Driving digital banking in the Philippines

John E. Kaye

- Published

- Banking & Finance, Home, Technology

Thanks to the creativity and tech know-how of a rising fintech force, banking in the Philippines is changing forever

Over the last 18 months, CIMB Bank Philippines has been at the vanguard of significant changes to the nation’s banking landscape. Using an all-digital, mobile-first approach, the bank managed to onboard 2.5 million customers through the CIMB Bank PH app.

What sets CIMB Bank apart from other key players in the Philippines is how accessible the bank’s services are to the everyday Filipino. By simply downloading the CIMB Bank PH app, anyone can sign up for a bank account in less than ten minutes, bypassing the extensive requirements traditional banks often ask of their customers.

“At the core of our services and offerings is the desire to give our customers the power to manage their money. Now anyone can open a bank account safely and securely without having to walk into a physical branch,” says CIMB Bank Philippines CEO Vijay Manoharan.

CIMB Bank attaches real importance to providing first class financial products to the nation’s unbanked. By reducing the hurdles in setting up a bank account, many Filipinos are now able to open their very first savings account, all through their mobile phones. In fact, 30% of CIMB’s customer base is comprised of individuals who are entirely new to the banking landscape.

“Our all-digital banking platform was designed to bring banking to more Filipinos, who otherwise may not have been able to access formal banking services,” Manoharan added.

Apart from the convenience and accessibility CIMB offers their customers, the bank also makes sure that they get the best value for their money. With one of the best interest rates on the market, UpSave account holders enjoy higher interest on their savings without a required minimum balance or lock-in period.

UpSave customers can also enjoy 1600% more on their savings as CIMB offers a special interest rate promo of 4% p.a. This promo is available to all UpSave account holders with balances of at least PhP100,000 ($2,000). Additionally, the bank also provides them with a hefty life insurance coverage which is equal to their average daily balance of up to PhP1,000,000 for free.

Addressing the need to access their finances easily, CIMB offers a free VISA payWave Card to its Fast Account holders. All they need to do is to deposit at least PhP5000 to their account in order to receive their debit card straight at their doorstep. Customers can use this card for online payments to 46 million merchants worldwide and in over 25,000 ATMs nationwide free of charge.

Along with deposit accounts, CIMB Bank is empowering many Filipinos through its CIMB Personal Loan. Unlike ordinary bank loans, customers no longer have to go through a tedious application process. Instead, they must submit one form of identification and one pay slip in order to borrow as much as PhP1m. All this can be done through the CIMB Bank PH app.

Through its customer-friendly Personal Loan, CIMB has helped 51% of customers secure their first-ever bank loan. Additionally, personal loans can also help the nation’s small business owners and entrepreneurs access the capital required to expand their businesses.

Robust digital strategy

CIMB is strengthening its market presence through partnerships with other fintechs to build a robust digital strategy. Its partnership with GCash, the Philippines’ leading digital wallet, has enabled many individuals to access financial tools. Through the money saving feature on the GCash app – known as GSave – users can start building their savings safely and securely with CIMB Bank’s competitive interest rate.

“Banking should be fast, simple and convenient, so Filipinos don’t need a physical bank branch. The recent pandemic has been an eye-opener, and has further shown the way to go all-digital as we see further demand in digital banking,” says Manoharan, emphasising on how CIMB Bank’s services have proved to be critical in the current situation.

With the game-changing products and services that CIMB offers, various institutions around the world continue to recognise their efforts. As of June 2020, CIMB Bank Philippines has accumulated a total of 12 different awards, despite being operational for less than two years. Just recently, The European named CIMB Bank Philippines “Most Innovative Digital Bank – Philippines 2020”.

“We are humbled by this award and are honoured to have been recognised in just our first year in the market.” Manoharan said. “We owe many of our milestones to our customers for trusting in us and for believing in the future of digital banking as we embark on transforming the banking landscape in the Philippines. We also look forward to empowering more Filipinos and giving them all the benefits of having a bank account and convenient access to credit.”

Above all, CIMB Bank will continue to help Filipinos gain access to safe and secure financial services. With only 35% of the Philippine population having access to formal banking facilities, the bank’s ultimate goal is to reach more underbanked and unbanked citizens – to make the process simple, easy and convenient for everyone.

“Filipinos deserve better value and returns from their bank. We at CIMB PH, hope with our all-digital mobile first bank, everyone can open a bank account without any hassle, anytime, anywhere, safe and securely. And with our best in market savings interest rates of up to 4%, our customers can start their savings journey with us,”concluded Manoharan. ν

Further information

Sign up to The European Newsletter

RECENT ARTICLES

-

Make boards legally liable for cyber attacks, security chief warns

Make boards legally liable for cyber attacks, security chief warns -

AI innovation linked to a shrinking share of income for European workers

AI innovation linked to a shrinking share of income for European workers -

Europe emphasises AI governance as North America moves faster towards autonomy, Digitate research shows

Europe emphasises AI governance as North America moves faster towards autonomy, Digitate research shows -

Surgeons just changed medicine forever using hotel internet connection

Surgeons just changed medicine forever using hotel internet connection -

Curium’s expansion into transformative therapy offers fresh hope against cancer

Curium’s expansion into transformative therapy offers fresh hope against cancer -

What to consider before going all in on AI-driven email security

What to consider before going all in on AI-driven email security -

GrayMatter Robotics opens 100,000-sq-ft AI robotics innovation centre in California

GrayMatter Robotics opens 100,000-sq-ft AI robotics innovation centre in California -

The silent deal-killer: why cyber due diligence is non-negotiable in M&As

The silent deal-killer: why cyber due diligence is non-negotiable in M&As -

South African students develop tech concept to tackle hunger using AI and blockchain

South African students develop tech concept to tackle hunger using AI and blockchain -

Automation breakthrough reduces ambulance delays and saves NHS £800,000 a year

Automation breakthrough reduces ambulance delays and saves NHS £800,000 a year -

ISF warns of a ‘corporate model’ of cybercrime as criminals outpace business defences

ISF warns of a ‘corporate model’ of cybercrime as criminals outpace business defences -

New AI breakthrough promises to end ‘drift’ that costs the world trillions

New AI breakthrough promises to end ‘drift’ that costs the world trillions -

Watch: driverless electric lorry makes history with world’s first border crossing

Watch: driverless electric lorry makes history with world’s first border crossing -

UK and U.S unveil landmark tech pact with £250bn investment surge

UK and U.S unveil landmark tech pact with £250bn investment surge -

International Cyber Expo to return to London with global focus on digital security

International Cyber Expo to return to London with global focus on digital security -

Cybersecurity talent crunch drives double-digit pay rises as UK firms count cost of breaches

Cybersecurity talent crunch drives double-digit pay rises as UK firms count cost of breaches -

Investors with €39bn AUM gather in Bologna to back Italy’s next tech leaders

Investors with €39bn AUM gather in Bologna to back Italy’s next tech leaders -

Axians and Nokia expand partnership to strengthen communications infrastructure across EMEA

Axians and Nokia expand partnership to strengthen communications infrastructure across EMEA -

Forterro buys Spain’s Inology to expand southern Europe footprint

Forterro buys Spain’s Inology to expand southern Europe footprint -

Singapore student start-up wins $1m Hult Prize for education platform

Singapore student start-up wins $1m Hult Prize for education platform -

UK businesses increase AI investment despite economic uncertainty, Barclays index finds

UK businesses increase AI investment despite economic uncertainty, Barclays index finds -

Speed-driven email security: effective tactics for phishing mitigation

Speed-driven email security: effective tactics for phishing mitigation -

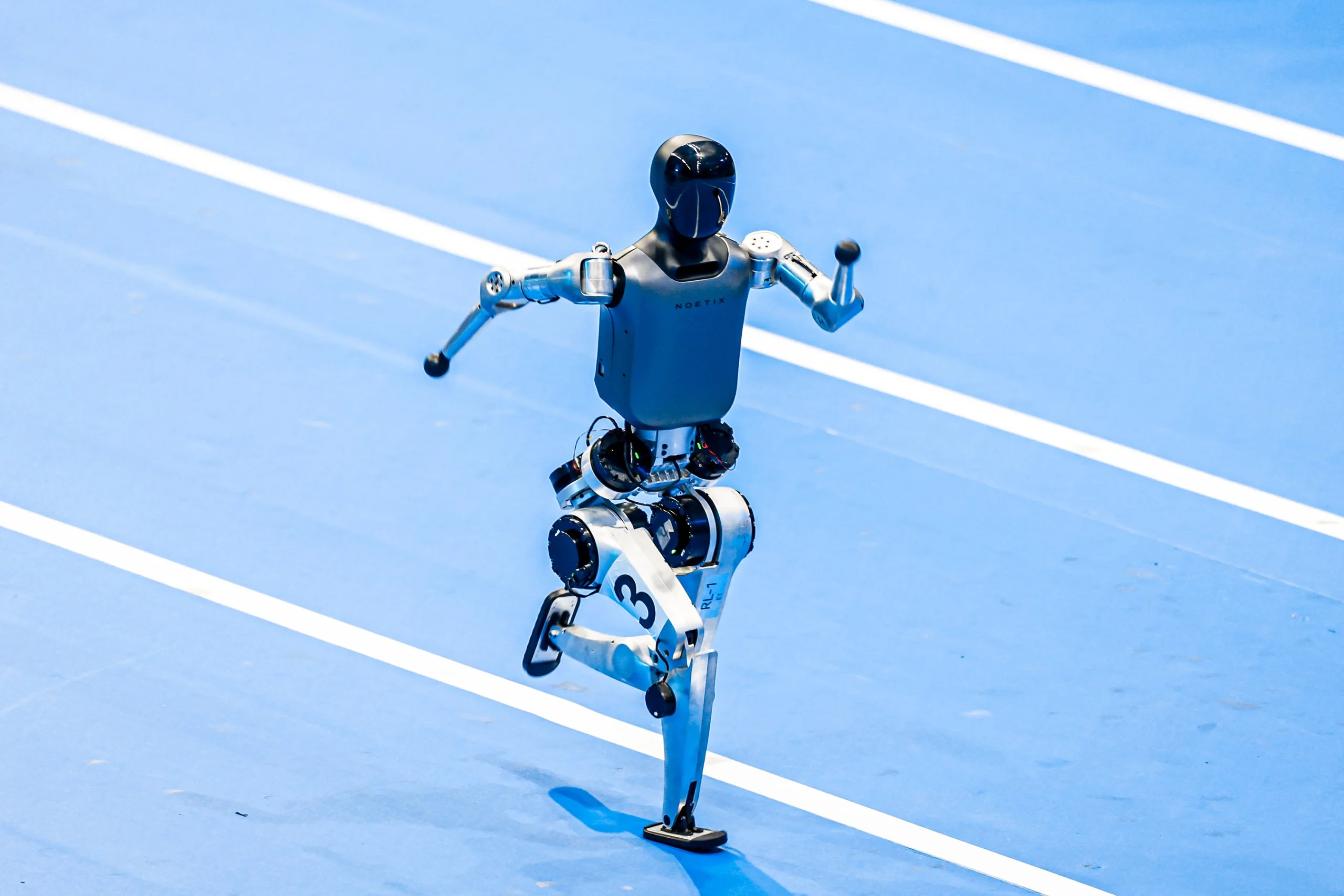

Short circuit: humanoids go for gold at first 'Olympics for robots'

Short circuit: humanoids go for gold at first 'Olympics for robots' -

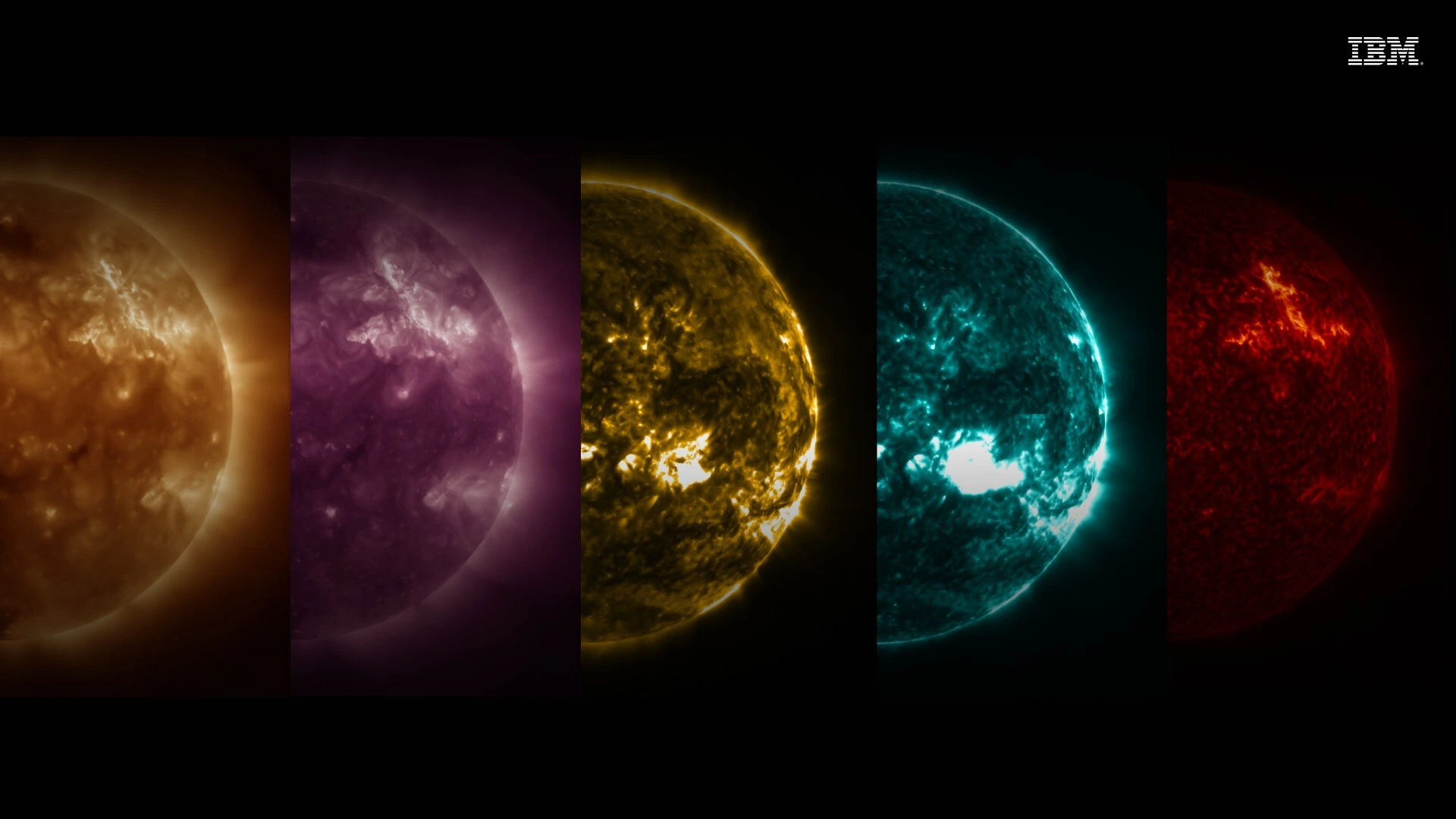

New IBM–NASA AI aims to forecast solar flares before they knock out satellites or endanger astronauts

New IBM–NASA AI aims to forecast solar flares before they knock out satellites or endanger astronauts -

AI is powering the most convincing scams you've ever seen

AI is powering the most convincing scams you've ever seen