first will be to reject proposals that focus on the average, historic, typical, median or similar basis for deciding on actions. The basis of decisions should be an understanding of how your business or your part of the public sector will respond to volatility. The second will be to focus on approving business cases that demonstrate the successful delivery of your products or services under a wider range of future scenarios. The third is to understand, based on those business cases, what is your demand of other leaders? Where the degree of volatility is not within your control, what do you expect fellow leaders to be doing in areas they can influence, telling them and developing ways of committing, jointly if needed, to acting accordingly.

The 23rd century historian may look back on us as going through the dark ages or a new renaissance. Their conclusion will depend on how we handle the volatility that will be the defining feature of our moment in history.

About the author

Matthew Bell is a Director at Frontier Economics and jointly leads the firm’s Public Policy Practice. He has been helping clients for over 20 years on the design of effective policies, including cost-benefit analysis, impact assessment, policy design, behavioural research and quantitative modelling. In 2018 Matthew was awarded an OBE in the Queen’s Birthday Honours List for services to combatting climate change.

For further information:

www.frontier-economics.com