Why do business in the Isle of Man?

John E. Kaye

- Published

- Business Travel, Foreign Direct Investment, Home, Lifestyle

A busy global business centre, the Isle of Man’s economy is diverse, spanning finance, eGaming, media, manufacturing, aerospace, food and drink production, and tourism.

The jurisdiction’s extensive and well established financial services sector has recently been surpassed in market share by digital sectors – including eGaming, fintech and digital media. This trend looks set to continue with a recent commitment to a national telecommunications strategy and the introduction of a new blockchain office offering a dedicated support network for businesses utilising blockchain technology. So, what are the key benefits to doing business in this small but globally connected jurisdiction?

Financially rewarding

The Isle of Man offers financial rewards for both individuals and organisations who choose to call it “home”. Business owners and entrepreneurs benefit from 0% corporate income tax, 0% capital gains and a range of government grants and assistance for those considering starting/relocating operations. Personal tax rates are low, between 10% and 20%, after a tax-free allowance of £14,250 per person per year. There are also no restrictions on purchasing property, whether residential or commercial, either.

A National Insurance Holiday Scheme provides individuals with a refund of NI contributions paid during the first 12 months of employment in the island – which is not only welcome news for entrepreneurs and business owners themselves, but also for staff members, who could be up to £4,000 better off when relocating.

Living and working in a compact island setting means benefitting from low commute times – an average of just 20 minutes – thanks to the Isle of Man’s relatively uncrowded roads and excellent infrastructure. And a shorter commute means more time to do what you enjoy – many islanders spend their evenings exploring the island’s extensive coastline or many beautiful glens. The island also has some of the lowest crime rates in Europe, offering a safe and secure place for individuals and families.

Ease of relocation

The Isle of Man Government has a proactive approach to bringing new businesses and talent to the island. The Employee Relocation Incentive is a grant designed for businesses which relocate an employee, or employees, to the island. It allows businesses to receive a payment of up to 20% of their employee’s first year salary costs, up to £10,000, paid one-year post-recruitment. This incentive could be very rewarding for entrepreneurs when considering basing business operations in the Isle of Man – particularly if they are likely to relocate a number of members of staff to work within the organisation. Employers use the incentive in a range of ways: some businesses have used it to engage with recruitment agencies, while some pass the figure onto the candidate to assist with relocation costs.

Further information

RECENT ARTICLES

-

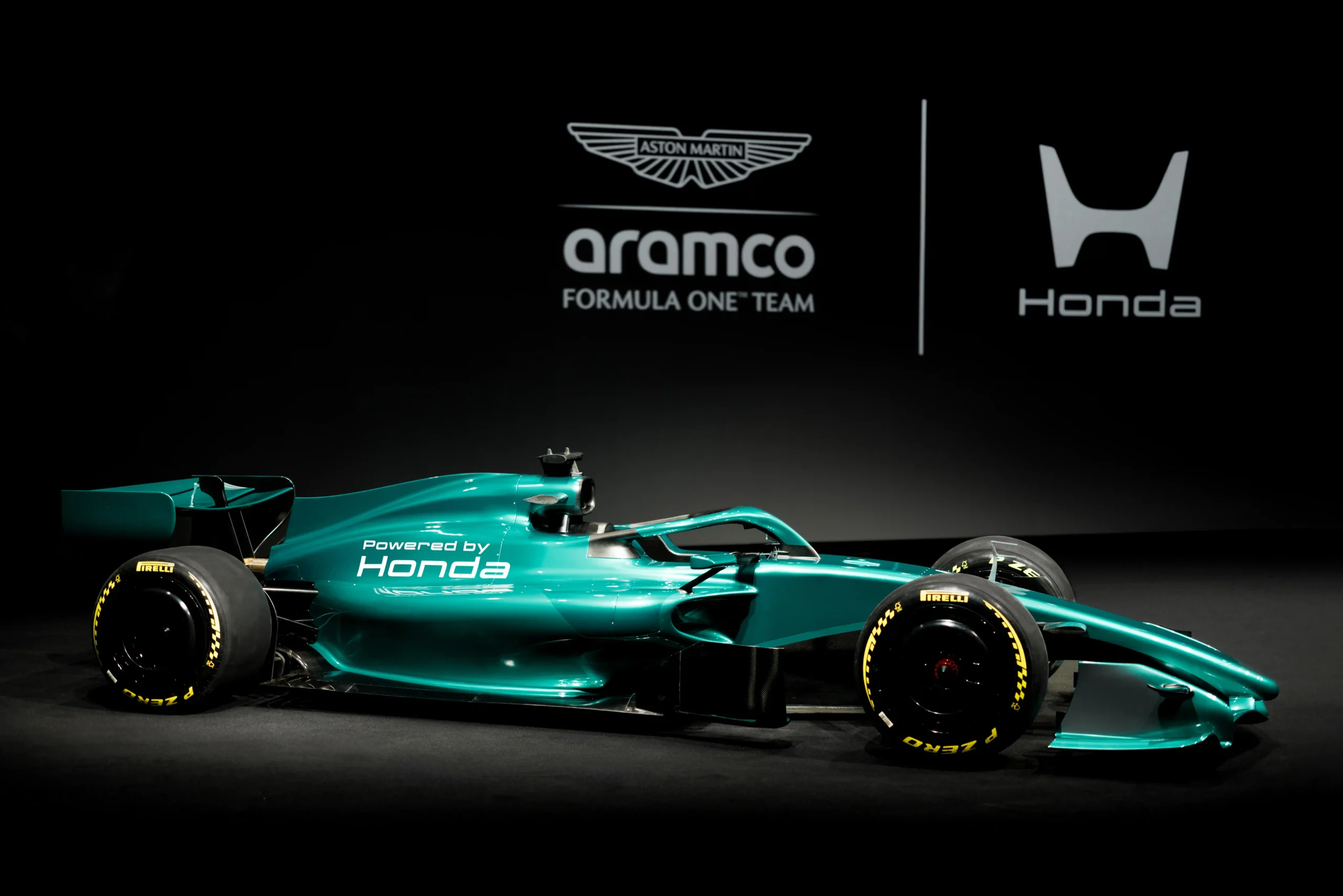

A new green dawn: inside Aston Martin’s turbulent start to Formula 1’s 2026 revolution

A new green dawn: inside Aston Martin’s turbulent start to Formula 1’s 2026 revolution -

WPSL targets £16m-plus in global sponsorship drive with five-year SGI partnership

WPSL targets £16m-plus in global sponsorship drive with five-year SGI partnership -

Need some downtime? Head to Nerja for some serious decompression

Need some downtime? Head to Nerja for some serious decompression -

How a book becomes a ‘bestseller' (and it’s not what you think)

How a book becomes a ‘bestseller' (and it’s not what you think) -

Fipronil: the silent killer in our waterways

Fipronil: the silent killer in our waterways -

Addiction remains misunderstood despite clear medical consensus

Addiction remains misunderstood despite clear medical consensus -

New guide to the NC500 calls time on 'tick-box tourism'

New guide to the NC500 calls time on 'tick-box tourism' -

Bon anniversaire, Rétromobile: Paris’ great motor show turns 50

Bon anniversaire, Rétromobile: Paris’ great motor show turns 50 -

Ski hard, rest harder: inside Europe’s new winter-wellness boom

Ski hard, rest harder: inside Europe’s new winter-wellness boom -

Baden-Baden: Europe’s capital of the art of living

Baden-Baden: Europe’s capital of the art of living -

Salzburg in 2026: celebrating 270 years of Mozart’s genius

Salzburg in 2026: celebrating 270 years of Mozart’s genius -

Sea Princess Nika – the ultimate expression of Adriatic elegance on Lošinj

Sea Princess Nika – the ultimate expression of Adriatic elegance on Lošinj -

Hotel Bellevue, Lošinj, Croatia – refined wellness by the Adriatic

Hotel Bellevue, Lošinj, Croatia – refined wellness by the Adriatic -

Padstow beyond Stein is a food lover’s dream

Padstow beyond Stein is a food lover’s dream -

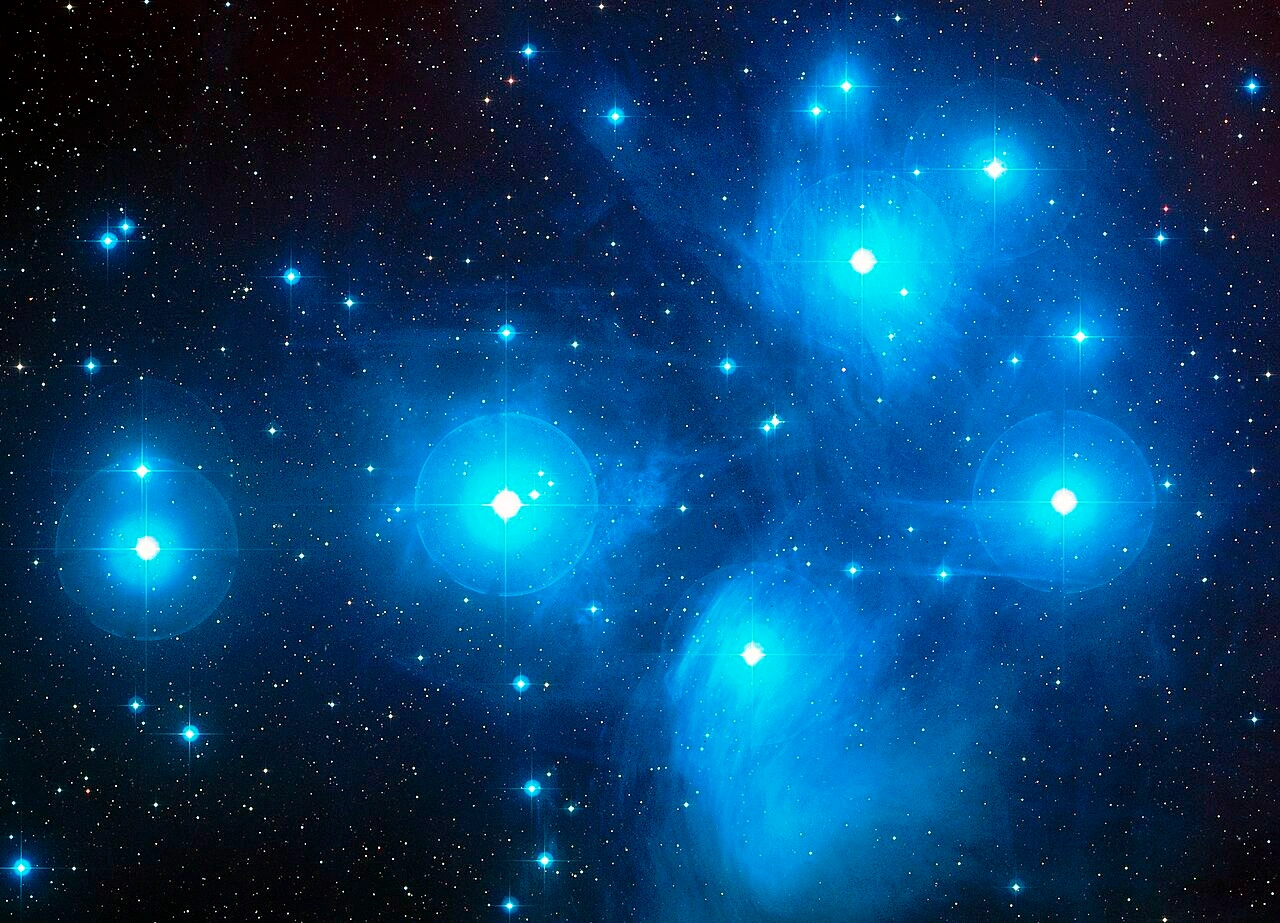

Love really is in the air. How to spot a sky full of heart-stealing stars this Valentine's Day

Love really is in the air. How to spot a sky full of heart-stealing stars this Valentine's Day -

Cora Cora Maldives – freedom, luxury and a celebration of island life

Cora Cora Maldives – freedom, luxury and a celebration of island life -

Hotel Ambasador: the place to stay in Split

Hotel Ambasador: the place to stay in Split -

Maslina Resort, Hvar – mindful luxury in the heart of the Adriatic

Maslina Resort, Hvar – mindful luxury in the heart of the Adriatic -

The bon hiver guide to Paris

The bon hiver guide to Paris -

Villa Mirasol – timeless luxury and discreet elegance on the island of Lošinj

Villa Mirasol – timeless luxury and discreet elegance on the island of Lošinj -

Lošinj’s Captain’s Villa Rouge sets a new standard in private luxury hospitality

Lošinj’s Captain’s Villa Rouge sets a new standard in private luxury hospitality -

Villa Nai 3.3: A Michelin-recognised haven on Dugi Otok

Villa Nai 3.3: A Michelin-recognised haven on Dugi Otok -

The European road test: The Jeep Wrangler Rubicon

The European road test: The Jeep Wrangler Rubicon -

Rattrapante Mondiale – Split-Seconds Worldtimer

Rattrapante Mondiale – Split-Seconds Worldtimer -

Adaaran Select Meedhupparu & Prestige Water Villas: a Raa Atoll retreat

Adaaran Select Meedhupparu & Prestige Water Villas: a Raa Atoll retreat