Generations of excellence

John E. Kaye

- Published

- Banking & Finance, Home

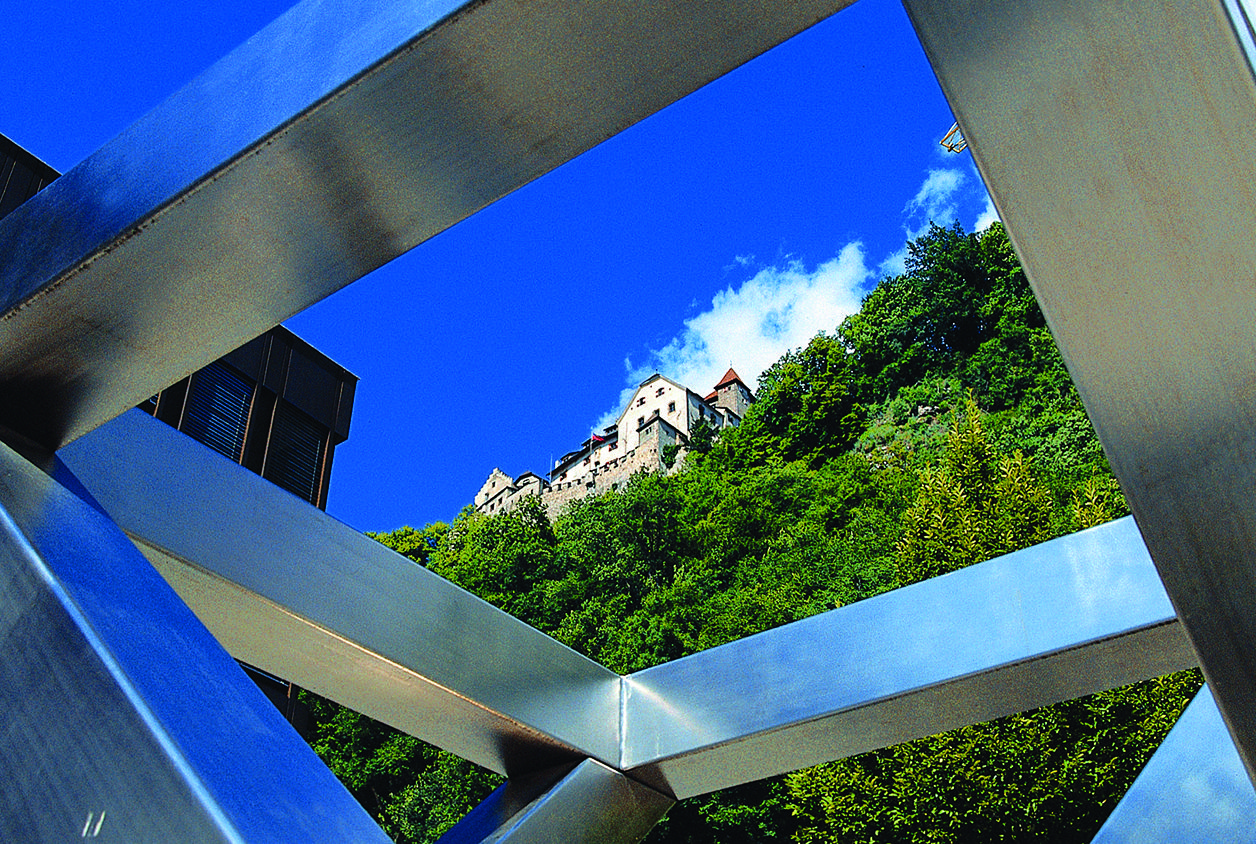

By actively promoting fintech innovation and driving responsible investment mechanisms, Liechtenstein continues to set the standards for global financial centres

Over the last century, state sovereignty combined with close ties to Switzerland and integration into the EU (through EEA membership) has fostered unprecedented economic growth in Liechtenstein, allowing the principality to become one of the wealthiest and most industrialised nations in the world.

Locational advantages

Liechtenstein has been a member of the European Economic Area (EEA) since 1995. For Liechtenstein-based companies, this ensures unrestricted market access to 30 states and around 500 million people in Europe. The free movement of goods, people, services and capital simplifies business relations with Europe. EEA membership means that the statutory operating conditions in force in Liechtenstein are the same as those in EU countries.

Since 1924, the customs and currency union with Switzerland has secured access to the country. The Principality of Liechtenstein is an outstanding location for financial services providers and their clients. They benefit from political continuity and economic stability. Analysts at Standard & Poor’s have for years awarded Liechtenstein an AAA rating and underscore the stable outlook.

Promoting innovation

Liechtenstein’s business-friendly company law offers wide-ranging opportunities and remains to this day a role model for other financial centres. In addition to conventional legal forms such as the stock corporation, foundations, protected cell companies or – uniquely in continental Europe – trusts can also be set up. In order to promote innovation, the Liechtenstein Venture Cooperative has also been created, which is specifically aimed at innovation in the financial markets and brings together ideas, work and capital for new ideas and technology.

In addition, the digital revolution and in particular new financial technologies are great innovation drivers for the international financial sector. Here too – as a centre for the very best fintech solutions – Liechtenstein is as at the vanguard. Investors are supported by the government and Liechtenstein’s Financial Market Authority (FMA), which promotes fintech innovation. The FMA’s Regulatory Laboratory serves as a first port of call for startups and established financial services providers who have questions relating to fintech.

The FMA is guided by the principle that regulations must comply with European standards and must be used and configured so that innovative business models can be realised, while ensuring client protection.

Through its Innovation Clubs the government also offers a state process for improving economic operating conditions. If necessary, amendments of statutory and, in particular of supervisory operating conditions, can be reviewed and proposed for implementation.

Legal and tax conformity

Liechtenstein pursues a clear strategy of tax conformity and plays an active role in the relevant bodies. Implementation of the standards was positively received by the Global Forum. Liechtenstein is continuously and actively expanding the network of bilateral double taxation conventions.

Transparency and stability

At the international level, the introduction of the Automatic Exchange of Information (AEOI) as well as various double taxation conventions and tax information treaties, inter alia with Germany, Switzerland, Austria as well as the USA, safeguard legal security and recognition. Banks, insurers, fiduciaries, investment fund companies, asset managers and common-benefit foundations all value Liechtenstein’s financial centre. Liechtenstein is stable and sovereign, its financial centre is transparent, secure and professional.

Liechtenstein was one of the first states to commit itself to the international standards on transparency and tax cooperation and pursues a clear strategy of tax compliance. This is underscored inter alia by the Liechtenstein Declaration and the Financial Centre Strategy of the Government. The country plays an active part in the OECD/Global Forum bodies and is a recognised partner within the international community. Implementation of the standards pertaining to the exchange of tax information in Liechtenstein was positively received by the OECD’s Global Forum (on Transparency and Exchange of Information for Tax Purpose).

Sustainability and philanthropy

Acting in a responsible, sustainable manner is a central component of Liechtenstein’s culture. Liechtenstein is establishing itself as a respected, stable, and sustainable financial centre.

In December 2015, at the Climate Conference in Paris, a new era was ushered in with all UN member states supporting a new climate convention. This convention continues to define the future direction of the financial sector. After all, it too is affected by climate change and the associated risks. If it does not focus its investments on sustainably oriented companies and sectors in good time, then climate change could destroy assets.

Sustainability is a priority in Liechtenstein, indeed it is one of the most sustainable countries in the world. In 2020 Liechtenstein was ranked as the “12th most sustainable country” in the Global Sustainable Competitiveness Index of 180 countries. The Liechtenstein financial centre has traditionally placed particular importance on the need to accept responsibility and to show commitment in the field of sustainability and has nurtured this through various activities and initiatives, as well as special niche products. Sustainability plays an important role in Liechtenstein’s financial centre – it promotes the development of cutting-edge products and structures, taking account of the responsible approach clients have towards social and environmental issues.

Socially responsible investment

Socially responsible investment considers not only economic but also ecological, ethical, governance and social aspects. This enables investors to achieve a kind of “double return”: they generate an economic return and at the same time can sustainably promote their missions. Through the asset management of foundations and non-profit organisations, such sustainable investments offer the option of supporting the purpose of the recipient institutions.

Sustainable investments are more than just an investment style or product category. For an increasing number of investors, they are becoming a personal mission and a different way of dealing with money. Their goal is the so-called impact that the investment makes. An investor’s targeted approach towards social, ecological, ethical or even governance goals is central to their motivation. Microfinance investment funds, green building investment funds or sustainable forest investments are examples of those already available on the market. Climate change is likely to continue playing a key role here.

Philanthropy: Financial products for the greater good

In today’s world, the traditional philanthropic concept of charity is undergoing changes. This means wealthy individuals are not necessarily donating less but are increasingly linking their donations to clear targets (venture philanthropy). In addition, an increasing number of organisations are discovering another way of having a positive impact in the form of investment.

Liechtenstein offers the best location worldwide for charitable foundations and philanthropic engagement. This is the result of the Global Philanthropy Environment Index (GPEI) 2022, published by the Lilly Family School of Philanthropy at Indiana University published in March 2022.

Further information

Sign up to The European Newsletter

RECENT ARTICLES

-

UK government sets up Women in Tech taskforce amid gender imbalance concerns

UK government sets up Women in Tech taskforce amid gender imbalance concerns -

Liechtenstein lands AAA rating again as PM hails “exceptional stability”

Liechtenstein lands AAA rating again as PM hails “exceptional stability” -

Lusaka Securities Exchange surges ahead on reform momentum

Lusaka Securities Exchange surges ahead on reform momentum -

PROMEA leads with ESG, technology and trust in a changing Swiss market

PROMEA leads with ESG, technology and trust in a changing Swiss market -

Why collective action matters for pensions and the planet

Why collective action matters for pensions and the planet -

Structuring success with Moore Stephens Jersey

Structuring success with Moore Stephens Jersey -

PIM Capital sets new standards in cross-jurisdiction fund solutions

PIM Capital sets new standards in cross-jurisdiction fund solutions -

Innovation, advisory and growth: Banchile Inversiones in 2024

Innovation, advisory and growth: Banchile Inversiones in 2024 -

Digitalization, financial inclusion, and a new era of banking services: Uzbekistan’s road to WTO membership

Digitalization, financial inclusion, and a new era of banking services: Uzbekistan’s road to WTO membership -

Fermi America secures $350m in financing led by Macquarie Group

Fermi America secures $350m in financing led by Macquarie Group -

Banchile Inversiones receives three prestigious international awards

Banchile Inversiones receives three prestigious international awards -

What makes this small island one of the world’s most respected financial hubs?

What makes this small island one of the world’s most respected financial hubs? -

MauBank wins international award for tackling barriers to finance

MauBank wins international award for tackling barriers to finance -

‘It’s like a private bank but with retail rates’: Inside Jersey’s mortgage market for new high-value residents

‘It’s like a private bank but with retail rates’: Inside Jersey’s mortgage market for new high-value residents -

How one fintech is using AI to fix Latin America’s broken mortgage system

How one fintech is using AI to fix Latin America’s broken mortgage system -

Why the humble trading journal could be your edge in volatile markets

Why the humble trading journal could be your edge in volatile markets -

The smart way to structure family wealth: Why Liechtenstein funds are in demand

The smart way to structure family wealth: Why Liechtenstein funds are in demand -

How market concentration is creating new risks and opportunities

How market concentration is creating new risks and opportunities -

Staying the course in an unpredictable market

Staying the course in an unpredictable market -

Decision-making factors when establishing a foundation

Decision-making factors when establishing a foundation -

Why the British Virgin Islands remains a top destination for global business

Why the British Virgin Islands remains a top destination for global business -

Malta’s growing appeal as a financial services domicile

Malta’s growing appeal as a financial services domicile -

Matthieu André on AXA IM Select’s award-winning approach to multi-manager investing

Matthieu André on AXA IM Select’s award-winning approach to multi-manager investing -

A legacy built on trust

A legacy built on trust -

U.S voters slam economy as ‘on wrong track’ — but back skills revolution, poll finds

U.S voters slam economy as ‘on wrong track’ — but back skills revolution, poll finds