Broll reveals state of play in SADC property market

John E. Kaye

- Published

- Lifestyle

For a prospective investor or developer who has set their sights on expanding a property portfolio in Southern Africa or entering the region for the first time, the way forward may appear complex and uncertain. Conflicting reports, dubious statistics and misconceptions can cloud their route. So how can an investor or developer who wants to spread their investment wings in Southern Africa make an informed and strategically sound decision?

Broll Property Group’s latest research report on certain SADC (Southern African Development Community) countries, entitled “SADC Market Snippet 2018”, is a powerful and invaluable tool, designed to assist with understanding property market conditions across the region.

SADC was established in Windhoek in 1992 to grow the economies of sub-Saharan African states and foster cooperation and peace amongst its members. Broll Intel has put a group of SADC countries, where property investment opportunity presents itself under the spotlight. It has crafted a brief report which looks at:

- Country facts

- Economic indicators

- Global rankings on indices e.g. corruption or competitiveness

- Key indicators in the office, retail and industrial property markets

Dedicated market research

Broll Intel specialises in converting property data into market knowledge, providing clients with decision-making research that spans the commercial property sector. Research teams across sub-Saharan Africa enable Broll to add value to clients’ portfolios, by partnering with them to make well-informed decisions and grow the performance of their investments. The Broll “SADC Market Snippet 2018” takes each of the countries in turn and presents an easily readable and accessible six-part picture to guide the investor on property market conditions in each country.

Investors get the big picture

By extracting data such as GDP alongside ease of doing business rankings, as well as office rentals and yields, a fascinating picture that’s tailor-made for investors emerges (see Figure 1 for example).

The report is packed with a wealth of critical data for investors and decision-makers. Taking a closer look at a particular country in the report, for example Mauritius. A country of 1.3 million people, Mauritius rates well on the democracy index. The country is managing to keep corruption levels at bay and is high on the best-countries-for-business index. This ranks it as a favourable location in the SADC region in which to do business.

Mauritius also has 58.6% of the population urbanised, intense mobile phone usage at 142 phones per 100 people, internet access with 46.2 users per 100 people and a Real GDP annual growth rate of 4.0%, and therefore offers potential for investors and developers. Asking rents are being achieved within the retail market with average yields of 7.75% – 8% being evident. The average yield for offices is generally a bit higher at 8.5% – 9% and demand within the market is forecast to be stable with supply increasing over the next six months.

The Broll “SADC Market Snippet 2018” is an outstanding guide for property investors, packed with useful data and statistics that will make decision-making that much easier. As a group, Broll serves the investor and occupier markets across the African continent. These services include, but are not limited to: real estate investor services, facilities management, occupier solutions, property auctioneering, industrial and commercial broking, research-based real estate consulting and advisory, shopping centre management, valuation and advisory.

Further information

To download the report go to:

www.broll.com/publications

RECENT ARTICLES

-

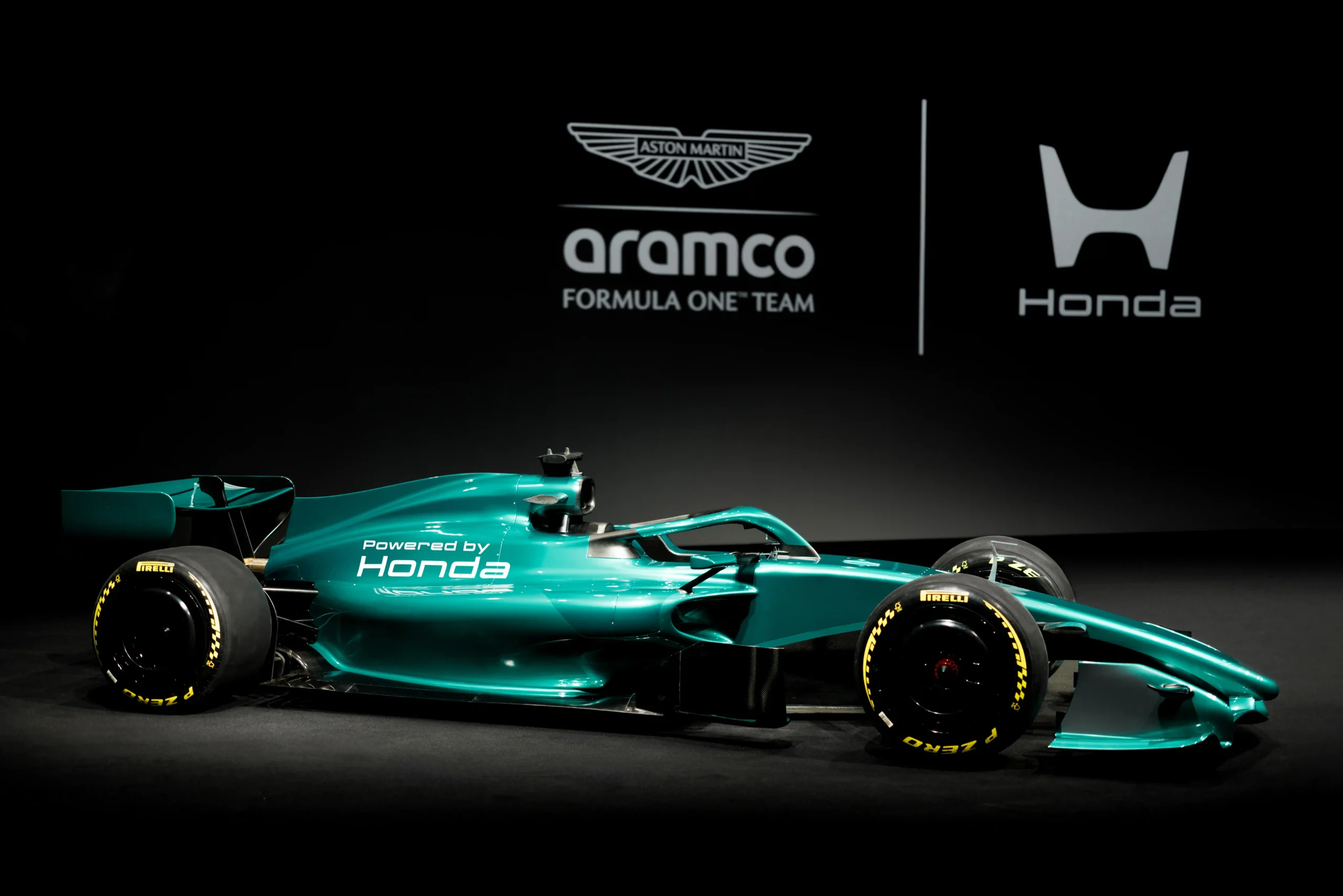

A new green dawn: inside Aston Martin’s turbulent start to Formula 1’s 2026 revolution

A new green dawn: inside Aston Martin’s turbulent start to Formula 1’s 2026 revolution -

WPSL targets £16m-plus in global sponsorship drive with five-year SGI partnership

WPSL targets £16m-plus in global sponsorship drive with five-year SGI partnership -

Need some downtime? Head to Nerja for some serious decompression

Need some downtime? Head to Nerja for some serious decompression -

How a book becomes a ‘bestseller' (and it’s not what you think)

How a book becomes a ‘bestseller' (and it’s not what you think) -

Fipronil: the silent killer in our waterways

Fipronil: the silent killer in our waterways -

Addiction remains misunderstood despite clear medical consensus

Addiction remains misunderstood despite clear medical consensus -

New guide to the NC500 calls time on 'tick-box tourism'

New guide to the NC500 calls time on 'tick-box tourism' -

Bon anniversaire, Rétromobile: Paris’ great motor show turns 50

Bon anniversaire, Rétromobile: Paris’ great motor show turns 50 -

Ski hard, rest harder: inside Europe’s new winter-wellness boom

Ski hard, rest harder: inside Europe’s new winter-wellness boom -

Baden-Baden: Europe’s capital of the art of living

Baden-Baden: Europe’s capital of the art of living -

Salzburg in 2026: celebrating 270 years of Mozart’s genius

Salzburg in 2026: celebrating 270 years of Mozart’s genius -

Sea Princess Nika – the ultimate expression of Adriatic elegance on Lošinj

Sea Princess Nika – the ultimate expression of Adriatic elegance on Lošinj -

Hotel Bellevue, Lošinj, Croatia – refined wellness by the Adriatic

Hotel Bellevue, Lošinj, Croatia – refined wellness by the Adriatic -

Padstow beyond Stein is a food lover’s dream

Padstow beyond Stein is a food lover’s dream -

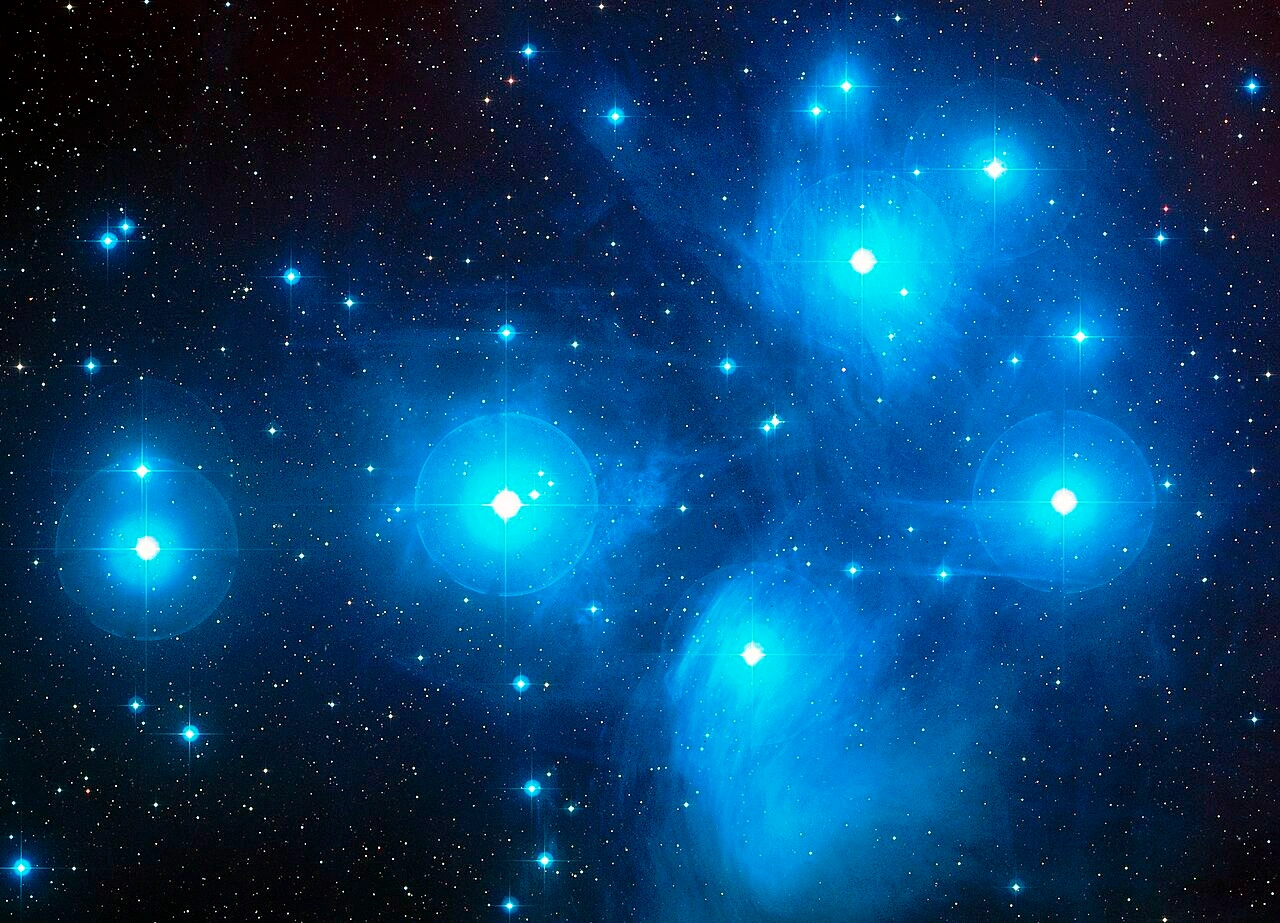

Love really is in the air. How to spot a sky full of heart-stealing stars this Valentine's Day

Love really is in the air. How to spot a sky full of heart-stealing stars this Valentine's Day -

Cora Cora Maldives – freedom, luxury and a celebration of island life

Cora Cora Maldives – freedom, luxury and a celebration of island life -

Hotel Ambasador: the place to stay in Split

Hotel Ambasador: the place to stay in Split -

Maslina Resort, Hvar – mindful luxury in the heart of the Adriatic

Maslina Resort, Hvar – mindful luxury in the heart of the Adriatic -

The bon hiver guide to Paris

The bon hiver guide to Paris -

Villa Mirasol – timeless luxury and discreet elegance on the island of Lošinj

Villa Mirasol – timeless luxury and discreet elegance on the island of Lošinj -

Lošinj’s Captain’s Villa Rouge sets a new standard in private luxury hospitality

Lošinj’s Captain’s Villa Rouge sets a new standard in private luxury hospitality -

Villa Nai 3.3: A Michelin-recognised haven on Dugi Otok

Villa Nai 3.3: A Michelin-recognised haven on Dugi Otok -

The European road test: The Jeep Wrangler Rubicon

The European road test: The Jeep Wrangler Rubicon -

Rattrapante Mondiale – Split-Seconds Worldtimer

Rattrapante Mondiale – Split-Seconds Worldtimer -

Adaaran Select Meedhupparu & Prestige Water Villas: a Raa Atoll retreat

Adaaran Select Meedhupparu & Prestige Water Villas: a Raa Atoll retreat