A green purpose to profits

John E. Kaye

- Published

- Home, Lifestyle, Sustainability

Article by Fiona Le Poidevin, CEO of The International Stock Exchange

Upon the conclusion of this year’s World Economic Forum Annual Meeting in Davos, Philip Aldrick, Economics Editor at The Times, noted that over the years business leaders have been talking about “stakeholder capitalism” but “little has been done.” What was different this year though was that the forum was specifically entitled “Stakeholders for a Cohesive and Sustainable World”. Oh, and a 17-year-old Swede by the name of Greta Thunberg was in attendance.

President Trump also made the headlines with his counter arguments and the meeting as a whole may not have delivered as many tangible developments as some, like Greta, might have hoped. But there is no doubt that it kept green finance both on, and at the top of, the news agenda.

At the same time, the bush fires which were raging in Australia seared the potentially awful consequences into our minds and helped to reinforce the need to find funding solutions not just to mitigate against the effects but to fight the underlying causes of climate change.

British Crown Dependencies

The International Stock Exchange Group (TISE) has offices in each of the Crown Dependencies of Guernsey, Jersey and the Isle of Man where, as relatively small islands, it is always easy to question what impact we may be able to have in fighting climate change. Where we can really make a difference is utilising the experience and expertise in our financial services industry to both encourage and facilitate global flows of capital into green finance initiatives.

The islands have a history in this regard. For example, around 10 years ago a cluster of Guernsey-domiciled, London Stock Exchange main market listed “cleantech” funds were launched. The market has continued to evolve and so has the jurisdictional offering, with Guernsey introducing specific green products, such as the world’s first regulated green fund, the Guernsey Green Fund. On the other hand, Jersey and the Isle of Man are focused on promoting the jurisdictions’ existing service offerings in being able to cater for a wide range of impact investing.

There is also scope for the Guernsey, Jersey, and Isle of Man governments to utilise existing (or new) public funds to seed some of these products which might also attract private-sector capital. Imagine if the Crown Dependencies could use public and private funds to create a “multiplier effect”, providing a greater impact globally than any current overseas aid or lone local initiatives might achieve. It is a bold ambition but, I believe, an achievable one and TISE can help.

TISE product

At TISE, we have launched a green market segment, TISE GREEN, to encourage greater flows of capital into investments which protect or enhance the environment. TISE GREEN is open to investments – bonds, funds and trading companies – from any jurisdiction.

The first investments which entered TISE GREEN came in the form of four green bonds. They are certified green bonds under the Climate Bonds Initiative (CBI) Climate Bond Standard & Certification Scheme, with the proceeds intended to finance solar energy projects in Brazil.

We have considered widening the scope of the segment, not least because we already have social housing investment vehicles listed on TISE but the standards and criteria in the social and impact investment area remain relatively immature. That said, we are keeping a close eye because the space is rapidly evolving as the world plays catch up in addressing the climate crisis.

Real change

Historically, many corporates have only paid lip service to such lofty ideals. However, Mr Aldrick of The Times is now more hopeful of tangible change because, as he says, “purpose is serving profit” and so called “sustainable” investments are both benefitting the planet and providing an attractive economic return, rather than being seen as a voluntary donation to the cause or an under-performing asset.

In addition, corporates are facing twin-fold pressures: from above, in the form of governments, regulators and supra-national bodies who are beginning to impose Environmental, Social, and Governance (ESG) standards on the business world; and from below as, in particular, a new generation of investors is providing the catalyst with demands for better regard to ESG factors which are feeding their way through, often via institutional investors and asset managers, to investee companies.

As such, it is those companies that have climate change truly on their agenda which are now in demand with investors. That is why the likes of the large oil companies are being shunned by some investors and some activists want to see the oil companies dismantled immediately. But there needs to be an understanding that these firms will be needed to assist us in transitioning to new forms of energy.

Green finance is no longer seen simply as a nice thing to do, it is also appealing to investors who can realise an attractive return. However, as this transition takes place and as “going green” becomes more profitable, it does raise the spectre of greenwashing. This is worth consideration by us all – at TISE, in the Crown Dependencies and beyond – as we develop policies, standards and products which facilitate the flows of global capital into environmental initiatives. We should be bold, we need to be brave but we also need to be prudent.

If this is the case, then there is no doubt that by having a genuine green purpose, we can all make a profit at the same time, preserving our world and fighting climate change.

Further information

RECENT ARTICLES

-

Whispering Angel at 20: the rosé that ruled them all

Whispering Angel at 20: the rosé that ruled them all -

Abu Dhabi to build first Harry Potter land featuring both Hogwarts Castle and Diagon Alley

Abu Dhabi to build first Harry Potter land featuring both Hogwarts Castle and Diagon Alley -

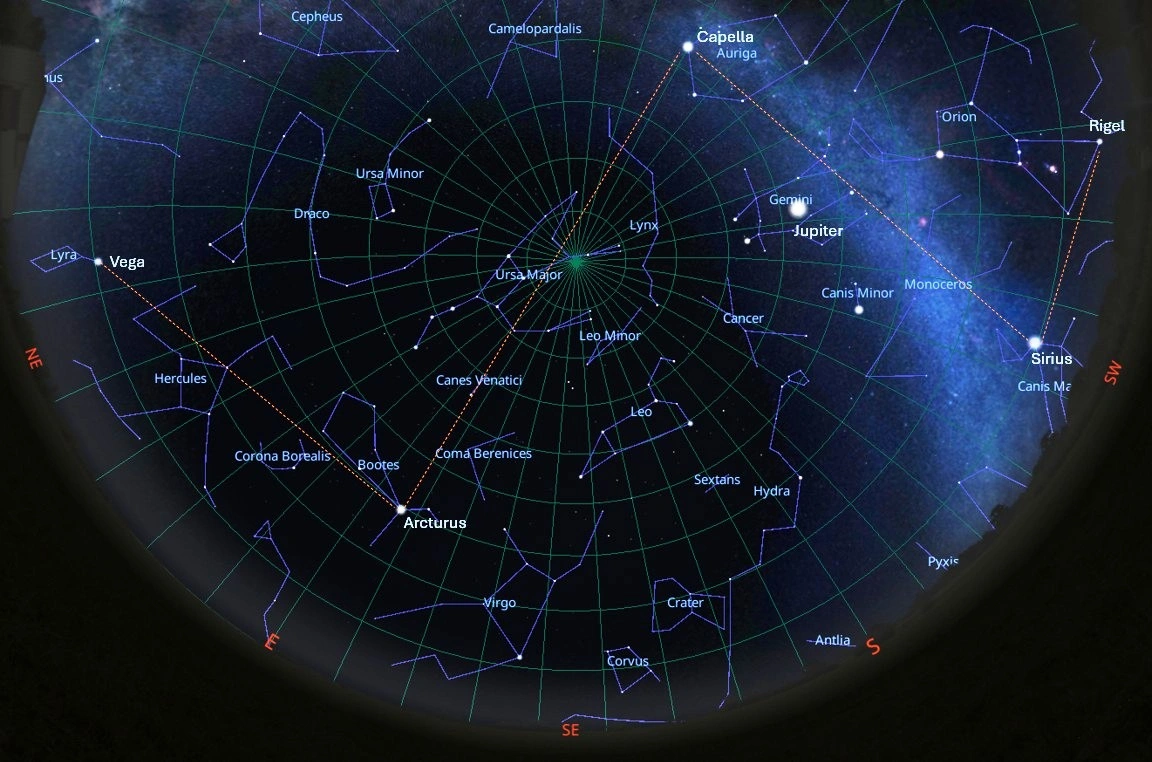

March stargazing guide: the brightest stars to spot this spring

March stargazing guide: the brightest stars to spot this spring -

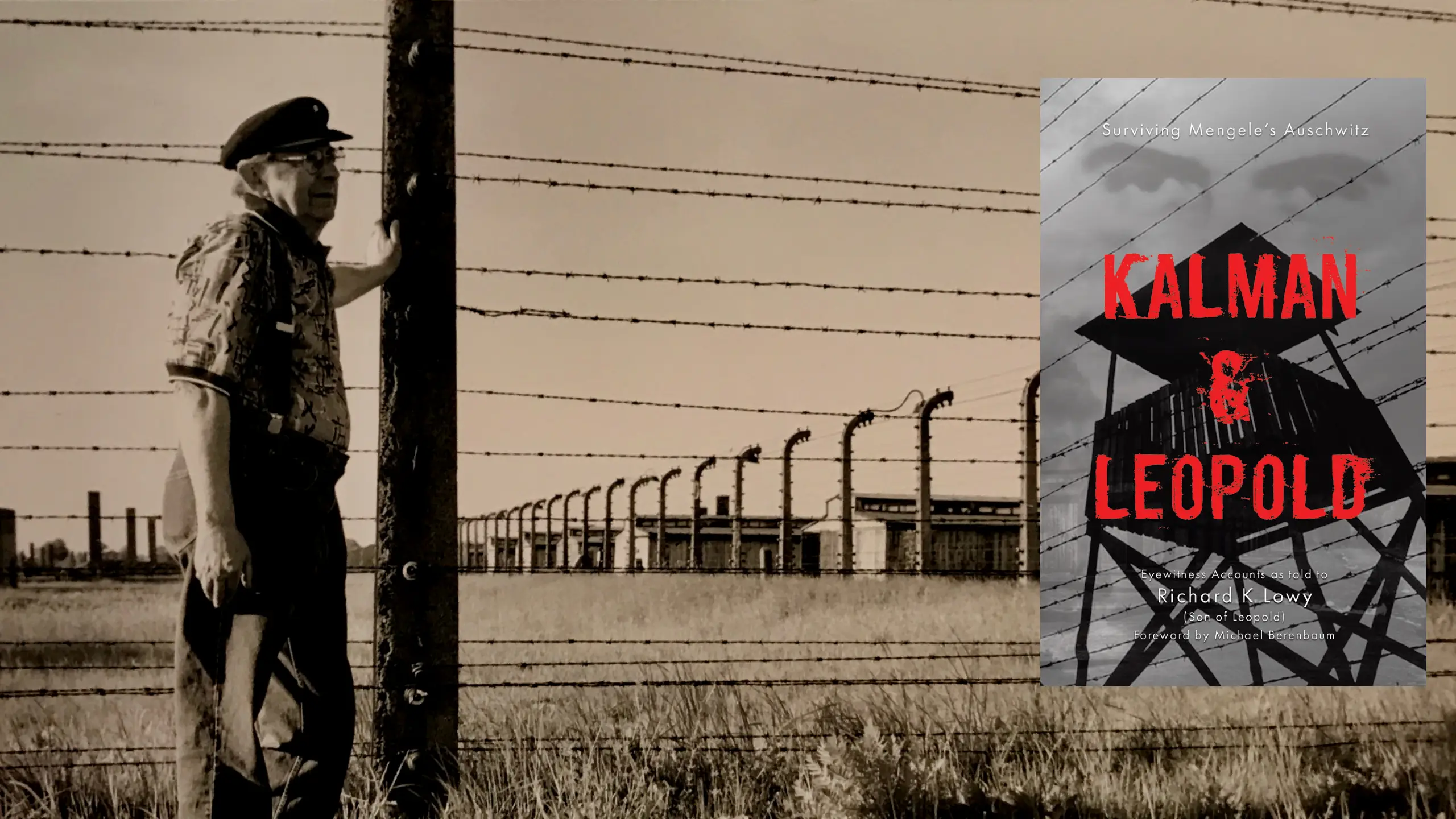

The European Reads: Kalman & Leopold: Surviving Mengele’s Auschwitz

The European Reads: Kalman & Leopold: Surviving Mengele’s Auschwitz -

The pearl of Africa: Stanley Johnson’s journey into Uganda’s wild heart

The pearl of Africa: Stanley Johnson’s journey into Uganda’s wild heart -

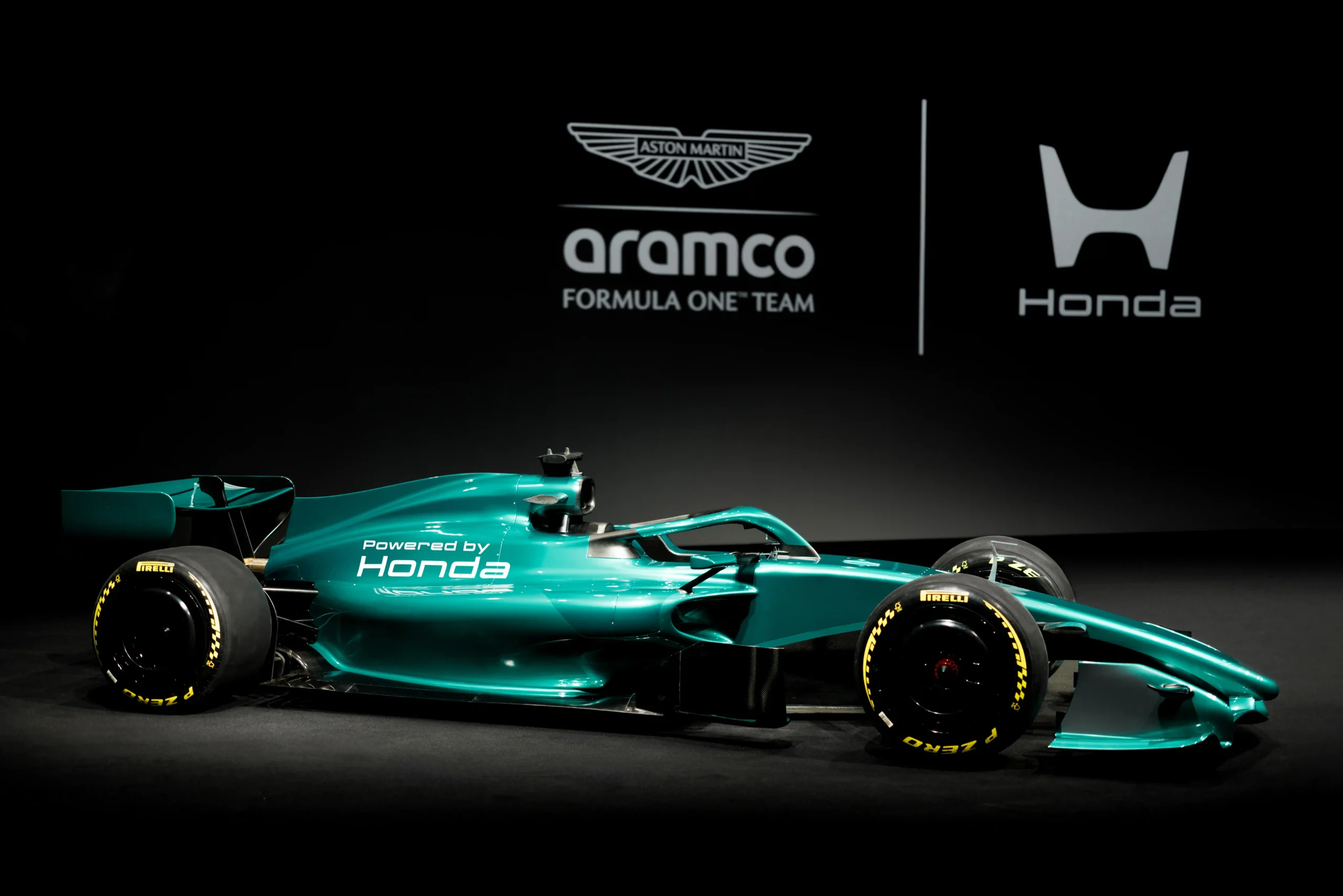

A new green dawn: inside Aston Martin’s turbulent start to Formula 1’s 2026 revolution

A new green dawn: inside Aston Martin’s turbulent start to Formula 1’s 2026 revolution -

WPSL targets £16m-plus in global sponsorship drive with five-year SGI partnership

WPSL targets £16m-plus in global sponsorship drive with five-year SGI partnership -

Need some downtime? Head to Nerja for some serious decompression

Need some downtime? Head to Nerja for some serious decompression -

How a book becomes a ‘bestseller' (and it’s not what you think)

How a book becomes a ‘bestseller' (and it’s not what you think) -

Fipronil: the silent killer in our waterways

Fipronil: the silent killer in our waterways -

Addiction remains misunderstood despite clear medical consensus

Addiction remains misunderstood despite clear medical consensus -

New guide to the NC500 calls time on 'tick-box tourism'

New guide to the NC500 calls time on 'tick-box tourism' -

Bon anniversaire, Rétromobile: Paris’ great motor show turns 50

Bon anniversaire, Rétromobile: Paris’ great motor show turns 50 -

Ski hard, rest harder: inside Europe’s new winter-wellness boom

Ski hard, rest harder: inside Europe’s new winter-wellness boom -

Baden-Baden: Europe’s capital of the art of living

Baden-Baden: Europe’s capital of the art of living -

Salzburg in 2026: celebrating 270 years of Mozart’s genius

Salzburg in 2026: celebrating 270 years of Mozart’s genius -

Sea Princess Nika – the ultimate expression of Adriatic elegance on Lošinj

Sea Princess Nika – the ultimate expression of Adriatic elegance on Lošinj -

Hotel Bellevue, Lošinj, Croatia – refined wellness by the Adriatic

Hotel Bellevue, Lošinj, Croatia – refined wellness by the Adriatic -

Padstow beyond Stein is a food lover’s dream

Padstow beyond Stein is a food lover’s dream -

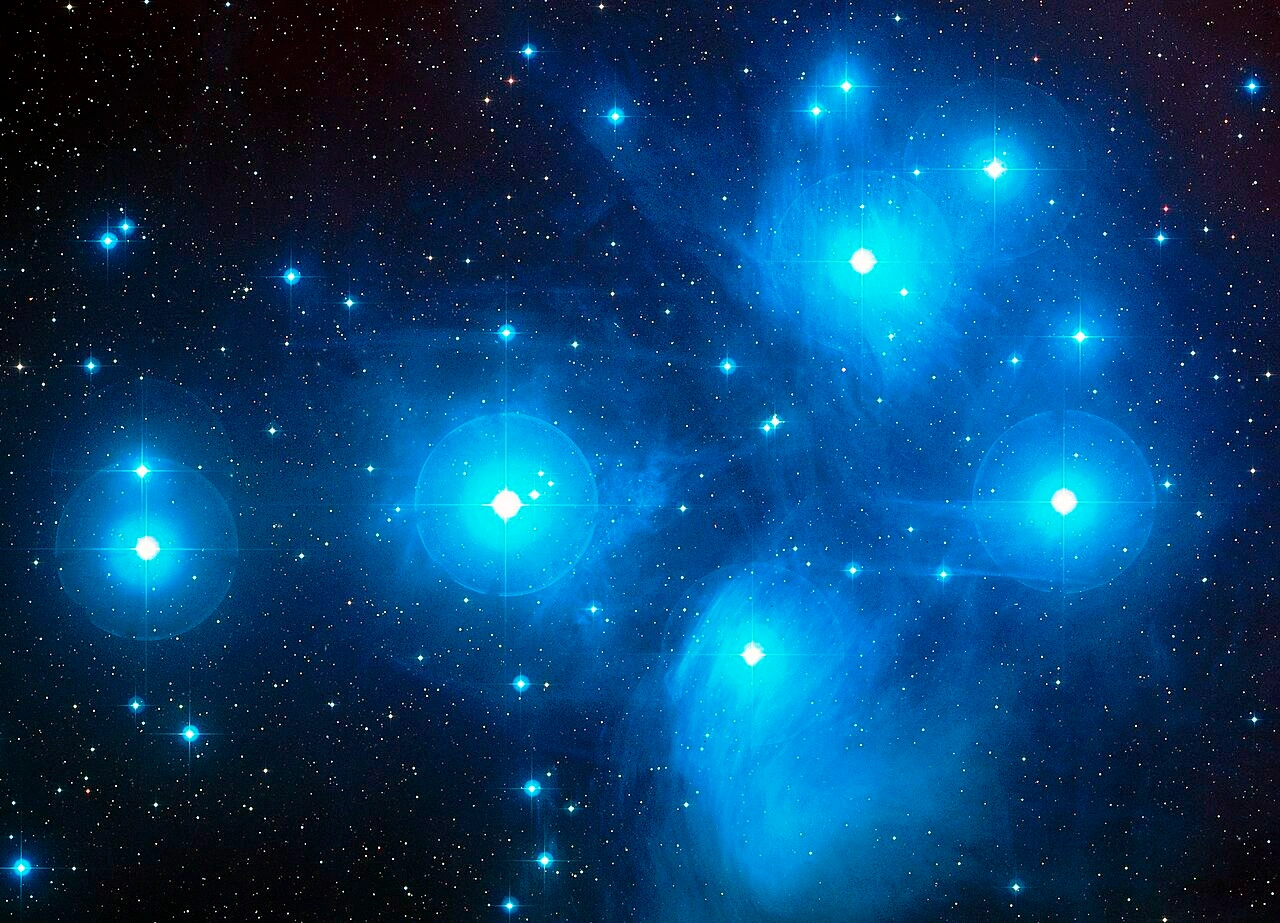

Love really is in the air. How to spot a sky full of heart-stealing stars this Valentine's Day

Love really is in the air. How to spot a sky full of heart-stealing stars this Valentine's Day -

Cora Cora Maldives – freedom, luxury and a celebration of island life

Cora Cora Maldives – freedom, luxury and a celebration of island life -

Hotel Ambasador: the place to stay in Split

Hotel Ambasador: the place to stay in Split -

Maslina Resort, Hvar – mindful luxury in the heart of the Adriatic

Maslina Resort, Hvar – mindful luxury in the heart of the Adriatic -

The bon hiver guide to Paris

The bon hiver guide to Paris -

Villa Mirasol – timeless luxury and discreet elegance on the island of Lošinj

Villa Mirasol – timeless luxury and discreet elegance on the island of Lošinj