Valero Energy tops profit estimates on higher Gulf Coast margins

John E. Kaye

- Published

- Home, Sustainability

Valero Energy Corp, an independent U.S. refiner, topped Wall Street estimates for quarterly profit on Thursday, as it acquired more from refining low-cost Canadian heavy crude. Refining margins in the company’s biggest segment, U.S. Gulf Coast operations, rose 16% to $1.64 billion.

“Our refineries operated well at 96% utilization, allowing us to take advantage of wider sour crude oil differentials and weakness in high sulfur residual feedstocks in the fourth quarter,” Chairman and Chief Executive Officer Joe Gorder said.

Valero Energy, as well as many of the U.S Gulf Coast refiners, can process heavy crude to make marine fuels compliant with the International Maritime Organization’s (IMO) new regulations. IN 2019, refiners spent massively to refurbish distillation units and cokers in order to process cheaper, heavy grade crude.

Analysts have highlighted Valero to be a major beneficiary of IMO’s low-sulfur fuel oil mandate.

During a Thursday morning conference call, analysts sought to get a better understanding to why Valero’s results were higher-than-expected, the opposite of what major oil companies like Royal Dutch Shell Plc had reported.

“Valero’s Gulf Coast results show its ability to run a cocktail of crudes including high-sulfur fuel oil which add to the earnings upside in an IMO 2020 environment,” said Credit Suisse analyst Manav Gupta.

Planned overhauls will cut the company’s refinery utilization in the first quarter of 2020.

Valero plans for its 15 refineries, two of which are outside the United States, to operate up to 91% of their combined capacity of 3.13 million barrels per day (bpd) in the first quarter of 2020, said Homer Bhullar, vice president of investor relations, in a Thursday conference call.

Excluding items, the company reported a profit of $2.13 per share beating analysts’ average estimate of $1.62, according to IBES data from Refinitiv.

Net income attributable to the shareholders rose to $1.1 billion, or $2.58 per share, in the fourth quarter ended Dec. 31, from $952 million, or $2.24 per share, a year earlier.

The San Antonio, Texas-based company’s total revenue, however, fell 3% to $27.88 billion.

Rival Marathon Petroleum posted higher adjusted earnings on Wednesday, well-above Wall Street expectations on better-than-expected refining margins setting a positive tone for the entire sector.

By Shradha Singh

Sourced Reuters

For more business news follow The European.

RECENT ARTICLES

-

Strong ESG records help firms take R&D global, study finds

Strong ESG records help firms take R&D global, study finds -

How residence and citizenship programmes strengthen national resilience

How residence and citizenship programmes strengthen national resilience -

Global leaders enter 2026 facing a defining climate choice

Global leaders enter 2026 facing a defining climate choice -

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change -

China’s BYD overtakes Tesla as world’s largest electric car seller

China’s BYD overtakes Tesla as world’s largest electric car seller -

UK education group signs agreement to operate UN training centre network hub

UK education group signs agreement to operate UN training centre network hub -

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing -

Oxford to host new annual youth climate summit on UN World Environment Day

Oxford to host new annual youth climate summit on UN World Environment Day -

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan -

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns -

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests -

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement -

Historic motorsport confronts its energy future

Historic motorsport confronts its energy future -

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation -

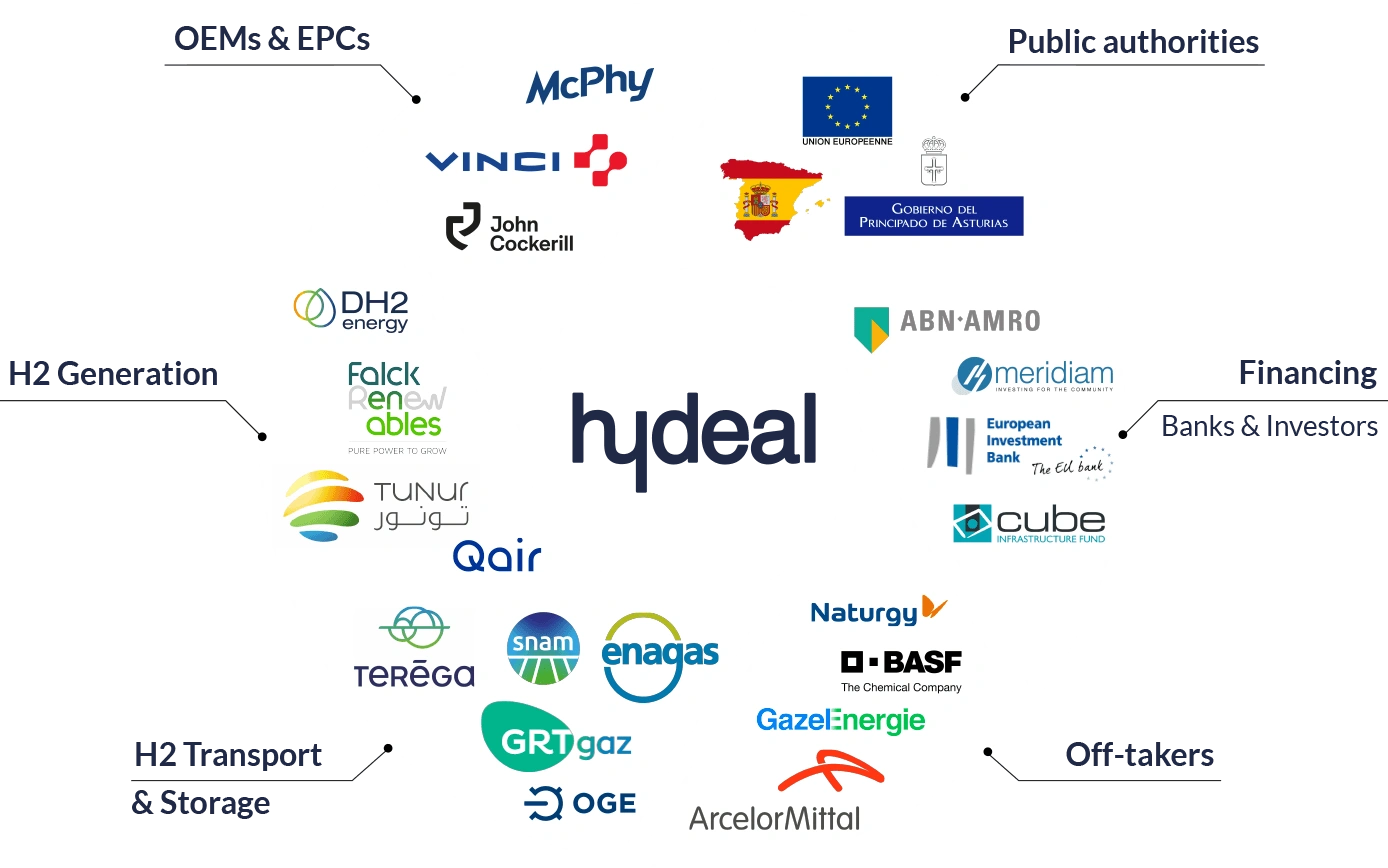

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe -

Fabric of change

Fabric of change -

Courage in an uncertain world: how fashion builds resilience now

Courage in an uncertain world: how fashion builds resilience now -

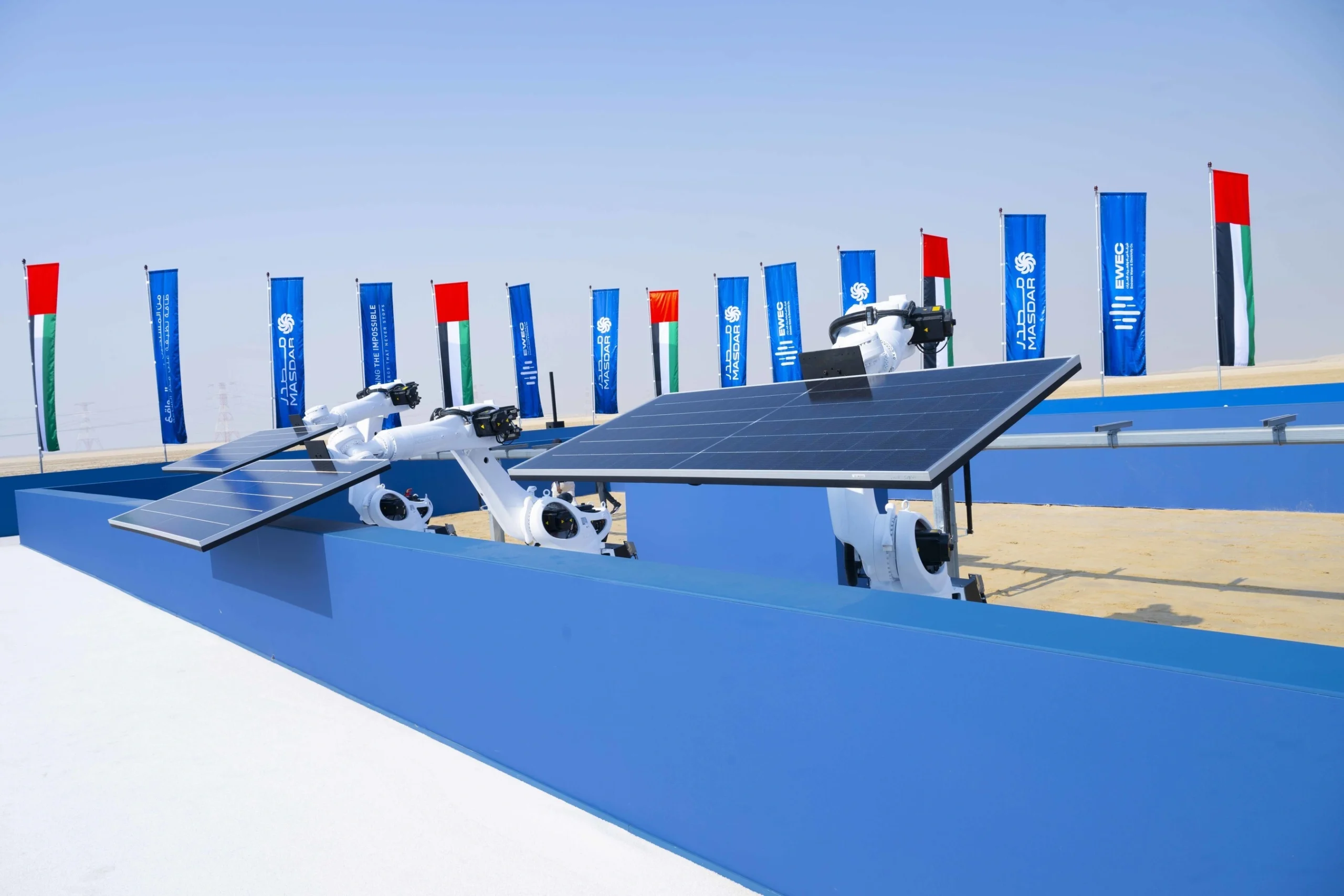

UAE breaks ground on world’s first 24-hour renewable power plant

UAE breaks ground on world’s first 24-hour renewable power plant -

China’s Yancheng sets a global benchmark for conservation and climate action

China’s Yancheng sets a global benchmark for conservation and climate action -

Inside Iceland’s green biotechnology revolution

Inside Iceland’s green biotechnology revolution -

Global development banks agree new priorities on finance, water security and private capital ahead of COP30

Global development banks agree new priorities on finance, water security and private capital ahead of COP30 -

UK organisations show rising net zero ambition despite financial pressures, new survey finds

UK organisations show rising net zero ambition despite financial pressures, new survey finds -

Gulf ESG efforts fail to link profit with sustainability, study shows

Gulf ESG efforts fail to link profit with sustainability, study shows -

Redress and UN network call for fashion industry to meet sustainability goals

Redress and UN network call for fashion industry to meet sustainability goals -

World Coastal Forum leaders warn of accelerating global ecosystem collapse

World Coastal Forum leaders warn of accelerating global ecosystem collapse