A platform for change

John E. Kaye

- Published

- Home, Technology

For all their reputation for dullness, economists are fond of using salacious examples to explain their theories. Inevitably, many of them involve bars. Take this one for example: a bar regularly holds ladies’ nights, offering free drinks to female customers. From a financial perspective, this sounds like a loss-making strategy. Not so much when the bar is full of male customers, happy to pay for their own drinks surrounded by female customers. All parties are happy, but none more so than the bar owner.

This is how a growing part of the economy works, argue two American economists and an Indian businessman in a book on the rise of digital marketplaces. Platform Revolution: How Networked Markets Are Transforming the Economy and How to Make Them Work for You, written by Dartmouth College’s Geoffrey G. Parker, Boston University’s Marshall W. Van Alstyne and Sangeet Paul Choudary, is not the first book on the subject. But its clarity and fact-based analysis have made it a business best-seller for 2016.

Some of the biggest companies in the world are digital platforms: two-sided markets where producers meet consumers. Business models vary from selling advertising space, as in the case of Facebook and Google, to charging a fee for transactions, as with sharing economy powerhouses Airbnb and Uber.

‘Platformisation’ has already transformed information-intensive industries, from music to retail. Its impact is already conspicuous in professional services, says Sangeet Choudary, whose stint at Yahoo has offered him first-hand insight into this slow-burning revolution. A bunch of legal services platforms match lawyers with clients. Finance and accounting are next in line with the advent of the blockchain. Even old fashioned sectors, such as mining and manufacturing are ripe for disruption with the rise of the Internet of Things, believes Choudary.

A game of one

The rise of the platforms has changed the nature of competition. Price is almost irrelevant, since most digital markets take a cut from transactions or benefit indirectly by offering other services. Their main aim is to increase the amount of interaction between suppliers and customers. To achieve that, they often help parties identify a reasonable price. Airbnb, a flat-sharing network, provides hosts with an indication of what a reasonable price for their property would be.

Platforms build their empires on massive heaps of data that help them match users with sellers, or with one another. Many are launching aggressive marketing services or offer giveaways to attract users and their data. Others acquire data from third parties or ‘piggyback’ on existing platforms – an example is Netflix, which relies on Amazon’s cloud computing services.

Once they tap into the data market, they tend to dominate it, exploiting the so-called ‘network effects’: the more users a platform has, the easier it becomes to attract more by improving its services through data. This inevitably leads to vast economies of scale and, in most cases, monopolies. “A lot of what these platforms do has fixed costs – they build new software that serves one person or billions and it costs roughly the same. So a small network trying to compete in a high fixed cost industry such as software development is disadvantaged,” says Parker. Entry can be nearly impossible in some markets: “If you want to launch a social network, how can you compete with Facebook’s 1.7 billion users? Whatever technology you employ they can detect it and roll it out themselves.”

Marshall W. Van AlstyneMonopolies of this scale are not unprecedented in the history of capitalism. For Van Alstyne, we are witnessing a revival of monopolies reminiscent of the industrial era. In the early 20th century, manufacturers such as Ford built supply-driven economies of scale with high fixed and low marginal costs, lowering prices and eventually driving competition out of the market. Today the trend repeats itself, but towards the opposite direction: the demand side.

This poses a problem for antitrust regulators, as traditional merger and acquisition rules become obsolete. When the European Commission investigates deals in the technology sector, such as the recent Microsoft-LinkedIn and Facebook-WhatsApp deals, it increasingly looks into user data as an asset that can stifle competition. Old recipes may not work however, thinks Van Alstyne: “Breakups would put walls in between the data analysis that gives the network effects. If you separate email from search and browsing behaviour you can’t get the user-to-user benefits that Google gets when combining all these services.’’ The solution, says Van Alstyne, should be a less heavy-handed approach: “We should be granting access to infrastructure and data to other companies, in the same way that in the industrial era third parties were offered access to railroad tracks and telephone networks.’’

A different leadership model

Business leaders are equally mystified by the rise of the platforms. Supply chains become vastly more complex. Employees often sit outside the business or become ‘micro-entrepreneurs’ – think of Uber drivers and Airbnb hosts. Customers participate in multiple marketplaces.

How can managers tame these forces? The answer, claim the authors of Platform Revolution, is to invert the firm and shift focus from internal to external forces. “Every single traditional value-creating activity must take on an external counterpart. You must think externally: how do you motivate communities that you do not control and persuade them to work on your behalf? It is a model based on orchestration and persuasion rather than dictation,’’ says Van Alstyne. If the platform economy was a football game, a leader would be the referee rather than a superstar striker: “You need a balanced mindset. Platforms are multi-sided markers, so if one side exploits the other one you have to curb that activity and make sure that value is created for both sides and that the rules are just for all players.’’

Metrics, an obsession of executives, may adjust accordingly, believes Parker: “Some of the metrics of success will change. Instead of return on assets or investment and other inventory terms you will see firms focusing more externally on things such as completed transactions, growth of different types of users and other metrics of supply and demand. These will be more visible and more shared.’’

Managers may need to develop the political nous and flexibility of a movement leader, believes Choudary: “Today, platform leadership is very similar to traditional management, which focuses on keeping customers happy. We need new leadership models that serve the whole ecosystem. The closest model is people who have led movements, such as Nelson Mandela. He led the anti-Apartheid movement, a multi-stakeholder system, so he ensured that everybody succeeded rather than focusing on a specific group.’’

Geoffrey G. ParkerEurope left behind

Not surprisingly, the majority of thriving platforms are located in the US. Asia is rapidly catching up with the likes of Alibaba and JD.com, China’s biggest online retailers. Europe’s fragmented regulatory framework, along with cultural and linguistic barriers, prevent European platforms from scaling up globally. Even much-celebrated European platforms such as Spotify had to tap into the US market to become household names.

The European market is rife with what the authors call “data nationalism”, as national regulators and the European Commission have started turf wars over data ownership. Many US tech companies face legal battles in several European countries over their data practices. “A lot of these data and privacy protection laws limit the analysis of data, which limits the capacity of firms to create network effects. These rules are well-intentioned, but they have the inadvertent consequence of splitting the market, which prevents the rise of large platforms,’’ says Van Alstyne.

The good news is that more integration is underway, says Choudary: “Silicon Valley is a huge player, but the fact that China and India are the next big players shows that a big home market is a good place to start. Europeans have started to realise this and the creation of the Digital Single Market is a step towards that direction. Germans especially realise that there is a big opportunity in business-to-business and industrial platforms, so there is more focus on winning that game rather than out-competing Facebook and Google.’’

Sign up to The European Newsletter

RECENT ARTICLES

-

Make boards legally liable for cyber attacks, security chief warns

Make boards legally liable for cyber attacks, security chief warns -

AI innovation linked to a shrinking share of income for European workers

AI innovation linked to a shrinking share of income for European workers -

Europe emphasises AI governance as North America moves faster towards autonomy, Digitate research shows

Europe emphasises AI governance as North America moves faster towards autonomy, Digitate research shows -

Surgeons just changed medicine forever using hotel internet connection

Surgeons just changed medicine forever using hotel internet connection -

Curium’s expansion into transformative therapy offers fresh hope against cancer

Curium’s expansion into transformative therapy offers fresh hope against cancer -

What to consider before going all in on AI-driven email security

What to consider before going all in on AI-driven email security -

GrayMatter Robotics opens 100,000-sq-ft AI robotics innovation centre in California

GrayMatter Robotics opens 100,000-sq-ft AI robotics innovation centre in California -

The silent deal-killer: why cyber due diligence is non-negotiable in M&As

The silent deal-killer: why cyber due diligence is non-negotiable in M&As -

South African students develop tech concept to tackle hunger using AI and blockchain

South African students develop tech concept to tackle hunger using AI and blockchain -

Automation breakthrough reduces ambulance delays and saves NHS £800,000 a year

Automation breakthrough reduces ambulance delays and saves NHS £800,000 a year -

ISF warns of a ‘corporate model’ of cybercrime as criminals outpace business defences

ISF warns of a ‘corporate model’ of cybercrime as criminals outpace business defences -

New AI breakthrough promises to end ‘drift’ that costs the world trillions

New AI breakthrough promises to end ‘drift’ that costs the world trillions -

Watch: driverless electric lorry makes history with world’s first border crossing

Watch: driverless electric lorry makes history with world’s first border crossing -

UK and U.S unveil landmark tech pact with £250bn investment surge

UK and U.S unveil landmark tech pact with £250bn investment surge -

International Cyber Expo to return to London with global focus on digital security

International Cyber Expo to return to London with global focus on digital security -

Cybersecurity talent crunch drives double-digit pay rises as UK firms count cost of breaches

Cybersecurity talent crunch drives double-digit pay rises as UK firms count cost of breaches -

Investors with €39bn AUM gather in Bologna to back Italy’s next tech leaders

Investors with €39bn AUM gather in Bologna to back Italy’s next tech leaders -

Axians and Nokia expand partnership to strengthen communications infrastructure across EMEA

Axians and Nokia expand partnership to strengthen communications infrastructure across EMEA -

Forterro buys Spain’s Inology to expand southern Europe footprint

Forterro buys Spain’s Inology to expand southern Europe footprint -

Singapore student start-up wins $1m Hult Prize for education platform

Singapore student start-up wins $1m Hult Prize for education platform -

UK businesses increase AI investment despite economic uncertainty, Barclays index finds

UK businesses increase AI investment despite economic uncertainty, Barclays index finds -

Speed-driven email security: effective tactics for phishing mitigation

Speed-driven email security: effective tactics for phishing mitigation -

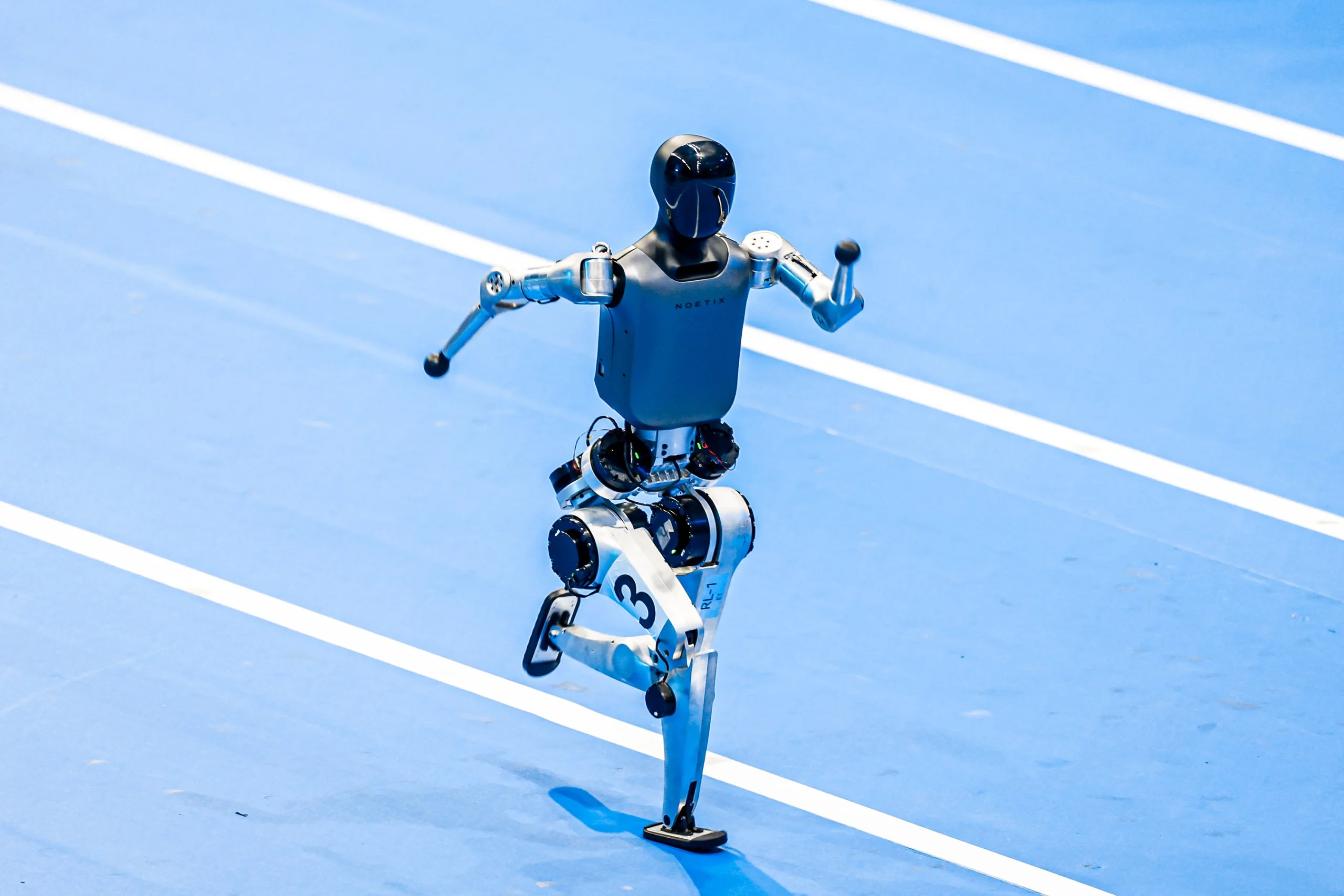

Short circuit: humanoids go for gold at first 'Olympics for robots'

Short circuit: humanoids go for gold at first 'Olympics for robots' -

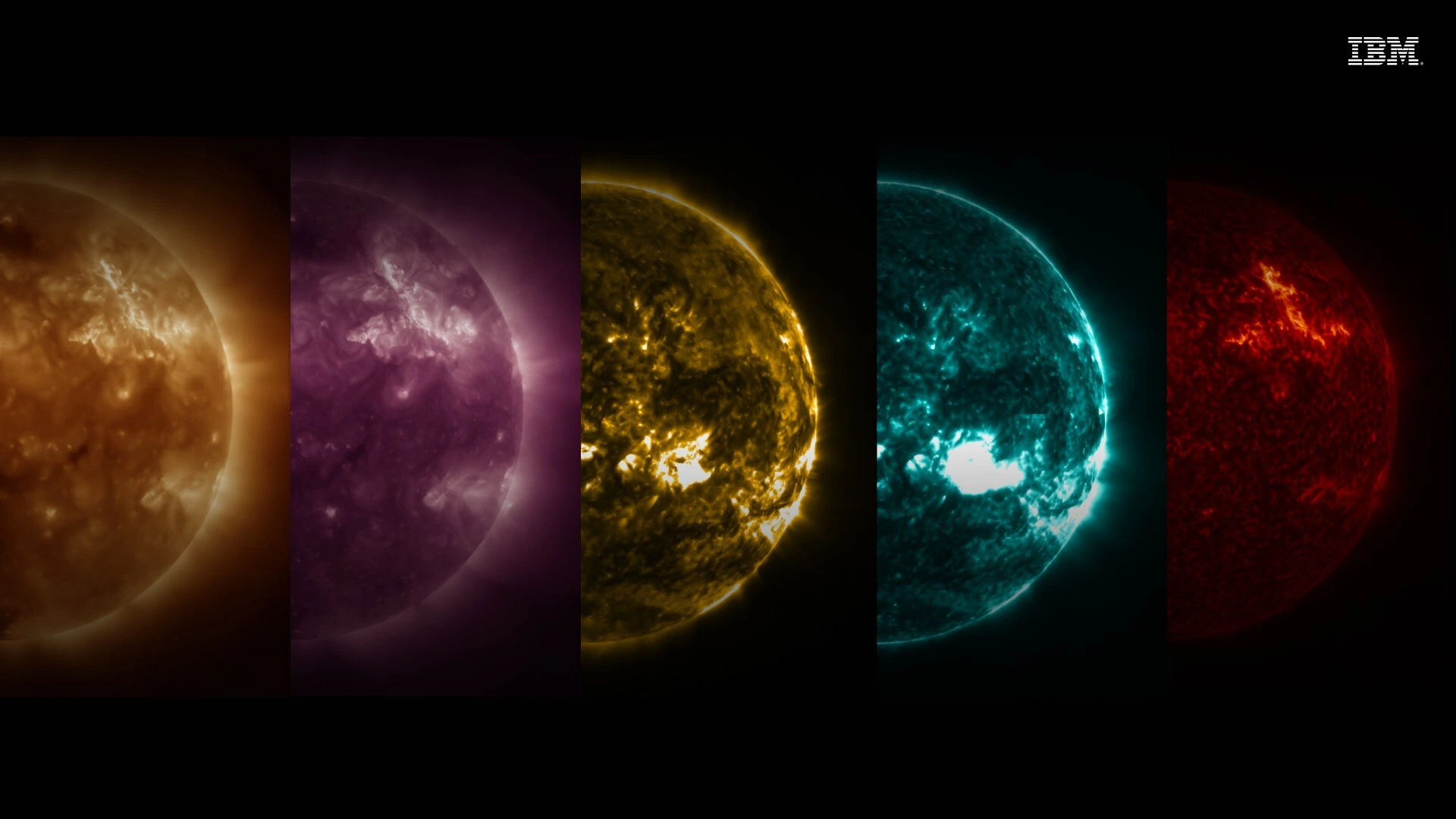

New IBM–NASA AI aims to forecast solar flares before they knock out satellites or endanger astronauts

New IBM–NASA AI aims to forecast solar flares before they knock out satellites or endanger astronauts -

AI is powering the most convincing scams you've ever seen

AI is powering the most convincing scams you've ever seen